The Q2 Fiscal Year 2024 Hewlett Packard Enterprise Earnings Conference Call is scheduled for today, Tuesday, June 4, 2024, at 5:00 PM EDT.

The Q2 Fiscal Year 2024 Hewlett Packard Enterprise Earnings Conference Call is scheduled for today, Tuesday, June 4, 2024, at 5:00 PM EDT.

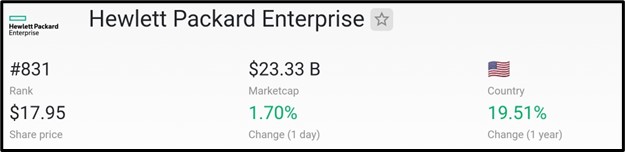

Hewlett Packard Enterprise has a market cap of $23.33 billion as of June 2024. This makes it the 831st most valuable company in the world, according to data from companiesmarketcap.com.

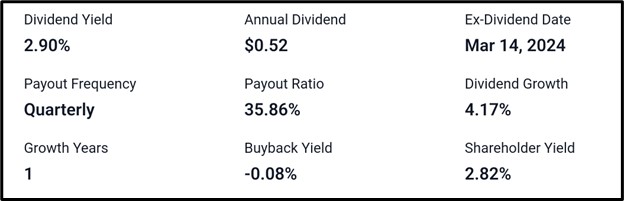

Dividend Information

The dividend yield for the company stands at 2.90%, with an annual dividend payout of $0.52. The ex-dividend date was on March 14, 2024, and dividends are paid out quarterly. The payout ratio is at 35.86%, and there’s been a dividend growth rate of 4.17% over the past year. In terms of buyback yield, there’s a slight decrease of -0.08%, contributing to an overall shareholder yield of 2.82%.

Recent Development At Hewlett Packard

Below are a few of the latest updates from Hewlett Packard Enterprise.

– HPE introduces HPE Aruba Networking Enterprise Private 5G, making private cellular networks easier to set up.

– HPE plans to divest its Communications Technology Group to HCLTech as part of its strategy advancement.

– HPE supports three institutions in revolutionizing higher education.

– HPE collaborates to enhance cybersecurity for survivors of modern-day slavery.

– HPE lays the groundwork for next-gen data management with software-defined storage and AI-driven automation.

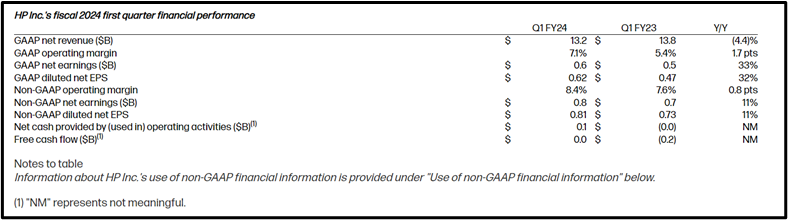

Q1 FY2024 Earnings Report Recap  On February 28, 2024, HP Inc. announced its fiscal 2024 first quarter results, including GAAP diluted net earnings per share (“EPS”) of $0.62 and non-GAAP diluted net EPS of $0.81, both falling within the expected range. The first quarter saw a net revenue of $13.2 billion, a decrease of 4.4% compared to the previous year. Net cash provided by operating activities was $121 million, with free cash flow at $25 million. Additionally, $0.8 billion was returned to shareholders through share repurchases and dividends. Enrique Lores, HP President and CEO, expressed satisfaction with the results, citing progress against their Future Ready plan and highlighting innovation and disciplined execution as driving factors behind solid earnings growth.

On February 28, 2024, HP Inc. announced its fiscal 2024 first quarter results, including GAAP diluted net earnings per share (“EPS”) of $0.62 and non-GAAP diluted net EPS of $0.81, both falling within the expected range. The first quarter saw a net revenue of $13.2 billion, a decrease of 4.4% compared to the previous year. Net cash provided by operating activities was $121 million, with free cash flow at $25 million. Additionally, $0.8 billion was returned to shareholders through share repurchases and dividends. Enrique Lores, HP President and CEO, expressed satisfaction with the results, citing progress against their Future Ready plan and highlighting innovation and disciplined execution as driving factors behind solid earnings growth.

Q2 FY2024 Earnings Report Forecast

HP Forcast

According to Hewlett Packard, for the fiscal 2024 second quarter, they expect GAAP diluted net EPS to range from $0.58 to $0.68, while non-GAAP diluted net EPS is estimated to fall between $0.76 to $0.86. These estimates for the second quarter exclude $0.18 per diluted share, mainly due to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, non-operating retirement-related credits, tax adjustments, and the related tax impact on these items.

