Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

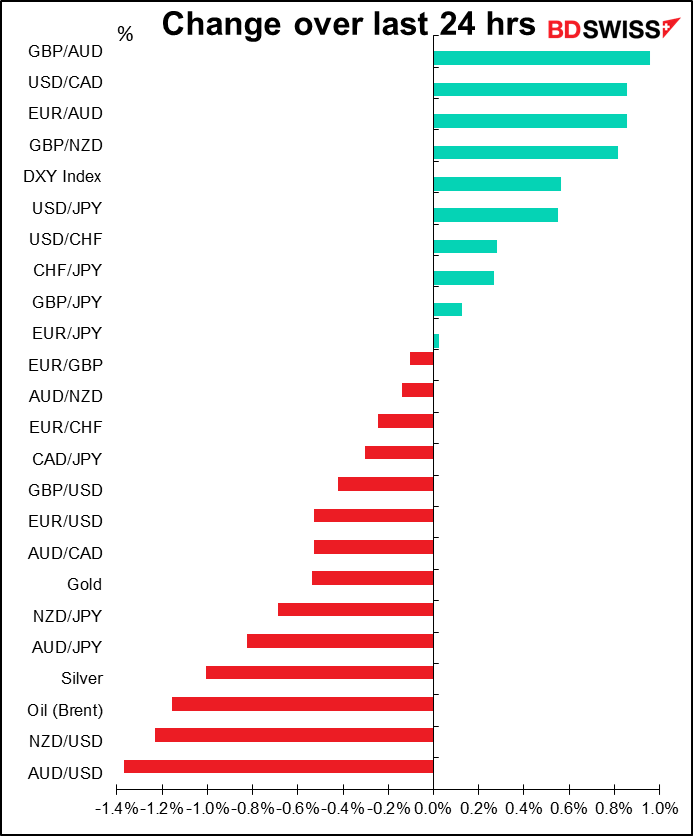

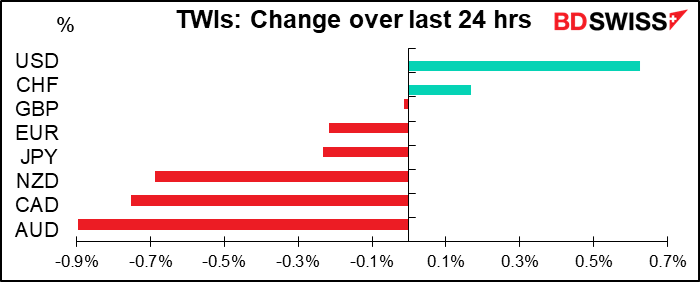

Market Recap

What’s the world coming to? I was all prepared to discuss in detail this morning last night’s statement from the Federal Open Market Committee (FOMC), Fed Chair Powell’s press conference, and what the Fed’s stance means for the market. But it didn’t mean anything when compared to the activity of a gang of Reddit readers taking aim at Wall Street. It’s the financial version of the storming of the US Capitol building, only in this case it’s not so easy to determine who are the good guys and who are the bad guys – neither group seems particularly admirable.

In any case, first let’s discuss the FOMC meeting and then we can talk about the stock market.

The FOMC meeting held no major surprises. The statement was little changed from December. I had thought they might be more optimistic about the longer-term, but in fact they downgraded both their view of the immediate future and further out. They added a bit to acknowledge that progress on vaccinations could change the course of the pandemic, but at the same time they eliminated some key qualifiers from the second paragraph that limited the time of concern – it’s now open-ended. This is a significant downgrade in their view, IMHO. To wit:

The path of the economy will depend significantly on the course of the virus, including progress on vaccinations. The ongoing public health crisis continues to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The press conference was a bit more like I had expected. Chair Powell appeared to signal that the Committee’s economic outlook has improved for this year in response to vaccines and fiscal policy developments. Nonetheless, he once again stressed that it’s “premature” to consider tapering their bond purchases and downplayed the risk of inflation from the administration’s fiscal support. On the contrary, he stressed that the Committee would welcome somewhat higher inflation, which is what one would expect from their new “average inflation targeting” framework. This was the kind of dovish talk that I thought would weaken the dollar. His approval of keeping policy unchanged while inflation rises would mean lower real yields and a weaker USD.

