PREVIOUS WEEK’S EVENTS (Week 24-28 April 2023)

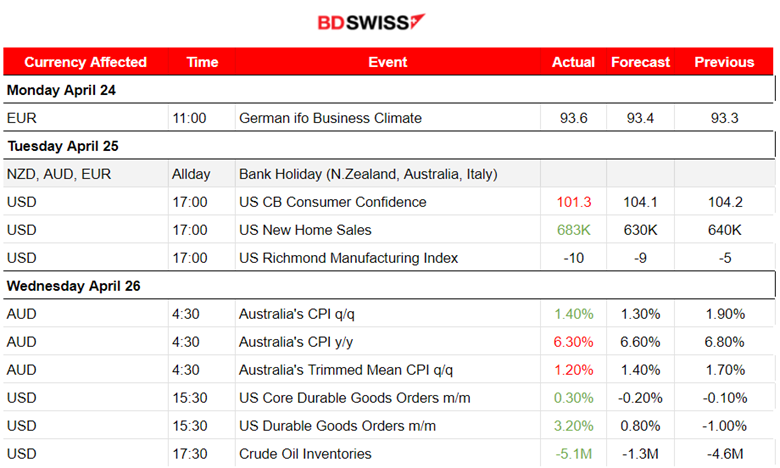

Announcements:

U.S. Economy

According to the U.S. Conference Board, consumer confidence experienced a decline. It was released at 101.3, which was lower than expected and down to 101.03, from 104.0 in March. There are now more pessimistic views about both business conditions and labour markets, even as current conditions improved.

Consumer six-month job expectations are pessimistic and remain below the level which often signals a recession looming in the short term. Only 12.5% expect more jobs to be available in the coming months. They expect that the labour market will show further cooling and even show dangerous unemployment levels if a recession takes place. Inflation is way above the Federal Reserve’s target. It will be harder to make loans with more hikes and both supply and spending will decline further.

The Richmond Manufacturing Index figure was expected to be -8. However, as it turned out, the survey resulted in showing that business conditions in the manufacturing sector actually worsened in April.

The U.S. Durable Goods Orders showed an increase of 3.2%, surpassing the market expectation for an increase of 0.8% by a wide margin. Imports are facing weaker consumer demand and tighter lending standards for businesses, while demand for exports is expected to slow down as USD strengthens.

U.S. Real Gross Domestic Product (GDP) increased at an annual rate of 1.1% in the first quarter of 2023, as per the Advance GDP Q/Q figure. This increase is attributed to increases in consumer spending, exports, federal government spending, state and local government spending and non-residential fixed investments.

“A U.S. recession is likely to start in the second half of this year,” said Gus Faucher, chief economist at PNC Financial in Pittsburgh, Pennsylvania. “It should be mild, however, as consumer balance sheets remain strong, and the tight labor market will discourage layoffs.”

U.S. weekly Initial Jobless Claims declined to 230K versus the expected 248K figures. In the last week of April 22, the advance figure for seasonally adjusted initial claims showed a decrease of 16,000 from the previous week’s revised level.

The U.S. job market has remained healthy. This shows that Americans are still utilising substantial job security despite rising interest rates, economic uncertainty and fears of a future recession.

German Economy:

According to the German ifo Business Climate Index, German business improved. The Index rose to 93.6 points in April, an improvement in companies’ expectations.

“German business worries are abating, but the economy is still lacking momentum,” Ifo’s president Clemens Fuest said.

Canada’s Economy:

Preliminary data for Canada’s Real Gross Domestic Product, the GDP M/M figure, was reported to be 0.1% – lower than expected. The previous month’s 0.1% expansion was slightly weaker than the expectations for 0.2% growth.

Bank of Canada paused hikes although further tightening is possible due to the job data showing a strong labour market and sticky high prices.

“Until there are clearer signs that slowing growth is also helping to ease core inflation, the Bank of Canada will continue to lean towards raising interest rates, even if a hike is not ultimately needed,” Andrew Grantham, an economist with Canadian Imperial Bank of Commerce, said in a report to investors.

