Previous Trading Day’s Events (07.06.2024)

Annual inflation in April stood at 2.7%.

“Little bit of an ugly job report,” said Jules Boudreau, senior economist at Mackenzie Investments. “The biggest worry is that the wages have gone up and that’s a problem for the Bank of Canada,” he said, adding that in the past the bank was hesitant to cut rates because wages were rising too quickly.

The BoC cut its key policy rate to 4.75% and indicated that further easing would be gradual and dependent on data. The bank will have another month’s job data before its next rate decision announcement on July 24.

PADHRAIC GARVEY, REGIONAL HEAD OF RESEARCH, AMERICAS, ING, NEW YORK

“It’s really quite difficult for the Fed to be anywhere near a rate cut…We see the odd weak reading in terms of activity, but then we come to the big numbers like payrolls and okay, the unemployment rate rose, I get that, it’s up to 4%, but that’s not high.”

QUINCY KROSBY, CHIEF GLOBAL STRATEGIST, LPL FINANCIAL, CHARLOTTE, NORTH CAROLINA

“The report suggests continued resiliency in the labour market despite the rise in the unemployment rate… The market responded immediately with the Treasury yield inching higher and the equity futures market pulling back.

The Fed may see these numbers as an obstacle for cutting rates in September because what a strong labour market leads to is a stronger consumer, a consumer that can continue to spend and fuel inflation.”

______________________________________________________________________

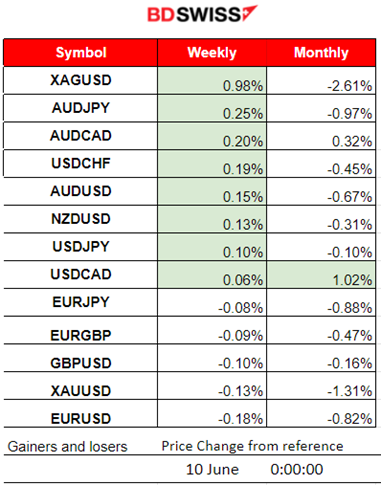

Winners vs Losers

Silver is on the top of this week’s list as it gains momentum and moves early to the upside to correct from the huge drop on Friday. USDCAD leads for the month as the USD continues to gain strength. The USD appreciated heavily after the NFP report release.

______________________________________________________________________

______________________________________________________________________

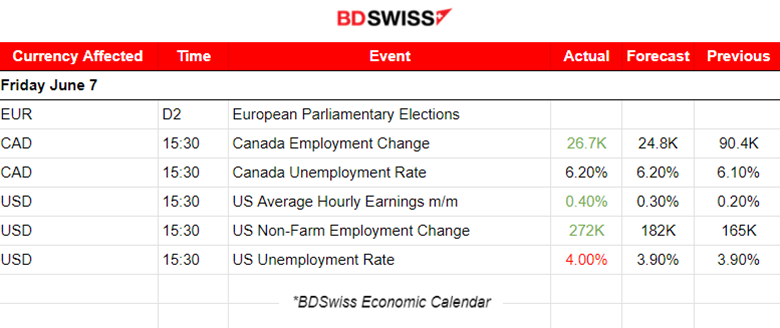

News Reports Monitor – Previous Trading Day (07.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special figure releases.

- Morning – Day Session (European and N. American Session)

At 15:30 the major labour market data for Canada and the U.S. were released. Canada’s employment change came with a little surprise to the upside but lower and as expected, while the unemployment rate increased to 6.2%. The market reacted with heavy CAD appreciation at the time of the release. CADCHF jumped around 35 pips at that time before a reversal took place.

The NFP figure shook the markets with a big surprise to the upside, reported at 272K versus the expected 182K while average hourly earnings growth was reported higher as well. The unemployment rate was reported also higher, providing in such a way a mixed picture in regards to market conditions. Despite that, the market reacted with aggressive USD appreciation upon release and this effect is still on.

BOC already cut rates, suggesting that they had strong “cooling” data and forecasts enough to support their decision. Employment indeed was reported lower but because the figure was higher than expected the initial response was appreciation of the CAD on Friday.