But Powell wasn’t the person moving markets yesterday. We don’t really have a name for the person who did. In the Eurobond market, Belgian dentists are the archetypical retail buyers. In the Japanese retail FX market, it’s the proverbial “Mrs. Watanabe” who’s thought to be sitting at her PC after the kids have gone off to school, trading USD/JPY while scrutinizing the ichimoku clouds. But what are we to make of the followers of Reddit’s wallstreetbets page? The people who have sent GameStop up from $17.25 a share at the start of the year to a high of $380 yesterday while turning this seemingly moribund purveyor of video games in decaying shopping malls into the most actively traded stock on Wall Street?

In case you’re not familiar with it, this is the story. Someone noticed that GameStop was being heavily shorted – that is, some hedge funds had borrowed the stock and sold it in anticipation that the price would fall and they could buy the stock back at a cheaper price. Short interest was reportedly around 148%, meaning more shares had been sold than existed (i.e., some shares had been borrowed and sold more than once). Furthermore, the hedge funds had bought a large number of put options in the stock, meaning they held options that would make money if the stock fell.

However, the small retail investors who read wallstreetbets thought that the stock had positive news and outlook from leadership additions and a changing business model. They thought it was undervalued at current revenue and of course massively over-shorted. They decided to push back against the professional short-sellers and buy the stock en masse. This isn’t market manipulation – you’re allowed to encourage other people to buy a stock, and if lots of them go along with you, then there’s no issue.

Shorting stocks is a risky proposition. If you buy a stock and it falls, it can only go to zero. You can only lose the money you invested. But if you short a stock, there’s no limit to how much you can lose because there’s no limit to how high a stock can go. If you shorted it at $17.25 a share, you took in $17.25. But if it then goes to $380 and you have to buy it back at that price to close out your position, you’re out $362.75. Limited upside, unlimited downside. To make matters worse, most of these hedge funds are using leverage, that is, they are borrowing money so that they can take larger positions than they could just by using their own money.

And that’s what happened. The retail buying forced several large hedge funds to buy the stock back ASAP in order to limit the damage. This relatively obscure company was the most actively traded stock in the US for the second day in a row in the middle of earnings season. This short squeeze caused the hedge funds huge losses (apparently over $2bn in the case of one) in just a few days. Furthermore, to offset their losses in those stocks they had to sell off other stocks that they had profits on. Result: S&P 500 and NASDAQ both down 2.6% yesterday, the worst day for the S&P 500 since October. The VIX index of expected volatility had its biggest one-day rise since last March, when the pandemic first hit.

In this David vs Goliath story, neither side is particularly admirable. No one will have a lot of sympathy for the giant hedge funds that make money driving companies’ stock prices into the ground, but no rational investor who believes the role of the stock market is to allocate capital to the most efficient companies can approve of thousands of small investors jumping on a bandwagon simply to make money off of another investor’s pain (although I admit there is undoubtedly some schadenfreude in the whole event). I’m particularly concerned about those small investors who may be left holding the bag in GameStock at $380 a share when the shorts are all squeezed out and there’s no one left to buy. Overnight, shares of GameStop are down -16% (was down as much as -38% at one point). But then attention is likely to pass to another obscure stock and the pattern will be repeated elsewhere.

The carnage is likely to continue this morning. Immediately after the US close, three of the mega-tech stocks reported their earnings. Apple’s shares fell 3.2% even though their quarterly revenue exceeded $100bn for the first time. For the fourth quarter in a row the company didn’t offer any guidance on earnings but did say that it expects growth in wearables (such as AirPods) and services to slow. Telsa fell 5.1% in after-market trading after its earnings come in lower than expected ($0.80 a share vs $1.03 consensus estimate). Facebook’s Q4 sales rose 33% on strong demand for ads, but the company’s shares fell -1.9% anyway after it warned of “significant uncertainty” in 2021. Also this morning, Samsung Electronics also reported weaker earnings in Q4.

As a result, all Asian stock markets are down this morning and the S&P 500 is indicated -0.6% at the time of writing.

