PREVIOUS TRADING DAY EVENTS – 20 June 2023

______________________________________________________________________

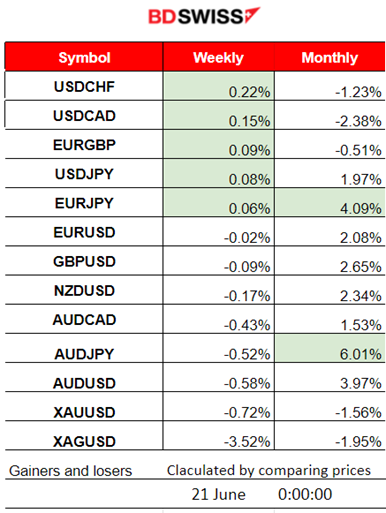

Summary Daily Moves – Winners vs Losers (20 June 2023)

- The USDCHF has reached the top this week but with only 0.22% so far.

- The AUDJPY remained on the top for this month with 6.01% so far. It retraced significantly yesterday after a long path upwards that lasted for days.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (20 June 2023)

Server Time / Timezone EEST (UTC+03:00)

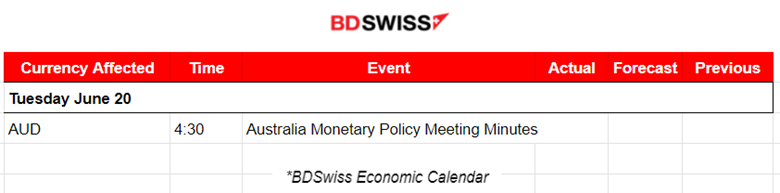

- Midnight – Night Session (Asian)

Two weeks ago, the RBA shocked markets by hiking rates. There is particular interest in the RBA (and BOC) because it had paused hikes earlier in the year but they resumed them. In the RBA monetary policy meeting, policymakers discussed that inflation in many economies remained well above central banks’ targets. Core inflation had remained sticky, not decreasing significantly. After 4:30 during this release, the AUD depreciated heavily against other currencies. AUDUSD moved downwards sharply by near 50 pips.

- Morning – Day Session (European)

No significant news announcements, no special scheduled releases.

General Verdict:

______________________________________________________________________

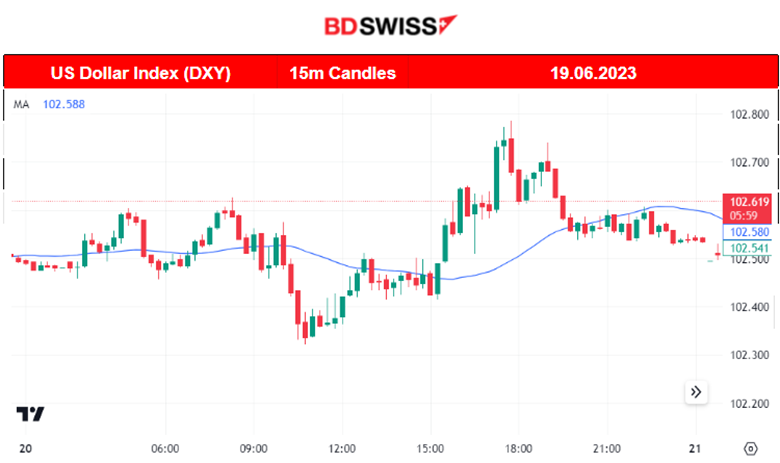

FOREX MARKETS MONITOR

EURUSD (20.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair moved sideways around the mean with low volatility since no major scheduled releases were taking place. It is mirroring the DXY chart since the USD is the main driver.

AUDUSD (20.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair fell rapidly after the Monetary Policy Meeting Minutes release. The AUD had depreciated greatly when the release took place at 4:30. The pair remained under the 30-period MA steadily falling until it found support at 0.67520 causing it to retrace back to the mean.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index signalled a stop for the upward trend as the price moved downwards crossing the 30-period MA and remaining below it. A sideways movement for now with low volatility is in place. Yesterday more volatility was observed after the market opening but we saw no significant one-sided direction. The market has not shown any turning point signs. We have to look closely at breakouts.

______________________________________________________________________

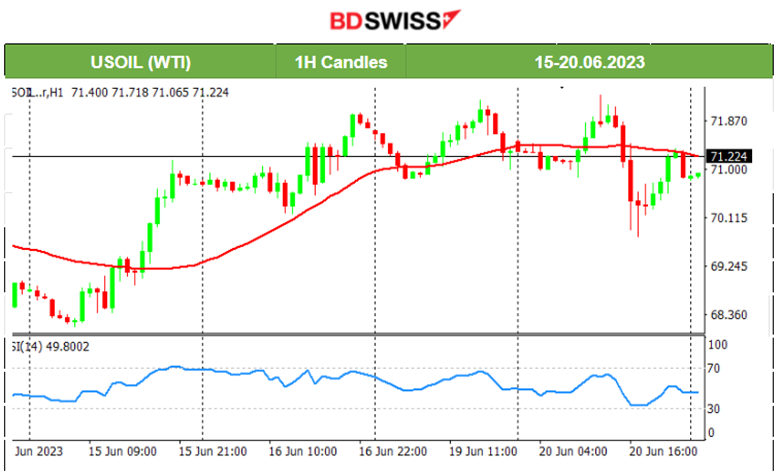

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude moves sideways and around the mean being resilient in dropping. 71.30 USD/b is the price that seems to act as the short-term mean price. 72.20 is the important resistance level while 70 USD/b is the important support level to be taken into consideration when looking for breakouts.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold’s path was mainly sideways since the 16th of June and remained sideways around the mean with more push to the downside. On the 20th at 15:30, the Building permits and Housing Starts figures were reported higher. At that time, Gold started to rapidly fall finding support at 1930 USD/b before retracing.

______________________________________________________________

News Reports Monitor – Today Trading Day (21 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

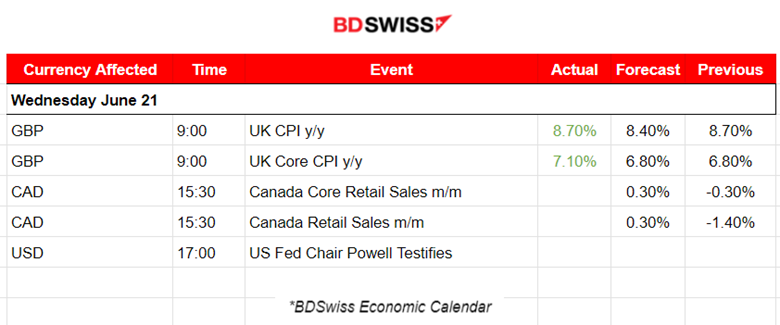

- Morning – Day Session (European)

Annual Inflation was reported higher than expected for the U.K. causing a surprise. It remains at 8.7%, the same as the previous figure. The GBP appreciated greatly and then reversed during the release. GBP pairs with GBP as base currency settled eventually downwards. EURGBP jumped.

At 15:30 significant releases for Canada, Retail Sales figures are to be announced and probably the CAD pairs will experience shock but not of such a high level.

The Fed Governor is due to testify about the Semi-Annual Monetary Policy Report before the House Financial Services Committee, in Washington DC at 17:00.

General Verdict:

______________________________________________________________