PREVIOUS WEEK’S EVENTS (Week 29.01 – 02.02.2024)

Announcements:

U.S. Economy

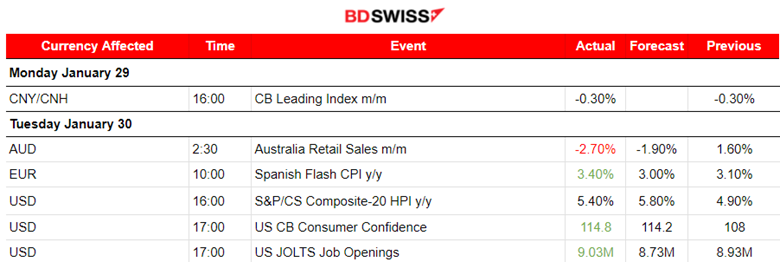

U.S. Consumer confidence rose in January, as recent reports suggested. It increased to a two-year high in January amid slowing inflation and expectations that the Federal Reserve would start cutting interest rates soon.

The consumer confidence index rose to 114.8, the highest reading since December 2021, from a downwardly revised 108.0 in December. The anticipation of lower interest rates ahead and indications of higher jobless claims played their part in this, during that period in forming such expectations.

The JOLTS U.S. job openings report showed that the figure increased in December, more than expected, and data for the prior month was revised higher, suggesting that the labour market likely remains stronger than expected.

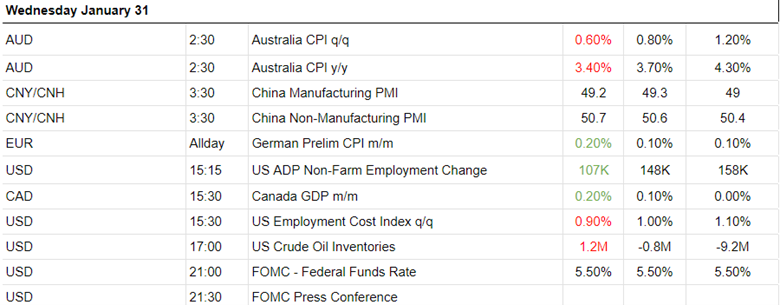

The U.S. ADP report showed that the private payrolls rose far less than expected in January showing signs that the labour market is cooling after December’s hot data. These latest labour market data reports indicated cooling which in turn caused market expectations to be formed in such a way that Non-Farm payrolls would actually be reported lower for January.

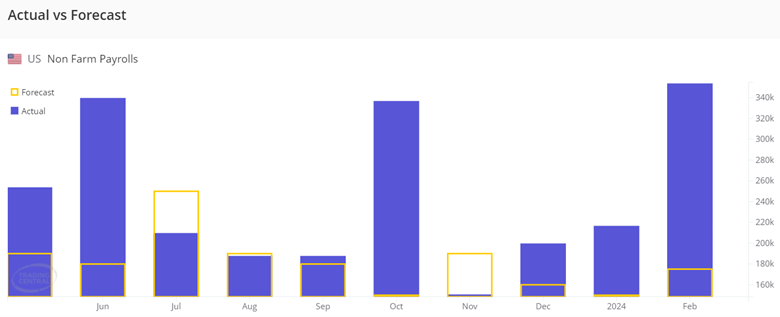

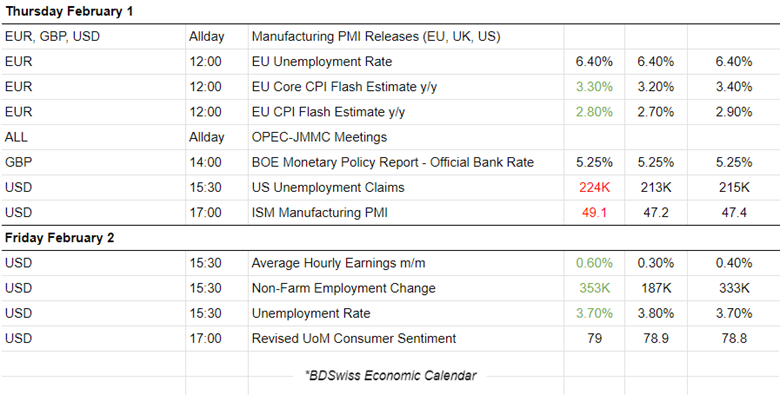

According to the U.S. labour data on Friday last week, including NFP, job growth accelerated in January and wages increased by the most in nearly two years, against expectations, causing a shock in the market and boosting the USD.

