PREVIOUS TRADING DAY EVENTS – 11 Oct 2023

- According to yesterday’s PPI data report, the U.S. producer prices increased more than expected in September amid higher costs for energy products and food. The producer price index for final demand rose 0.5% last month after accelerating by an unrevised 0.7% in August.

The increase in these prices raises questions in regard to how effective are the rate hikes at the moment and if the latest rate hike pause was a good call from the Fed. The report was being closely watched for clues on whether the Federal Reserve will raise interest rates in the future.

“The Fed has not finished the job and stamped inflation out completely yet, and if anything, policymakers have their work cut out for them as much of the inflation we see in producer prices is coming from food and energy prices that monetary policy has less effect on,” said Christopher Rupkey, chief economist at FWDBONDS in New York.

Gasoline prices rose 5.4%, making up more than 40% of the increase in the cost of goods. Though core inflation is cooling, higher gasoline and food prices could hamper progress by raising the cost of other goods as well as making consumers expect inflation to rise.

“From the Fed’s perspective, cooler goods prices are a necessary, but not sufficient, condition in restoring price stability right now,” said Will Compernolle, macro strategist at FHN Financial in New York. “The most concerning consumer inflation is in core services, which has a weaker connection with the PPI, and rising energy prices pose an upside inflation risk via pass-through effects and inflation expectations.”

Based on the PPI data, economists estimated that the core PCE price index rose 0.2% in September after edging up 0.1% in August. That would push the annual increase in the core PCE price index to 3.7% in September from 3.9% in August.

______________________________________________________________________

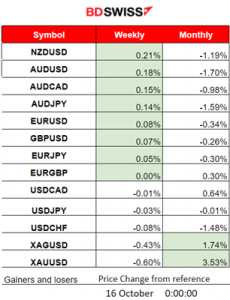

Winners and Losers

Metals climb higher and higher. Almost 3% gains so far for Gold and Silver this week. Gold leads with 1.83% gains this month.

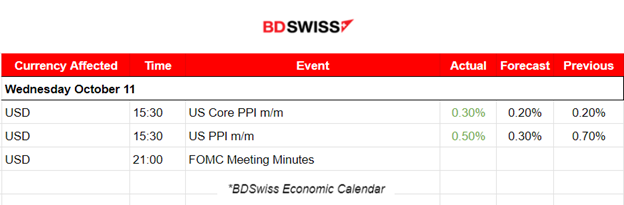

News Reports Monitor – Previous Trading Day (11 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

The U.S. PPI data were released at 15:30 with higher-than-expected figures. This indicates inflation pressures for the U.S. economy. The producer price index, which measures costs for finished goods that producers pay, increased 0.5% for the month, against the Dow Jones estimate of a 0.3% rise. The market reacted with a small shock that caused a sudden USD appreciation that soon faded. Not much of an impact.

General Verdict:

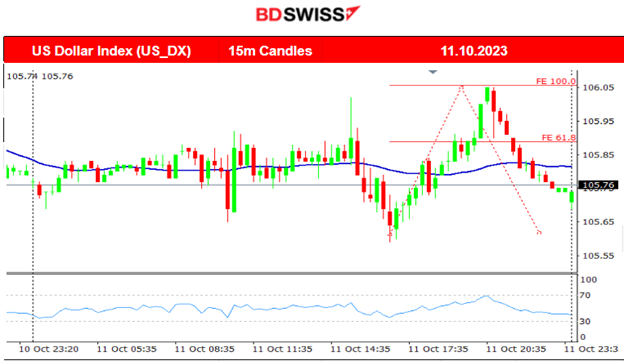

- The absence of special releases keeps FX volatility at relatively low levels.

- The DXY closed flat for the day as it moved sideways around the mean overall.

- The U.S. Indices experienced huge volatility after the PPI data release leaning towards the upside overall.

- Metals continue with an upward trend. Crude, however, broke consolidation and dropped.

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (11.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD was following a sideways path with low volatility until the news came out. Initially, the pair experienced a small shock with a small drop and a quick reversal. It soon moved to the upside, found resistance and moved back with another reversal crossing the 30-period MA on its way down and finding support before retracing back to the mean. Quite high volatile market conditions after the news but it closed flat overall for the trading day.

___________________________________________________________________

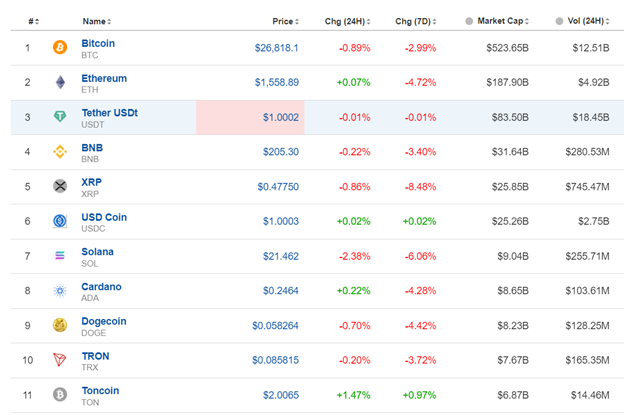

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin moves lower and lower as days pass. Important support levels are broken such as the levels near 27300 and 26900. The next support is at 26500. Its price is on a clear downtrend while we see that preferences for other risky assets such as stocks have increased with U.S. indices showing an uptrend instead. Similarly, with Metals.

