PREVIOUS TRADING DAY EVENTS – 03 May 2023

Announcements:

The Reserve Bank of NZ is raising interest rates to slow demand and estimates that there will be a recession this year. It is possible that the central bank is likely to hike interest rates later this month.

“Labor cost growth was not as strong as expected, but still hit a record annual high with widespread lifts,” said Mark Smith, senior economist at ASB Bank in Auckland. “Both weaker demand and stronger supply should see greater labour market slack emerge over 2023, but the RBNZ is unlikely to shirk from further monetary tightening.”

The next policymaker’s meeting is on May 24 and the consensus is a final 25 basis-point hike, bringing the Official Cash Rate to 5.5%.

“The slowdown in pay growth gives the clearest signal of what’s going on in the labour market right now,” Nela Richardson, the chief economist at ADP, said in a statement. “Employers are hiring aggressively while holding pay gains in check as workers come off the sidelines. Our data also show fewer people are switching jobs.”

Other Labor Department data released earlier this week, the Job Openings data, showed a cooling demand for labour. The figure reported was significantly lower while layoffs increased to the highest level since 2020.

“The committee will closely monitor incoming information and assess the implications for monetary policy,” the Federal Open Market Committee said in a statement on Wednesday. It omitted a line from its previous statement in March that said the committee “anticipates that some additional policy firming may be appropriate.”

“Sound and resilient banking system“ is once more mentioned. The Committee seeks to achieve maximum employment and the long-run inflation target is at the rate of 2%. With such inflation figures, it is doubtful that they are going to pause hikes for long if they actually do it. Fed policymakers pledged to keep rates elevated for at least some time to make sure the central bank’s preferred measure of inflation will be reached.

“That’s a meaningful change that we’re no longer saying that we anticipate further increases” as Chair Jerome Powell said at a press conference following the decision and when asked whether the statement is a signal that officials are prepared to pause rate increases in June. “So we’ll be driven by incoming data, meeting by meeting, and we’ll approach that question at the June meeting.”

______________________________________________________________________

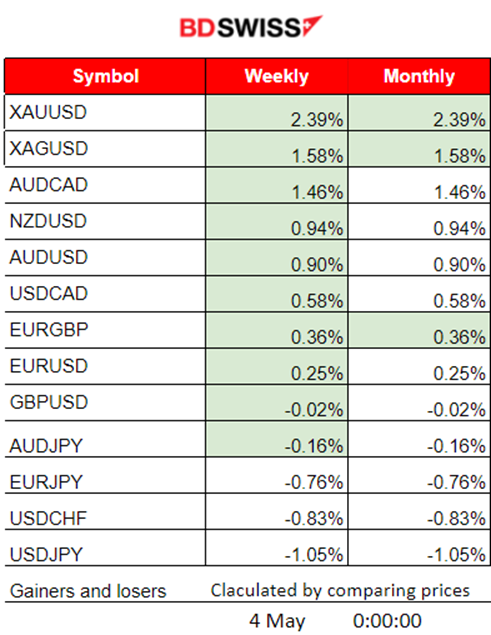

Summary Daily Moves – Winners vs Losers (03 May 2023)

______________________________________________________________________

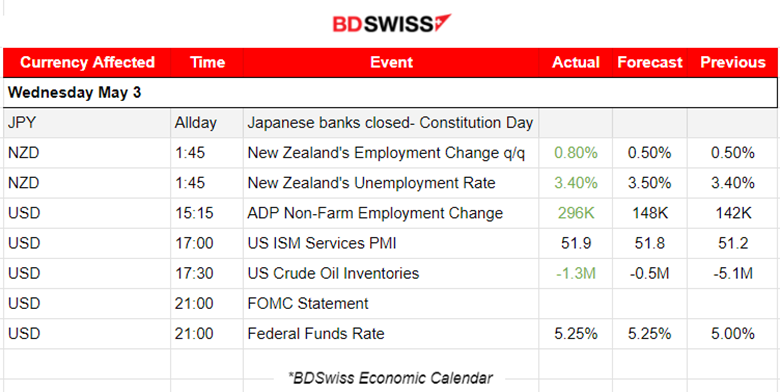

News Reports Monitor – Previous Trading Day (03 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

During the Asian Session, New Zealand’s Labour data came out. The unemployment rate remained unchanged at 3.4% and employment change for the last quarter was more than expected, at 0.8%. NZD experienced a small shock at that time. NZDUSD moved rapidly upwards before retracing immediately.

