Previous Trading Day’s Events (03.06.2024)

The ISM Manufacturing PMI index for May fell to 48.7 from 49.2 in April, the research group said on Monday, noting an increase in references to “softening” among survey respondents. It was both the second straight decline and the second month below the 50 level that separates growth from contraction.

Source: https://www.reuters.com/markets/us/us-factory-activity-slips-second-month-may-ism-says-2024-06-03/

______________________________________________________________________

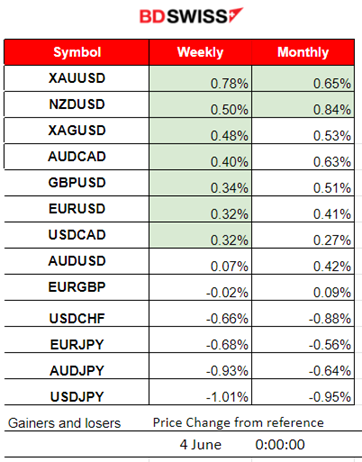

Winners vs Losers

Gold is currently leading with 0.78% this week. JPY pairs (JPY as quote currency) have reached the bottom as the JPY suddenly gained strength. Possible bank intervention as the USDJPY dropped more than 220 pips in the last 2 days.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (03.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

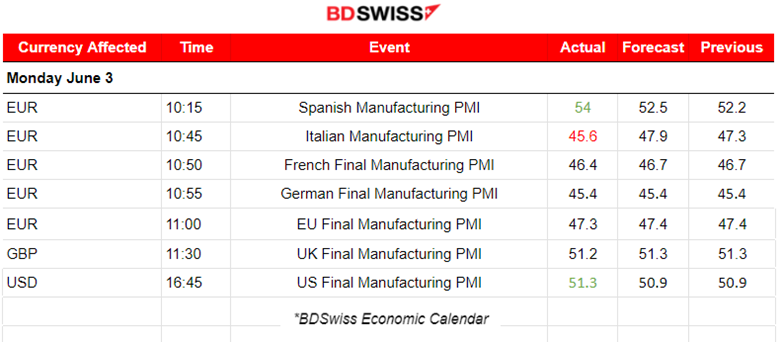

PMI Releases for the Manufacturing Sector:

Eurozone PMIs

The month of May signalled acceleration of Spanish manufacturing sector growth. A rapidly increasing production and new order levels have contributed to having a reported PMI of 54 points, in expansion and improvement from the previous report.

In Italy, the manufacturing sector downturn was sustained in May. A worsening PMI figure was reported, at 45.6 points. Operating conditions deteriorated at a sharper rate. It experienced rapidly reduced order book volumes. Manufacturers lowered their production volumes. Firms cut jobs and reduce input buying.

French manufacturing conditions remain subdued, but business confidence jumped. A sustained weakness in order books. Drop in production volumes. Firms reduced their purchasing activity, as well as both pre- and post-production inventories.

The German manufacturing sector showed further signs of steadying in May. Notable slower declines in both output and new orders. Business confidence towards growth prospects seemed to have increased. Currently, the PMI remains however in the contraction area, quite low at 45.4 points.

In the Eurozone, manufacturing production fell again in May but marginally and to the slowest extent in over a year. Reported PMI remains below 50, in the contraction area, however, this marked the third successive month where the decline in factory output has slowed. Softer contractions in new orders, exports and purchasing activity. Business confidence increased.

U.K. PMI

U.K. manufacturing production growth and new orders hit two-year highs in May. The PMI reading is again reported in the expansion area, at 51.2 points. Output expanded at the quickest pace in over two years. Positive sentiment rose to its highest level since early-2022, with most companies expecting output to expand over the coming year.

U.S. PMI

The U.S. manufacturing sector in May saw order growth and a faster expansion in production midway through the second quarter of the year. May saw an improved 51.3 points PMI figure, in the expansion area. Business confidence picked up and positive expectations regarding the future. The hiring of additional staff took place. Renewed rise in purchasing activity and a build-up of stocks of finished goods.

The ISM Manufacturing PMI was released at 17:00 showing that U.S. manufacturing activity slowed down in May instead. A slight monthly decline in May, with the PMI going down from 49.2 figure to 48.7. The New Orders Index landed at 45.4, dropping by 3.7 percentage points compared to April. The Production Index remained in the expansion territory but still decreased by 1.1 percentage points month-on-month.

Before the PMI releases for the U.S. the EURUSD experienced a downward movement with the start of the European session and the start of the grim Eurozone PMI releases after 10:00.

The market reacted with U.S. dollar depreciation in general after the U.S. manufacturing PMI releases. EURUSD moved to the upside. The pair jumped around 30 pips after the first release at 16:45.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (03.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to move downwards steadily with the releases of the Eurozone PMIs. The pair started to reverse as the U.S. PMIs were about to be released and the dollar started to depreciate. With the release of the U.S. PMIs, the dollar suffered further depreciation and the pair jumped. It continued upwards since the dollar was weakening further.