Source: https://www.reuters.com/markets/us/us-core-capital-goods-orders-shipments-drop-march-2023-04-26/

_____________________________________________________________________________________________

Inflation

Australia:

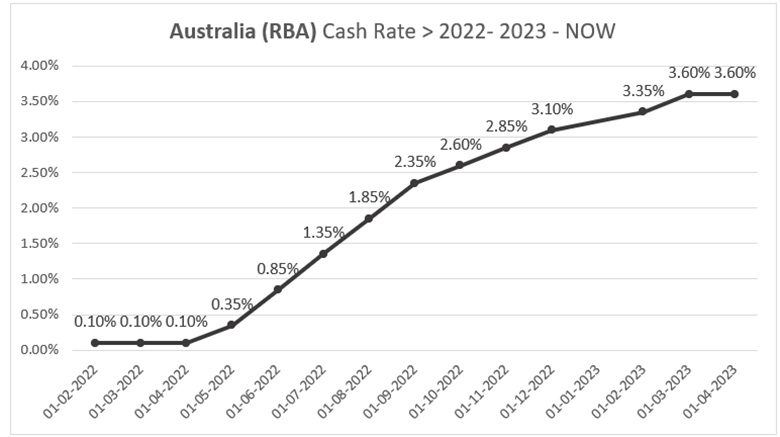

CPI figures for Australia showed that it rose by 1.4% this quarter. The annual pace dropped to 7.0% from 7.8%, suggesting inflation had finally peaked after two years of rapid acceleration in costs.

Even though it is quite high, core inflation remains far above the RBA’s target band of 2-3%. The Reserve Bank of Australia (e streak.RBA) resumed raising rates at its May 2 meeting, having paused in April after a 10-hike.

“Headline inflation has peaked, and weaker tradables inflation will contribute to slower inflation over the rest of 2023,” said Sean Langcake, head of macroeconomic forecasting for BIS Oxford Economics.

Germany:

The German Prelim CPI M/M figure was reported at 0.4% – lower than expected. It significantly eased in April after the economy struggled at the start of 2023. Consumer prices went up by 7.6% from a year ago. The Federal Statistical Office (Destatis) reports that consumer prices are expected to increase by 0.4% in March 2023.

“What happened to euro-area inflation in April could be pivotal to the ECB’s May policy decision — a big upward surprise on core inflation would put the decision over whether to hike by 25 or 50 basis points on a knife edge.”

_____________________________________________________________________________________________

Interest Rates

BOJ:

The Bank of Japan (BOJ) released the monetary policy report and interest rate decision on the 28th of April, causing turmoil in the market for JPY. JPY suffered high depreciation as the BOJ left interest rates unchanged, in line with expectations. The rate has been held at -0.1% since the central bank lowered rates below zero in 2016. USDJPY moved nearly 260 pips upwards. Japanese bonds and stocks rallied.

A new 71-year-old governor took office this month, Kazuo Ueda. “While trend inflation is gradually heightening, it will take some time to achieve our inflation target,” Ueda said after the BOJ’s widely-expected decision to make no changes to its yield curve control (YCC) policy.

U.S:

The Fed is expected to raise interest rates by another 25 basis points next week. It will probably be the last hike. There is currently a tight labour market, characterised by a 3.5% unemployment rate.

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (24-28 April 2023)

_____________________________________________________________________________________________

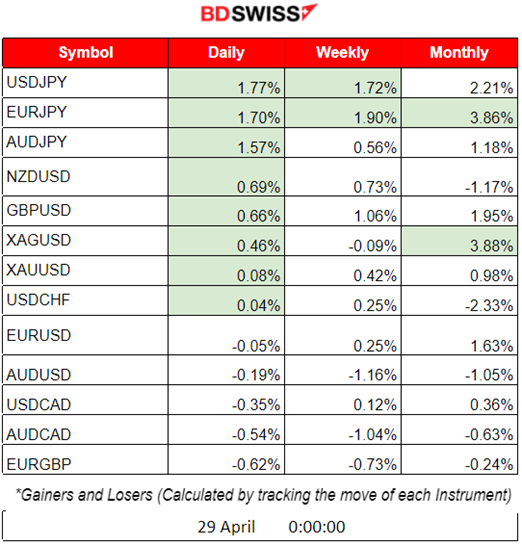

Summary Total Moves – Winners vs Losers (Week 17-21 April 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

The pair moved sideways around the 30-period MA. The NFP release this month is expected to cause a shock, following the pair’s deviation from the mean greatly.

