Today is poised to be a dynamic day in the London and New York sessions, with the release of impactful economic indicators in both trading periods.

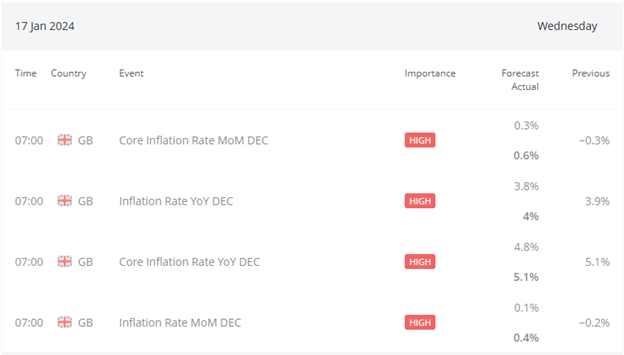

At 7 GMT, the United Kingdom unveiled its Inflation Rate YoY for December, which gauges the change in the price of goods and services purchased by consumers. The forecast stood at 4.8%, reflecting a 0.3% decrease compared to the previous rate of 5.1%.

As shown below the data beat expectations with the headline figure rising to 4.0% from 3.9% and the key CORE CPI data remained at 5.1% and the RPI (Retail Price Index) at 5.2%.

Source: https://global.bdswiss.com/economic-calendar/

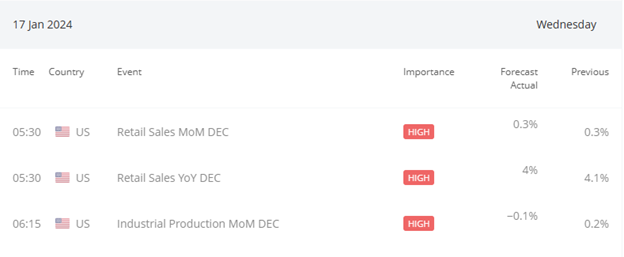

Later today , at 13:30 GMT, the United States will disclose its Retail Sales MoM for December, measuring the change in the total value of sales at the retail level. The forecast is aligned with the previous release at 0.3%. Additionally, Retail Sales YoY for December is anticipated to be 4%, slightly lower than the previous figure of 4.1%. A result surpassing the forecast would be favorable for the United States Dollar (USD).

Source: https://global.bdswiss.com/economic-calendar/

Given these significant economic announcements from both the United States and the United Kingdom, the impact on the GBPUSD currency pair is expected to be substantial. Traders are likely to seek opportunities to capitalize on potential price movements in the GBPUSD. Following the UK CPI release the GBPUSD pair spiked from under 1.2600 to 1.2655 and has since gained further momentum to test the key 1.2700 zone.

From a technical analysis standpoint, focusing on the Daily timeframe reveals an uptrend trendline. This trendline, originating from 1.20697, initially rejected the price at 1.21937 and later at 1.26127. However, the current status indicates a breakdown of the uptrend trendline, signaling a potential reversal from the previous upward trend.

The forthcoming news from the New York session will play a pivotal role in shaping the trajectory of the GBPUSD pair. Should the news push the price above the trendline, there will be increased likelihood of an uptrend continuation. Conversely, if the news fails to drive the price upward, there is a higher probability of the downtrend persisting, affirming the trend reversal.

As traders, it is crucial to analyze the chart and draw insights into the potential movements of the GBPUSD pair in anticipation of the news emanating from both trading sessions. What do your charts reveal about the likely direction of the GBPUSD today as we await the economic releases?