PREVIOUS TRADING DAY EVENTS – 31 May 2023

Announcements:

This legislation temporarily removes the debt until the first quarter of 2025, after the 2024 elections, allowing the U.S. to borrow more.

“At best, we have a two-year spending freeze that’s full of loopholes and gimmicks,” said Representative Chip Roy, a prominent member of the hardline House Freedom Caucus.

The next step: the Senate must vote on the bill later this week before President Joe Biden can sign it into law. In the Senate, leaders of both parties said they hoped to move to enact the legislation before the weekend. But a potential delay over amendment votes could complicate matters.

Source: https://www.reuters.com/world/us/us-debt-ceiling-bill-faces-narrow-path-passage-house-2023-05-31

“It now looks more likely than not that Q2 inflation will overshoot the RBAs forecast of 6.3%,” said Marcel Thieliant, a senior economist at Capital Economics.

“Coupled with the increasing strength of the rebound in the housing market and continued sluggish productivity growth, that will almost certainly convince the RBA to raise interest rates again, perhaps as soon as next week.”

The Reserve Bank of Australia is ready to take action and willing to continue rising interest rates in order to bring inflation back to target by mid-2025.

The ECB raised rates by a record 375 basis points over the past year and has already committed to another rate hike in June. National data suggest that eurozone inflation may have dropped more than expected in May.

“Clearly the decline has been bigger than what was discounted by analysts and I think that is positive news,” ECB vice president Luis de Guindos said on Wednesday.

Source:

This flow of strong Labor Market data forms new expectations that the Fed could revise decisions for a rate hike pause next month.

“This is not what the Fed was hoping to see,” said Priscilla Thiagamoorthy, a senior economist at BMO Capital Markets in Toronto.

The Fed’s “Beige Book” report on Wednesday described the labour market as having “continued to be strong” in May, “with contacts reporting difficulty finding workers across a wide range of skill levels and industries.”

Source:

https://www.reuters.com/markets/us/us-job-openings-unexpectedly-rise-april-2023-05-31/

______________________________________________________________________

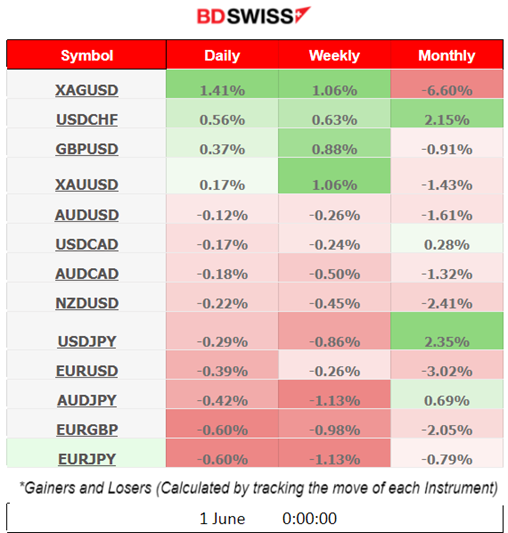

Summary Daily Moves – Winners vs Losers (31 May 2023)

- Silver (XAGUSD) moved surprisingly high yesterday reaching the top of the gainers list, with a 1,41% price change. Still, it is the biggest loser of the month having a 6.6% loss.

- Silver this week came on top and Gold (XAUUSD) followed with 1.06% price change.

- The month closes with top winners USDJPY and USDCHF having 2.35% and 2.15% gains respectively. This results obviously from the high appreciation the dollar was experiencing recently.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (31 May 2023)

Server Time / Timezone EEST (UTC+03:00)

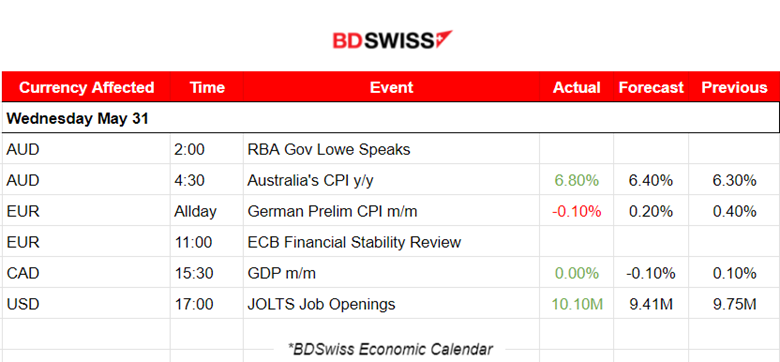

- Midnight – Night Session (Asian)

The annual CPI figure for Australia was released yesterday and it was higher than expected and above the previous figure. It was reported to be 6.8% which is quite high. It seems that RBA has more to do in regard to raising rates. Expectations are surely towards that direction.

- Morning – Day Session (European)

The Preliminary figure for Germany’s monthly CPI change was negative, -0.1%. Headline inflation for Germany declines further, coming in at 6.1% year-on-year in May (from 7.2% YoY in April). The market reacted with a steady EUR depreciation yesterday at the time of the release, at about 15:00.

