PREVIOUS WEEK’S EVENTS (Week 02 – 06 Oct 2023)

Announcements:

PMIs

Last week the Manufacturing and Services PMIs showed another grim and contracting picture in business, especially for the Eurozone. For the U.S. the picture is better for both sectors.

The U.S. manufacturing sector contracted for a 10th straight month in August, but the pace of decline continued to slow, suggesting sector stability. Manufacturing PMI increased to 47.6 last month from 46.4 in July.

The Services PMIs give a somewhat better picture regarding business conditions overall. Some figures are in the expansion area or better than the previously recorded figures. More details are in the analysis below.

U.S. Economy

The JOLTS report took the market by surprise with way more than expected job openings in August amid a surge in demand for workers in the professional and business services sector, pointing to a still-tight labour market.

Job openings were reported at 9.610M versus the previous 8.92M on the last day of August. That was the most in just over two years. Expectations changed regarding the U.S. central bank’s decision on rates. A stronger-than-expected report will puzzle the Fed and the financial markets. The Fed holds rates steady currently but signalled a hike by the end of this year.

The ADP Report showed that private payrolls rose by just 89K jobs last month beating expectations that private employment would rise by 153K. This data suggested that the labour market is gradually easing due to interest rate hikes from the Fed. However, it is known that the ADP report has not been a reliable gauge in trying to predict the private payroll count in the employment report.

U.S. Jobless claims were reported again at low levels near 200K. The number rose moderately last week pointing to still-tight labour market conditions at the end of the third quarter. Inflation indeed gets lower but this labour resilience raises the risk of the U.S. central bank hiking rates again by year-end.

U.S. job growth surged as per Friday’s NFP report. The actual number of NF Payrolls was reported way higher than expected causing market turmoil. Nonfarm payrolls increased remarkably by 336K jobs last month. This high increase in employment suggests that the labour market remains strong enough for expectations to form in favour of the view that the Federal Reserve will raise interest rates this year, though wages are increasing moderately.

The data are encouraging about the health of the labour market, but a stronger inflation report next week could shake the Fed. All of this potentially is inflationary. This may encourage the Fed to raise interest rates again.

Canada Economy

Job growth in Canada reached high levels, more than tripling expectations by adding 63K jobs in September with higher wages. The unemployment rate remained unchanged at 5.5% for a third consecutive month. The average hourly wage for permanent employees rose 5.3% from September 2022, up from the 5.2% annual rise in August.

Despite the aggressive rate hikes by the Bank of Canada, demand remains strong and companies continue to hire rising possibilities for another rate hike.

_____________________________________________________________________________________________

Interest Rates

Australia:

The Reserve Bank of Australia (RBA) decided to keep rates unchanged. There was no significant shock observed at that time. The market did move, but with less volatility than expected.

The inflation rate, which is nearly twice as high as the target of 2%-3% at 5.2% in August, suggests further monetary policy tightening may be required to get prices under control with a hike to a peak of 4.35% next quarter.

New Zealand:

New Zealand’s central bank decided to hold rates unchanged, with OCR at 5.5%, as reported on Wednesday with policymakers considering that rate hikes so far are sufficient to fight inflation. Interest rates are constraining economic activity and reducing inflationary pressure as expected and needed. Further increases however are still in play after taking into consideration recent developments and the economic data.

New Zealand’s annual inflation is currently running at 6.0%, just below a three-decade high of 7.3% (June 2022) with expectations that it will return to its target band within the next two years.

_____________________________________________________________________________________________

Sources:

https://www.reuters.com/world/us/us-job-openings-unexpectedly-rise-august-2023-10-03/

https://www.reuters.com/markets/us/us-private-payrolls-growth-slows-sharply-august-adp-2023-08-30/

https://www.reuters.com/markets/us/us-weekly-jobless-claims-rise-moderately-2023-10-05/

https://www.reuters.com/markets/us/view-us-job-growth-far-exceeds-expectations-september-2023-10-06/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 02 – 06 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

Eurozone PMIs:

According to the reports, the Italian manufacturing sector continues to show an economic downturn. The result was mainly due to weak demand conditions, sustained, but softer declines in production and new orders. The PMI remained in the contraction area with a slightly improved figure, 46.8 vs last month’s 45.4.