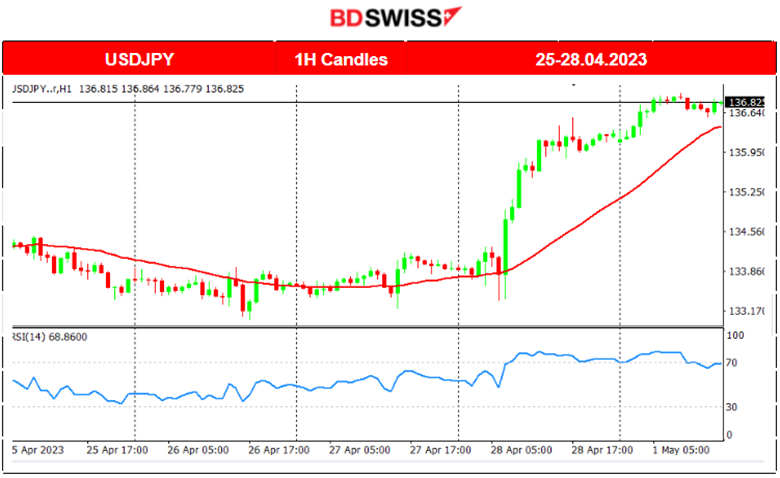

USDJPY

The BOJ’s Monetary Policy Statement was released on the 28th of April, causing high depreciation of the JPY. USDJPY jumped and retracement did not take place still.

DXY (US Dollar Index)

The dollar was moving sideways around the mean. The chart confirms that the USD is the main driver and related news is causing mixed reactions. There is no clear trend.

_____________________________________________________________________________________________

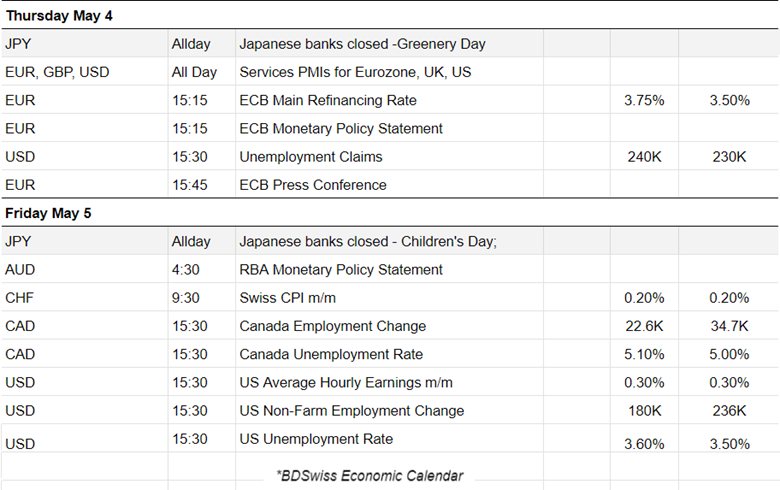

NEXT WEEK’S EVENTS (01-05 May 2023)

This week, we have important figure releases that will cause intraday shocks for many pairs.

Currency Markets Impact:

_____________________________________________________________________________________________

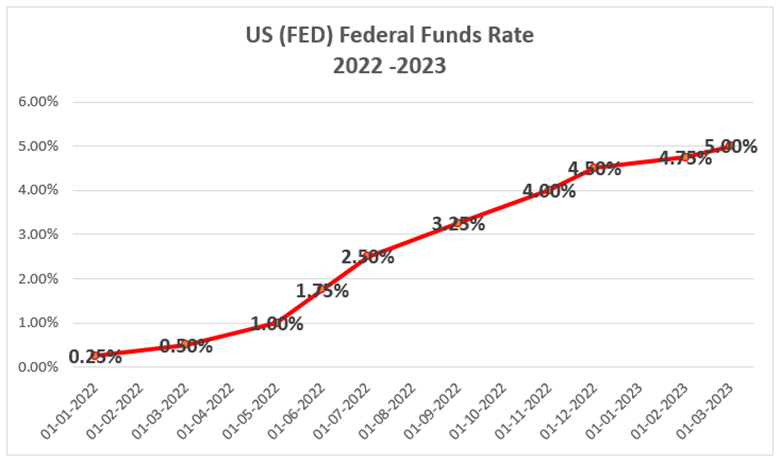

Federal Funds Rate

The Federal Reserve raised interest rates for the ninth time straight, in the face of a banking crisis to 5%. Policymakers also stated that their plans for the year did not change and that they will go through with another hike. 25 basis points increase will lead the rate to 5.25%. Markets and the Fed both expect a pause in June after this last hike.

