PREVIOUS TRADING DAY EVENTS – 25 July 2023

“The German economy has not really got back on its feet since the coronavirus crisis,” said VP Bank chief economist Thomas Gitzel. “The problem is that cyclical uphills are not accompanied by strong GDP growth rates, but rather by fragile growth.”

Germany’s economy was described as falling into a technical recession in early 2023, defined by two consecutive quarters of contraction.

“We seem to be in an unusual eddy in this expansion, with consumer confidence up but consumer spending clearly levelled off,” said Robert Frick, corporate economist with Navy Federal Credit Union in Vienna, Virginia. “Lower inflation is why confidence has surged, but Americans have become cautious, trimming spending and increasing savings.”

Consumers’ perceptions of the likelihood of a recession over the next year rose but stayed below the recent peak earlier in the year.

Today, the U.S. central bank is expected to raise interest rates by 25 basis points.

Source: https://www.reuters.com/markets/us/us-consumer-confidence-rises-two-year-high-july-2023-07-25

______________________________________________________________________

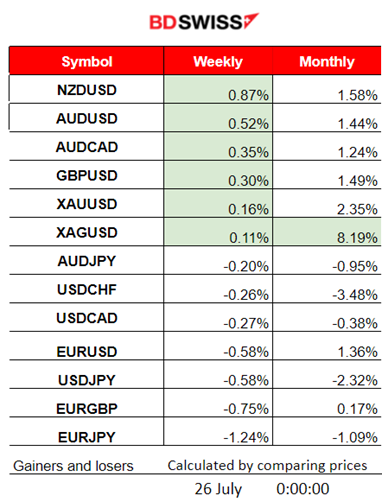

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (25 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, nor any major scheduled releases.

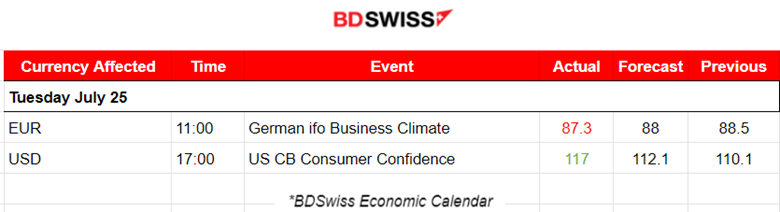

- Morning – Day Session (European)

The German Ifo Business Climate Index fell from 88.5 to 87.3 in July. During the release of the figure, the EUR has not depreciated greatly; only a small intraday shock was observed when looking at the EUR pairs. The EURUSD moved downwards at that time but the USD had also appreciated at that time adding to the move.

The U.S. CB Consumer Confidence showed improvement in July. The American economy continued to show resilience in the face of dramatically higher interest rates. The market didn’t react significantly to the figure release at that time. The Dollar closed almost flat for the trading day after a sideways path around the mean with low volatility.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

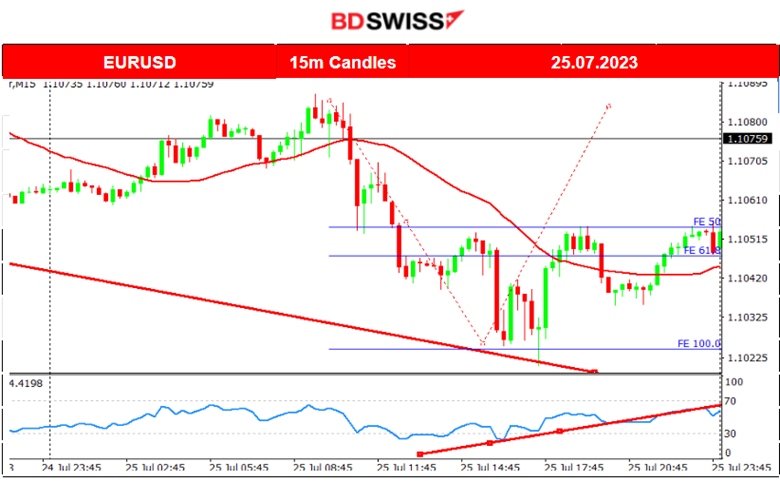

EURUSD (25.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD dropped during the European session. The German Ifo Business Climate Index was reported lower than expected. However, it did not have much impact on the EUR; mostly, the USD has driven the pair. The USD experienced appreciation during the European session, pushing the pair downwards. It found support before retracing back to the mean, as depicted on the chart with the Fibonacci extension tool.

