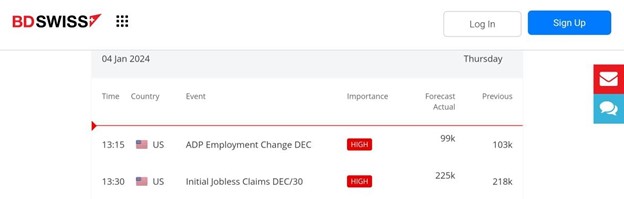

Today, ( January 4th, 2024), the BDSwiss economic calendar ( https://global.bdswiss.com/economic-calendar/ ) highlights two significant events that can greatly influence the currency market, specifically the United States Dollar (USD). First, there is the ADP Employment Change for December, a crucial indicator measuring the estimated change in the number of employed individuals during the previous month. It excludes data from the farming industry and government. If the actual figure surpasses the forecasted value of 99k, it is generally considered positive for the USD.

Simultaneously, the Initial Jobless Claims for the week ending December 30th will be released. This metric gauges the number of individuals filing for unemployment insurance for the first time during the past week. A scenario where the actual value is less than the forecast is seen as favorable for the USD.

These high-impact news releases from the United States have the potential to significantly affect USD currency pairs. Turning our attention to the EURUSD pair’s daily timeframe chart, we observe an existing uptrend. The price faced rejection at 1.07254, bouncing off the trendline drawn from 1.05171 after a pullback. The current price action involves a pullback phase after reaching a peak at 1.1140.

If the trendline is breached, there are increased probabilities of the price continuing its downward trajectory. Conversely, if the price experiences rejection at the trendline once again, it signals a likelihood of an uptrend continuation.

Given the impending economic news releases, the movement in the EURUSD pair today is prone to significant impact. Traders and analysts need to be vigilant and factor in the potential outcomes of the economic indicators in their chart analysis.

As we navigate through these dynamics, it would be insightful to gather perspectives from your charts on the EURUSD pair. How does your analysis align with the current market conditions and the anticipated impact of the economic news on this currency pair?