PREVIOUS WEEK’S EVENTS (Week 01 – 05.07.2024)

U.S. Economy

The ISM’s manufacturing PMI slipped to 48.5 last month from 48.7 in May showing that it contracted for a third straight month in June as demand remained subdued. Inflation could continue to slow. Weakness at the end of the second quarter took place. Manufacturing is being pressured by higher interest rates and softening demand for goods.

The U.S. services sector activity slumped to a four-year low in June amid a sharp drop in orders. The Services PMI index dropped to 48.8 last month, the lowest level since May 2020, from 53.8 in May.

The PMI fell below the 49 level. The survey’s business activity measure dropped to 49.6, the first contraction since May 2020, from 61.2 in May.

Services inflation slowed a bit last month. The ISM’s prices paid measure for services inputs slipped to 56.3 from 58.1 in May.

The U.S. job growth slowed more than expected in April and the increase in annual wages fell below 4.0% for the first time in nearly three years, but the labour market remains fairly tight.

Nonfarm payrolls increased by 175K jobs last month. Revisions showed 22K fewer jobs created in February and March than previously reported. Average hourly earnings rose 0.2% after climbing 0.3% in March. Wages increased 3.9% in the 12 months through April.

The unemployment rate rose to 3.9% from 3.8% in March amid increasing labour supply. Nonetheless, the jobless rate remained below 4% for the 27th straight month. Data this week showed job openings declining in March. Signs of labour market cooling raised optimism that the U.S. central bank could after all engineer a “soft-landing” for the economy.

Financial markets boosted the odds of a September rate cut and saw the Fed reducing borrowing costs twice this year instead of only once before the data.

Canada Economy

Canada’s unemployment rate rose to a 29-month high of 6.4%, data showed on Friday. The jobs report, which also showed that youth unemployment reached almost a decade high barring the pandemic years, prompted money markets to increase bets of a rate cut by the Bank of Canada this month to around 56% from 40% a day earlier.

Canada lost a net 1.4K jobs in June, a further indication of weakness in economic conditions.

Despite increasing unemployment, wage growth has been a sore point in the BoC’s efforts to tame inflation and it ticked up again in June.

The average hourly wage growth of permanent employees accelerated to an annual rate of 5.6% from 5.2% in May.

The central bank lowered its key policy rate for the first time in more than four years in June and said more cuts were likely if inflation continued to cool. The bank’s next rate announcement is on July 24, roughly a week after the release of the next inflation data, which is seen as a critical factor in firming up expectations for a definitive rate cut this month.

______________________________________________________________________

Inflation

Eurozone

Eurozone inflation eased last month but a crucial services component remained stubbornly high. In June, consumer inflation in the 20 nations sharing the euro currency slowed to 2.5% from 2.6% a month earlier. This is in line with expectations in a Reuters poll of economists, as a rise in energy and unprocessed food costs moderated.

This closely watched core inflation figure held steady at 2.9%, coming above expectations for 2.8%, mostly on a continued 4.1% rise in services prices.

The figures are unlikely to provide the ECB much clarity on where prices are heading and ECB President Christine Lagarde already said that more time is needed to be certain, so there should be no hurry to ease policy further.

Switzerland

Swiss inflation unexpectedly eased and was reported at 0% — offering reassurance to Swiss National Bank officials who’ve lowered borrowing costs for two straight meetings.

Consumer prices rose 1.3% from a year ago in June. The slowdown was aided by a 0.2% annual decline in the cost of goods, while services were up 2.4%. Core inflation also moderated to 1.1%, defying expectations of its quickening.

The SNB has cut interest rates at its last two meetings — kicking off its easing campaign before global peers like the European Central Bank.

Policymakers have said the third quarter will see slightly faster inflation, but that it will then slow — reaching 1% in 2026.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/us/us-job-growth-slows-april-unemployment-rate-rises-39-2024-05-03/

https://www.reuters.com/markets/us/us-service-sector-sags-june-orders-sink-2024-07-03/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 01 – 05.07.2024)

Server Time / Timezone EEST (UTC+03:00)

Currency Markets Impact:

Manufacturing PMI releases

Eurozone Manufacturing PMIs

Eurozone Manufacturing PMIs

Spain’s manufacturing sector expanded further in June but at a more modest pace. The PMI figure is at the expansion area, at 52.3, less than the previous MI recorded at a figure of 54 points. Both output and new orders rose on the back of positive demand conditions. Firms turned on hiring. However, growth rates were down as well as confidence in the future.

The Italian manufacturing sector continued with a decline again in June, marking a third successive monthly deterioration in operating conditions. The PMI was reported to have slightly improved to 45.7. Weakening demand, with accelerating output reduction.

In France, the manufacturing sector experienced a deterioration in operating conditions at the end of the second quarter. PMI was reported again in contraction at 45.4 points. New factory orders decreased at an accelerated pace. Production volumes, purchasing activity, employment and stocks of inputs went down, while business confidence also eased during the month.

