Previous Trading Day’s Events (13 Dec 2023)

“The good news today is that there are minimal price increases at the lower stages of factory production,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “This makes it even more likely they (Fed officials) will bring inflation down for a ‘soft-landing’ without bringing the economy to its knees.”

Though inflation remains above the Fed’s 2% target, price increases are less broad-based.

“While consumer spending is still fueling inflation even in service categories such as leisure and hospitality industries, the downward trend among service providers’ own costs suggests that if consumer demand cools, consumer price inflation should also then have a path to stability,” said Kurt Rankin, senior economist at PNC Financial in Pittsburgh, Pennsylvania.

“This report provides another small piece of good news at the margin in the Fed’s quest to return inflation to 2%,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York.

Source: https://www.reuters.com/markets/us/us-producer-prices-unchanged-november-2023-12-13/

Fed Chair Jerome Powell said at Wednesday’s Federal Open Market Committee (FOMC) meeting that tightening of monetary policy is likely over, with a discussion of cuts in borrowing costs coming “into view”.

“Every vehicle of Fed communication – the statement, the dots, and Powell’s press conference – was unambiguously dovish,” said RBC strategist Blake Gwinn. “This shift was perhaps most obvious when Powell admitted that the committee discussed the appropriate timing of cuts at the meeting.”

Markets are now pricing a more than 85% chance of a rate cut in March, according to CME FedWatch tool, compared with 40% a day before. Traders are pricing in a one-in-five chance that the Fed cuts rates next month.

Expectations that the Bank of Japan (BOJ) could end negative interest rates at its monetary policy meeting on Dec. 18-19 have largely died down.

______________________________________________________________________

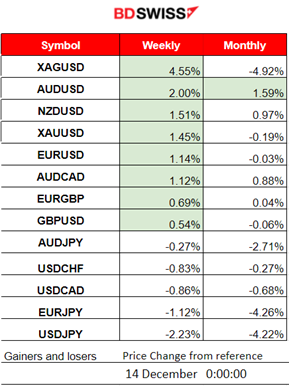

Winners vs Losers

The FOMC statement and Fed’s comments took market participants by surprise causing a deep dollar depreciation against other currencies and assets. Dollar pairs (USD as quote) jumped to the top of the winner’s list for the week, including metals.

______________________________________________________________________

______________________________________________________________________

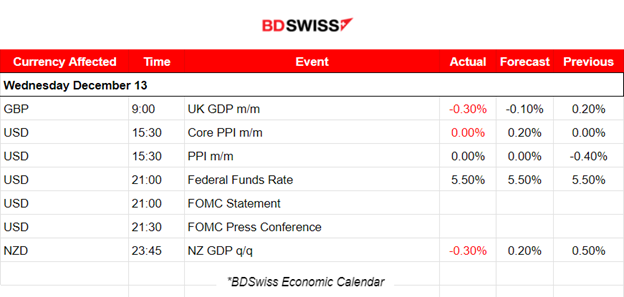

News Reports Monitor – Previous Trading Day (13 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

Monthly real gross domestic product (GDP) is estimated to have experienced a negative change of -0.30%, a more negative figure than the one expected, in the three months to October 2023, compared with the three months to July 2023. The market reacted with GBP depreciation at the time of the release.

At 15:30 the U.S. inflation-related figures, PPI data, were released showing no change, 0%. The Core PPI data was unchanged from the previous figure while the PPI change improved to 0% instead of negative. The data suggest that price increases in the economy’s pipeline are continuing to gradually ease. No major impact was recorded at the time of the release since the FOMC and Fed rate news were more important for market participants.

At 21:00 the FOMC statement and Fed rate announcements took place causing high volatility and one-sided direction movement for USD pairs and other related assets. As expected, the FOMC kept rates unchanged at today’s meeting signalling that they are most likely done raising rates. The recent fall in inflation played a key role in what was discussed about the future policy. Landing the economy softly is more important it seems, than getting inflation to the target 2%. Rate cuts were again brought to the table. They increased the guiding on rate cuts next year from 50bps to 75bps, clearly more than most analysts expected. The statement highlighted that economic activity was clearly weaker than in the third quarter.

