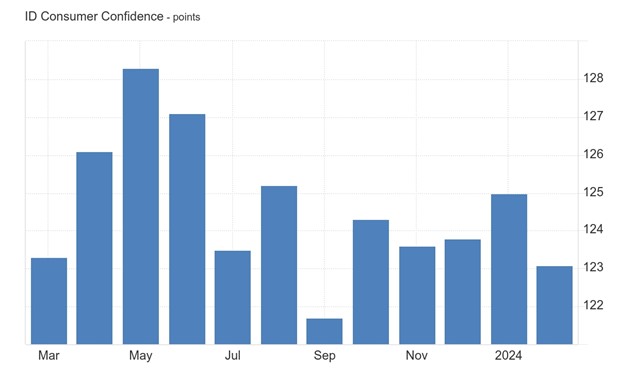

Today at 03:00 GMT, Indonesia’s consumer confidence figure was released at 123.10, lower than the previous month’s 125.00 This decline suggests decreased spending, possibly could be due to the unemployment rate, which stands at 5.32%.

Part of Indonesia’s strategy to address unemployment involves attracting global investors to participate in processing critical minerals and other natural resources.

Indonesia’s Vice Minister for Foreign Affairs, Pahala Mansury, emphasized the importance of inviting investment into the country during an interview in Tokyo on Monday, March 11, 2024. He said “To be able to actually process these critical minerals, as well as other natural resources through what we call the ‘downstream’ initiative that we have, of course we need to invite investment into Indonesia,”

Today at 03:00 GMT, Indonesia’s consumer confidence for February 2024 dropped to 123.10 from January’s 125.00, marking a decline amid increasing inflation. This represents the lowest figure since September, with three of six sub-indices showing deterioration. These include expectations regarding the current economic conditions (down 4.7 points to 110.9), current income expectations (down 4.4 points to 112.1), and job availability compared to six months ago (down 8.3 to 110.1). However, there were improvements in other sub-indices, such as economic outlook (up 0.8 to 135.3), job availability (up 3.3 points to 137), and income expectations for the next six months (up 3.8 to 138.6). In Indonesia, the Consumer Confidence Index (CCI) gauges consumers’ expectations about current income, job availability, timing for durable goods purchases, and general economic conditions, along with job availability expectations for the next six months.

The drop in consumer confidence may result in reduced spending, potentially dampening economic expansion. Consequently, investors might sell off the Indonesian Rupiah, leading to its depreciation.

From a technical analysis perspective, observing the 4-hour chart of IDRUSD, the exchange rate has been consolidating within a range bound by 0.00006316 as support and 0.00006432 as resistance, with the current rate hovering around 0.00006402. Should the resistance be breached, there is a strong likelihood of the exchange rate trending higher. Conversely, a rejection at the resistance level could indicate a potential decline towards the support. Similarly, if the support level is respected, there is a probability of the exchange rate rallying towards the resistance, whereas a breakdown below the support suggests further downside potential.

Sources :

Bank Indonesia , https://www.bi.go.id/id

https://www.tradingview.com/chart/4IThf1h1/?symbol=FX_IDC%3AIDRUSD