Germany’s manufacturing sector experienced rates of contraction in both output and new orders reaccelerating after having eased substantially in May. Firms reported deepening declines in both pre and post-production inventories. PMI figure is in contraction at 43.5.

Eurozone manufacturing activity suffered. The downturn in Europe was widespread, with Italy the only big player not to see a fall in its PMI, despite manufacturers largely cutting prices.

In the U.K. the manufacturing sector saw further growth in June but input cost inflation rose to a 17-month high. The upturn continued at the end of the second quarter. June saw output and new orders both expand for the second successive month, with rates of expansion remaining close to the highs reached in May. PMI was reported at 50.9 points lower than the previous figure but still in the expansion area.

The U.S. manufacturing sector remained in growth territory at the end of the second quarter of the year. Client demand remained muted and business confidence hit a 19-month low. New orders rose however for a second month running. Production continued to rise. Although input costs continued to rise sharply, the rate of inflation eased in June. SPGlobal PMI figure was reported to be 51.6 points, in the expansion area not deviating much from the previous figure.

Eurozone Services PMIs

Spain’s services sector continued to expand at an above-average pace in June. Positive demand from both domestic and external clients took place. Firms added to their staffing levels at a significant rate. Confidence for future business conditions remained positive. A reported PMI of 56.8, in expansion, shows great potential for the sector.

The Italian service sector expanded again in June despite a slower rate of output growth. Service providers’ confidence grew at high levels. Overall new business picked up. Notable less intense cost pressures at Italian service sector firms.

France’s service sector experienced a further monthly contraction in business activity. The sharpest fall in new orders since January weighed on output. In some cases, survey respondents linked the softening to the uncertainty surrounding July’s general election. Business confidence also weakened, as did job growth. The reported PMI was 49.6 points, in contraction, however, it improved from the previous month.

In Germany, there was a solid rise in business activity in June ending a positive second quarter for the service sector. Firms’ growth expectations for the coming year were at a five-month low. Business costs across the service sector meanwhile rose at the slowest rate since March 2021. The PMI figure was reported at 53.1 in expansion but not improving from last month.

The Eurozone economy continued to grow at the end of the second quarter, although the expansion cooled to a three-month low. New orders decreased for the first time since February though. The latest survey data highlighted a cooling of price pressures across the euro area.

The U.K. service sector continued to show greater levels of business activity at the end of the second quarter, a sequence of growth to eight months. Despite a reported PMI of 52.1 in expansion, momentum was lost in June, with the upturn at its weakest since November last year as the upcoming general election reportedly led clients to adopt a “wait-and-see” approach before placing orders and commissioning new projects.

The U.S. service sector in June showed an improvement in growth momentum, with firms seeing sharper increases in both business activity and new orders. Companies increased their workforce for the first time in three months. Rates of increase in both input costs and output prices eased in June.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The U.S. suffered last week as it experienced strong weakening due to the weak figure releases regarding the U.S. business conditions and labour market. All related figures, ADP Employment Change, ISM PMIs and NFP point to a cooling of economic conditions and raise the probability of a rate cut in September. All these have pushed the U.S. dollar index to the downside.

EURUSD

The EURUSD experienced a strong uptrend mainly driven by the USD. Since the USD was experiencing weakening the pair moved upwards. Even though elections in France had some impact, that was only in the short-term/or intraday. The USD weakened overall and this was the main reason for the uptrend forming.

USDJPY

The JPY was weakening for a very long time and that helped the USDJPY to reach higher and higher levels. Last week though the JPY started to show some periodical strengthening while at the same time, the USD started to experience strong weakening due to the news releases related to the U.S. The pair crossed the 30-period MA and moved to the downside where it remained until the end of the week. It was moving with high volatility however suggesting major activity for both currencies.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

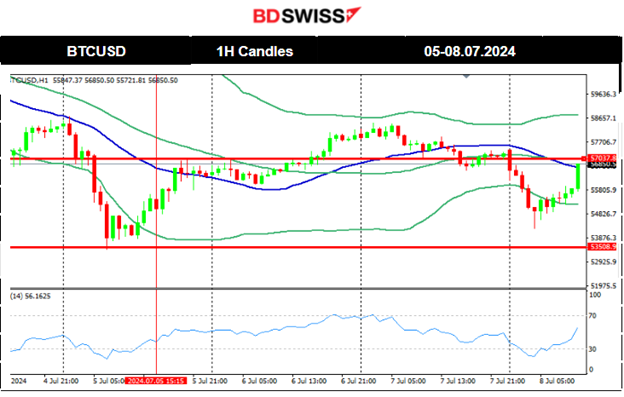

BTCUSD

On the 2nd of July, a clear and steady downtrend took place that resulted in Bitcoin breaking more and more support levels, eventually reaching the 60,500 USD support level. On the 3rd of July, the price dropped further, reaching 60K USD. July 4th found Bitcoin even lower breaking another support and reaching 58K, which is a crucial support level. On the 5th of July, the price fell further breaking the 57K USD level and dropped to the next support at 54K USD. Since then the market recovered and corrected by moving upwards and crossing the 30-period MA. The price remained close to the MA as it continued moving sideways with a clear mean level at nearly 57K USD for now.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