The Non-Farm Employment change was reported surprisingly at 353K, higher than the previous 333K for December, while the market was actually expecting lower figures. The unemployment rate was reported steady at 3.7% last month, remaining below 4% for two consecutive years.

Source: https://global.bdswiss.com/economic-calendar/

Average hourly earnings increased 0.6% in January, the biggest gain since March 2022, after rising 0.4% in December, supporting views that the Fed will not move quickly to lower borrowing costs.

This confirms that the labour market conditions are actually pretty strong, thus making it difficult for the Federal Reserve to start cutting interest rates soon. According to the Federal Reserve statements, March is out of the table for interest rate cuts, moving the expected start date/month to May.

Australia Economy

December’s report yesterday for Australia’s retail sales showed a huge decline surprising the market while annual growth in spending slowed to lows last seen during the COVID-19 pandemic lockdowns.

Retail sales decline was reported at 2.7% on a seasonally adjusted basis, after rising 1.6% in November.

______________________________________________________________________

FOMC – FED Fund Rate

FOMC: Policymakers announced last week, on the 31st Jan, an unchanged interest rate policy keeping the Fed Funds Rate steady, high at 5.5%, until more data support that inflation will indeed retreat as expected lower reaching the desired target, speculating that it will cut rates significantly later this year. Fed’s Powell mentioned that it’s unlikely to act as quickly as March for a policy change.

The current economic situation in the U.S. is favourable, considering the high borrowing costs in place. Both sectors of the economy show expansion and surprisingly, a strong NFP report was reported on Friday. Inflation, however, despite the fact that it has eased over the past year, remains elevated. Key statement:

“The Committee does not expect it will be appropriate” to cut “until it has gained greater confidence that inflation is moving sustainably” to 2%.

The above signals a delay in interest rate cuts that boosts the dollar in the short term.

BOE Interest Rates

The Bank of England (BOE) kept the Bank rate steady but announced that borrowing costs would be kept “under review.” The central bank Governor Andrew Bailey said inflation was “moving in the right direction”. Bailey further said the central bank was still cautious and inflation falling to its 2% target would not be “job done.”

______________________________________________________________________

Sources:

https://www.reuters.com/markets/australian-retail-sales-slam-into-reverse-december-2024-01-30/

https://www.reuters.com/markets/us/us-job-growth-surges-january-wages-rise-2024-02-02

https://www.reuters.com/markets/us/us-private-payrolls-miss-expectations-january-adp-2024-01-31/

https://www.reuters.com/markets/us/us-job-openings-unexpectedly-rise-december-2024-01-30/

https://www.reuters.com/markets/us/us-consumer-confidence-rise-two-year-high-january-2024-01-30

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 29.01-02.02.2024)

Server Time / Timezone EEST (UTC+02:00)

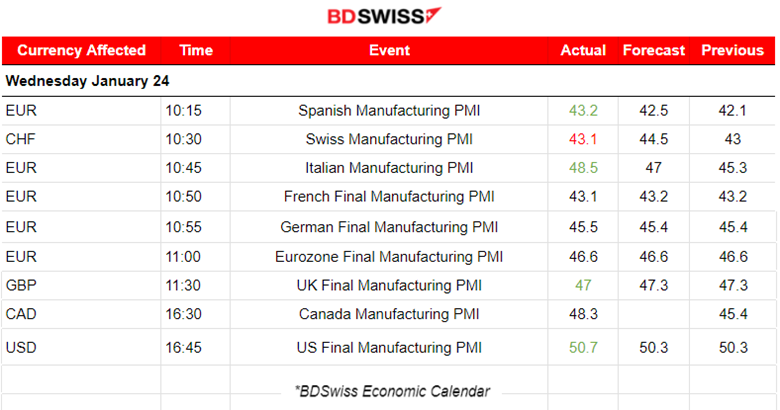

Manufacturing PMI releases:

Eurozone PMIs:

In Spain, the manufacturing sector continues to contract despite an improved figure. It is still significantly lower than 50, at 43.2 points in contraction territory during January with falls in output, new orders, employment, and stocks.

Italian business conditions deteriorated at a softer rate in January as the figure suggests, which is reported higher than expected, at 48.5 versus 47 points. Declines in production and factory orders slowed favourably. Firms continued to reduce input buying levels and deplete stocks in January.