Australia’s RBA Cash Rate

At its meeting last time, RBA decided to leave the cash rate target unchanged at 3.60%. Policymakers recognise that monetary policy operates with a lag and that the full effect of the interest rate increase is yet to be seen. With unchanged rates, RBA provides more time to assess the impact of the increase in interest rates.

_____________________________________________________________________________________________

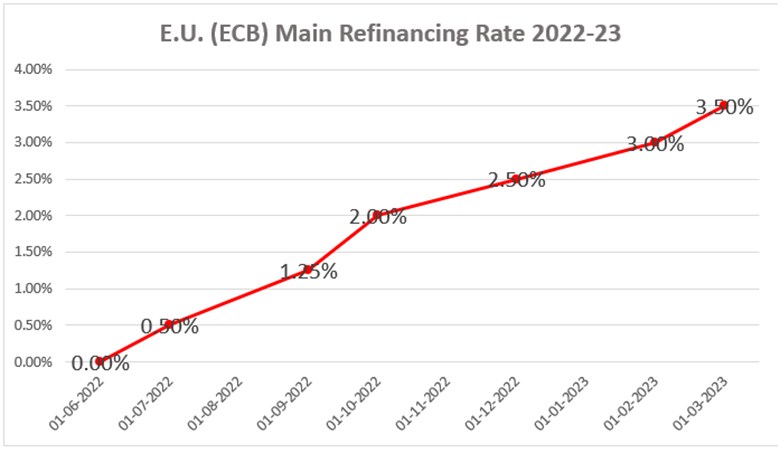

Eurozone: Main Refinancing Rate

Another interest rate increase on Thursday is expected, from 3.5% to 3.75%. Headline inflation has moved to lower levels but almost exclusively due to energy price base effects, while core inflation remains high. Projections of inflation converging to 2% in 2025 are doubtful.

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

US Crude Oil

Crude was testing the support near 73.96 USD/barrel. A further downward movement was less probable and this idea was supported by the recent U.S. inventory figures, showing fewer and fewer barrels in inventories. On the 28th of April, its price started to move upwards. There is no retracement to the mean yet, something expected after a price reversal.

Gold (XAUUSD)

Gold is moving around the 30-period MA for days testing the resistance levels near the 2000 USD level and around the mean near the 1990 level.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

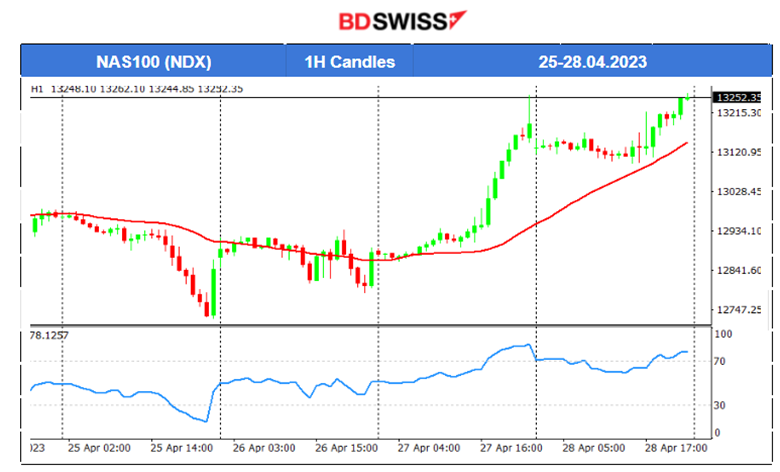

NAS100 (NDX)

Price Movement

While the index showed a clear downward trend, it rose unexpectedly on the 27th of April, moving above the 30-period MA and gaining momentum. Current fears of a new recession do seem to have an impact. Recent U.S. Labour Data show a strong labour market still. The upward movement continued on the 28th of April, signalling that this might be the start of a new upward trend.

______________________________________________________________