Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

Finally! Congress agreed on a new fiscal package Sunday night, just in time to avert yet another government shut-down. The terms of the package aren’t completely clear yet (the text isn’t available to reporters) but it appears it will provide $600 payments to many people and revive lapsed supplemental federal unemployment benefits at $300 a week for 11 weeks. Both of these amounts are half that of the original stimulus law. It would also continue and expand benefits for gig workers and freelancers and extend federal payments for people whose regular benefits have expired. It’s also expected to extend an eviction moratorium set to expire at the end of the year. That’s important – otherwise the US was looking at millions of people becoming homeless.

Just FYI, the one-off payments that people get look like this. The payments are adjusted for income. I must admit, I wasn’t very stimulated by my stimulus payment.

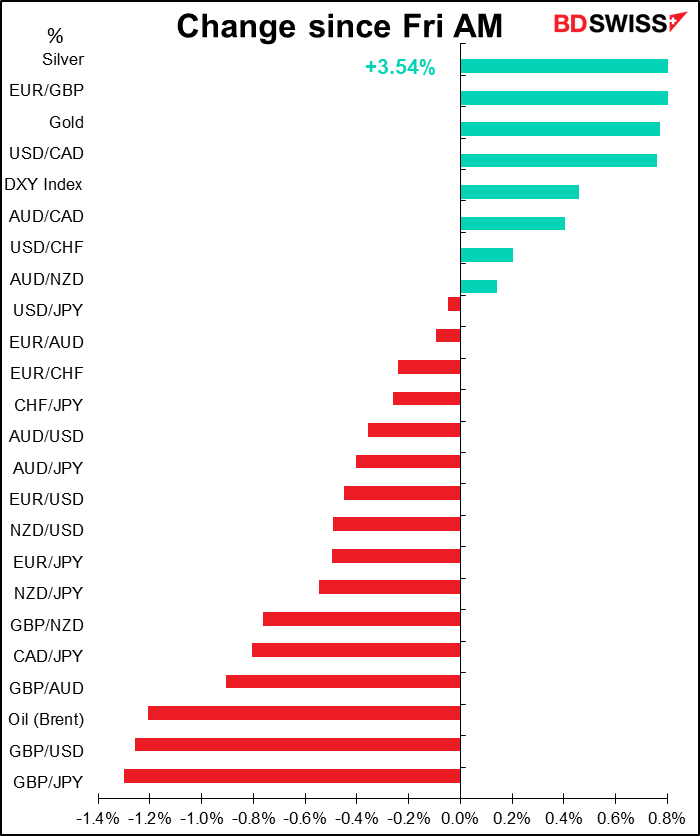

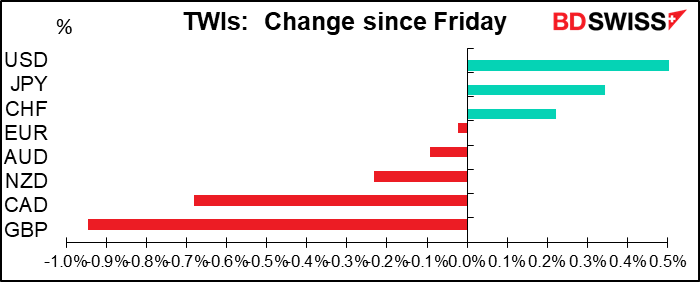

The agreement on a fiscal package should normally have created a strong “risk-on” tone in the markets. However stocks in Asia were mixed as the good news was offset by some frightening news from Britain (next topic). As a result, we had a typical “risk-off” move in currencies, with USD, JPY and CHF gaining and the commodity currencies losing.

