Previous Trading Day’s Events (31.07.2024)

Monthly CPI (Australia): CPI rose 3.8% YoY to June 2024, down from 4% in May. Key driver: easing transport costs (4.2% vs. 4.9% in May).

BOJ Interest Rate: Raised short-term rate to ~0.25% in July 2024; bond-buying cut to JPY 3 trillion from JPY 6 trillion starting January 2026.

Euro Area Inflation: Annual inflation ticked up to 2.6% in July 2024, exceeding forecasts; energy costs rose 1.3%.

US ADP Employment: 122K private sector jobs added in July 2024, below forecasts; pay gains continue to slow.

Canada Monthly GDP: Expected 0.1% growth in June 2024; construction and finance sectors up, manufacturing down.

US Fed Funds Rate: The Fed held rates at 5.25%-5.50% in July 2024, the eighth consecutive meeting; progress was noted towards the 2% inflation target.

Mastercard Earnings: Q2 net income of $3.3B; EPS of $3.50. Revenue up 11%, gross dollar volume up 9%, purchase volume up 10%.

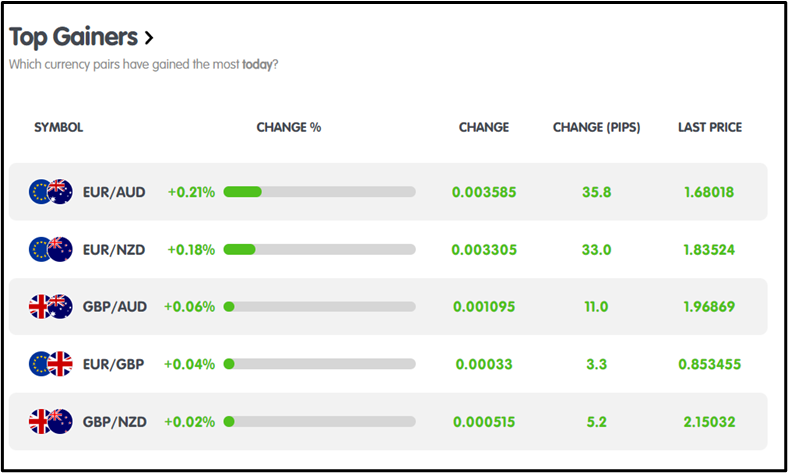

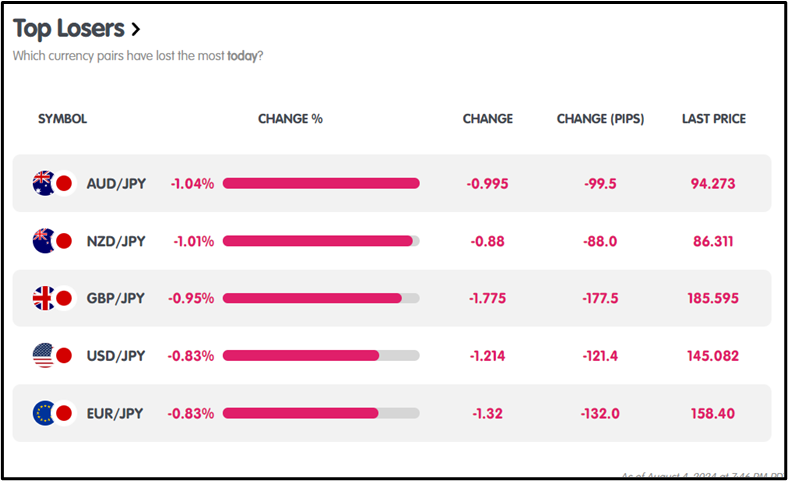

Winners Vs Losers

On July 31, 2024, NZDCAD led with a gain of +0.58%, translating to 47.0 pips, while CADCHF saw the largest decline, down -0.28% or -17.6 pips.

On July 31, 2024, NZDCAD led with a gain of +0.58%, translating to 47.0 pips, while CADCHF saw the largest decline, down -0.28% or -17.6 pips.

News Reports Monitor – Previous Trading Day (31.07.2024)

Server Time / Timezone EEST (UTC+03:00)

Tokyo Session:

Monthly CPI (Australia): CPI rose 3.8% YoY to June 2024, down from 4% in May. Major bearish impact on AUD pairs at 1:30 am GMT.

BOJ Interest Rate: Short-term rate increased to ~0.25% in July 2024; bond-buying was reduced to JPY 3 trillion from JPY 6 trillion starting January 2026. Major bearish impact on JPY pairs at 3:57 am GMT.

London Session:

Euro Area Inflation: Annual inflation rose to 2.6% in July 2024; energy costs increased by 1.3%. No major impact on the market when released at 6:00 am GMT.

New York Session:

US ADP Employment: Added 122K jobs in July 2024, below forecasts; pay gains slow. Bearish impact on USD pairs at 12:15 pm GMT.

Canada Monthly GDP: Expected 0.1% growth for June 2024; bullish impact on CAD pairs at 12:30 pm GMT.

US Fed Funds Rate: Held at 5.25%-5.50% for the eighth consecutive meeting; major bearish impact on USD pairs at 6:00 pm GMT.

