Previous Trading Day’s Events (03 Jan 2024)

Financial markets are now betting that the U.S. central bank will begin cutting rates as early as March as it potentially reached its rate policy peak.

“The Fed is likely in a sweet spot as they prepare markets for an upcoming cut in rates,” said Jeffrey Roach, chief economist at LPL Financial in Charlotte, North Carolina.

“Anyone still looking for signs of a recession won’t find it in this report,” said Layla O’Kane, a senior economist at Lightcast. “The Fed has succeeded in managing to curb inflation without blowing up the labour market. I’m expecting that to continue in 2024.”

FOMC: Minutes of that meeting released yesterday showed that policymakers appeared increasingly convinced that inflation was coming under control, with diminished “upside risks” and growing concern about the damage that “overly restrictive” monetary policy might do to the economy.

Source: https://www.reuters.com/markets/us/us-job-openings-fall-moderately-november-2024-01-03/

______________________________________________________________________

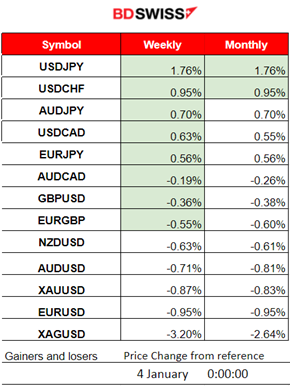

Winners vs Losers

The USD has been rallying still. USDJPY remains on the top of the week’s gainers list with a 1.76% performance. Metals lost ground and Silver hit the bottom.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (03 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

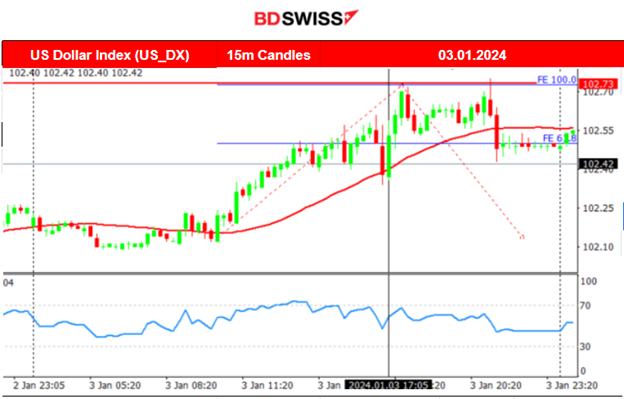

The ISM Manufacturing PMI report and JOLTS Job openings reports confirm that the U.S. economy is still affected negatively by elevated rates enhancing the cooling narrative. Economic activity in the manufacturing sector contracted in December for the 14th consecutive month following a 28-month period of growth. U.S. Job openings were reported lower, In addition to lower openings, hiring fell by 363K, moving the rate down to 3.5%, a 0.2 percentage point decline. The market reacted with a moderate shock at that time with volatile up-down movement that eventually kept the markets stable on the usual path. The dollar index moved sideways around the mean closing higher.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (03.01.2024) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced a drop after 10:00 at the start of the European session. The path is clearly formed by the USD, which is the main driver. The dollar started to appreciate steadily since that time, with the pair finding support eventually at near 1.08950. After 21:00, the dollar depreciated with a shock since the FOMC statement was released. The government officials stated that the policy rate is likely at its peak and that they acknowledged the projections for the suggested rate cuts in 2024. However, the dollar does not seem to be affected much by the news as the market participants are waiting for the NFP report to act heavily.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

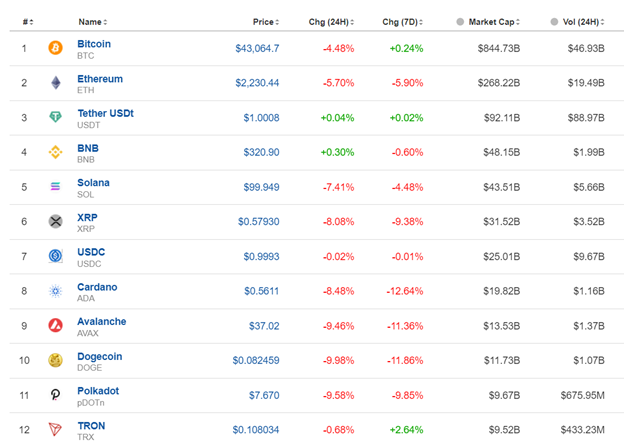

Bitcoin saw a rapid drop after 13:00 yesterday, more than 4800 USD, followed by a quick retracement and a stable path soon after. It was a reaction to the news that included rumours of SEC rejecting ETF applications this month, spread by Financial services company Matrixport. Matrixport rebuffed optimistic expectations, saying: “We believe all applications fall short of a critical requirement that must be met before the SEC approves. This might be fulfilled by Q2 2024, but we expect the SEC to reject all proposals in January.”

