Previous Trading Day’s Events (31 Jan 2024)

Total nonfarm payrolls are estimated to have increased by 180K jobs after rising 216K in the prior month.

Source: https://www.reuters.com/markets/us/us-private-payrolls-miss-expectations-january-adp-2024-01-31/

Fed’s Powell reported that it’s unlikely to act that quickly as March for a policy change shaking the markets as expectations formed.

“The decision to begin cutting is of great consequence — I really think it is that they don’t want to rush into it,” Jeffrey Rosenberg, a portfolio manager at BlackRock Inc., said on Bloomberg television.

The current economic situation in the U.S. is actually good considering the high borrowing costs. Both sectors of the economy show expansion, labour market conditions have been stable, with improvement in December 2023 and a low, stable unemployment rate. Inflation, however, despite the fact that it has eased over the past year, remains elevated. Key statement:

“The Committee does not expect it will be appropriate” to cut “until it has gained greater confidence that inflation is moving sustainably” to 2%.

The above signals a delay in interest rate cuts that boosts the dollar in the short term.

______________________________________________________________________

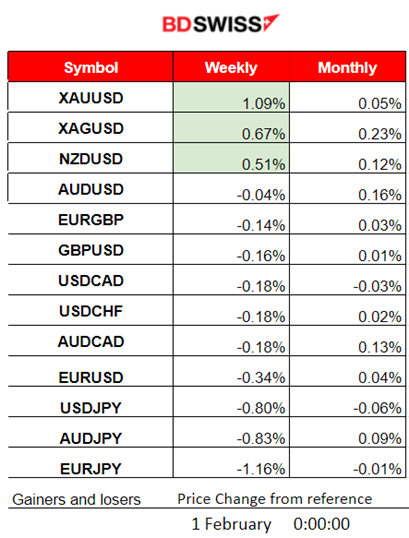

Winners vs Losers

Metals are on the top of the week’s winners list. Gold gained ground managing to pass Silver’s performance. The U.S. dollar, despite huge volatility caused by the news, remained at the same levels.

______________________________________________________________________

______________________________________________________________________

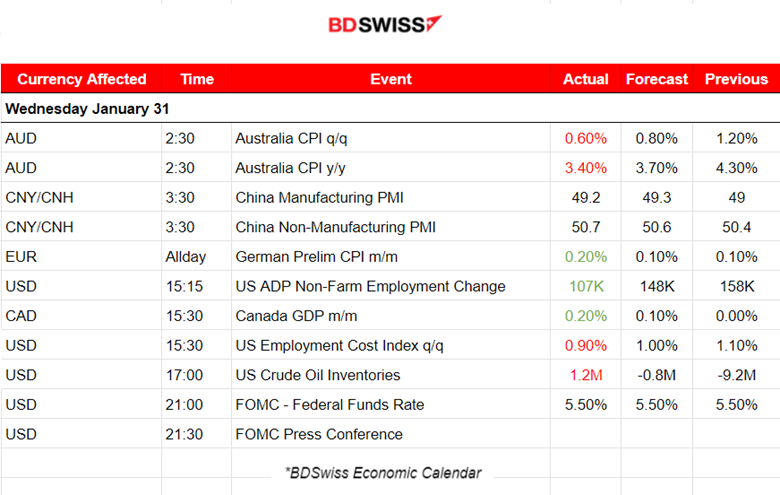

News Reports Monitor – Previous Trading Day (31 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The inflation-related data for Australia were released at 2:30. The annual CPI figure was reported lower, 3.4%, surprising even the Bank of Australia’s economists on how inflation moves significantly in the desired direction. The inflation print for December is a relief to the Reserve Bank. The quarterly figure for headline inflation was also reported lower at 0.6% strengthening the case for the Reserve Bank to keep interest rates unchanged next week. The market responded with an intraday shock and AUD depreciation. AUDUSD dropped near 30 pips until finding support and significant retracement.

- Morning–Day Session (European and N. American Session)

The U.S. ADP Non-Farm Employment change figure reported at 15:15 showed that private sector employment increased only by 107K jobs in January, lower than the expected 148K and confirming that the labour market is slowing this year. At the time of the release, the USD suffered depreciation at that time against the other currencies. This is probably a valid reaction to the news since a slowdown indicates a higher probability of cuts sooner than expected. The effect soon reversed though as the FOMC news was approaching.

