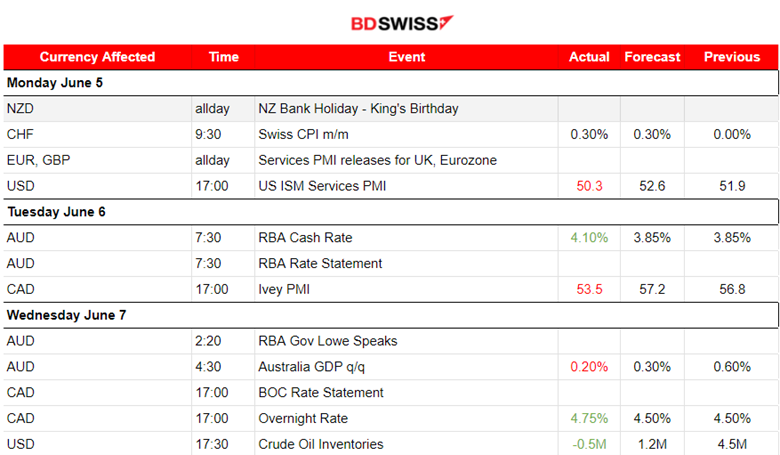

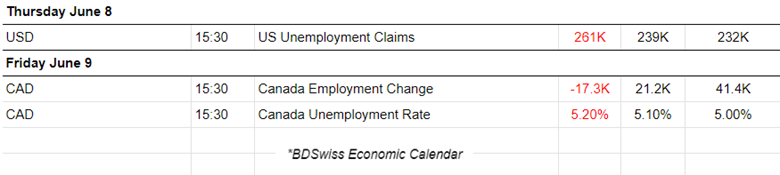

PREVIOUS WEEK’S EVENTS (Week 05 – 09 June 2023)

Announcements:

U.S. Economy

The U.S. Institute for Supply Management (ISM) services PMI fell to a more-than-expected 50.3. Tight credit conditions, pandemic savings and the U.S. banking crisis are finally hitting the services sector.

This figure is just over 50 and it shows weakness rather than improvement, raising fears and risks of a recession. There have been 500 basis points worth of interest rate increases from the Fed since March 2022. This figure is good news for the U.S. central bank since they finally see lower desirable figures, with the services sector finally cooling down.

New U.S. claims for unemployment benefits jumped surprisingly high. The actual figure showed 261K more claims versus the lower and expected 236K. The U.S. dollar had lost ground since expectations shifted as we are currently waiting for the Fed to actually pause hikes.

The market is still strong and exhibits remarkable resilience. NFP data showed a high positive change in employment while the unemployment rate increased slightly. Claims remained well below the estimates and considering such numbers, it will be interesting to see what the Fed is actually going to decide on rates. We might have a possible surprise just like the RBA and BOC cases.

Australia Economy

The release of Australia’s quarterly Gross Domestic Product (GDP) was lower than expected. GDP rose by 0.2% in the first quarter, easing from 0.5% in the previous quarter. Annual growth at 2.3%, also missing forecasts for 2.4% expansion.

The Reserve Bank of Australia (RBA) has been engaged in a battle with inflation, while simultaneously trying to avoid bringing the economy down into a sharp recession.

Canada Economy

Canada labour data showed 17,3K fewer jobs in May while the unemployment rate rose by 0.2%, reaching 5.2%. It is the first increase since August which signals employment softness following the Central Bank’s rate hikes.

The Bank of Canada struggles to bring down inflation which remained more than double its 2% target in April. On Thursday, Bank of Canada Deputy Governor Paul Beaudry highlighted that a tight labour market and sticky core inflation contributed greatly to the decision for a rate hike.

The Canadian labour market in May showed softness, but the figures may not be yet significant enough for the Bank of Canada. Some economists support that the labour force survey needs to be enhanced with additional information to support the view that the Bank of Canada will not hike again.