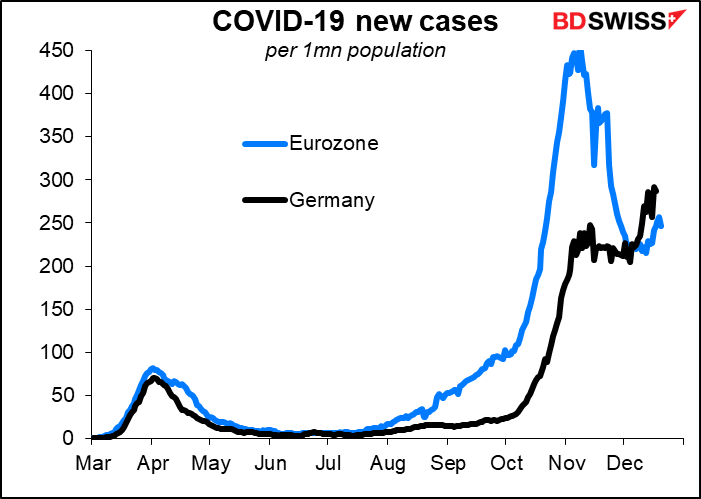

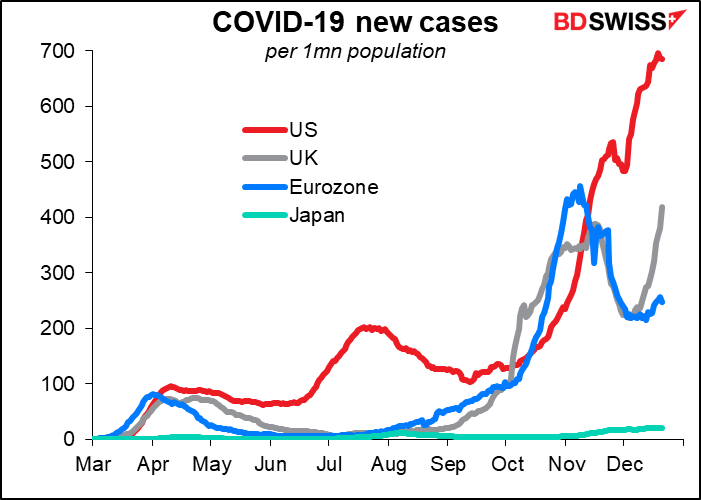

GBP is taking center stage this morning as the Brexit talks drag on and a more virulent mutant strain of the virus discovered in London has caused many European countries to cut all incoming traffic from the UK. The UK government canceled plans to allow families to see each other over the holidays as the government warned that the new, more easily transmitted strain of the virus was “out of control.”

The Brexit talks are still floundering over fishing rights, apparently. UK officials insisted the EU offer on fisheries and the fair competition level playing field remained “unacceptable” and accused member states of not showing enough “flexibility” (“member states” = France). The European Parliament Sunday warned that it will now refuse to vote on any agreement before the end of the year. This means Brussels will have to explore legal stopgap solutions if it wants a deal to take effect on time – assuming that one can be reached in the first place. Some UK officials are now saying that they want the issue settled before Christmas. That implies MPs and MEPs would have to approve it in the six days between Christmas and 31 December in order for it to take effect before the transition period ends. That would add another source of risk, because some MPs might be hesitant to vote for it without adequate time to examine it closely.

All told, it looks like a pretty grim combination for GBP. On Friday I suggested that the theme song for those trading the currency recently should be Bananarama’s I Heard a Rumor, but one of my readers suggested that if the talks fail and the UK economy goes into a tailspin after 1 January, the group’s Cruel Summer might be a more appropriate song.

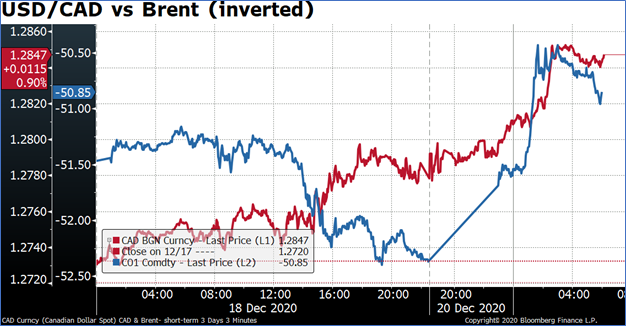

Elsewhere, the news about the new virus strain hit oil prices as market participants worry about more lockdowns and restrictions on movement. The fall in oil had a knock-on effect on CAD, as usual.

The fall in oil seems to be reversing now, however. CAD may well follow along.

Today’s market

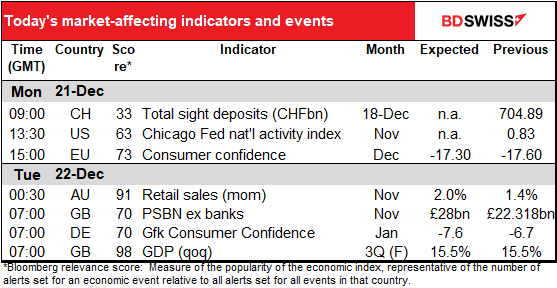

Not much on the schedule in the next 24 hours.