At 15:30, an important GDP figure for Canada was released showing no change in GDP. The CAD appreciated greatly after the release with the CAD pairs experiencing an intraday shock.

At 17:00 the JOLTS Job Openings figure was reported more than expected and higher than the previous. Job openings reached 10.1M on the last business day of April versus 9.75M the previous month. That caused the USD to appreciate at the time of the release and the USD pairs to experience an intraday shock that was not so great.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (31.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD was falling steadily during the Asian Session, obviously from the USD appreciation. As the European Session kicked in, volatility got higher and eventually the pair dropped heavily after the JOLTS Job Openings figure release at 17:00. The pair retraced after finding support at 1.06350.

USDCAD (31.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving steadily on an intraday upward trend when suddenly at 15:30 with the GDP for Canada figure release it started dropping. The price reversed, crossing the 30-period MA going downwards and experiencing high volatility. The Job opening figures at 17:00 pushed the pair sharply downwards followed by a retracement soon enough. It eventually found support near 1.35700 and remained close to that level.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Stocks move lower as the debt-default day approaches. As per Yellen, the day is June 5th. Today the House has passed legislation to suspend the debt ceiling and limit spending as time runs out. The bill will still need to pass the Senate. The index moved lower after climbing significantly last week. Yesterday it reversed crossing the 30-period MA, moving downwards. This was predicted by the bearish divergence the price and RSI formed previously as well as the Fibonacci expansion tool that could “see” this retracement coming using the H4 chart.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was moving sideways the past few days around the 30-period MA until yesterday, the 30th of May when it dropped rapidly. It found support at nearly 69 USD. Even though we are waiting for a retracement, it would be appropriate to see if the price is going to move upwards breaking some important resistance first, confirming that retracement at 69.80 USD.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold reversed on the 30th of May crossing the 30-period MA and moving significantly upwards. It started to show signs of an upward trend. Investors switched their preferences to less risky assets as the debt-default day approaches for the U.S. The stock market declined for the last couple of days while Gold was climbing as the chart depicts. A bearish divergence (Price: higher highs, RSI: lower highs) is formed indicating that Gold might drop to lower levels or at least indicate a sideways path.

______________________________________________________________

News Reports Monitor – Today Trading Day (01 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no significant scheduled releases.

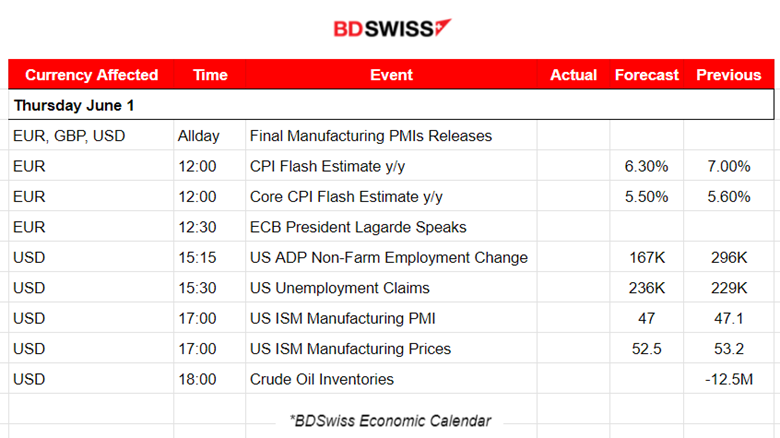

- Morning – Day Session (European)

The House has passed legislation to suspend the debt ceiling and limit spending to allow the U.S. to avert defaulting on its debt. The bill still needs to pass the Senate.

Final Manufacturing figures might not have much impact, unlike the earlier reported Flash figures.

CPI Flash figures for the Eurozone will be released at 12:00. These will probably cause an intraday shock for the EUR pairs as they are considered important inflation data. The European Central Bank has been increasing rates continuously fighting inflation since Jul 21, 2022. Main Refinancing Rate is currently at 3.75%. The ECB president will have a speech shortly after, at 12:30.

The U.S. ADP Non-Farm Employment Change figure is about to be released at 15:15. It is expected that it will drop while unemployment claims released at 15:30 are expected to be reported higher. I would expect that it is more probable to see an intraday shock for the USD pairs at 15:30. Nevertheless, the market will experience higher volatility in general.

The U.S. ISM Manufacturing PMI figure release at 17:00 is expected to have an impact on the USD pairs. The level of impact will depend on how the market reacted to the previous USD-related figure releases. Reacting significantly at first might not leave room for more later.

Crude Oil inventories will be interesting to look at since the price was declining recently. Crude trades at 69 USD/b currently. The previous figure was a large negative number, -12.5M, indicating much fewer barrels remained in inventories. It is expected that a much smaller negative change will be reported today, just -1.4M.

General Verdict:

______________________________________________________________