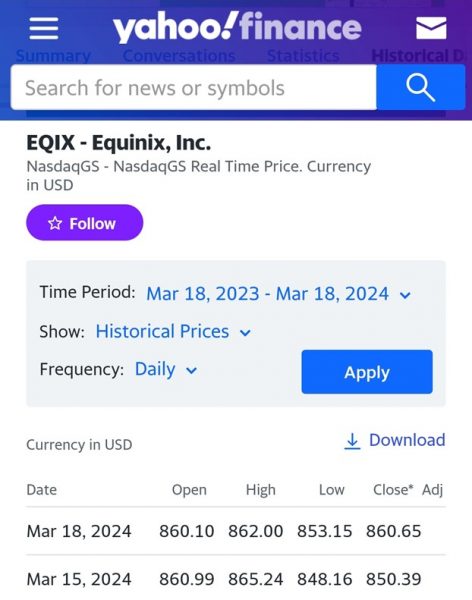

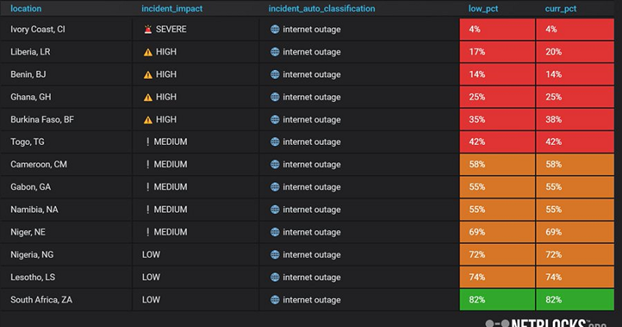

Equinix Inc., a provider of data center services, witnessed a 1.66% decline in its shares (NASDAQ: EQIX) to $850.39 on Friday, March 15, 2024. This decline occurred following an internet outage affecting West and Central Africa. The outage was linked to a break in the submarine cable system operated by MainOne, a subsidiary of Equinix Inc., which also offers data center and connectivity services in the region.

MainOne stated that the disruption was caused by an “external incident,” likely seismic activity on the seabed near the coast of Cote D’Ivoire. Human activity such as ship anchors or fishing was ruled out due to the cable’s depth of approximately 3 kilometers. The outage affected countries where MainOne operates, including Nigeria, Ghana, and Cote D’Ivoire.

Ghana’s National Communication Authority indicated that full service restoration could take at least five weeks. Ghana’s Communications and Digitalisation Minister, Ursula Owusu Ekuful, addressed Parliament on March 18 to discuss the government’s efforts in resolving the internet disruptions.

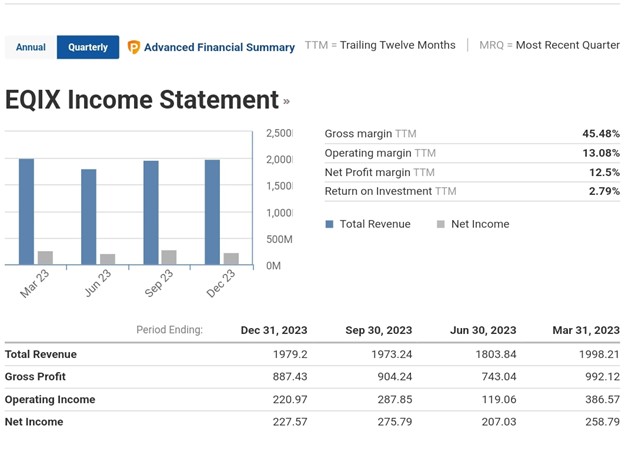

Equinix, Inc. (NASDAQ: EQIX) released its earnings report for the fourth quarter and full year ending on December 31, 2023. In the fourth quarter, the company recorded revenue of $2,110.49 million, up from $1,870.85 million the previous year. Net income for the quarter was $227.57 million, compared to $128.76 million a year ago. Basic earnings per share from continuing operations were $2.41, up from $1.39 the previous year, while diluted earnings per share from continuing operations were $2.40, compared to $1.39 a year ago. For the full year, revenue totaled $8,188.14 million, an increase from $7,263.11 million the previous year. Net income for the full year was $969.18 million, up from $704.35 million a year ago. Basic earnings per share from continuing operations were $10.35, compared to $7.69 the previous year, and diluted earnings per share from continuing operations were $10.31, up from $7.67 a year ago.

From a technical analysis perspective, Equinix Inc. shares (NASDAQ: EQIX) have been trading within a range, with $915.53 acting as resistance and $847.71 as support, while the current price hovers around $860.65.

If the price breaches the support level, there is an increased likelihood of further downward movement. Conversely, if the support holds, there is a higher probability of an upward movement towards the resistance level. If the resistance level rejects the price, there is a greater chance of another downward movement, but if the resistance is broken, there is an increased likelihood of further upward movement.

Sources :

https://twitter.com/netblocks/status/1768234033098444882?t=LmSAAaTkOfOV4rcFVvC6Cg&s=19

https://finance.yahoo.com/quote/EQIX/history/

https://finance.yahoo.com/news/african-internet-outage-caused-subsea-222538373.html

https://nca.org.gh/2024/03/18/update-4-undersea-cable-disruptions-affect-data-services/

https://www.investing.com/equities/equinix,-inc.-earnings

https://www.investing.com/equities/equinix,-inc.-financial-summary