Source: https://www.coindesk.com/markets/2024/01/03/bitcoin-slumps-as-400m-liquidated-in-two-hours/

Crypto sorted by Highest Market Cap:

Volatility currently remains low after the huge drop and it is clear from the 24-hour column that all crypto still suffer from the news.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Benchmark indices were experiencing an amazing performance this year. Recently there was an uptrend since the 21st that lasted until the 29th when the index faced a drop again. With the New Year, the stock market experienced a shock bringing the NAS100 further to the downside. That is clear on the 2nd Jan 2024, when the index fell more than 380 dollars before retracing slightly. The retracement to the 61.8 Fibo level was not completed as the indices were pushed more to the downside yesterday. The support near 16470 was strong but was eventually broken reaching to the next support at near 16360. Amid NFP I am expecting that the retracement will happen eventually. The RSI is also showing bullish divergence as it has higher lows, while the price shows lower lows. The alternative scenario is that the support at 16360 eventually breaks and the index falls further. This will be determined after the NYSE opening probably.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

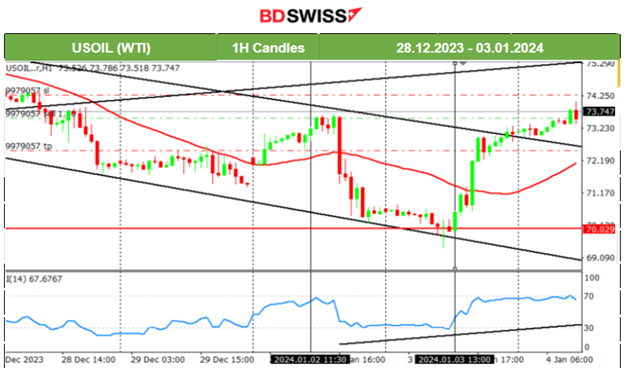

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The support at near 69.5 USD held quite strongly yesterday causing the price to reverse heavily, crossing the 30-period MA and moving to the upside. We already mentioned that price volatility is high and for that reason, high deviations from the MA are expected. This reversal to the upside could be a good opportunity for catching a retracement. The 74 USD/b level looks like a good resistance. The RSI shows that the price path is slowing down, however, it does not show strong evidence of a turning point just yet.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold is volatile and has moved to the downside recently but in a very volatile downward trend. This is clear when observing the downward moving average and the price moving around it. In the previous analysis, we mentioned that a downward wedge was formed. That eventually was broken yesterday with the price moving further downwards rapidly reaching the next support at 2030 USD/oz. It retraced after the drop back to the mean, as depicted on the chart.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (04 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

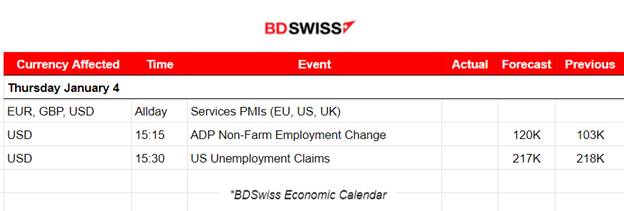

Services PMI releases are affecting the FX market with steady deviations from the means.

The ADP Non-Farm Employment Change and U.S. Unemployment Claims reports are potentially going to affect the USD pairs heavily. The Fed is anticipating that the figures will remain roughly the same as the forecasts with no big surprises, however keeping the direction towards cooling. Meaning, less employment and/or higher claims. NFP tomorrow so we could see only some moderate intraday shock as market participants wait for tomorrow’s reports to react with big volumes.

General Verdict:

______________________________________________________________