Today’s market

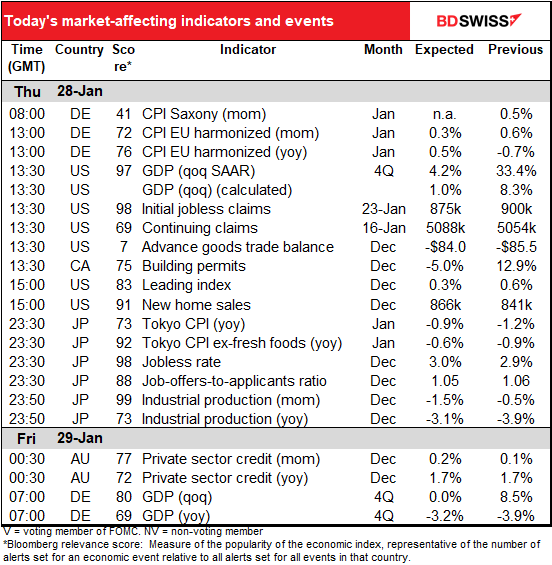

There’s not that much in the early part of the day, but from 13:00 GMT the wires start to heat up with the German consumer price index, followed half an hour later by US Q4 GDP and the weekly US initial jobless claims.

But first a word about the CPI.

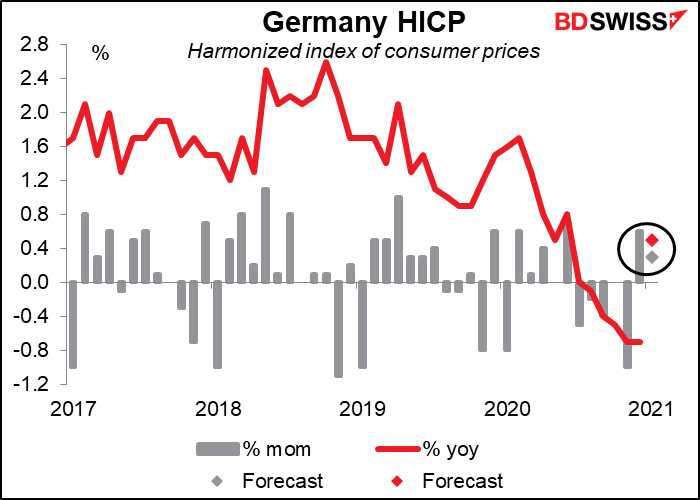

Reweighting of the German (and other countries’) consumer price indices

The consumer price index (CPI) is calculated by taking the price of a representative basket of goods and services that the average consumer buys. Every year the statisticians rebalance this basket to take into account changes in what people have bought during the preceding year. Demand for some products wanes (CDs) and demand for other products increases (music streaming services). New products appear (smartphones) and old ones disappear (VTR players). The weights in the representative basket are adjusted accordingly.

Normally these adjustments are small and slip by without any notice, but not this year. This year, everyone’s consumption patterns changed radically. Restaurant meals? Forget it! Homecooked food – lots of it. Air travel? Not much. New bicycle? Millions! The weights in Germany’s January CPI, released today, will reflect these unusual consumption patterns.

Eurostat, the European statistical agency, has given some guidance about what the changes might be, but it’s still unclear. Food will have a higher weight, while services and energy should be lower. That suggests headline inflation, which includes fresh food and energy, is likely to be higher than it is now relative to core inflation, also more volatile as fresh food prices will have a bigger weight. We won’t know the details until the final CPI is published on Feb. 10th.

The changes are likely to have a different effect at different points during the year. For example, in the summer the price of travel and package tours is usually a major component of the CPI, but not this year. That means the inflation figure for July and August may be lower than it would otherwise have been, and November higher (since few people usually take a holiday in November even in a normal year).

Although it’s worth knowing about this change, it’s not something to worry about that much. The difference is liable to be in the neighborhood of 10 bps or so, not a major change. Furthermore, the European Central Bank (ECB) is well aware of the changes and any change attributable to the new weightings would probably not affect their assessment of the euro area’s inflation dynamics.

Having said that, the more important things for this month’s German CPI are higher energy prices and the end of the temporary German VAT cut, which should allow Germany to exit deflation. Unusually, the EU-wide CPI is not coming out the following day but rather next Wednesday.