A similar grim picture is shown regarding French Manufacturing since downturns in output and new orders gather pace. Purchasing activity, inventories and employment are posting declines as well. The PMI remained also in the contraction area with a slightly improved figure, 44.2 vs the previous month’s 43.6.

German manufacturing sector PMI remains in contraction territory as well with a worse PMI figure of 39.6 points. Output fell to the greatest extent for almost three-and-a-half years amid a further sharp drop in new orders and weaker demand across the sector.

The Eurozone PMI figure remains at 43.4 points, in the contraction area. The Eurozone is experiencing a deep downturn as factory orders see a sharp fall and the job loss rate is accelerating. Business strategies included sustained reductions in employment, purchasing activity and inventories.

U.K. PMI:

The U.K. manufacturing sector remains in contraction and continues with the downturn. Output and new orders contract facing weak domestic and export markets. New orders and employment declined. The PMI figure was reported slightly higher, 44.3 against the 44.2 of the previous month.

U.S. PMI:

Just below the 50 threshold level, the U.S. PMI for manufacturing was reported at 49.8, a slight improvement of 1 point from the previous month. The reports showed further deterioration in overall operating conditions during September. A slower pace of contraction, however, since the sector experienced a small fall in new orders with a rise in output, greater hiring activity and expanded capacity. A more optimistic picture for this sector in the U.S.

The market had not experienced major shocks at the time the figures were released. That is probably because the business conditions in that sector are well-known and predictable for the current period. However, the USD has gained more strength since a better picture is shown for U.S. manufacturing.

The U.S. ISM Manufacturing PMI figure was released at 17:00 showing an improvement, at 49 versus the previous 47.6 points of the previous month. Still in contraction though.

Eurozone:

The Spanish service sector returned to expansion during September as per the PMI shows, 50.5 points. New business volumes, but activity rose only just. Higher employment and confidence in the future was again positive.

In Italy, the services sector experienced a fall in activity, unchanged business levels and weak demand conditions in September. The PMI remained fractionally below the 50.0 no-change mark in September at 49.9, little-changed compared to 49.8 in August.

The French services PMI remains low at 44.4 signalling that French services activity is falling and in fact at the sharpest pace since November 2020. Business activity levels shrunk for the fourth consecutive month, output fell at the sharpest rate since November 2020 and is also suffering from further deteriorating demand for services. Business confidence slumped to its lowest level in almost three years.

The German service sector shows improvement in business conditions as the PMI was reported in the expansion area just a little above the 50 points threshold. Business activity improved following a notable decline the month before. Sharp and accelerated drop in new business affected demand levels as well negatively. Employment fell, and for the first time since mid-2020 as firms’ expectations towards future activity weakened.

The Eurozone economy continues with contraction, entering the 4th Quarter now, as demand falls at the quickest pace in almost three years. The services PMI was reported devastating again at 43.4 points. Output volumes across both the manufacturing and service sectors were affected negatively by deteriorating demand conditions driven by the fall in new orders and in new business received by service providers.

United Kingdom:

The U.K.’s Services PMI reported in the contraction area, at 49.3 points, not far from the 50-point threshold. Still, it is indicating the weakest service sector performance for eight months in September. Hopes of a further moderation in inflationary pressures are rising. However, service providers reported a renewed fall in employment, in part due to cost considerations.

United States:

The PMI figure shows that the U.S. services sector experienced stable business activity amid weak demand conditions, reported to be 50.1 points, in the expansion area. Broadly unchanged levels of business activity stemmed from a second successive monthly drop in new orders, arising from weaker domestic and foreign client demand.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

DXY (US Dollar Index)

The USD last week depreciated overall. The Fed’s decision to pause hikes seems to have had this effect on the dollar. On the 4th of October, it seems that the DXY reversed and stayed below the 30-period MA for the rest of the week. On Friday it experienced a shock with the NFP release but the path remained to the downside with signs of continuing sideways.

EURUSD

The chart is mirroring the DXY chart since it was driven mainly from the USD. The pair started to move to the upside and over the 30-period MA last week. It remained on the path and experienced the NFP shock on Friday. Despite the fact that the Labor market for the U.S. remains strong and the chances of a hike increase the USD has not experienced appreciation. The ECB is going to proceed with statements next week regarding monetary policy. It is however stated many times so far that they are committed to fighting inflation with more hikes. This could keep the EUR gaining strength steadily.