The market reacted with strong USD depreciation at the time of the release. EURUSD jumped near 100 pips, Gold moved rapidly upwards reaching near 58 USD movement with no retracement and Silver reaching near 13 USD keeping a similar path. U.S. indices also experienced an upward movement that lasted quite long until the next day, 14th Dec, when they faced resistance to the upside.

The change in the Gross domestic product, September 2023 quarter, was reported negative, -0.30%. The NZD was depreciated against other currencies at the time of the release but the effect soon faded.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

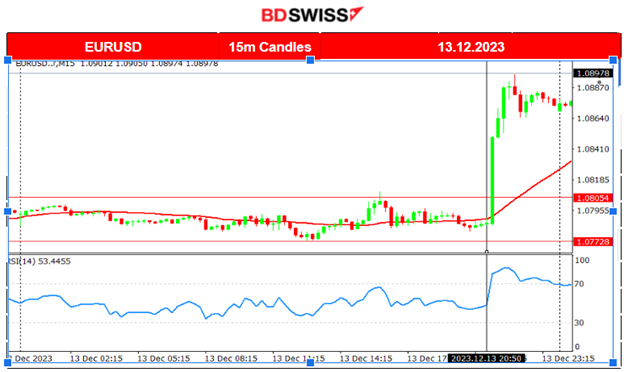

EURUSD (13.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced unusually low volatility during the trading day before the FOMC news and Fed Rate release. It was moving sideways until the FOMC news. The Fed rate was kept steady and rate cuts were discussed. Statements generated expectations about lower future interest rates causing the USD to depreciate heavily, thus the pair jumped high at that time of the release.

___________________________________________________________________

___________________________________________________________________

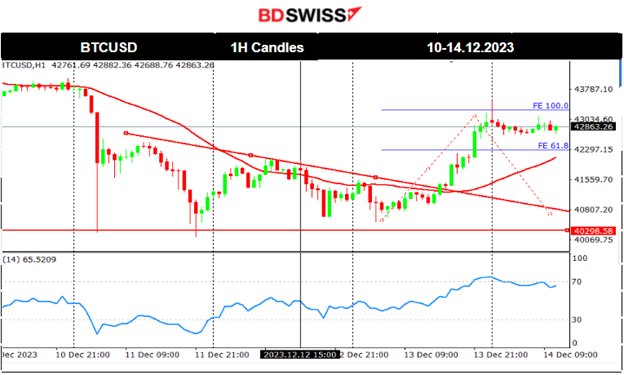

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin fell significantly during the Asian session on the 11th Dec, falling under 41K USD wiping out significant performance during the past week. This was a sudden 6.5% drawdown from 43K USD to as low as near 40K USD in a span of 20 minutes. It seems that technicals and posts from analysts caused the recent downturn. After a quick retracement, it dropped again, testing the 40300 USD level once more before finally retracing to the 30-period MA and the 61.8 Fibo level. The price path showed lower volatility levels this week forming a triangle. On the 13th Dec, the triangle broke as the price moved to the upside, reaching the resistance at near 43200 USD.

Crypto sorted by Highest Market Cap:

Just like Bitcoin, all cryptos saw an increase in price the last 24 hours. Cardano and Avalanche remain as top performers for the last 7 days, with nearly 45% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

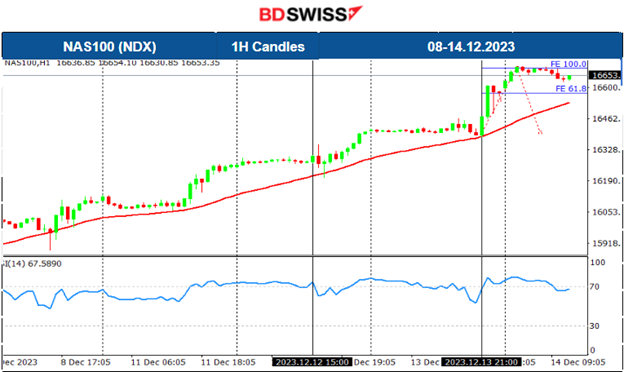

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Risk-on sentiment as market participants are pushing U.S. stocks higher and higher. NAS100 and other indices are clearly on an uptrend. This month has been good for stocks especially since the Fed is discussing rate cuts, thus future lower borrowing costs for businesses. During the FOMC news yesterday, their statements caused huge volatility in the market causing the indices to jump. Technically we are currently waiting for the retracement back to the mean to be completed before indices see another upward movement.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

