PREVIOUS TRADING DAY EVENTS – 26 June 2023

Europe’s largest economy fights against recession.

“The economy faces the prospect of a longer recession as domestic demand and the expectations of exporters have both weakened”, Klaus Wohlrabe, the head of Ifo surveys, told Reuters in an interview on Monday. “The probability has increased that gross domestic product will also shrink in the second quarter,” he said.

“Sentiment in the German economy has clouded over noticeably,” Ifo’s president Clemens Fuest said.

The Ifo’s decline is in line with the drop in the flash purchasing managers index, published on Friday. The report showed that there was a combination of a slower rise in service sector business activity and a deepening downturn in manufacturing output.

“It is clear that the industry remains under pressure from waning demand, in line with Friday’s PMIs which saw the industry in the Eurozone’s biggest economy deep in contractionary territory amid rapidly shrinking backlogs and destocking,” said Mateusz Urban, senior economist at Oxford Economics.

“We feel confirmed in our forecast that the German economy will shrink again in the second half of the year,” Commerzbank’s chief economist Joerg Kraemer said.

Source: https://www.reuters.com/markets/europe/german-business-sentiment-falls-further-june-2023-06-26

______________________________________________________________________

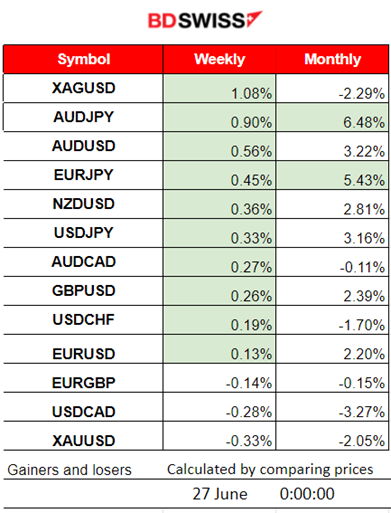

Summary Daily Moves – Winners vs Losers (26 June 2023)

- XAGUSD (Silver) has reached the top this week with a 1.08% price change followed closely by AUDJPY with a 0.90% change.

- AUDJPY is still on the top this month, gaining 6.48%.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (26 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

Germany’s most prominent leading indicator, the Ifo index, dropped for the second consecutive month. The EUR pairs experienced an intraday small shock as EUR depreciated slightly.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURGBP (26.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced high volatility as the European session was approaching. It dropped at 10:00 with the opening and then found support near 0.85430. It eventually reversed significantly crossing the 30-period MA on the way up and found resistance at 0.85945 before retracing back to the mean.

Trading Opportunities

We can use the Fibonacci expansion tool after the reversal when we find that strong resistance. The 61.8% Fibo level is the level at which the pair usually retraces to at least. It is depicted below.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index was testing the significant support levels near 14805 USD and eventually broke that support yesterday after the NYSE opening. It moved further downwards finding resistance at near 14700. It was expected that the path would be sideways, however, this breakout signals a volatile downward movement. The RSI slows down showing higher lows, however, this just supports the retracement that probably will take place and not a reversal. 14800 is the stop level of a potential retracement.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

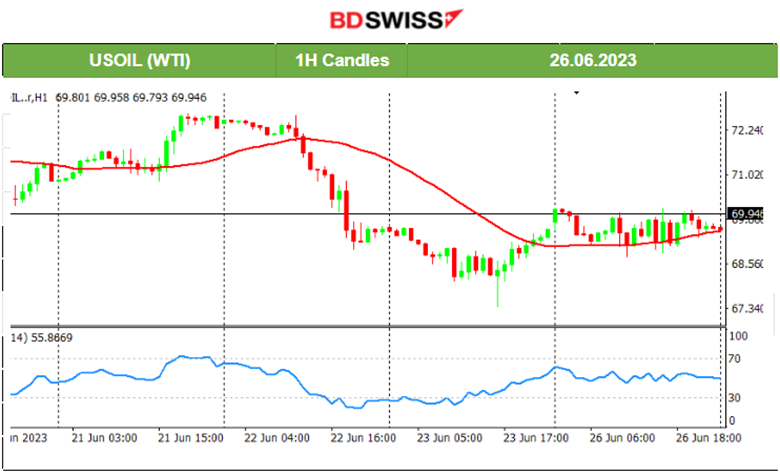

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude moved significantly lower on the 22nd, deviating highly from the mean and moving downwards. It later experienced a sideways path close to the mean but with the usual high volatility to govern the path. Yesterday, volatility was low and Crude moved sideways without showing any significant deviations with the price settling near 69.50 USD/b. 70.10 USD/b is a significant resistance. 68.75 is significant support. This consolidation phase is expected to end soon. A breakout in either direction will probably cause the price to deviate significantly.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The Gold price has put a stop to the downward trend and moves sideways with high volatility. There is a significant resistance level near 1935 USD/oz. It moved above the 30-period MA recently but the path is probably sideways unless it breaks that resistance. Then it will signal the end of the sideways movement. Eyes should be on the scheduled releases that affect USD, for example, the NFP. USD is the real market mover.

______________________________________________________________

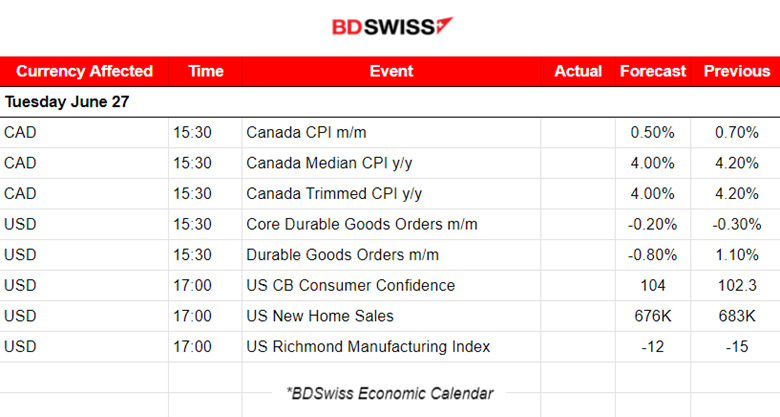

News Reports Monitor – Today Trading Day (27 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

At 15:30 on the 27th, CAD pairs will probably be affected by the CPI data with an intraday shock, causing the pairs to deviate from the mean before retracing. U.S. Durable Goods data is also being released at that time so USD pairs might experience some high volatility.

U.S. CB Consumer Confidence report will potentially have a significant impact on the dollar. It is expected that the figure will be higher.

General Verdict:

______________________________________________________________