- Morning – Day Session (European)

At 15:25, the U.S. ADP Non-Farm Employment Change figure was released showing that Private Sector Employment Increased by 296,000. It did not have much impact on the USD since the market was waiting for the FOMC.

The Services PMI figure was at 51.9 showing that economic activity expanded in April for the fourth consecutive month. Again no significant impact on the USD.

The FOMC statement, along with the Fed Rate were released at 21:00. The market experienced a shock. First, the USD was affected by depreciation causing the major pairs to move over 20 pips. EURUSD moved upwards and then retraced fully. USDJPY moved downwards, retraced fully and continued with a sideways volatile move. Eventually, it dropped more until the end of the trading day.

General Verdict:

USD depreciated, moving downwards for the whole trading day. After the rate increase at 21:00, volatility settled lower and the USD continued with its depreciation steadily.

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (03.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD has been moving upwards since the start of the trading day. It experienced an intraday upward trend. Related figure releases during the day for the USD did not have much impact on the pair. It was finally affected greatly at 21:00 with an intraday short shock followed by volatile moves close to the 30-period MA, without deviating much from the mean.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. Stocks have officially and eventually reversed moving downwards since the 2nd of May. The NAS100 index shows a similar path as the other major U.S. indices. Following the FOMC statement and the Fed Rate figure release the index dropped significantly for the second day in a row.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude continued with the downtrend. Its price has sharply declined since the 2nd of May. According to the data released yesterday, inventories showed a decline of 1.3 Million Barrels. Oil fell even further, extending its losses after the Fed rate hike yesterday at 21:00.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

With important figure releases concerning labour data and interest rates for the U.S., Gold has been trading higher and higher as the USD depreciates and Stocks move lower. It started to gain momentum on the 2nd of May. The rate hike from the Fed yesterday pushed Gold higher, reaching 2040 USD.

______________________________________________________________

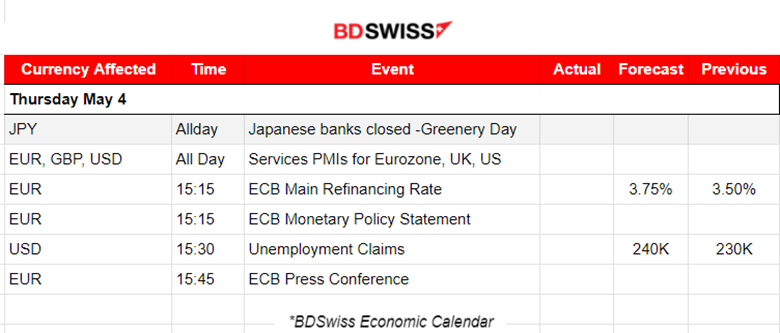

News Reports Monitor – Today Trading Day (04 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no important scheduled figure releases.

- Morning – Day Session (European)

PMIs for the services sector are to be released today. More volatility is expected for all major pairs.

At 15:15, the ECB is going to release its Monetary Policy statement and announce the Main Refinancing Rate figure. EUR is expected to be affected causing an intraday shock to EUR pairs. Retracement opportunities might arise. The ECB press conference takes place at 15:45. Discussions at that time might cause more volatility.

At 15:30 the Unemployment claims figure is to be released and will probably have a small impact on the USD.

General Verdict:

______________________________________________________________