Rates as of 05:00 GMT

Market Recap

Fed decision: The Fed yesterday announced that it would taper down its monthly bond purchases, to no one’s surprise. As was widely expected, they will immediately reduce their $120bn-a-month purchases by $15bn a month, aiming to end next June. They said they expect to keep to that schedule, although they are of course prepared to adjust it if necessary.

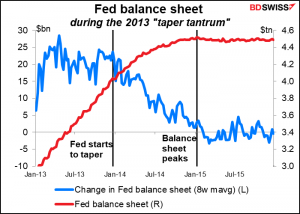

The Fed stressed that monetary conditions will remain accommodative during this period. This is true. Tapering down the purchases doesn’t mean shrinking the Fed’s balance sheet, it just means growing it at a slower pace. During the 2013 tapering episode for example they started tapering in Dec 2013 and the Fed’s balance sheet didn’t peak until Jan. 2015. Nor did it shrink significantly in the year after that.

Moreover, the Treasury is reducing issuance faster than the Fed is reducing purchases, so the Fed will be buying a greater proportion of the new issuance.

They finessed the question of whether the current high level of inflation is “transitory” by including the word in their statement but hedging it. Previously they said “Inflation is elevated, largely reflecting transitory factors.” They changed this to “Inflation is elevated, largely reflecting factors that are expected to be transitory.” So not yet “persistent” but admitting some doubt.

Perhaps the key point was a change in their definition of “maximum employment.” Once again they said that they would not have “lift-off,” i.e. would not begin raising interest rates, until they had achieved their goal of “maximum employment.” Of course they never define that specifically, but previously they had pointed to the February 2020 level of 3.5% unemployment as a benchmark for full recovery.

However in the press conference Fed Chair Powell noted that there have been changes in the labor market due to COVID-19 and that the Fed doesn’t have a good handle yet on how permanent these changes are. He admitted that a lot of people could have retired or otherwise left the job market permanently and so the previous benchmarks in terms of participation rate might not hold.

So, in terms of full employment, as I discussed earlier I think at the very beginning of the recovery, the natural thing to do was to look back at labor market conditions in February of 2010, at the end of the longest expansion in our history…We’re in a different world now, it’s just very different.

Under these conditions, maybe you don’t need to see 1mn new jobs created every month to have strong job creation:

…you don’t have to think back to the million job months of June and July, you can just think, okay, 550 to 600 [thousand a month], we should get back on that path, then we would be making good progress.

He made it clear that although the main risk was higher inflation, they want to see what happens with employment once the Delta variant declines and people can freely choose to work or not.

…we have high inflation and we have to balance that with what’s going on in the employment market. So it’s a complicated situation, and I would say we hope to achieve significantly greater clarity about where this economy’s going and what the characteristics of the post-pandemic economy are over the first half of next year.

It seems to me more likely now that they will be able to decide immediately after they finish tapering whether to start hiking rates. Thus the likelihood of two or even three rate hikes next year has increased, IMHO. Bottom line: the Fed’s stance is positive for the dollar.

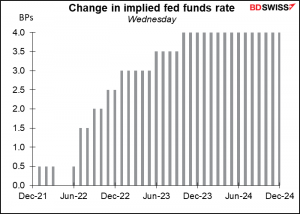

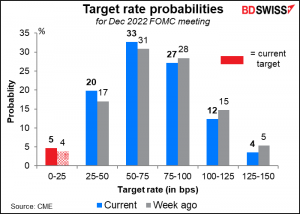

The results were largely in line with market expectations, as shown by the small move in the fed funds futures. There was no big re-rating of the probability of Fed rate hikes next year.

The market thinks that the probability of one or two rate hikes has increased, but the probability of more hikes than that has decreased.

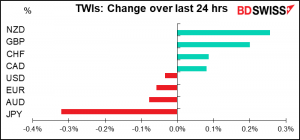

ECB President Lagarde on the other hand sounded much less concerned about inflation than the Fed or Bank of England (see below). She said that their three conditions for raising rates “are very unlikely to be satisfied next year” as “the outlook for inflation over the medium term remains subdued” in spite of the recent surge in inflation. She repeated the point later in the day in an interview and pushed back even more forcefully against market pricing of higher rates than she did after last week’s ECB meeting. The “monetary policy divergence” theme is likely to push EUR/USD lower over time, in my view.