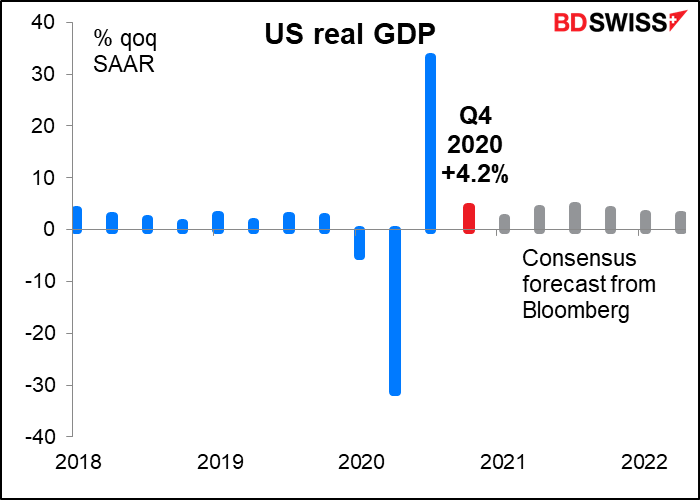

The US Q4 GDP figure is a biggie! The market is going for +4.2% qoq SAAR, which works out to +1.0% qoq, in case you’re interested. The various Feds have their forecasts too, ranging from +2.6% for NY Fed Nowcast, +3.2% for the St. Louis Fed, to 7.5% for the Atlanta Fed’s GDPNow.

The GDP figure is important not only as a measure of how the economy was doing then, but also as the baseline for how it’s doing now. Most forecasters expect Q1 growth to be positive, too, but much depends on the fiscal package that the Biden administration is hoping to pass. Given the uncertainty around that package, the Q4 GDP figure is perhaps less important than it would normally be.

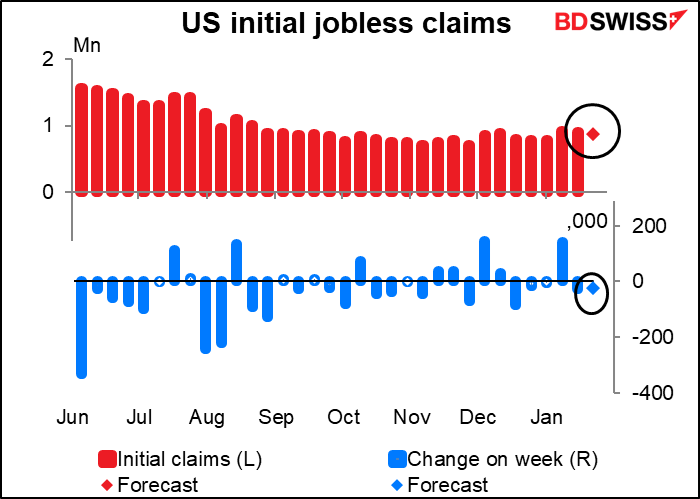

The weekly US jobless claims come out at the same time, which could blunt the impact of a good GDP figure (assuming that the GDP figure is good). Two weeks ago they shocked everyone by vaulting over 900k. They fell the following week and are expected to fall again this week, but by a measly 25k – that’s nothing. After all these weeks they’re still expected to be higher than the highest level ever hit during the Global Financial Crisis (665k on 27 March 2009, just FYI). And remember, this is not continuing claims – this is the number of people who lost their jobs in the most recent week.

Furthermore, everyone’s looking at the wrong figure. The weekly jobless claims are weekly state claims for unemployment. But there are a lot of people who are ineligible for state unemployment insurance, such as Uber drivers and the self-employed. These people turn to the Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) Program. Ignore these – as everyone does – and you miss half the problem. Last week for example initial jobless claims fell by 26k. Mazel tov! Wonderful news! But at the same time, PUA claims rose by a much-larger 139k, wiping out the fall. Hmm, bummer, bummer.

As you can see, the picture changes when you add in the PUA claims. And last week was the week that the survey for the January nonfarm payrolls was taken. That suggests we could see another drop in the NFP for the month.