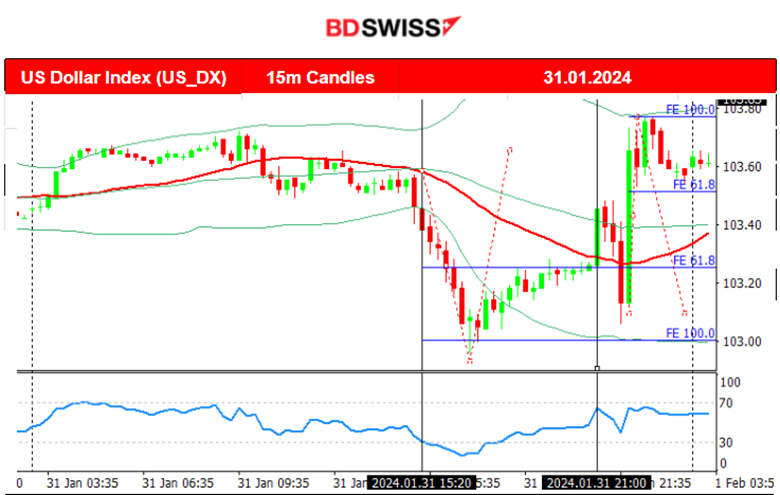

At 21:00, the Fed announced that it had decided to keep the Fed Fund Rate steady and elevated at 5.5%. At the time of the release, the market experienced a shock but it was rather moderate. The dollar index had not settled into one direction remaining close to the 30-period MA. During the press conference however that started at 21:30, the USD appreciated against other currencies significantly, reversing from the downside.

The current economic situation in the U.S. is actually good considering the high borrowing costs. Both sectors of the economy show expansion, and labour market conditions have been stable, with improvement in December 2023 and a low, stable unemployment rate. However, inflation, even though it has eased over the past year, remains elevated. Since the economy can handle elevated interest rates for longer, the Fed would care to see data suggesting a downtrend in inflation before changing policy.

Key statement:

“The Committee does not expect it will be appropriate” to cut “until it has gained greater confidence that inflation is moving sustainably” to 2%.

The above signals a delay in interest rate cuts that boosts the dollar in the short term.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

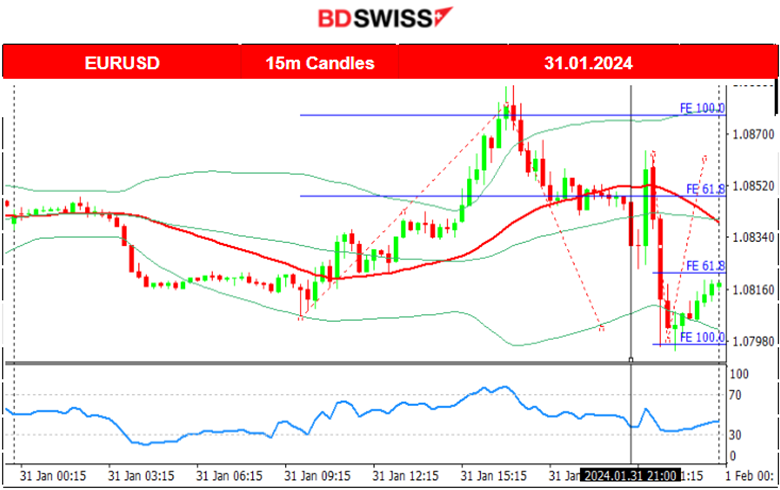

EURUSD (31.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

EURUSD moved higher after the start of the European session, when the ADP report was released after 15:00, the dollar depreciated against the EUR and the pair climbed further reaching the resistance at near 1.08860. Around 17:00 it reversed when the dollar experienced surprising strength before the FOMC news with the pair reversing to the 30-period MA. At 21:00 a shock took place with the announcement of the decision to keep the policy rate steady causing up-down movement close to the MA. More volatility took place after the start of the press conference with statements pointing to a delay in cuts for now.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin and the crypto market in general experienced a recovery after a long retreat since the Spot Bitcoin ETF approvals. The resistance near 43,800 USD was hard to break, it was tested 3-4 times, and on the 31st Jan Bicoin lost over the dollar heavily bringing it down to 41,800 USD support before retracing slightly.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Most of the week’s gains were wiped out after Crypto experienced a downturn. Overall, since the ETF approvals for Bitcoin, the market still recovered significantly. Solana has remained strong in the last seven days with 7.17% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