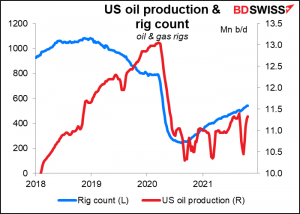

Elsewhere, oil fell ahead of today’s OPEC+ meeting (see below). The US Dept of Energy weekly data showed a larger-than-expected increase in inventories (although in line with what the American Petroleum Institute had found) but, perhaps more importantly, the US and Iran said they will resume talks on Nov. 29th on reviving the 2015 agreement. There’s still a lot of doubt that an agreement can be reached, as the Iranian side wants something impossible: a guarantee that a future US president won’t back out of the agreement as Trump did. US officials say that they can’t bind future administrations. Nonetheless it’s clear President Biden wants to reverse a lot of what the former guy did in the world and if there’s a chance that they might undo this, then the oil market will remain nervous.

Today’s market

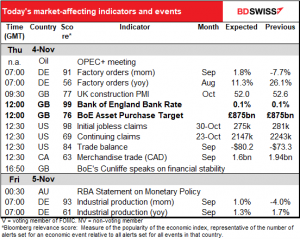

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Two important meetings today.

First the Bank of England (BoE) Monetary Policy Committee (MPC) meeting. As usual, I gave a detailed explanation of what I expect in my coruscatingly brilliant Weekly Outlook, “Transitory” Proves Transitory. Again as usual, I’ll summarize my views here:

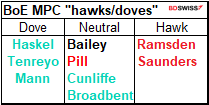

Basically, it’s no secret that BoE Gov. Bailey would like to hike rates – he’s been very open about that – but I just don’t think he’ll have the votes at this meeting.

The way the MPC works is that the Governor “invites” the Committee to vote on a proposition that he believes will be supported by the majority of MPC members. The MPC’s decision reflects the votes of each individual member rather than a consensus of the committee. If there is a tie, the Governor casts the deciding vote.

Since the pandemic began, the votes have been unanimous to keep rates unchanged. It would be unusual – although not unprecedented – for them to suddenly turn around and tighten policy.

The MPC has voted to raise rates 21 times since the Bank of England became independent in 1997, and only six of those times followed meetings when officials had voted unanimously to keep rates unchanged. Most of the time the change is preceded by dissent. But this time around, no one has voted to hike rates since the pandemic began, although two – Ramsden and Saunders – did vote at the last meeting to stop the BoE’s quantitative easing program “as soon as practical…rather than continuing it until around the end of the year, as currently planned.” These two might well vote to hike rates this time, as perhaps would Chief Economist Pill.

But with three definitely in the “dove” camp, the decision would require both of the centrists – Jon Cunliffe and Ben Broadbent – to move over into the hawk camp. I doubt that they will do that without up-to-date information on the UK labor market. Back in September, the MPC said that a key question for its decision is “how the economy would adjust to the closure of the furlough scheme; the impact of any change in unemployment; the persistence of any difficulties in matching jobs with workers.” The furlough scheme, which finished at the end of September, supported the employment of an estimated 1mn workers out of a workforce of 33.9mn so a sizeable percentage of the workforce.

The Committee didn’t have the results of today’s Office of National Statics Survey on the subject (they actually decide on Wednesday but the results aren’t released until Thursday) nor the full employment data for September, which is due out on Nov. 16th.

If one of the centrists voted to tighten then Gov. Bailey could break the tie, but with so many uncertainties in the world – the virus plus all the Brexit issues – is now really the time for such a close vote on a major change?

I think Gov. Bailey has painted himself into a corner and is likely to find that he doesn’t have the votes to tighten at this meeting. I would expect then for him to propose to keep rates unchanged and for there to be several dissents, paving the way for a rate hike at the December meeting. This would probably disappoint the market, which is pricing in a 57% of a 10 bps rate hike at the meeting. Failure to hike rates at this meeting would probably be negative for GBP.

