PREVIOUS WEEK’S EVENTS (12.08.2024 – 16.08.2024)

Australia Economy:

Aug 13, 1:30am: Wage Price Index q/q – Actual: 0.8%, Forecast: 0.9%

Aug 15, 1:30am: Employment Change – Actual: 58.2K, Forecast: 20.2K

Aug 15, 1:30am: Unemployment Rate – Actual: 4.2%, Forecast: 4.1%

Aug 15, 11:30pm: RBA Gov Bullock Speaks

United Kingdom Economy:

Aug 13, 6:00am: Claimant Count Change – Actual: 135.0K, Forecast: 14.5K

Aug 14, 6:00am: CPI y/y – Actual: 2.2%, Forecast: 2.3%

Aug 15, 6:00am: GDP m/m – Actual: 0.0%, Forecast: 0.0%

Aug 16, 6:00am: Retail Sales m/m – Actual: 0.5%, Forecast: 0.6%

U.S. Economy:

Aug 13, 12:30pm: Core PPI m/m – Actual: 0.0%, Forecast: 0.2%

Aug 13, 12:30pm: PPI m/m – Actual: 0.1%, Forecast: 0.2%

Aug 14, 12:30pm: Core CPI m/m – Actual: 0.2%, Forecast: 0.2%

Aug 14, 12:30pm: CPI m/m – Actual: 0.2%, Forecast: 0.2%

Aug 14, 12:30pm: CPI y/y – Actual: 2.9%, Forecast: 3.0%

Aug 15, 12:30pm: Core Retail Sales m/m – Actual: 0.4%, Forecast: 0.1%

Aug 15, 12:30pm: Retail Sales m/m – Actual: 1.0%, Forecast: 0.4%

Aug 15, 12:30pm: Unemployment Claims – Actual: 227K, Forecast: 236K

New Zealand Economy:

Aug 14, 2:00am: Official Cash Rate – Actual: 5.25%, Forecast: 5.50%

Aug 14, 2:00am: RBNZ Monetary Policy Statement

Aug 14, 2:00am: RBNZ Rate Statement

Currency Markets Impact – Past Releases ( 12.08.2024 – 16.08.2024 )

Australia Economy:

Aug 13, 1:30am: Bullish AUD. Wage Price Index q/q – Actual: 0.8%, Forecast: 0.9%

Aug 15, 1:30am: Bullish AUD. Employment Change – Actual: 58.2K, Forecast: 20.2K

Aug 15, 1:30am: Bullish AUD. Unemployment Rate – Actual: 4.2%, Forecast: 4.1%

United Kingdom Economy:

Aug 13, 6:00am: Bullish GBP. Claimant Count Change – Actual: 135.0K, Forecast: 14.5K

Aug 14, 6:00am: Bearish GBP. CPI y/y – Actual: 2.2%, Forecast: 2.3%

Aug 15, 6:00am: Bullish GBP. GDP m/m – Actual: 0.0%, Forecast: 0.0%

Aug 16, 6:00am: Bearish GBP. Retail Sales m/m – Actual: 0.5%, Forecast: 0.6%

U.S. Economy:

Aug 13, 12:30pm: Bearish USD. Core PPI m/m – Actual: 0.0%, Forecast: 0.2%

Aug 13, 12:30pm: Bearish USD. PPI m/m – Actual: 0.1%, Forecast: 0.2%

Aug 14, 12:30pm: Bullish USD. Core CPI m/m – Actual: 0.2%, Forecast: 0.2%

Aug 14, 12:30pm: Bullish USD. CPI m/m – Actual: 0.2%, Forecast: 0.2%

Aug 14, 12:30pm: Bullish USD. CPI y/y – Actual: 2.9%, Forecast: 3.0%

Aug 15, 12:30pm: Bullish USD. Core Retail Sales m/m – Actual: 0.4%, Forecast: 0.1%

Aug 15, 12:30pm: Bullish USD. Retail Sales m/m – Actual: 1.0%, Forecast: 0.4%

Aug 15, 12:30pm: Bullish USD. Unemployment Claims – Actual: 227K, Forecast: 236K

New Zealand Economy:

Aug 14, 2:00am: Bearish NZD. Official Cash Rate – Actual: 5.25%, Forecast: 5.50%

Aug 14, 2:00am: Bearish NZD. RBNZ Monetary Policy Statement

Aug 14, 2:00am: Bearish NZD. RBNZ Rate Statement

FOREX MARKETS MONITOR

EURUSD (12.08.2024 – 16.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EUR/USD Recap (12.08.2024 – 16.08.2024):

Bullish momentum observed; opened at 1.09091, closed at 1.10253, with a weekly low of 1.09090 and high of 1.10486.