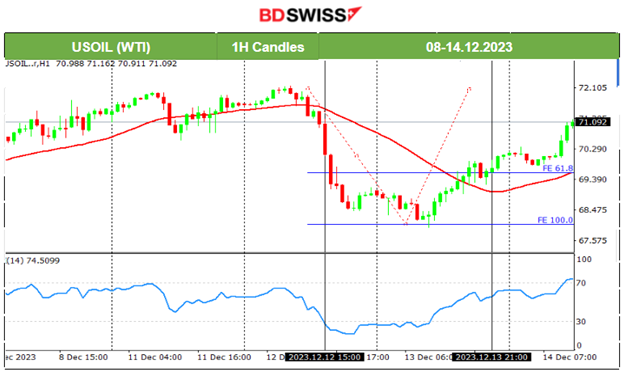

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 12th Dec Crude’s price dropped heavily during the inflation-related figure releases for the U.S. but found support near 69.5 USD/b where it eventually settled for only some time. It soon broke that support and the price reached 68.5 USD/b before retracing only a bit until the end of the trading day. Crude’s price went even lower reaching 68 USD/b on the 13th Dec showing signs of retracement. It eventually completed the retracement back to the mean, just as we predicted, and moved further upwards.

Tradingview Analysis:

https://www.tradingview.com/chart/WTI/epKXmw5U-Crude-Oil-Retracement-13-12-2023/

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

In the previous analysis, we mentioned that Gold could stay on an upward path if it crosses the 30-period MA and remains on the upside. With the FOMC and Fed Rate release the dollar had depreciated greatly enhancing the upward path. Gold jumped until it reached the resistance at 2040 USD/oz. No significant retracement has taken place yet. The RSI however is signalling a bearish divergence. We could see Gold falling to 61.8 Fibo level soon, as depicted on the chart. This will be the case unless the 2040 level breaks eventually, showing that the shock is not over yet.

______________________________________________________________

______________________________________________________________

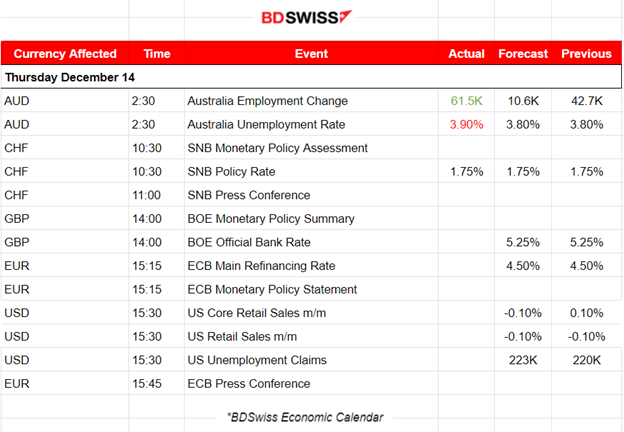

News Reports Monitor – Today Trading Day (14 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

At 2:30, during the Asian session, Australia’s labour-related data were released showing that employment change was reported higher than expected, however, unemployment hit a 1-1/2 year high. The market reacted with steady AUD appreciation against other currencies since the report’s release.

- Morning–Day Session (European and N. American Session)

The Swiss National Bank (SNB) kept the SNB policy rate unchanged at 1.75%. Inflationary pressure has decreased slightly over the past quarter and the SNB is willing to be active in the foreign exchange market as necessary. The market reacted causing high volatility for CHF pairs, an up-down effect, keeping them close to the mean (30-period MA).

The market continues to experience the BOE and ECB monetary policy statements and rate decision figures releases. We expect GBP and EUR pairs to be affected greatly. Possible increase in volatility levels and high deviations from means.

The USD will be affected greatly later at 15:30 when the Retail Sales and Unemployment claims figures will be released for the U.S. Retail sales should be reported lower coinciding with expectations of a drop in demand and unemployment claims to climb further as time goes by meeting expectations of labour market cooling.

General Verdict:

______________________________________________________________