_____________________________________________________________________________________________

Interest Rates

Australia

The Reserve Bank of Australia (RBA) eventually raised interest rates on June 6th and stated that further tightening is possible. The AUD surged. The RBA Governor Lowe said the latest rate increase will “provide greater confidence that inflation will return to target within a reasonable timeframe.”

However, as the RBA takes rates higher, the economy is slowing down and might create more issues. These are basically similar concerns for other economies experiencing rising rates.

Canada

The Bank of Canada surprisingly increased rates and caused the CAD to appreciate greatly at that time and further turmoil in the market for USD and U.S. Stocks.

We have seen a lot of surprises lately. Another surprise took place just recently on the 6th of June with the RBA increasing the Cash rate to 4.10% against the expected unchanged 3.85%. Central Banks will not hesitate to act aggressively against stubborn inflation and expectations for future rate hikes are formed.

The Bank of Canada (BOC) raised the concern that inflation would stack higher than the target and that monetary policy so far was not sufficient to return inflation sustainably to the 2% target level. Another 25 basis points increase is expected in July though. The BOC will assess economic indicators and inflation and take appropriate decisions in the future.

https://www.cnbc.com/2023/06/07/australias-economy-expands-2point3percent-in-the-first-quarter.html

https://www.reuters.com/markets/rates-bonds/bank-canada-hikes-rates-475-highest-22-years-2023-06-07

https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-more-than-expected-2023-06-08/

_____________________________________________________________________________________________

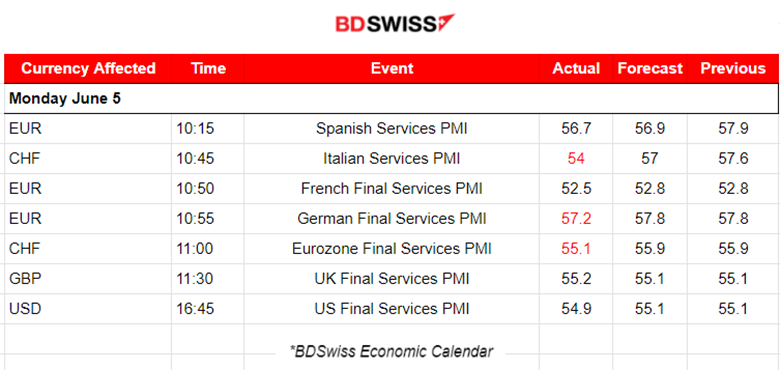

Currency Markets Impact – Past Releases (05 – 09 June 2023)

_____________________________________________________________________________________________

Summary Total Moves – Winners vs Losers (Week 05 – 09 June 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD was moving around the mean with high volatility. On the 8th of June, the pair moved rapidly upwards since the unemployment claims figures for the U.S. were reported more than expected and the market reacted with USD depreciation. This was one of the recent and weak labour market data that surprised the market participants that were used to seeing hot data for Labour. The Fed will take this into account and would probably enhance their decision to not hike this month. Volatility continues to be high for the pair and this week we expect high deviations from the mean. The FOMC report and Fed funds rate release take place on Wednesday this week.

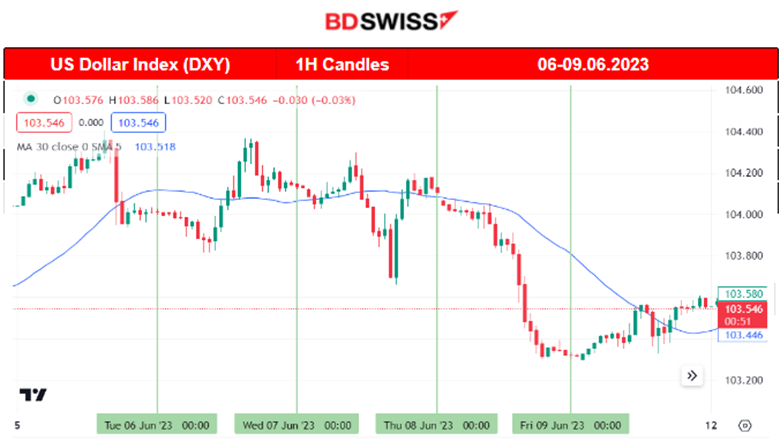

DXY (US Dollar Index)

The DXY index moved sideways with high volatility. It is a “mirror” of the EURUSD chart confirming that the USD is the main driver here. We see the drop on the 8th of June from the USD depreciation against other major currencies caused by the labour data releases that day. A retracement followed back to the mean on Friday 9th June.