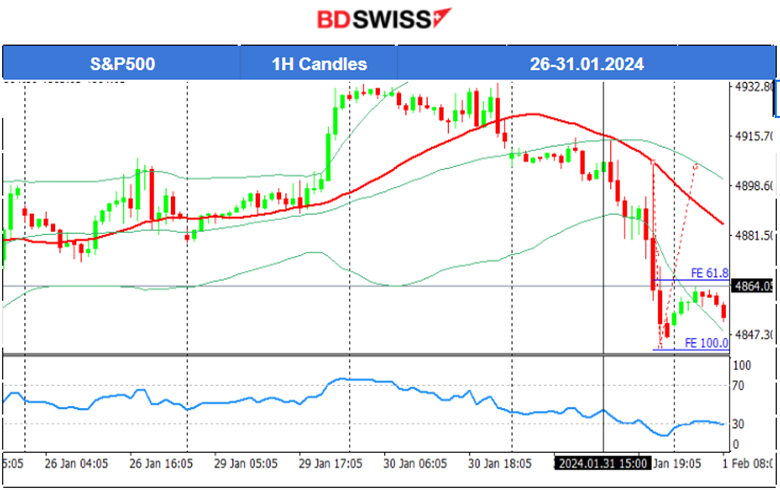

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The S&P 500 index broke the resistance near 4908 USD on the 29th Jan and jumped to the next resistance at 4933 USD. All benchmark indices followed the same path to the upside yesterday, an unexpected jump, late after 20:00. Retracement followed as expected, moving away from the 4933 USD resistance towards the 30-period MA and the 61.8 Fibo level. On the 30th it started to drop rapidly, reversing from the upside, crossing the MA on its way down and moving aggressively to the downside. U.S. indices fell rapidly after the expectation that borrowing costs might be kept higher for longer than expected. The S&P500 fell to near the support of 4845 USD and retraced to the upside and the 61.8 Fibo level.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil found strong support this week around 76 USD/b on the 30th Jan. It reversed upwards, crossing the 30-period MA on its way up, finding support at near 78 USD/b. Retracement followed with Crude settling near 77 USD/b. As previously stated in our previous analysis, the price signalled a downward movement and on the 31st it dropped until the support of 75.5 USD/b, before retracing back to the mean.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

A clear short-term uptrend is clear after the 25th Jan. On the 29th the price rose significantly and on the 30th Jan, it broke the 2040 USD resistance reaching 2049 USD/oz just before the U.S. news. After 17:00 gold moved lower since the news release caused dollar appreciation and the market was also putting pressure on Gold to drop, reversing back to the MA. Gold on the 31st broke the resistance again, reaching 2055 USD/oz prior to the FOMC news. The heavy reversal followed and increased volatility after the USD was affected positively by the Fed’s statements.

______________________________________________________________

______________________________________________________________

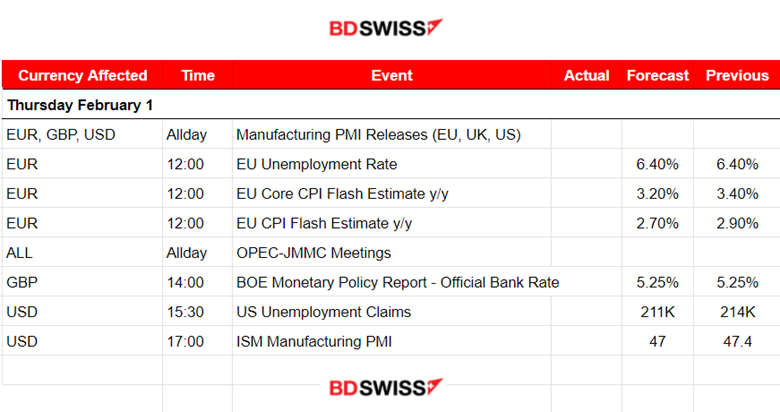

News Reports Monitor – Today Trading Day (01 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The manufacturing PMI figures will be released during the trading day, potentially raising FX volatility. At 12:00 the CPI data could cause an effect on the EUR and related pairs. They are expected to be reported lower as inflation tends to drop as expected in the Eurozone. However, the impact on the market would probably be moderate with no major movement at that time.

At 14:00 the Bank of England (BoE) is going to release its interest rate policy decision at 14:00 and the market expects it to be unchanged. At that time the GBP will be affected probably moderately, though there is a possibility of high intraday shock at that time for the related pairs. That depends on the statements in the monetary policy report with a focus on future rate-cut-related expectations. Intraday traders should look for reversals as they tend to create opportunities.

The next U.S. Unemployment Claims report is going to be reported at 15:30, expected to be reported above 200K and close to the previous figure. No major shock is expected at that time. The USD pairs could see, though, higher volatility, especially in the case of a big surprise to the downside.

The ISM Manufacturing PMI will add to the rest of the PMI figures this week and provide the latest information that could confirm if business in the sector slowed down in January. It is not expected to have much impact on the market unless it shows expansion, and that is unlikely.

General Verdict:

______________________________________________________________