PREVIOUS WEEK’S EVENTS (Week 09 – 13 Oct 2023)

Announcements:

War and Conflict

The Palestinian Islamist group Hamas launched a devastating attack—the worst breach in Israel’s defences since Arab armies waged war in 1973. Hamas fighters stormed into Israeli towns, killing and abducting.

Hamas used an unprecedented intelligence tactic to mislead Israel, giving the public the impression that it was not willing to go into a fight or confrontation with Israel.

Oil prices rose momentarily following Hamas’ attack on Israel. The attack on Israel boosted gold and the demand for more safe-haven assets.

U.S. Economy

According to the PPI data report last week, the U.S. producer prices increased more than expected in September amid higher costs for energy products and food. The producer price index for final demand rose 0.5% last month.

The report was being closely watched for clues on whether the Federal Reserve will raise interest rates in the future. Much of the inflation we see in producer prices comes from food and energy prices that monetary policy has less effect on, and both policymakers and market participants are taking that into account. Progress on inflation might be delayed for these reasons, making consumers expect inflation to rise.

The core PCE price index is estimated to have risen 0.2% in September after increasing 0.1% in August. That would push the annual increase in the core PCE price index to 3.7% in September from 3.9% in August.

The U.S. CPI report showed that U.S. consumer prices increased in September. The annual increase in consumer prices, excluding the volatile food and energy components last month, was the smallest in two years. The labour market is still tight though, making it likely that the U.S. central bank could keep rates elevated for longer or even proceed to another hike.

The CPI soared 0.6% in August, which was the largest gain in 14 months. In the 12 months through September, the CPI advanced 3.7% after rising by the same margin in August. Year-on-year consumer prices have come down from a peak of 9.1% in June 2022.

Financial markets overwhelmingly anticipate the Fed will leave rates unchanged at its Oct. 31-Nov. Policy meeting, according to CME Group’s FedWatch Tool.

According to the University of Michigan’s preliminary reading on the overall index of consumer sentiment, US consumers’ year-ahead inflation expectations rose sharply. Consumer sentiment fell sharply as households anticipated higher inflation over the next year.

The survey’s reading of one-year inflation expectations increased to 3.8% this month from 3.2% in September. The five-year inflation outlook rose to 3.0% from 2.8% in the prior month, staying within the narrow 2.9-3.1% range for 25 of the last 27 months.

_____________________________________________________________________________________________

Sources:

https://www.reuters.com/markets/us/us-consumer-sentiment-weakens-october-2023-10-13/

_____________________________________________________________________________________________

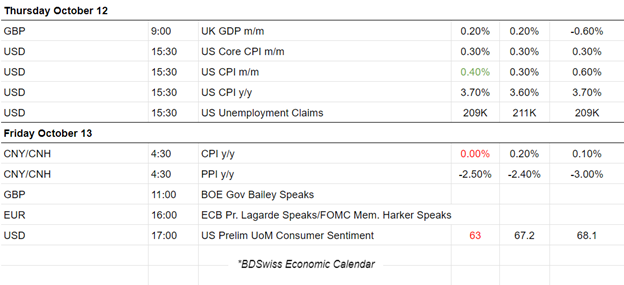

Currency Markets Impact – Past Releases (Week 09 – 13 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

DXY (US Dollar Index)

The path to the downside remained in place for a while until the 12th Oct. The CPI data was released that day, causing a shock. The USD started to appreciate significantly against other pairs, suggesting that the market participants may have shifted expectations towards increased inflation in the near future. This response stopped the downward trend, with this price reversal to the upside, signalling a new sideways path as volatility levels get lower and lower.

EURUSD

The chart mirrors the DXY chart since it was driven mainly from the USD. The pair started to move to the upside and over the 30-period MA. With the release of the CPI data on the 12th Oct, the USD appreciated causing the pair to drop heavily. Since then, it has remained to the downside and below the 30-period MA. The RSI suggests bullish divergence meaning that some room for the pair to retrace more to the upside still exists.

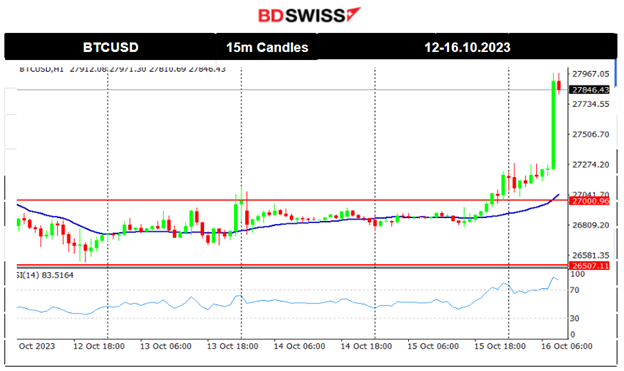

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin’s price was following a clear downtrend as preferences for other risky assets, such as stocks, have increased, with U.S. indices showing an uptrend instead. Similarly, with Metals. Surprisingly, there was movement on the 15th and this morning, with bitcoin jumping and breaking the resistance at 27000 and later at 27300, moving significantly upwards over 700 USD. Retracement at 27650 is expected.

_____________________________________________________________________________________________

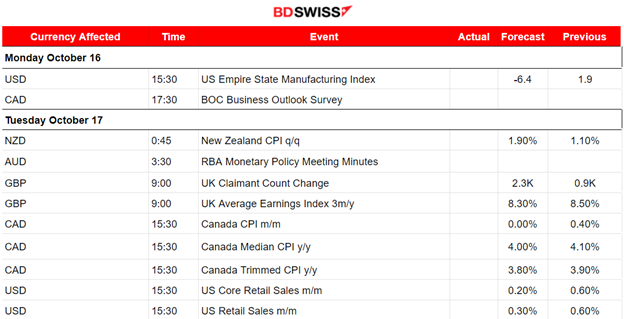

NEXT WEEK’S EVENTS (Week 16 – 20 Oct 2023)

Another week with Inflation-related data potentially influencing central banks’ decisions.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

On the 11th of October, Crude finally broke consolidation and moved to the downside, rapidly finding support at near 81.7 USD/b. Soon after the drop, it retraced back to the mean at nearly 83 USD/b and continued with remarkably high volatility sideways around the MA before eventually deviating significantly to the upside and breaking important resistance levels. This upward movement continued on Friday, with the price breaking eventually the resistance at 83.85 USD/b and the 85 USD/b rising rapidly until the level of 85.5. A retracement is probable as shown by the Fibo tool.

Gold (XAUUSD)

Gold was on an uptrend last week, but on the 13th, it experienced a rapid movement to the upside near 60 USD. The 1885 level was broken, and its price was boosted to the upside before retracing. It eventually returned to the 30-period MA after reaching the resistance near 1930, as shown by the Fibo expansion tool.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

All benchmark indices experienced similar upward paths. The U.S. stock market picked up momentum and caused the indices to move to higher levels. Yesterday, the CPI news caused a shock in the U.S. stock market. All indices crashed before they retraced again, but now signal that the upward trend is finally over since the price currently remains under the MA. When the index breaks more important support levels, we will be in a position to suggest that a long period of retracement to the downside has started. Currently, that support near 15000 has been broken, but the price remained settled close to that level while being below the MA.

______________________________________________________________