The earnings conference call for FedEx’s fourth quarter of fiscal year 2024 is scheduled for today at 4:00 PM Central Time.

FedEx’s market cap as of June 2024 is $63.12 billion, placing it as the 287th most valuable company globally by market cap, according to companiesmarketcap.com data.

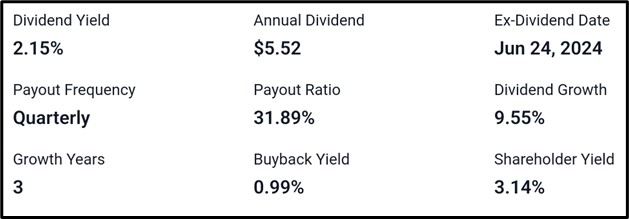

As of June 24, 2024, the ex-dividend date for FedEx, the annual dividend stands at $5.52, reflecting a dividend yield of 2.15%. The company maintains a quarterly payout frequency with a payout ratio of 31.89%. Over the past three years, FedEx has shown a dividend growth rate of 9.55%. Additionally, the buyback yield is 0.99%, contributing to a shareholder yield of 3.14%.

Recent Development At FedEx

Here are recent developments at FedEx:

– FedEx grants over $230,000 to 10 small businesses.

– FedEx introduces the NIL program for University of Memphis student-athletes.

– Karen Blanks Ellis appointed as FedEx’s new Chief Sustainability Officer.

– FedEx initiated discussions on reducing workforce in Europe.

– FedEx issues statement on USPS contract expiration.

Recap of Q3 FY2024 FedEx Earnings Report

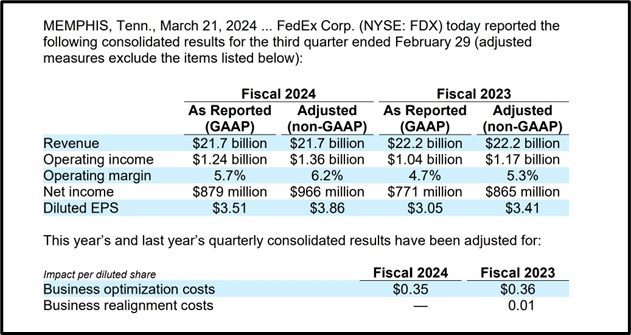

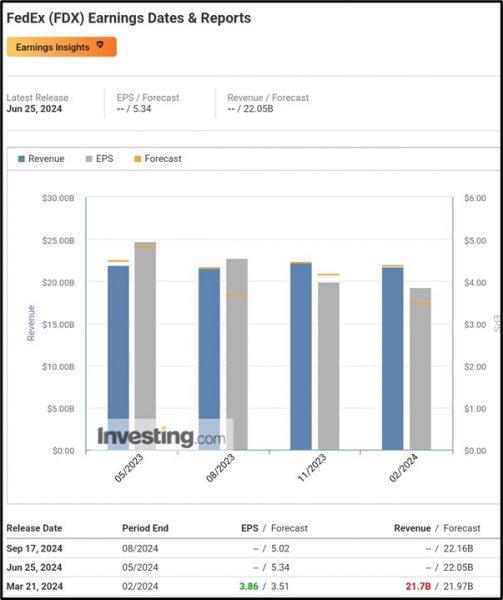

On March 21, 2024, FedEx Corp. (NYSE: FDX) announced its consolidated financial results for the third quarter ending February 29. For Fiscal 2024, the company reported revenue of $21.7 billion, operating income of $1.24 billion, an operating margin of 5.7%, net income of $879 million, and diluted EPS of $3.51. Adjusted (non-GAAP) results showed $21.7 billion in revenue, $1.36 billion in operating income, a 6.2% operating margin, $966 million in net income, and $3.86 in diluted EPS. Comparatively, for Fiscal 2023, reported GAAP results were $22.2 billion in revenue, $1.04 billion in operating income, a 4.7% operating margin, $771 million in net income, and $3.05 in diluted EPS, while adjusted results were $22.2 billion in revenue, $1.17 billion in operating income, a 5.3% operating margin, $865 million in net income, and $3.41 in diluted EPS. Adjustments for this year and the previous year included business optimization and realignment costs impacting diluted EPS by $0.35 and $0.36 respectively, with an additional $0.01 for realignment costs in Fiscal 2023.

