On a fateful Tuesday, October 25th, 2022, some members of Ghana’s ruling party, the New Patriotic Party (NPP), cried out to President Nana Addo Dankwah Akuffu Addo, demanding the dismissal of Finance Minister Ken Ofori-Atta and his deputy, Dr. John Kumah, to rekindle hope in the country’s finances.

Then, on the 14th of February 2024, 16 long months after those pleas, the president finally made his move, shuffling his ministers and swapping out the finance minister. Was it mere coincidence that this day fell on Valentine’s Day, or was it the president’s love offering to the people of Ghana?

When the finance minister was ousted, the USD to GHS exchange rate stood at 12.3752, with whispers of improvement echoing through the nation. Yet today, that hope seems fleeting, as the exchange rate hovers around 12.7500.

As the cedis continues its downward spiral, so too does the fate of the deputy minister. Tragically, Dr. John Kumah met his end on Thursday, March 7th, 2024, just one day after Ghana’s Independence Day celebrations.

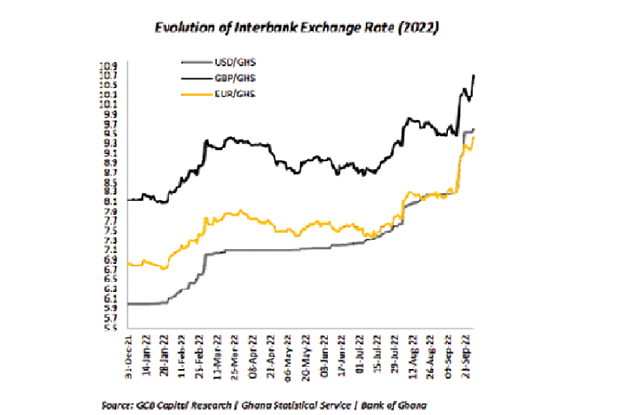

In November 2022, Finance Minister Ken Ofori-Atta revealed that Ghana’s currency had lost 53.8% of its value against major trading currencies since the start of 2022.

During his presentation of the 2023 Budget in Parliament on Thursday, November 21st, 2022, the Minister lamented, “The demand for foreign exchange to support our unbridled demand for imports undermines and weakens the value of the cedi. This contributed to the depreciation of the Cedi which has lost about 53.8% of its value since the beginning of this year, compared to the average 7% annual depreciation of the Cedi between 2017 and 2021.”

He further highlighted that the cedi’s depreciation severely impacted the Ministry’s ability to manage the country’s debt, which surged by ¢93 billion in 2022 alone. He stated, “Mr. Speaker, the external debt as a percentage of the total debt stock is 58.1 percent as at end of September 2022. The sharp growth in the external debt stock is largely driven by the depreciation of the local currency. The depreciation of the Ghana cedi added GH¢93,855.15 million to the external debt stock.”

From a technical analysis perspective using the Weekly USDGHS chart, the exchange rate has oscillated between 14.7834 as resistance and 8.2669 as support. Presently, the exchange rate hovers around 12.7500. A breach of the resistance level suggests a likelihood of further upward movement in the exchange rate.

Examining the Daily USDGHS chart, an uptrend has been observed since January 17, 2024, starting from an exchange rate of 11.9079. A trendline drawn from this point rejected the exchange rate at 12.3709 on February 23, 2024, following a pullback from the uptrend. Subsequently, the exchange rate continued its upward trajectory to 12.8666, encountering resistance before pulling back to its current level of approximately 12.7500.

A breakdown of the trendline signals a potential trend reversal, indicating a probable decline in the exchange rate. Conversely, if the trendline rejects the exchange rate again, there is a likelihood of the exchange rate resuming its uptrend towards the resistance level at 12.8666. Should this resistance level be breached, it suggests a heightened probability of further upward movement in the exchange rate.

Sources :

https://www.graphic.com.gh/news/politics/akufo-addo-sacks-13-minister-see-list.html

https://www.euromoney.com/article/b12xyggjh95xst/africa-ken-ofori-atta-the-man-to-make-ghana-fly

https://www.tradingview.com/chart/4IThf1h1/

https://www.graphic.com.gh/features/opinion/biography-dr-john-ampontuah-kumah.html

https://www.graphic.com.gh/business/business-news/cedi-depreciation-eases.html