In the U.S., it is true that economic data so far support an increase (check ISM PMIs) as business is showing signs of moderate strength. The NFP figure was reported way higher than expected signalling that an interest rate cut could eventually take longer to implement. The major labour market data signalled strong future price pressures and the inflation figure would be unlikely to be reported lower. The USD currently gains huge strength as interest rates in the U.S. are likely to remain higher for longer.

U.S. CPI data release took place this week on the 12th and anticipation is picking up as analysts expect no change in the annual inflation figure of 3.4%.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

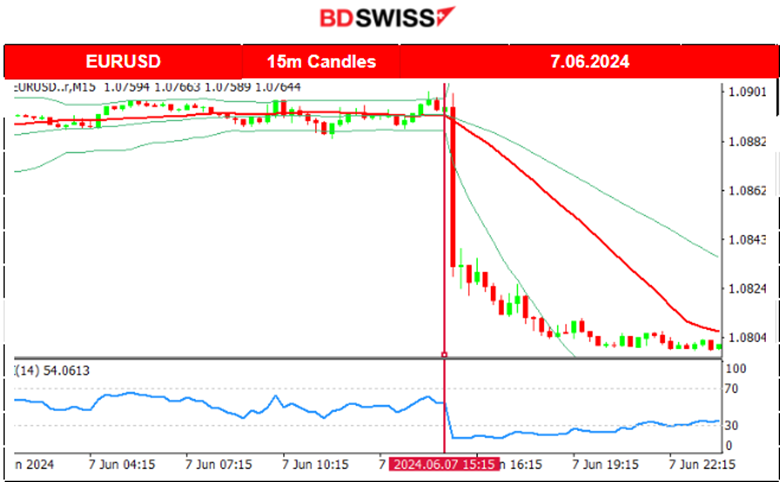

EURUSD (07.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair moved with low volatility, sideways, within a range of 12-15 pips as the market was waiting for the news at 15:30. After the U.S. labour data release, the USD appreciated heavily causing the EURUSD to experience a drop around 70 pips at the time of the release and that drop extended further downwards until the end of the trading day without any retracement to take place. The dollar is currently continuing to strengthen.

CADCHF (07.06.2024) 15m Chart Summary

CADCHF (07.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was experiencing moderate volatility before the employment data release at 15:30. It is obvious that the market reacted with CAD appreciation. The BOC had already proceeded with a cut and the employment change was reported higher than expected causing the initial reaction to the news to be CAD strengthening. That effect was reversed soon as depicted on the chart since the CADCHF retraced to the 30-period MA.

___________________________________________________________________

___________________________________________________________________

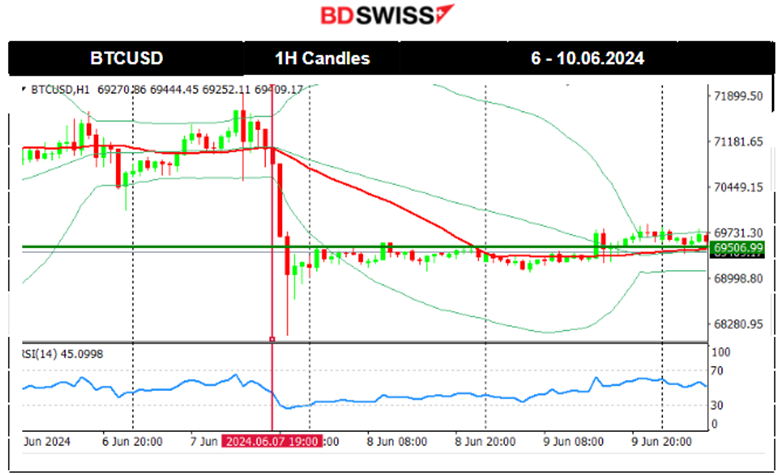

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price had stalled at the resistance near 69K USD even after the volatile market conditions that took place on the 3rd during the PMI releases. Since the 3rd of June, Bitcoin gained momentum and moved to the upside. It steadily broke resistance levels, 68K, 69K, 70K and lastly 71K. That changed on Friday, 7th of June, with the NFP news release that caused dollar appreciation and bitcoin’s price to crash near 3000 USD. Retracement took place with the price settling at 69.5K USD.