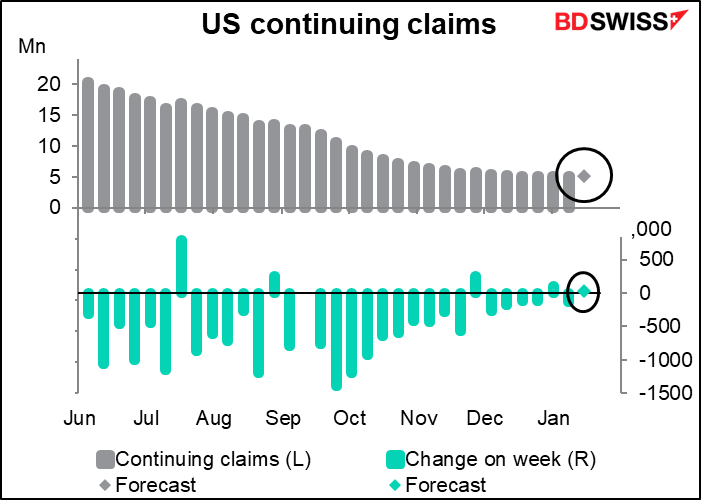

Continuing claims are expected to be a bit higher, but people don’t care so much about continuing claims.

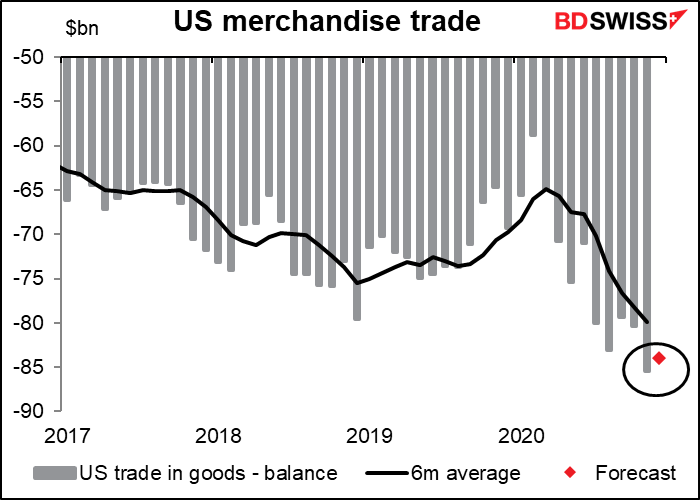

Speaking of not caring about an indicator, I’m probably the only person in the FX community who still cares about the US advance trade figure (trade in goods only). That’s because when I started out in FX, trade mattered, and I can’t shake the idea. But looking at the exceptionally low Bloomberg relevance score (7!), not many other people do.

The deficit is expected to narrow a bit from the record level in November, but it’s still tremendous. In theory this should mean a weaker dollar, but in fact the FX market is not likely to notice the number at all.

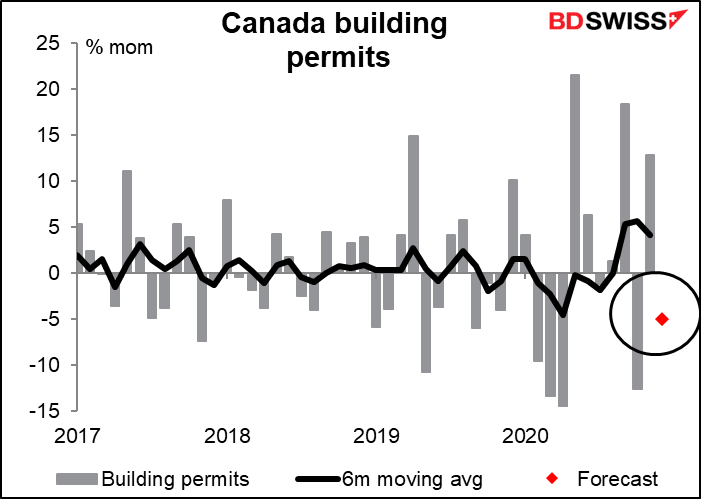

Canadian building permits are expected to be lower, but that’s after a pretty good run in a healthy market – I think given the worsening virus situation in Canada, no one can blame builders for a little caution.

The US leading index for December is expected to be positive but showing signs of slowing. That would corroborate other information that we have, as mentioned above.