Upcoming Week Outlook (19.08.2024 – 23.08.2024):

A potential resistance breakout at 1.10468 on the 1-hour chart.

If breakout holds: Target levels are 1.10833 and 1.11298.

If breakout fails: Support levels to watch are 1.10180 and 1.09955.

Apply Risk Management

CRYPTO MARKETS MONITOR

BTCUSD (12.08.2024 – 16.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD Weekly Performance (12.08.2024 – 16.08.2024):

BTCUSD Weekly Performance (12.08.2024 – 16.08.2024):

The market opened at $58,680.51 and closed higher at $59,836.76, after dipping to a low of $56,134.91 and reaching a high of $61,735.24, signaling a bullish trend throughout the session.

Upcoming Week Outlook (19.08.2024 – 23.08.2024):

Potential 1hr chart downtrendline breakout at $60,210.55

If breakout holds: Target levels at $61,313.57 and $62,716.66

If breakout fails: Support levels at $59,324.74 and $58,661.47

Apply Risk Management

STOCKS MARKETS MONITOR

NVIDIA (12.08.2024 – 16.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last Week (12.08.2024 – 16.08.2024):

Nvidia experienced a bullish trend, opening at $106.14 and closing at $124.58. The weekly low was $106.12, and the weekly high was $124.59.

Upcoming Week (19.08.2024 – 23.08.2024):

Potential resistance breakout at $125.01 on the 1-hour chart.

If breakout holds: Price may target $130.27 and $136.95.

If breakout fails: Price may decline to $120.88 and $117.64.

Apply Risk Management

COMMODITIES MARKETS MONITOR

XAUUSD (12.08.2024 – 16.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last Week (12.08.2024 – 16.08.2024):

XAUUSD exhibited a bullish trend, opening at $2430.22 and closing at $2506.84. The week’s low was $2424.10, and the weekly high was $2509.77.

Upcoming Week (19.08.2024 – 23.08.2024):

Potential resistance breakout on the 1-hour chart at $2509.96.

If Breakout Holds: Target levels are $2533.53 and $2563.52.

If Breakout Fails: Downside targets are $2491.41 and $2476.85.

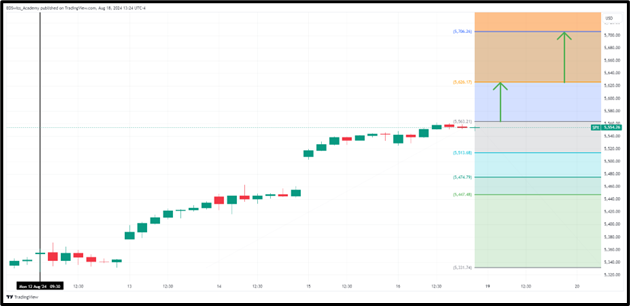

INDICES MARKETS MONITOR

S&P 500 (12.08.2024 – 16.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last week (12.08.2024 – 16.08.2024):

S&P 500 was bullish, opening at $5350.15 and closing at $5554.26. Low: $5325.79; High: $5562.21.

This week (19.08.2024 – 23.08.2024):

Potential resistance breakout at $5563.21 on the 1-hour chart.

If breakout holds, target levels are $5626.17 and $5706.26.

If breakout fails, support levels are $5513.68 and $5474.79.