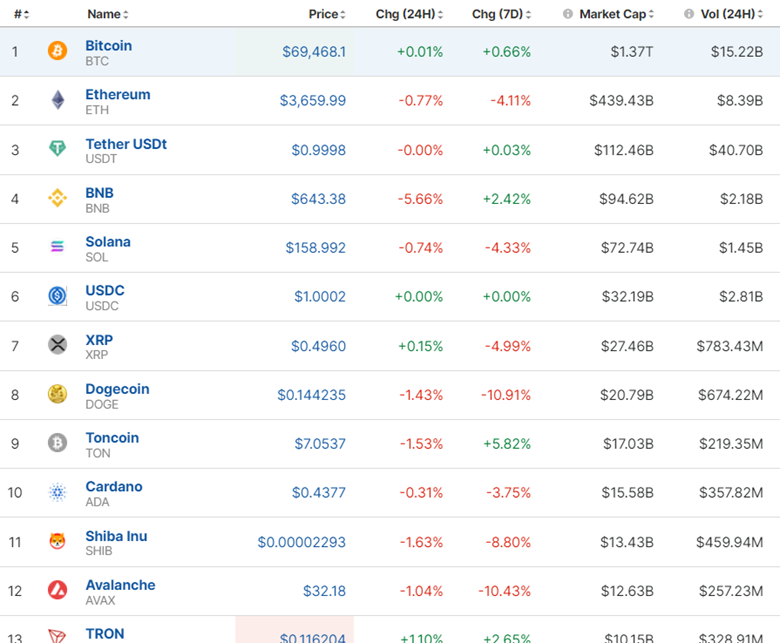

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The market suffered with the release of the employment data for the U.S. The dollar appreciated heavily causing most crypto on the list above to suffer losses.

Sources:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A triangle formation started to form and on the 4th of June, a breakout to the upside took place. The upward movement after the breakout took place and the index reached higher and higher levels. The RSI started to show bearish signals and retracement was possible after this rapid upward movement, as mentioned in our previous analysis. The market was quite volatile upon the release of the employment figures for the U.S. The dollar appreciated while stocks plunged at that time completing the retracement to the 61.8% of the movement. The index soon reversed though back to the 30-period MA and remained stable.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Hour Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price of crude oil eventually retraced, as mentioned in our previous analysis. It was a long way down until the 4th and the RSI indicated a slowdown and possible bullish divergence increasing the chances for retracement. Retracement reached the 74.5 USD/b level on the 6th of June and moved further to the upside after the release of the higher unemployment claims for the U.S. On the 7th the market experienced some moderate volatility but the price remained stable moving sideways. It currently settled near 75.4 USD/b. The RSI indicates bearish divergence.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 5th of June, the price jumped reaching 2,375 USD/oz, before retracement took place. The price continued to move higher on an uptrend and above the 30-period MA. On the 7th of June, Gold saw a sudden drop of 20 dollars passing the first support, indicating an uptrend stop. GOLD dropped ahead of NFP on Friday though. Data showed that China’s central bank didn’t buy any gold last month, ending a massive buying spree that ran for 18 months. Gold’s price had already dropped since 11:00 server time on Friday, near 90 dollars drop for the day. Well, it seems that a retracement could take place. However, it needs more evidence. Not to mention that the USD could appreciate further after the CPI news on the 12th of this week. 2,300 USD/oz is a critical resistance level that, if it is broken, retracement will be more probable to happen with a target level of 2,317 USD/oz.

______________________________________________________________

______________________________________________________________

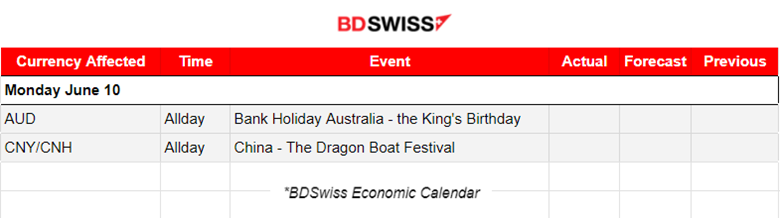

News Reports Monitor – Today Trading Day (10.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special figure releases.

- Morning – Day Session (European and N. American Session)

No important news announcements, no special figure releases.

General Verdict:

______________________________________________________________