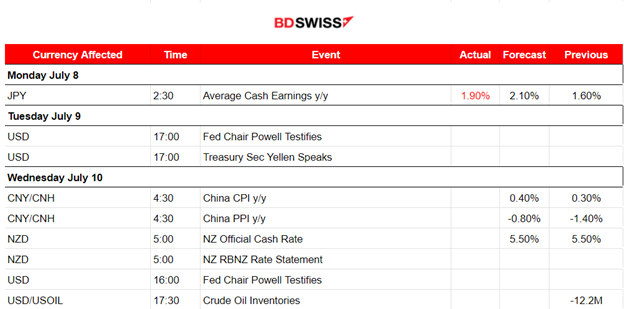

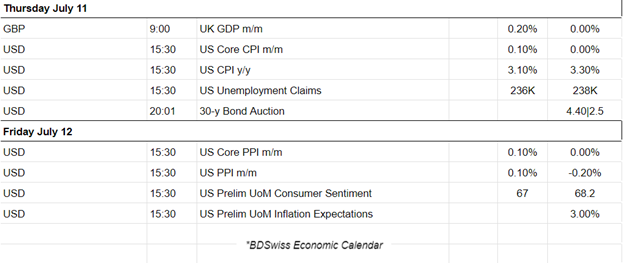

NEXT WEEK’S EVENTS (Week 08 – 12.07.2024)

Coming up:

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

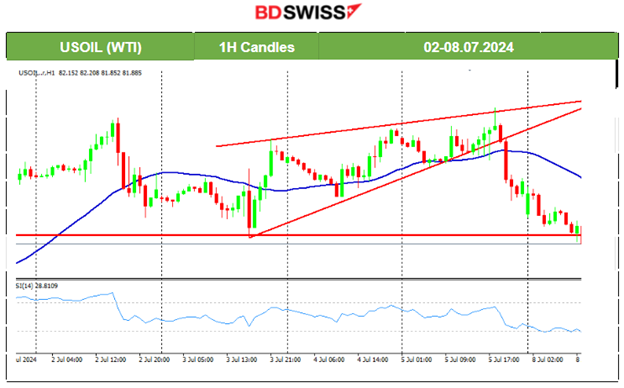

U.S. Crude Oil

Since the 1st of July a new trend started with the price reaching 83 USD/b, on the 2nd however, the price retraced to the 30-period MA testing the 82.3 USD/b support. Despite the breakout of that support and the channel that formed, there was not a significant downside movement. The support was strong enough and the price moved sideways around the mean on the 3rd of July. On the 4th, the price remained above the 30-period MA and continued upwards within the channel. However, a triangle formation was formed and on the 5th of July after 18:00 server time, the price dropped heavily breaking that triangle to the downside. The price continues to drop until now and historical prices are not providing an apparent support area so far. 81.20 however, seems to be an important mean level that the price could reach next as it falls currently.

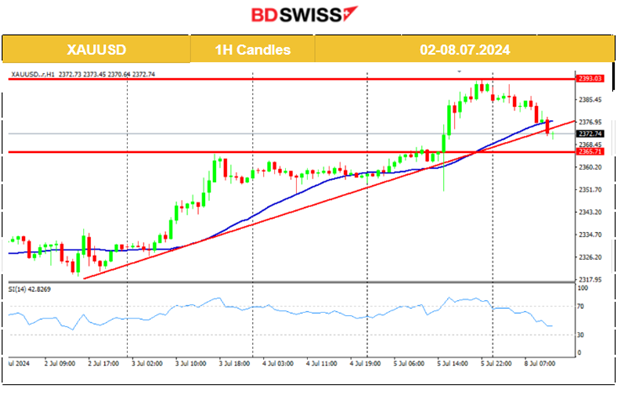

Gold (XAUUSD)

A steady sideways movement took place on the 4th of July with the price closing bear flat as volatility levels lowered. Gold jumped due to the USD’s early depreciation and tested the high at 2,365 USD/oz on the 5th of July. On the same day, it jumped again during the NFP release. It was an intraday shock that resulted in increased demand for metals, pushing Gold upwards in order to technically complete the breakout of the previous triangle formation and reaching the next target level at nearly 2,393 USD/oz as mentioned in our webinar on Friday. On the 8th, today, it was corrected from that jump.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

A slowdown took place on the 4th of July after the index experienced quite an increase in value. The other benchmark indices as well. Despite the stock market closure due to the holiday, some volatility was observed in index trading (futures) with the uptrend experiencing a slowdown. On the 5th of July, the index moved aggressively upwards again early during the Asian session on the index (futures) market opening. Retracement took place. Looking at things from afar, no significant correction is expected yet. A clear uptrend.

______________________________________________________________