ZACK Forecast

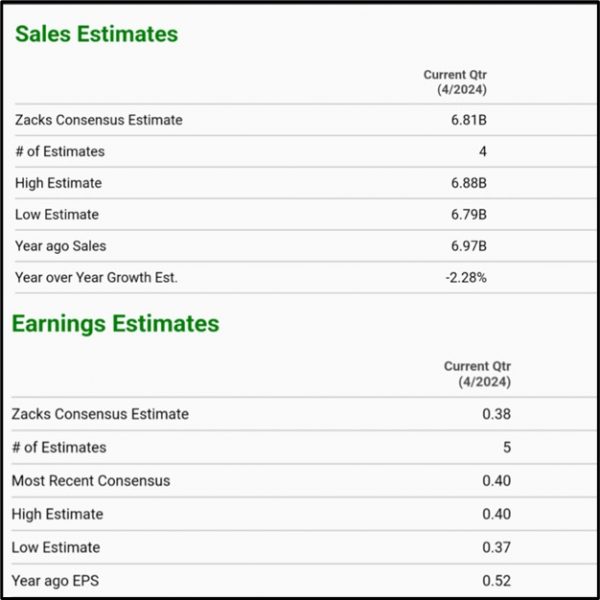

For the current quarter, the sales estimate by Zacks Consensus is $6.81 billion, based on four estimates, with a high estimate of $6.88 billion and a low estimate of $6.79 billion, compared to sales of $6.97 billion a year ago, representing a year-over-year growth estimate of -2.28%. Regarding earnings, the Zacks Consensus Estimate for the current quarter is $0.38, based on five estimates, with the most recent consensus at $0.40, ranging from a high estimate of $0.40 to a low estimate of $0.37, compared to an EPS of $0.52 a year ago, reflecting a year-over-year growth estimate of -26.92%.

Tradingview

As per Tradingview.com forecasts, Hewlett Packard Enterprise Co (NYSE:HPE) is expected to achieve an earnings per share (EPS) of $0.39, with an estimated revenue of $6.82 billion.

Investing.com

Investing.com forecasts anticipate that Hewlett Packard Enterprise Co (NYSE:HPE) will achieve an earnings per share (EPS) of $0.3897, along with an estimated revenue of $6.83 billion.

Technical Analysis

From a technical analysis perspective, an uptrendline rejection is identified on the 4-hour chart of Hewlett Packard Enterprise (NYSE:HPE) on TradingView. The uptrendline drawn from the $14.49 price level repelled the price at $16.24 after retracing from $20.21. Subsequently, the uptrend persisted to $18.99 before experiencing a pullback, currently hovering around $17.96. If the uptrendline rejection holds, and if the $18.04 price level is breached to the upside, there are high probabilities of the price advancing to $18.99. Furthermore, if the $18.99 price level is surpassed to the upside, there are high probabilities of the price ascending to $20.21. Conversely, if the uptrendline rejection fails, there are high chances of the price declining to $16.76, and if the $16.76 price level is breached to the downside, there are high probabilities of the price descending further to $14.52.

Conclusion

In conclusion, the outlook for Hewlett Packard Enterprise (HPE) in the fiscal 2024 second quarter appears positive despite some challenges. The company anticipates a GAAP diluted net EPS ranging from $0.58 to $0.68, and a non-GAAP diluted net EPS estimated between $0.76 to $0.86, excluding certain charges. Additionally, sales estimates from Zacks Consensus and TradingView indicate a slight decline year-over-year, with earnings per share forecasts also showing a decrease compared to the previous year. However, amidst these projections, recent developments such as the introduction of innovative technologies and strategic divestitures highlight HPE’s commitment to growth and adaptation. Furthermore, technical analysis suggests potential price movements, with an uptrendline rejection presenting both upward and downward possibilities, depending on price level breaches. Overall, while acknowledging the market fluctuations and estimates, HPE remains focused on driving innovation and delivering value to its shareholders, paving the way for future success.

Sources:

https://companiesmarketcap.com/hewlett-packard-enterprise/marketcap/#google_vignette

https://stockanalysis.com/stocks/hpe/dividend/

https://www.zacks.com/stock/quote/HPE/detailed-earning-estimates

https://www.tradingview.com/symbols/NYSE-HPE/forecast/

https://www.investing.com/equities/hewlett-packard-enterprise-co-earnings

https://www.tradingview.com/chart/EMXIYOD6/?symbol=NYSE%3AHPE