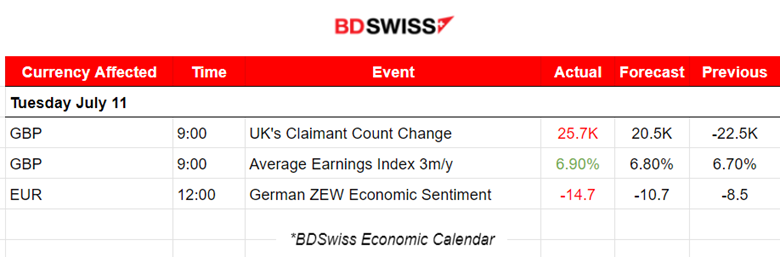

PREVIOUS TRADING DAY EVENTS – 11 July 2023

Yesterday at 9:00, the Jobless Claims figure for the U.K was reported higher than expected. The average earnings figure was also reported higher by 0.20%. The growth of employees’ average total pay (including bonuses) was 6.9% and in regular pay (excluding bonuses), the growth was 7.3% from March to May 2023.

The unemployment rate from March to May 2023 increased by 0.2 percentage points in the quarter to 4.0%.

Following the latest U.K. labour market data, markets priced in over a 50% chance that the Bank of England (BoE) will again increase interest rates by 50 basis points at the August meeting.

Source:

“The economic outlook for the second half of the year has become even gloomier,” summarised Helaba senior economist Ralf Umlauf on Tuesday with an eye to the indicators.

The German economy fell into recession in early 2023 and it is not expected to get out of it soon because of the sharp rise in key interest rates, which are just beginning to show their effect.

“Hopes for an economic recovery in the second half of the year are melting away,” said VP Bank chief economist Thomas Gitzel.

“The German economy is currently being squeezed twice – by high inflation rates and the weak global economy.”

Source: https://www.reuters.com/markets/europe/german-investor-morale-falls-july-zew-2023-07-11/

______________________________________________________________________

News Reports Monitor – Previous Trading Day (11 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, nor any significant scheduled releases.

- Morning – Day Session (European)

The Claimant Count Change figure was reported higher than expected. This coincides with the labour marketing cooling expectations after an aggressive rate increase campaign by the central bank. However, the average earnings figure was reported higher than expected. The market reacted to this at that time with an intraday shock, causing the GBP to appreciate for a while. GBPUSD jumped 40 pips before reversing soon after.

The German ZEW Indicator of Economic Sentiment Stands recorded a decrease in the current July 2023 survey. At -14.7 points, it stands at 6.2 points below the previous month’s value. The assessment of the economic situation in Germany also worsened. The Market did not react with a shock; however, the EUR depreciated after the release for a while before reverting.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (11.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD has been moving early to the upside above the 30-period MA steadily. At the start of the European session, more volatility kicked in with the pair showing a resistance at near 1.10260 and then reversing rapidly, crossing the MA on its way down. The German ZEW Indicator of Economic Sentiment index fell to -14.7 points. Financial market experts predict a further deterioration in the economic situation by year-end. Factors, such as rising interest rates, support this expectation. The EUR depreciated significantly after the release, pushing the pair further downwards until the 1.09775 support. After several tests of that support, the pair eventually retraced back to the mean and beyond, moving sideways for the rest of the trading day.

GBPUSD (11.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair gained overall yesterday, as it experienced an upward trend. At 9:00, the Claimant Count Change and Average Earnings Index figures were out causing the GBP to appreciate and the pair to move upwards for a while before shortly retracing back to the mean. However, it retained its upward momentum for the whole trading day since the Dollar steadily depreciated against major currencies yesterday.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. stock market seems to be reversing as all benchmark indices are moving rapidly upwards. During the week, we have seen the RSI showing signs of bullish divergence and that is slowing down. The path was expected to move more sideways and around the 30-period MA. This is now visible when looking at the NAS100. 15220 seems to be the next important resistance, with 14985 being the next important support. The high gap between them is due to the high volatility that the index experiences lately. Will this price reversal be sustainable? My guess is still in favour of a volatile sideways path around the mean.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The Oil price follows an upward path formed by the OPEC meetings’ recent statements and other factors. The trend paused for a while until yesterday, when Crude Oil prices jumped after breaking the resistance of 74 USD/b, reaching the next resistance near 74.85 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold has been experiencing high volatility, mostly as a result of the USD impact. After the reversal on the 6th of July, it showed more movement to the upside, even though the RSI is showing lower highs. That is why it makes sense that the price resists moving rapidly upwards after some resistance breakouts, for example near 1934.70.

______________________________________________________________

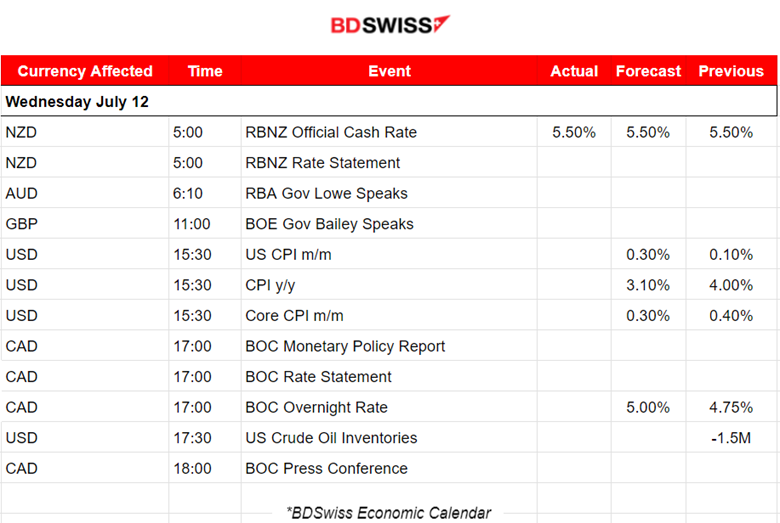

News Reports Monitor – Today Trading Day (12 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The RBNZ left rates unchanged as expected. An intraday short shock occurred causing the NZD to depreciate for a while, but the effect soon faded.

- Morning – Day Session (European)

At 15:30, the CPI change data will be reported potentially causing a shock to the USD pairs. Annual inflation is expected to be reported lower as a result of rising interest rates, coinciding with the labour market cooling, as indicated by the NFP.

At 17:00, the Bank of Canada is going to decide if there will be a rate increase. The market expects a 25 basis points increase. CAD pairs will probably experience an intraday shock but it’s not expected to be great unless there is a hike surprise.

General Verdict:

______________________________________________________________