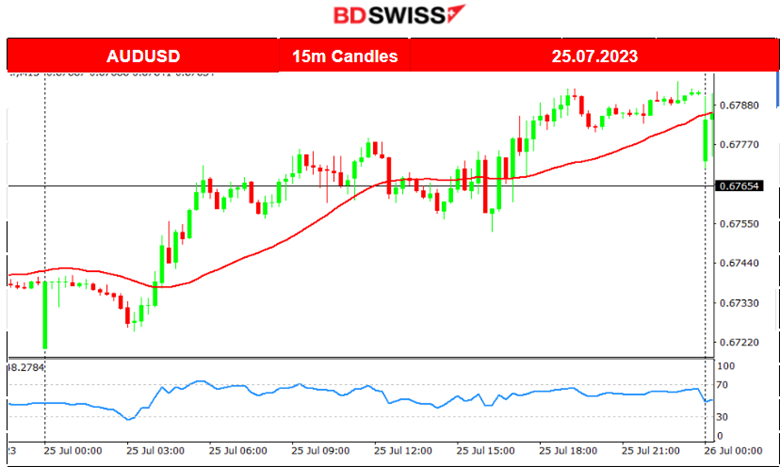

AUDUSD (25.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

We have already seen that the AUD pairs had big gains this week. Yesterday, the AUDUSD apparently moved upwards as the AUD appreciated before the next day’s CPI figures release. A clear intraday uptrend was apparent yesterday.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. is waiting for the Fed’s rate confirmation of an increase of 25 basis points that will take place tomorrow at 21:00. After the release, the market’s reaction will show its updated expectations. Currently, the upward movement of the NAS100 index was interrupted. In the past week, the index moved downwards below the 30-period MA but soon found support levels to test. After failing to break them, it reversed. The Fibonacci expansion tool suggests that it was actually a retracement back to the 61.8 level.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

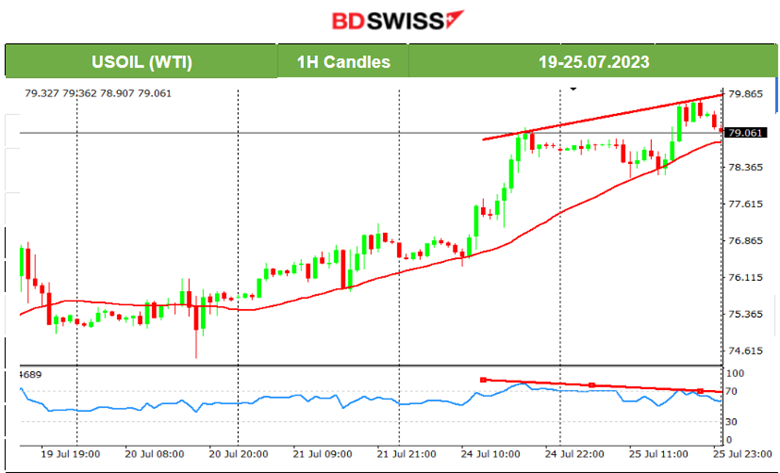

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude is continuing its upward path with high volatility. The RSI signals bearish divergence, with lower highs while the price is forming higher highs. Due to its volatile nature, we could see a reversal to the downside soon. However, waiting for the Fed rate decision might be a good idea before assessing.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold is testing the resistance at 1968 USD/oz. The RSI showed higher lows in the last couple of days, signalling a potential upward move for Gold. Breaking the 1968 USD/oz might push it more to the upside.

______________________________________________________________

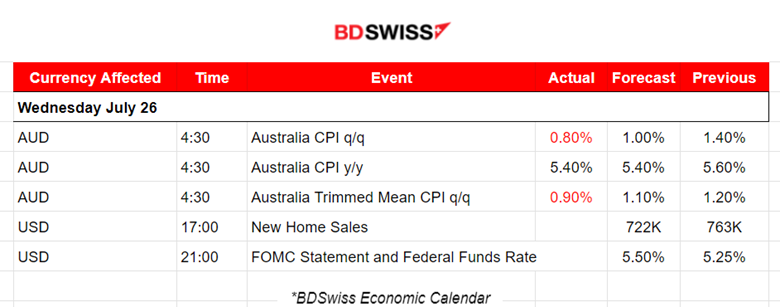

News Reports Monitor – Today Trading Day (26 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Australia’s inflation figures were reported lower than generally expected. June monthly inflation dropped to 5.4% YoY as expected, though last month’s inflation was revised down to 5.5%. This data caused the AUD to depreciate greatly and the AUDUSD to drop close to 40 pips before retracing back to the mean shortly after.

- Morning – Day Session (European)

Market participants are waiting for the FOMC report and Fed Fund Rate decision. A 25 basis points increase is expected. We expect that an intraday shock is going to take place at the time of the figure release, at 21:00.

General Verdict:

______________________________________________________________