___________________________________________________________________

___________________________________________________________________

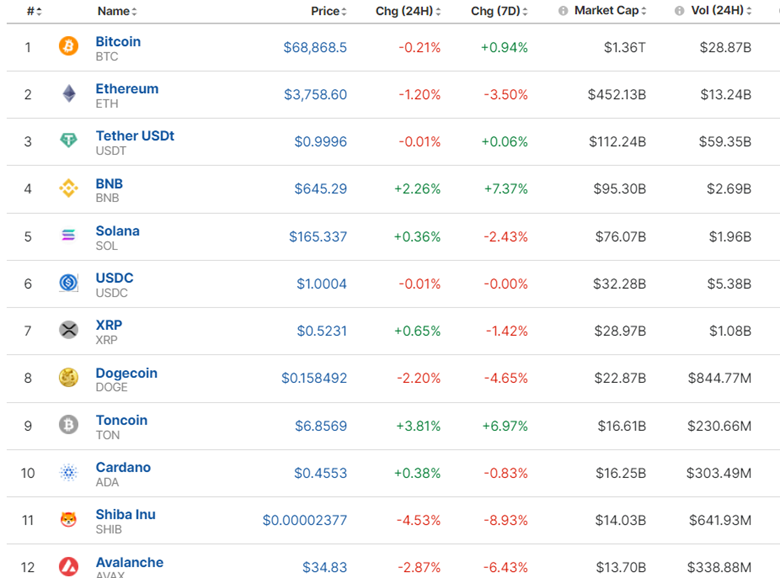

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 31st of May, Bitcoin dropped after the U.S. PCE Price Index figure release reaching near the support at 65,500 USD before retracing to the 30-period MA. After a period of consolidation taking place over the weekend, the price broke the resistance and moved to the upside. It stalled at the resistance near 69K USD even after the volatile market conditions that took place on the 3rd during the PMI releases.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The market remains volatile but in range. Currently, it has seen some improvement this week. Let’s see if it is going to continue showing performance.

Sources:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A jump occurred eventually on the 31st of May which was a huge reversal, crossing the 30-period MA on its way up potentially ending the downtrend. This was the confirmation of the bullish divergence. The index is near the upper band of the 50-period Bollinger Bands indicating a resistance for moving further to the upside. Retracement to the 61.8 Fibo level (back to 61.8% of the total movement to the upside) eventually took place as mentioned in our previous analysis. The index even crossed the 30-period MA on its way down but reversed quite soon. Currently, a triangle formation is apparent. A future breakout is expected after the rate decision events from BOC and ECB that are expected to cause extreme market volatility.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

OPEC+ is in the financial media’s focus. After the shock that caused a price slump the trading opportunity slowly arose. Despite OPEC+ production cut extension oil prices fell rapidly on the 3rd of May.

Source:

https://finance.yahoo.com/news/oil-falls-opec-signals-plan-230212640.html

Retracement could happen and the RSI is helping. Around 5 dollars drop was recorded for the price of Crude oil since yesterday so far. If this is the end of the downward and rapid movement then a retracement to the upside is possible back to 74 dollars/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 30th of May, the price continued to the downside, testing the 2,320 USD/oz as mentioned in our previous analysis, however, it was unsuccessful. 2,340 USD/oz served as the mean price until the 31st of May with the price deviating around 20 dollars from that mean. The price broke the support at nearly 2,320 USD and with the potential to move further downwards. However, it stalled after the breakout, indicating that there are upward pressures that keep the support strong. On the 3rd of May, the dollar suffered strong depreciation helping Gold to climb. Currently, there is high volatility with Gold moving sideways around the mean near 2,340 USD/oz and deviating 20 dollars from the mean currently.

______________________________________________________________

______________________________________________________________

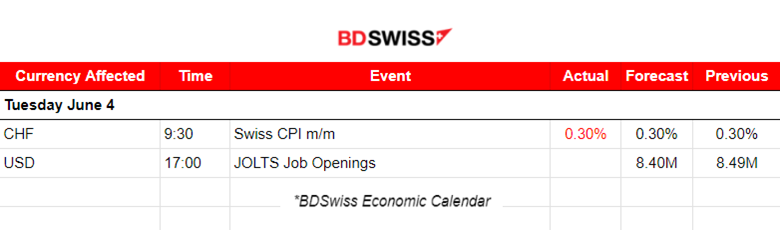

News Reports Monitor – Today Trading Day (04.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

The Swiss consumer price index (CPI) increased by 0.3% in May 2024 compared with the previous month. The 0.3% increase compared with the previous month is due to several factors including rising prices for housing rentals and international package holidays. The CHF depreciated at the time of the release and USDCHF jumped around 35 pips before a reversal took place.

JOLTS job openings report will probably affect the USD pairs on the 4th of June as it is the only labour market-related figure released that day. The shock however is not expected to be high as the market usually reacts heavily to the NFP instead.

General Verdict:

______________________________________________________________