Q3 FY2024 FedEx Earnings Outlook

FedEx Outlook

FedEx is unable to forecast fiscal 2024 MTM retirement plans adjustments, thus can’t provide GAAP EPS or ETR outlook, relying on SEC exemption. MTM adjustments may materially affect 2024 financials and ETR.

Fiscal 2024 projections:

– Revenue: Low single-digit YoY decline

– EPS (pre-MTM adjustments): $15.65-$16.65 (prior: $15.35-$16.85)

– Adjusted EPS (excluding optimization costs): $17.25-$18.25 (prior: $17.00-$18.50)

– Cost savings: $1.8B from DRIVE program

– ETR: ~25% pre-MTM adjustments

– CapEx: $5.4B (prior: $5.7B), focusing on efficiency investments

Assumptions: Current economic/fuel forecasts, stock repurchases, no new geopolitical issues, current tax laws.

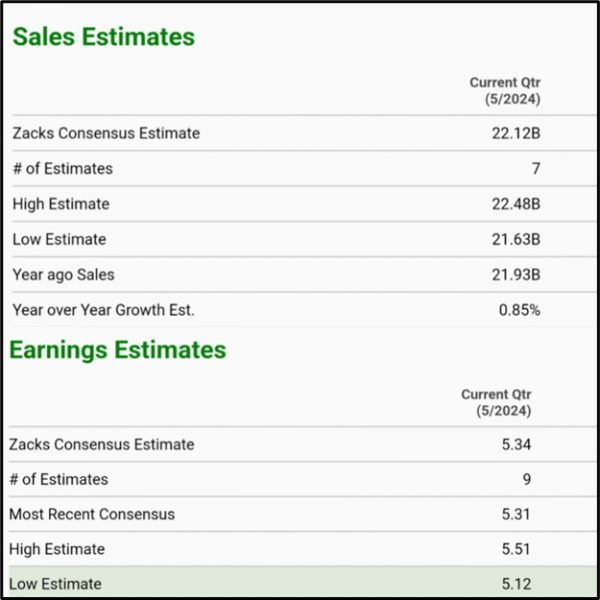

ZACK’S Estimate

For the current quarter, Zacks consensus projects sales at $22.12B, with estimates ranging from $21.63B to $22.48B, reflecting a YoY growth of 0.85% from last year’s $21.93B. On the earnings front, the consensus EPS is $5.34, with nine estimates varying between $5.12 and $5.51, indicating an 8.10% YoY increase from last year’s $4.94. The most recent consensus is $5.31.

Investing.com forecasts FedEx (NYSE: FDX) EPS at $5.34 and revenue at $22.05 billion.

Tradingview.com forecasts FedEx (NYSE: FDX) EPS at $5.34 and revenue at $22.04 billion.

Technical Analysis

– Uptrendline Rejection: FedEx (NYSE: FDX) at $243.69 on 4hr chart, current price $256.62

– Bullish Scenario:

– Target 1: $261.90

– Target 2: $267.52 (if $261.90 breaks)

– Bearish Scenario:

– Target 1: $230.73

– Target 2: $214.23 (if $230.73 breaks)

Apply Risk Management

Conclusion

FedEx’s Q3 FY2024 results demonstrated robust performance with significant YoY increases in operating income and net income, alongside a healthy adjusted EPS. Looking ahead to Q4, FedEx forecasts continued growth, with projected EPS improvements and substantial cost savings from the DRIVE program, positioning the company for strong future performance despite minor revenue declines. These positive indicators highlight FedEx’s resilience and strategic focus on efficiency and shareholder value.

Source:

https://companiesmarketcap.com/fedex/marketcap/#google_vignette

https://stockanalysis.com/stocks/fdx/dividend/

https://newsroom.fedex.com/newsroom/global-english/fedex-appoints-new-chief-sustainability-officer

https://images.app.goo.gl/wioSzzaTvt22xtzz8

https://investors.fedex.com/financial-information/quarterly-results/default.aspx

https://www.zacks.com/stock/quote/FDX/detailed-earning-estimates

https://www.investing.com/equities/fedex-corp-earnings

https://www.tradingview.com/chart/FDX/0c5Q3OV7-FEDEX-Uptrend-Line-Rejection-at-243-69-25-06-2024/