Mastercard Earnings: Q2 net income of $3.3B; EPS of $3.50. Revenue up 11%, with a major bearish impact when released at 1:00 pm GMT.

General Verdict:

FOREX MARKETS MONITOR

EURUSD (31.07.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

On July 31, 2024, EURUSD displayed a bullish trend, opening at 1.08124 and closing at 1.08243. The pair hit a daily high of 1.08491 and a low of 1.08005.

On July 31, 2024, EURUSD displayed a bullish trend, opening at 1.08124 and closing at 1.08243. The pair hit a daily high of 1.08491 and a low of 1.08005.

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On July 31, 2024, BTCUSD exhibited a bearish trend, opening at $66,172.22 and closing at $64,521.36. The daily high was $66,843.76 and the low was $64,521.36.

On July 31, 2024, BTCUSD exhibited a bearish trend, opening at $66,172.22 and closing at $64,521.36. The daily high was $66,843.76 and the low was $64,521.36.

STOCKS MARKETS MONITOR

Mastercard ( NYSE : MA ) 15 minutes Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On July 31, 2024, Mastercard (NYSE: MA) experienced a bearish trend, opening at $468.05 and closing at $463.18. The intraday high was $473.07 and the low was $457.30.

On July 31, 2024, Mastercard (NYSE: MA) experienced a bearish trend, opening at $468.05 and closing at $463.18. The intraday high was $473.07 and the low was $457.30.

EQUITY MARKETS MONITOR

SP500 15 minutes Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On July 31, 2024, SPX500 displayed a bullish trend, opening at $5,430.65 and closing at $5,543.12, with a daily high of $5,556.68 and a low of $5,430.65.

On July 31, 2024, SPX500 displayed a bullish trend, opening at $5,430.65 and closing at $5,543.12, with a daily high of $5,556.68 and a low of $5,430.65.

COMMODITIES MARKETS MONITOR

GOLD 15 minutes Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On July 31, 2024, XAUUSD exhibited a bullish trend, opening at $2,409.45 and closing at $2,447.72. The day’s range saw a low of $2,403.53 and a high of $2,450.85.

On July 31, 2024, XAUUSD exhibited a bullish trend, opening at $2,409.45 and closing at $2,447.72. The day’s range saw a low of $2,403.53 and a high of $2,450.85.

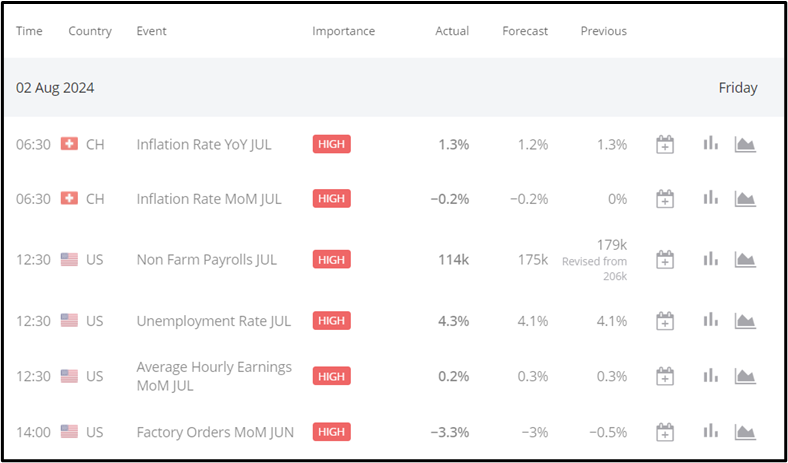

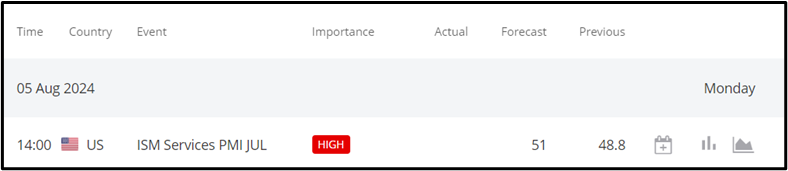

News Reports Monitor – Today Trading Day (01.08.2024)

Tokyo Session

Tokyo Session

Australia’s Balance of Trade for June was reported at 1:30 AM GMT, showing A$5.589B, surpassing the forecast of A$5.3B.

London Session

Euro Area unemployment rate is forecasted at 6.9%, to be released at 9:00 AM GMT.

BOE interest rate decision expected at 5%, announced at 11:00 AM GMT.

New York Session

Initial Jobless Claims are expected at $241K, released at 12:30 PM GMT.

ISM Manufacturing PMI data forecasted at 48.2, reported at 2:00 PM GMT.

Apple earnings release anticipated with EPS of $1.35 and revenue of $84.45 billion.

General Verdict

Sources

https://ec.europa.eu/eurostat/

https://adpemploymentreport.com/

http://www.federalreserve.gov/

https://investor.mastercard.com/financials-and-sec-filings/quarterly-results/default.aspx

Metatrader 4 ( MT4)