Then overnight comes the usual end-of-month data dump from Japan.

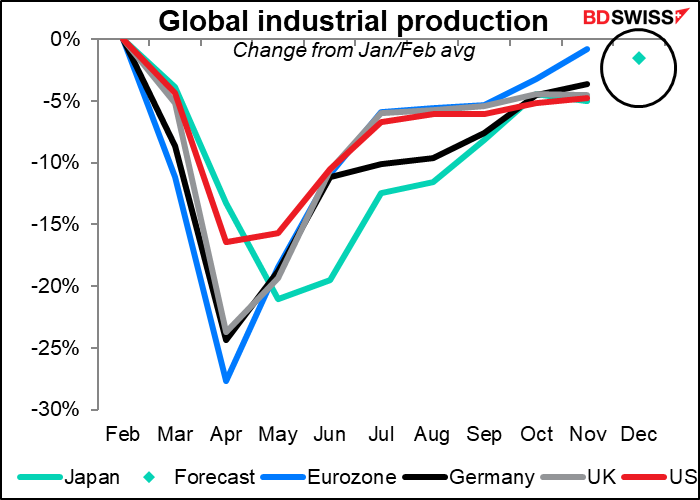

The most important of these is the industrial production data. The market looks for a second consecutive month-on-month decline and the forecast for February is likely to show a decline, too.

That’s’ probably because exports have started to drop off again.

While the news isn’t good, it would be pretty much in line with the other major industrial countries, none of which have returned to pre-pandemic levels yet.

The news could be negative for Japanese stocks, but whether that’s negative or positive for the yen is up in the air. Since 2013 a fall in the TOPIX index has resulted in a fall in USD/JPY (i.e., a stronger yen) 58% of the time, which is a bit better than random but not much.

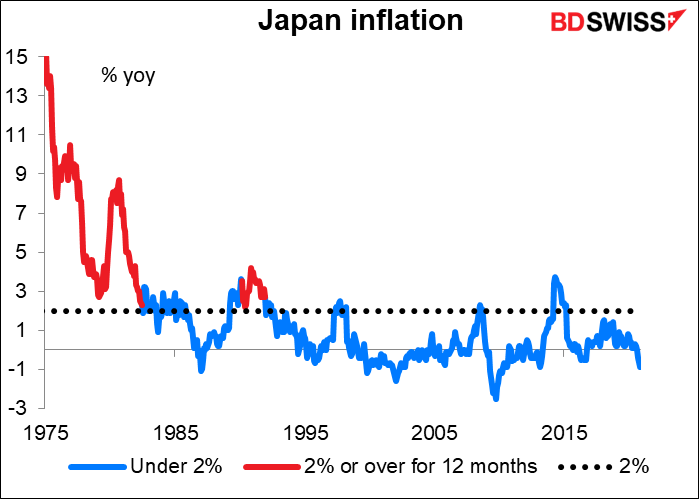

Next is the closely watched but somewhat pointless Tokyo CPI. The temporary suspension of the government’s “Go To Travel” campaign, which offered discounts at hotels, contributed to somewhat less deflation during the month.

I say that the Tokyo CPI is “closely watched” because it comes out about two weeks before the national CPI and the Tokyo area comprises 7% to 43% of the Japanese population, depending on how you define “Tokyo” (the city itself or the general Kanto region, which would include Yokohama etc.) Pointless though because the Bank of Japan hasn’t sustainably hit its 2% inflation target for almost 30 years. It’s almost given up trying. So the market impact of a rise or fall in inflation is just through the real yield on Japanese government bonds, not via any expected reaction from the central bank.

They haven’t had a period of a year of inflation over 2% since December 1991 (with the exception of one month a year after they hiked the consumption tax, which doesn’t really count as inflation.) So inflation is up a bit, inflation is down a bit…no real difference. Nowadays USD/JPY responds more to “risk-on” and “risk-off” than to Japanese real interest rate changes too, so I don’t see this causing any major glitch in the FX matrix tonight.