CRYPTO MARKETS MONITOR

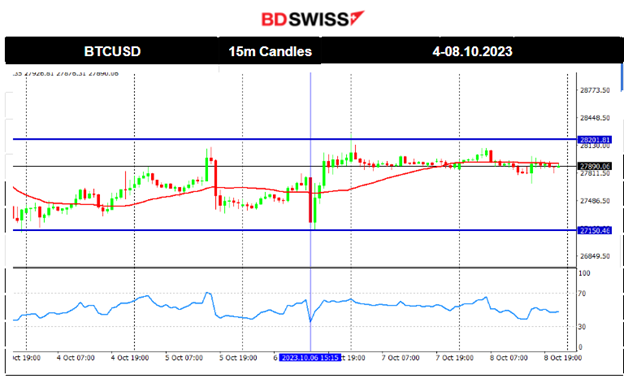

BTCUSD

A sudden jump on the 2nd of October caused Bitcoin to move upwards more than 900 USD after breaking the resistance at 27300. The market calmed down after that, moving to lower levels. No other important movement was recorded recently, and the path keeps a sideways direction. Despite the highly volatile market conditions on Friday during the most important news for the month affecting the USD, the price of bitcoin did not deviate much from the MA. There was a drop at 15:30 but soon after, bitcoin’s price reversed. It continued to move sideways within a range and around the mean. Significant support now is at 27150 and the resistance level at 28200.

_____________________________________________________________________________________________

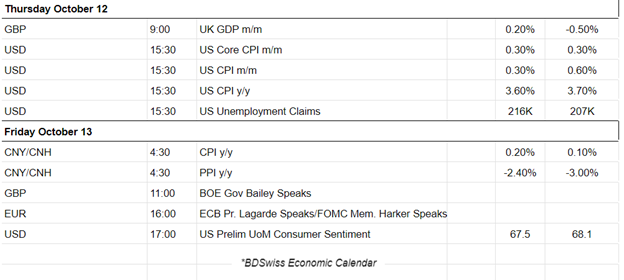

NEXT WEEK’S EVENTS (Week 09 – 13 Oct 2023)

Inflation-related data are about to be released this week influencing the central bank’s decisions on rates.

Currency Markets Impact:

_____________________________________________________________________________________________

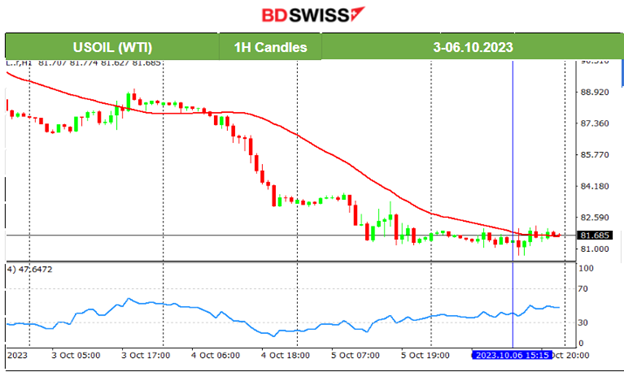

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude oil settled near 81.20 and remained close to that level until finally, the NFP came out affecting the USD. A breakout seems to have occurred but the price kept a strong support there. It did not start to fall rapidly but instead, the price of Crude remained settled to the same levels as before the news. The RSI is forming a bullish divergence since it has higher highs while the price remains low. Is this a strong signal for a reversal to the upside? Possibly.

Gold (XAUUSD)

Gold’s support at near 1814 USD/oz eventually held even during the NFP and the following USD appreciation at that time. Gold’s price moved to the downside rapidly but after testing again the support it eventually reversed. It managed to break out from the resistance near 1830 USD/oz and reach higher levels. Could this be a sign of a further movement to the upside after breaking consolidation? By looking at a H4 chart this coincides with a possible retracement since Gold experienced a large drop with our retracement so far.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The U.S. stock market was in downfall recently after some significant performance this year reaching the previous year’s early highs. It reached critical support levels and that is the reason why it remained in consolidation for a while moving sideways with high volatility. The previous week it moved around the 30-period MA and sideways with volatility getting lower and lower until the release of the NFP news. After the NFP release the NAS100 index moved to the downside but soon reversed and got out of the range with a breakout to the upside instead reaching to near 15000. All benchmark indices experienced similar paths.

______________________________________________________________