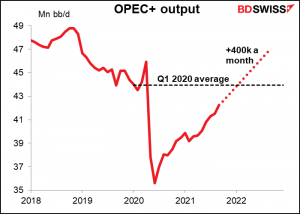

As for the OPEC+ meeting, several of the oil-consuming countries have urged the group to boost production. For example, US President Biden complained, “The idea that Russia and Saudi Arabia and other major producers are not going to pump more oil so people can have gasoline to get to and from work, for example, is not right,” ignoring the fact that the world’s largest oil producer, the US, has raised its output by less than 3% this year and is pumping 5% less oil than before the pandemic.

The reaction from the cartel has been largely negative. Kuwait, Iraq, Algeria, Angola, and Nigeria alls said they should stick with their plan to increase output at a steady 400k barrels a month. The Saudis, close allies of the US, could boost output unilaterally, but they tend to prefer OPEC+ unity. I therefore expect the group to vote to stick with the plan, which could disappoint some in the oil market and lead to higher oil and higher CAD.

The reason for the cartel’s caution is simple. They remain concerned that the recovery is fragile, the virus is not yet extinguished, and demand could collapse again. In preparation for today’s meeting, OPEC’s Joint Technical Committee last week updated its Q4 supply/demand figures to reflect a deficit of only 300k barrels a day (b/d), while they raised their estimate for next year’s surplus to 1.6 mn b/d. That would certainly cap the oil price if it comes true.

One argument against the “global crude oil shortage” story: global floating storage has remained relatively constant this year. If oil really were in short supply, traders would be running down their floating stocks. Why pay money to rent a ship to store oil in such circumstances? I’ll believe oil is in short supply when this series breaks out of its 2021 range to the downside.

The Indicators

As for today’s indicators, we’ve already had the German factory orders.

US jobless claims are always a source of wonder and enlightenment.

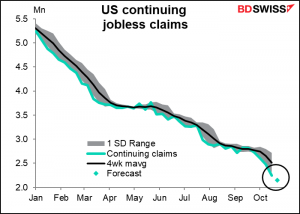

After a period of stagnation, the dreaded initial jobless claims have been declining slowly but steadily recently, averaging -21k a week over the last month. This week the market expects -6k, which seems easily achievable.

Meanwhile the continuing claims continue to decline! I continue to have to lower the bottom of this graph. This week the market expects a 93k decline. That would be a slowdown from the -142k-a-week average decline we’ve had for the last month, but it would still be pretty good.

The US trade deficit is expected to widen further to a record, which would be no surprise after the trade in goods alone widened to a record. The foreign demand for US crude, which is draining the tanks at Cushing, Oklahoma down to dangerously low levels, doesn’t appear to be helping the trade balance any as the US imports other oil to compensate for the lack of any expanded US production.

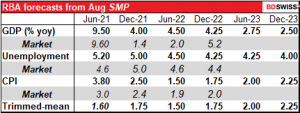

Overnight, the Reserve Bank of Australia (RBA) releases its quarterly Statement on Monetary Policy. This includes updated forecasts for growth and inflation, which were summarized in the statement following Tuesday’s meeting. That said (compared with Bloomberg consensus forecasts)

■ GDP: 3% over 2021, 5 1/2% and 2 1/2% over the following two years

Market forecast: 3.8%, 3.7%, 3.0%

■ Unemployment: 4 1/2% end-2022, 4% end-2023

Market forecast: 4.5%, 4.2%

■ Underlying inflation: 2 1/4% over 2021 and 2022, 2 1/2% over 2023

Market forecast for headline CPI: 2.5%, 2.1%, 2.2%

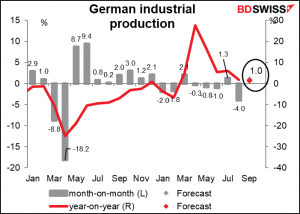

Then Friday morning, while I’m still in my PJs trying to figure out why Currency X outperformed Currency Y even though I expected Currency Z to soar, Germany announces its industrial production as usual following today’s factory orders figure, which was lower than expected (+1.3% mom vs +1.8% expected). A healthy rise as is predicted could give EUR a boost early in the morning.