Apply Risk Management

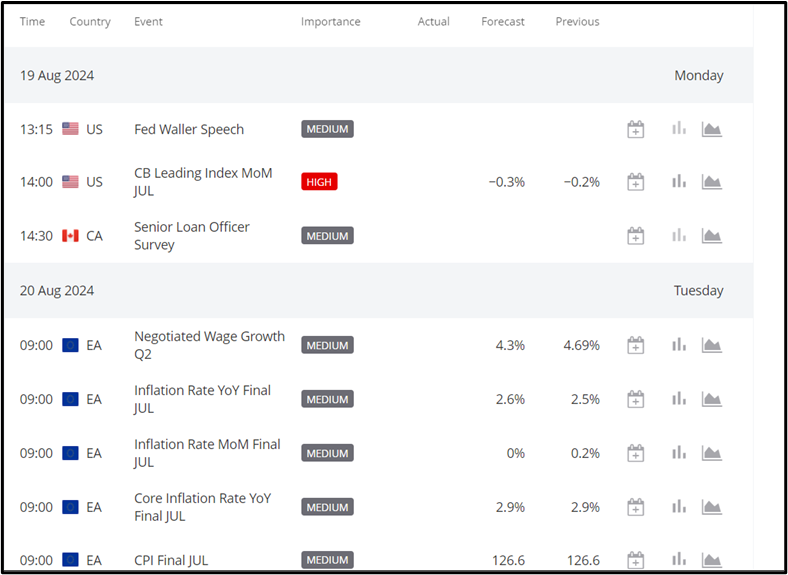

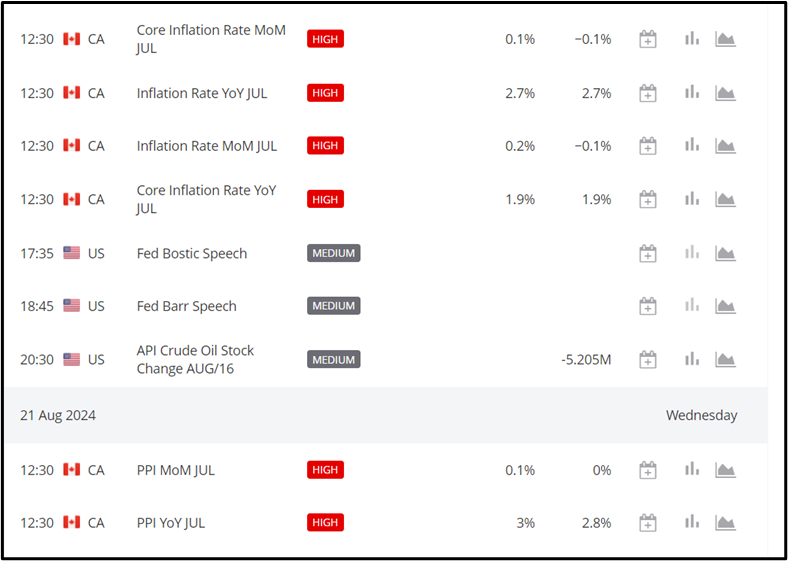

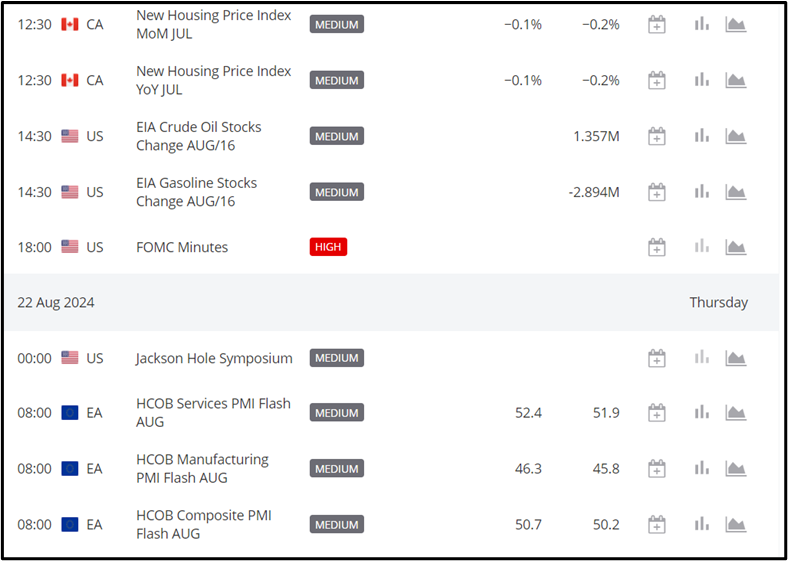

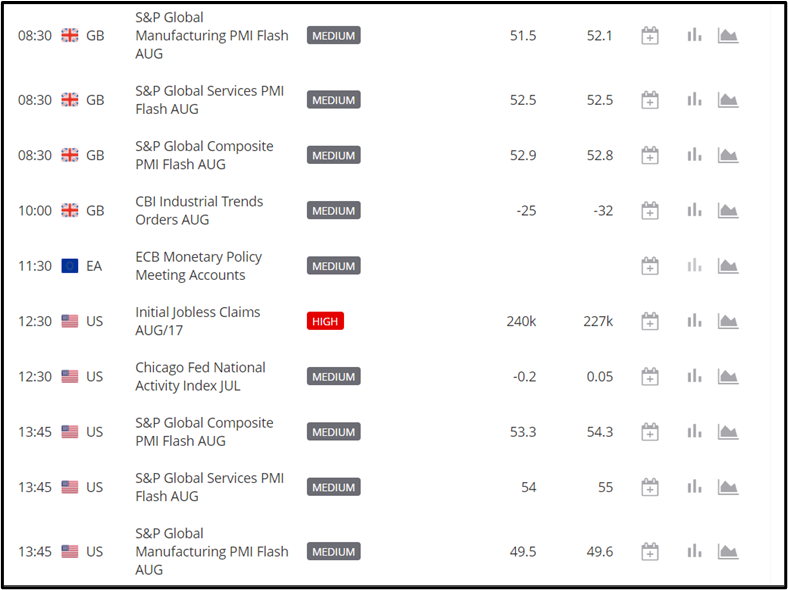

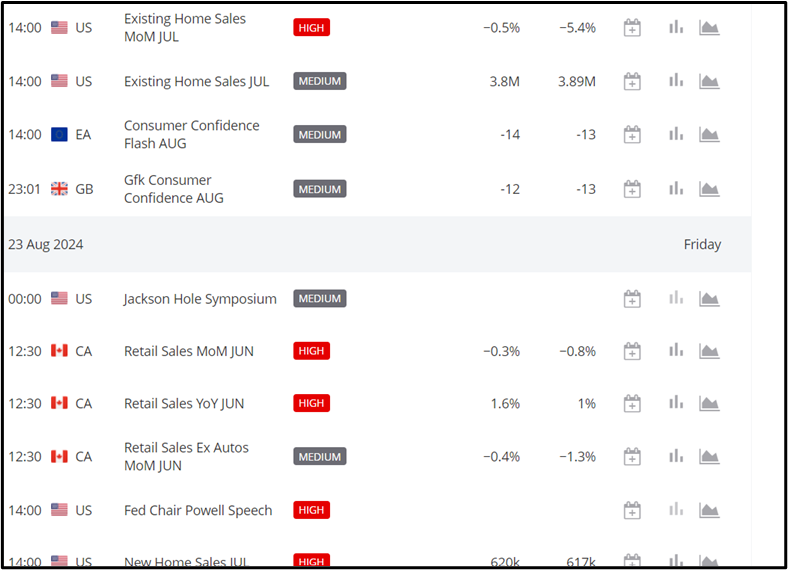

THIS WEEK’S EVENTS

(19.08.2024 – 23.08.2024)

Coming up:

Canadian Economy:

CPI m/m: Forecast 0.4%. Above supports CAD; below weakens.

Median CPI y/y: Forecast 2.5%. Deviation impacts CAD.

Trimmed CPI y/y: Forecast 2.8%. Higher supports CAD; lower pressures.

Core Retail Sales m/m: Forecast -0.4%. Better boosts CAD; worse weakens.

Retail Sales m/m: Forecast -0.3%. Similar impact as Core.

U.S. Economy:

FOMC Minutes: Hawkish boosts USD; dovish weighs.

Unemployment Claims: Forecast 233K. Fewer strengthens USD; more weakens.

Flash Manufacturing PMI: Forecast 49.8. Higher boosts USD; lower pressures.

Flash Services PMI: Forecast 54.0. Similar to Manufacturing.

Fed Chair Powell: Remarks impact USD.

Jackson Hole Symposium: Insights may move USD.

European Economy:

French Manufacturing PMI: Forecast 44.2. Better supports EUR; worse weakens.

French Services PMI: Forecast 50.2. Similar impact as Manufacturing.

German Manufacturing PMI: Forecast 43.4. Higher supports EUR; lower pressures.

German Services PMI: Forecast 52.3. Similar to Manufacturing.

United Kingdom Economy:

Manufacturing PMI: Forecast 52.1. Higher supports GBP; lower weakens.

Services PMI: Forecast 52.7. Similar impact as Manufacturing.

BOE Gov Bailey: Remarks influence GBP.

Sources :

Sources :

https://www.federalreserve.gov/

https://www.bankofengland.co.uk/