Japan’s unemployment rate is expected to rise a bit but still be at a preternaturally low 3.0%, while the job-offers-to-applicants ratio is forecast to come down a tic. With the increasing spread of the virus, employment has been slow to recover, particularly for face-to-face services. Employment-related indices worsened in both the Consumer Confidence Survey and the Economy Watchers Survey for December, so no surprise if the unemployment rate tics up a bit. Still it’s low by international standards and having more than one job offer for every applicant is stunning (in the US, I calculate the similar number to be around 0.61). There’s been no major decline in the participation rate either as far as I can see.

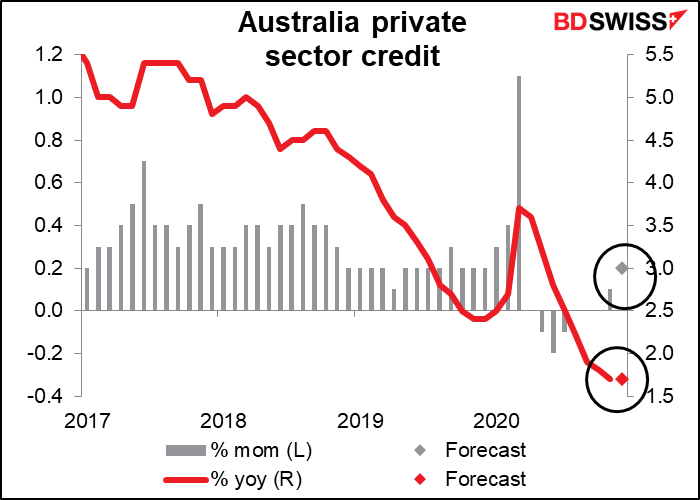

Moving right along, after the Japanese data comes Australia private credit. It’s been stagnant at best — it grew a tiny 9.1 mom in November after four consecutive months of no change (which followed three months of decline). The market is looking for a somewhat better 0.2% mom increase in December, which isn’t great historically (it averaged 0.28% mom in 2018-19) but at least it’s an increase. The figures are no surprise though as credit growth is bound to be weak with the economy in recession – there’s already a lot of spare capacity and the future is quite uncertain. The brightest of the not-so-bright spots is housing credit, which is responding to low interest rates.

Then as the sun continues its permanent peregrination, the European morning brings the first Q4 GDP figures from Europe, starting with France, where the economy has been hard-hit by restrictions to control the virus, not to mention the virtual collapse of the tourist sector.

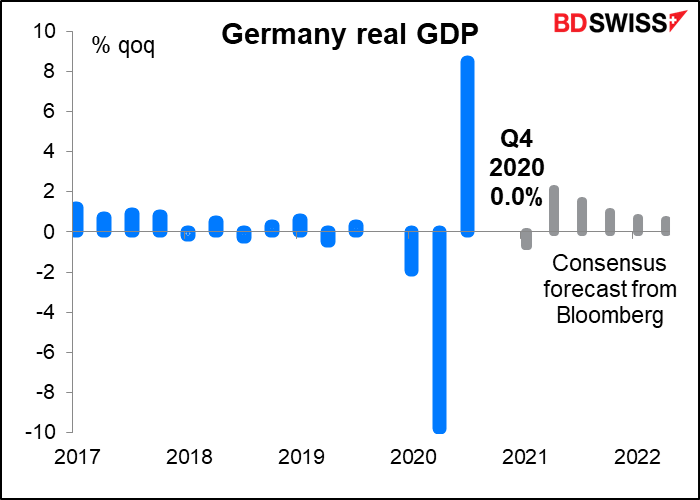

In Germany, the most important of those coming out this morning, the provisional 2020 reading last week implied close to zero qoq GDP in Q4, which is the consensus forecast. The risks seem tilted towards a marginally positive figure. However note that the forecast for Q1 this year is for a decline in output as the various restrictions put in place to deal with the virus stifle activity. This is in contrast to the US, where Q1 GDP is expected to show yet another rise.

And in Spain, the official data is relatively positive, with the Nowcast model from the fiscal watchdog even suggesting positive growth in Q4. But private sector forecasters aren’t that optimistic.

Italy releases its Q4 GDP next Tuesday.

Everyone expects Eurozone growth to be sluggish, so I think an upside surprise would have a bigger impact on EUR/USD than a downside surprise. Still, the market will be sensitive to any major discrepancies from the forecasts.