France’s manufacturing sector is showing that it remains under a lot of pressure as incoming data for January suggest. The PMI figure is reported to be 43.1 points reflecting strong contraction in output, new orders and employment.

Germany also faces a downturn in the manufacturing sector and the PMI is not improving, however, the sector showed further signs of easing in January, with output, new orders and purchasing activity all falling at the slowest rates.

In the Eurozone the PMI is still reported in contraction, 46.6 points, however, reports show that the slump in the Eurozone’s manufacturing sector eased in January. Factory output and new orders continued to decline, however at the softest rates. Cutbacks to purchasing activity, stocks of inputs and employment cooled. Business confidence rose to a nine-month high. Decreases in both input costs and output prices gathered momentum.

United Kingdom PMIs:

U.K. manufacturing sector contracts as January saw output and new orders decline further, leading to additional job losses and cutbacks in purchasing and stock holdings. Furthermore, the Red Sea crisis hits supply chains and contributes to rising costs. The Red Sea has experienced a surge in regional tensions recently, leading to attacks on commercial vessels, and causing significant rerouting of maritime traffic. The PMI was reported at 47 points, confirming that there is no improvement in the sector at all.

United States PMI:

The U.S. continues to lead with the best conditions in the manufacturing business. It has faced the strongest improvement in manufacturing performance since September 2022. The PMI figure was reported in the expansion area which is above 50, at 50.7 points and more than the expected 50.3 figure.

Chair Jerome Powell said in an interview broadcast Sunday night that the Federal Reserve remains on track to cut interest rates three times this year, a move that’s expected to begin as early as May.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

Quite obvious that after some period of experiencing sideways movement with low volatility, the dollar index on the 31st Jan dropped heavily during the ADP private employment change news reaching the support near 103 points. It reversed soon after and back to the 30-period MA moving with high volatility. The FOMC news at 21:00 caused a shock in the market, however after the index deviated from MA it returned quickly to the mean and settled very close to it. Later, on the 1st Feb, it experienced another drop during the higher-than-expected unemployment claims figure release. Without retracement taking place, the index remained low and tested again the 103 points support on the 2nd Feb, unsuccessfully. On the same day, during the NFP news the USD strengthened heavily, the dollar index jumped breaking the resistance at near 103.8, moving higher. Currently, the dollar index is experiencing strong momentum to the upside.

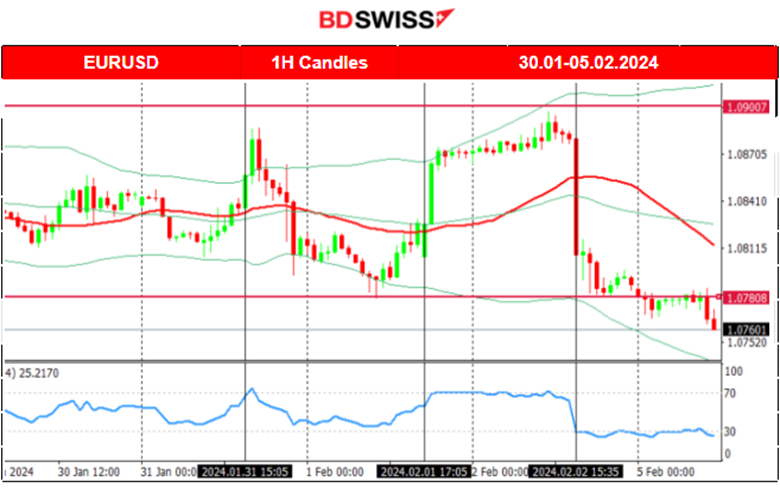

EURUSD

EURUSD

The pair experienced the opposite path in every case since the USD is driving the market. On the 31st Jan, the pair moved upwards as the USD depreciated from the U.S. ADP report. Reversal followed. On the 1st of Feb, higher Jobless claims caused another depreciation of the USD causing the pair to move to the upside as expectations formed regarding less employment change reported next. However, on the 2nd Feb, the NFP, Wage and Jobless rate data surprised the market with figures against the expectations, causing the USD to appreciate heavily and the EURUSD to drop. The USD currently is gaining more strength and thus more ground against the EUR, causing the pair to fall further. It might be the case that it reaches the next support at near 1.07200.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin faced a shock during the NFP report release on Friday but closed near flat for the trading day. Volatility levels lowered after that event and a triangle was formed during the weekend. On Sunday, 4th Feb, the price broke the triangle to the downside reaching the support at 42200 USD. It soon reversed after that crossing the 30-period MA on its way to the upside and remains currently settled near 43000 USD.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