Crypto sorted by Highest Market Cap:

Clear weakness for Bitcoin and for other Cryptos with Solana losing the most in the last 24 hours with nearly 2.4% losses. Toncoin experiences resilience instead with both 24-hour and 7-day periods to experience gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

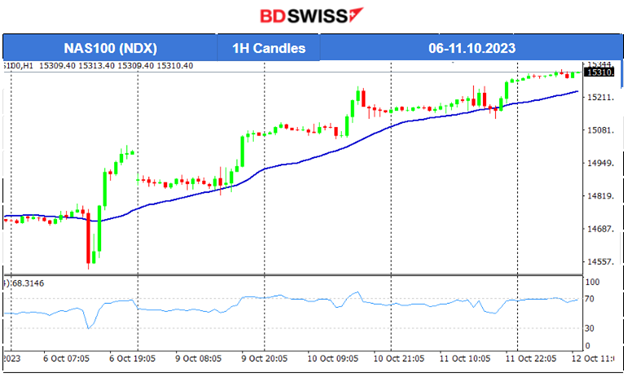

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

All benchmark indices experienced similar upward paths. The U.S. stock market picked up momentum and caused the indices to move to higher levels. The Israel-Hamas conflict has affected the markets greatly and the NAS100 is now on an uptrend. Currently, the RSI shows a slowdown with lower highs, however, this does not give a signal for a retracement yet. When the index breaks important support levels we will be in a position to suggest that the trend halted.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude oil jumped on the 9th of October due to the events happening in Israel. The Hamas-Israel conflict erupted into a war affecting oil prices. For some time it remained in the consolidation phase until the 11th of October when it finally broke consolidation and moved to the downside rapidly finding support at near 81.7 USD/b. Currently, it is retracing back to the mean at near 83 USD/b soon after the drop.

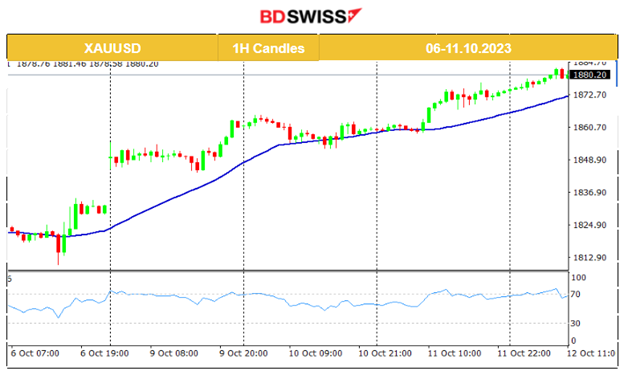

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold broke the consolidation and moved rapidly to the upside. The fundamentals are currently at work. The Hamas-Israel conflict started to push prices to new higher levels for a couple of days now. Currently, the trend upwards is clear. The price deviated and moved away to the upside from the 1860 USD/oz consolidation level reaching current levels near 1880 USD/oz.

______________________________________________________________

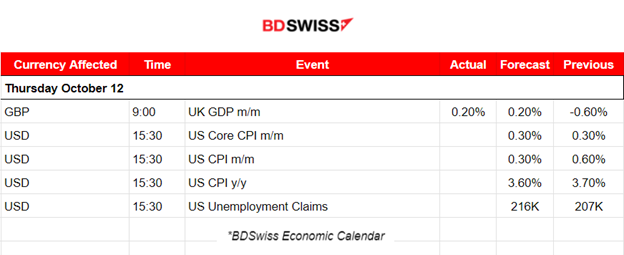

News Reports Monitor – Today Trading Day (12 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

U.K.‘s Gross Domestic Product (GDP) figure is estimated to have grown by 0.2% in August 2023, following a fall of 0.6% in July 2023. Looking at the broader picture, GDP increased by 0.3% in the three months to August 2023. The impact was not great with this release. Expectations were met and no shock was recorded to the GBP pairs at 9:00, the time of the release.

The USD is affected greatly since market conditions are more volatile. Today at 15:30 the long-waited CPI data for the U.S. is going to be released. The monthly and yearly figure is expected to be reported lower since hikes are known to have a long-lasting effect on inflation. The Fed decided to pause and assess the situation before taking another decision to hike again. However, we know that geopolitical events are currently having an effect. In September, there was a surge in oil prices and this would be incorporated into today’s figures. This adds to the odds of a surprise increase. USD pairs are expected to be affected by a moderate shock at the time of the CPI release.

General Verdict:

- The market expects the release of the CPI figures upon which the Fed’s next decision on rate hikes depends. The labour market is hot and fears that demand will kick in, pushing prices higher, start to rise.

- Oil dropped and corrected the start-of-the-week jump generated from the Israel-Hamas events and moves with high volatility racing from the drop.

- Gold still moves higher.

- The U.S. Stock market still shows that it is on an uptrend.

______________________________________________________________