_____________________________________________________________________________________________

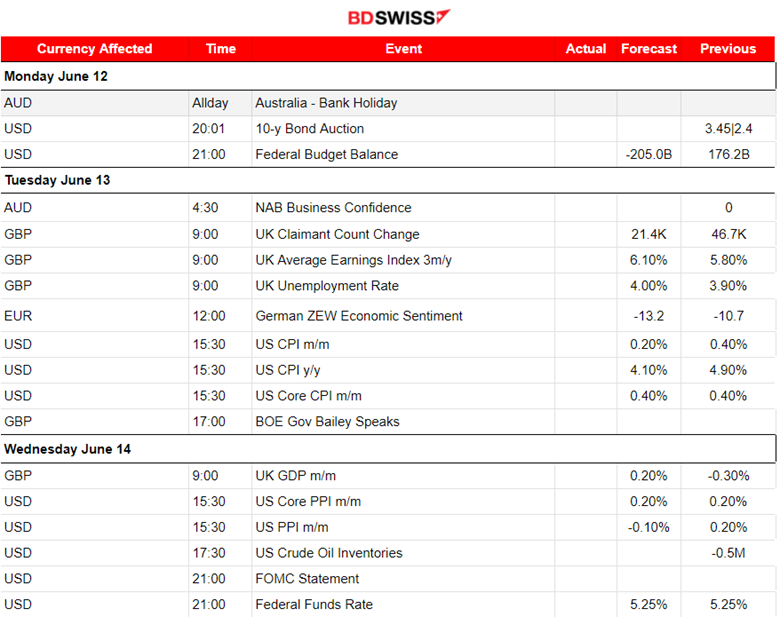

NEXT WEEK’S EVENTS (12 – 16 June 2023)

Rate decisions ahead this week again. The Fed will announce the Fed rate on the 14th of June. The ECB will announce the Main Refinancing rate on the 15th of June. The Bank of Japan will announce the BOJ Policy rate on the 16th of June.

Labor Market data will be reported this week for Australia and the U.K.

The US Inflation data will be reported ahead of the FOMC. This is the release of the CPI data while the PPI data will be reported on the 14th, also before the rate decision takes place.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

The price of Crude was steady the last few days, with sideways movement around the 30-period MA. On the 8th of June, after the U.S. Unemployment claims figures were released, the price dropped rapidly finding resistance at 69 USD/b before retracing significantly. The claims were higher than the forecast, shifting the expectations towards a pause in hikes. This weak data caused turmoil and USD depreciated while actually crude dropped. On the 9th of June, its price experienced lower volatility and a drop overall settling at 70.4 UD/b.

Gold (XAUUSD)

On the 7th of June, after 17:00, the USD appreciated greatly causing Gold’s price to crash and test the 1938 USD/oz support. Later on, it retraced fully back to the 61.8 Fibo level and even jumped further upwards when the USD depreciated greatly on the 8th of June after the high unemployment claims figures released that day. It remained on a sideways path until the end of the week, even though on Friday it experienced a low-level intraday shock possibly affected by the CAD news at 15:30.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

On the 7th of June, the index crashed after 17:00, near a 300 USD drop. This was after the BOC rate figure release at that time and the USD appreciation that followed immediately after. NAS100 dropped further following the next day, 8th June, and found significant support at nearly 12245 USD. It later retraced during the day back to the mean. With the release of the high U.S. Unemployment claim figures, the index moved rapidly upwards. On the 9th of June, after the NYSE opening, the stock market experienced an upward shock in general. The index jumped and tested once more the resistance of 14672 USD before retracing back to the intraday mean.

______________________________________________________________