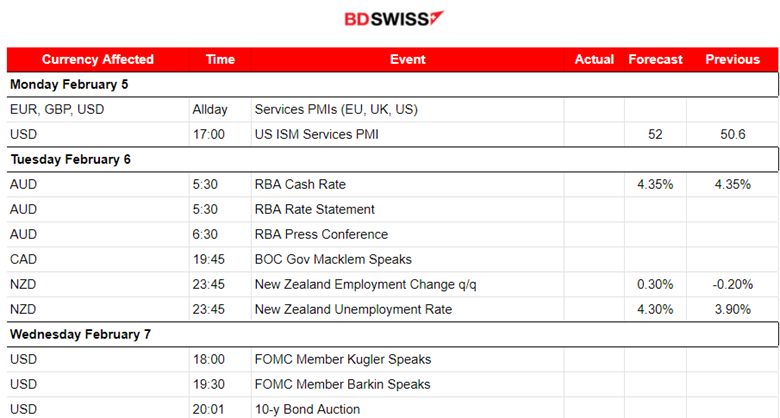

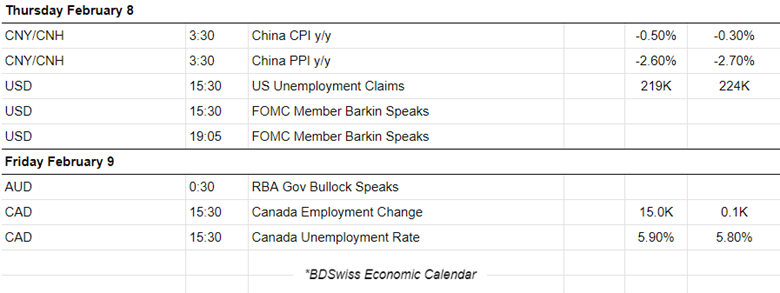

NEXT WEEK’S EVENTS (05 – 09.02.2024)

Coming up:

Services PMI figures for January, giving important information about the sector and helping in providing the whole picture in regards to business conditions in the mentioned regions.

The Reserve Bank of Australia (RBA) decides on interest rates and is expected to keep a steady policy.

New Zealand and Canada labour market data are to be reported shaking the markets a bit and providing the necessary data to the central banks in order to speculate when rate cut talks could take place.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude’s price signalled a downward movement and on the 31st it dropped to the support of 75.5 USD/b, before retracing back to the mean. On the 1st of February it tested that support and successfully broke it, coming down to near 73.6 USD/b before retracing. On the 2nd Feb the price was stable until the NFP news was released. Then the price saw a rapid drop breaking the support at 73.6 USD/b moving towards the next at near 71.8 USD/b before retracing to the 61.8 Fibo level. A clear downtrend as it seems for now. However, that might end soon while crude shows resilience to fall further and the RSI signals bullish divergence (higher lows).

Gold (XAUUSD)

Gold (XAUUSD)

Gold, on the 31st Jan, broke the resistance, reaching 2055 USD/oz prior to the FOMC news. The heavy reversal followed and increased volatility after the USD was affected positively by the Fed’s statements. On the 1st of February Gold tested the support near 2031 USD/oz unsuccessfully and reversed with a jump upwards reaching the resistance near 2065 USD/oz before retracing. The market shook on the 2nd Feb, at the release of the NFP news. Gold dropped heavily to around 28 USD, found support and soon after it retraced to the 61.8 Fibo level. Obviously, the drop was attributed to USD strengthening and the effect could possibly continue for longer. Currently Gold broke the 2030 USD/oz support moving lower, possibly towards the next support at near 2015 USD/oz.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

NAS100 reversed on the 1st Feb, moving to the upside crossing the 30-period MA and reaching the resistance at 17,550 USD. After some sideways movement with low volatility early on the 2nd Feb, the NFP news at 15:30 caused an intraday shock that brought the U.S. indices down to lower levels for some time. NAS100 reached the support near 17,400 USD before a huge reversal took place. The index reversed, crossing the 30-period MA on the way up and reaching the resistance higher at near 17,700 USD before retracing. The RSI is currently signalling a bearish divergence, however the market is about to test that intraday resistance for now.

______________________________________________________________