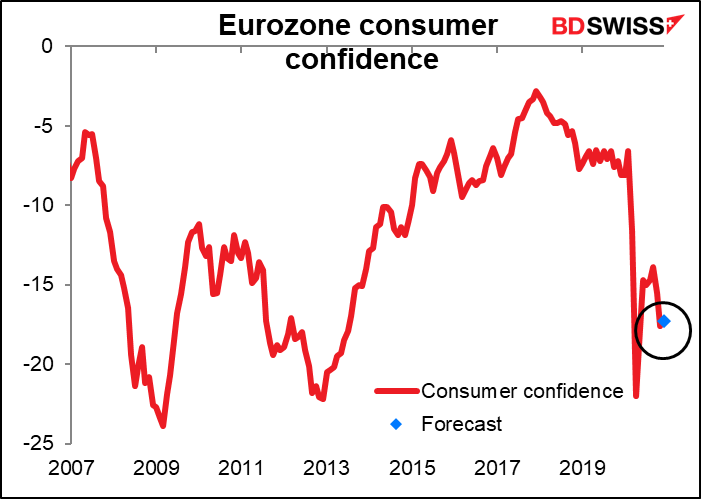

Eurozone consumer confidence isn’t normally a big market-mover, and this month it’s expected to be barely changed. That wouldn’t be a bad result, given everything that’s happening, but it still probably wouldn’t move the euro.

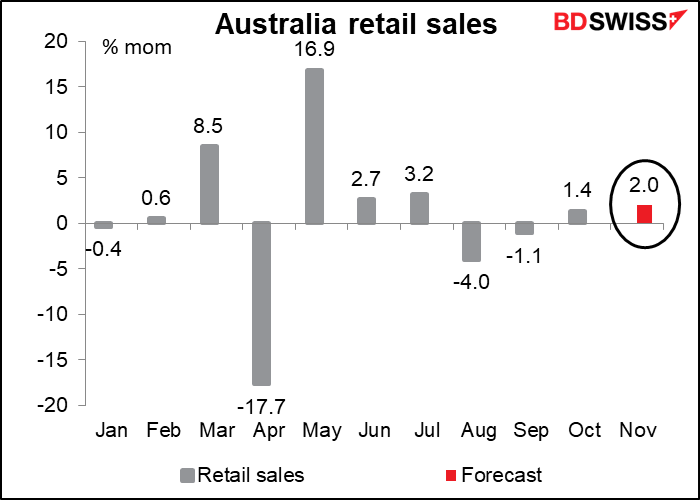

Overnight, Australia retail sales used to be important for AUD, but now that the Australian Bureau of Statistics is putting out a preliminary figure, it’s well discounted and therefore not so market-moving.

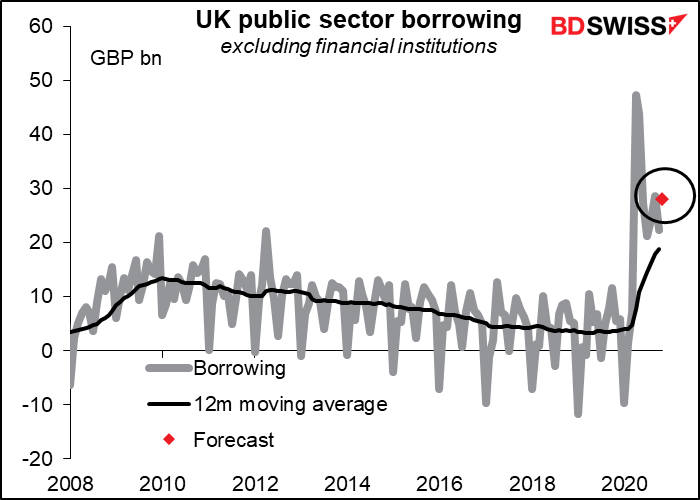

Then early Tuesday morning, are people really going to worry about UK government borrowing when Brexit may be about to fall through? Maybe a little bit but it’s only of secondary concern, I’d say. Meanwhile the third and final revision of UK Q3 GDP should probably result in little change and garner little attention.

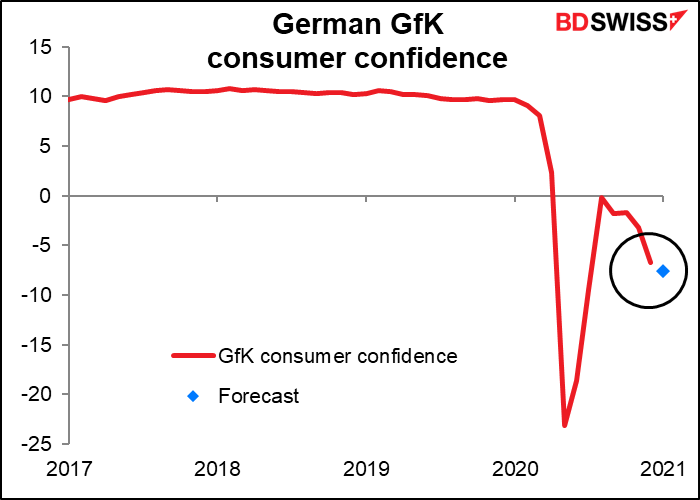

German consumer confidence is expected to continue falling.