PREVIOUS TRADING DAY EVENTS – 16 Oct 2023

Major U.S. stock indexes ended sharply higher on Monday as investors were optimistic about the start of earnings season, while transportation and small-cap shares also jumped.

Source:

https://www.newyorkfed.org/survey/empire/empiresurvey_overview

______________________________________________________________________

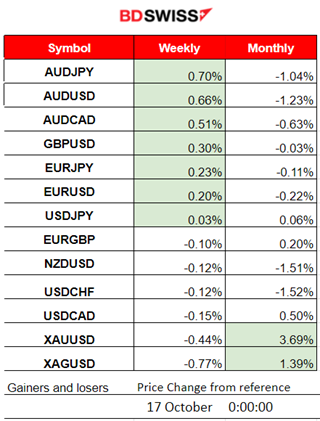

Winners and Losers

News Reports Monitor – Previous Trading Day (16 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

The Empire State Manufacturing Index figure released at 15:30 showed that business activity edged lower in New York State, according to firms responding to the October 2023 Empire State Manufacturing Survey. The headline general business conditions index fell seven points to -4.6. No major impact in the market was recorded at that time.

Business Outlook: Canadian business sentiment fell to its weakest level since the Covid recession of 2020, but inflation expectations remain high. At the time of the release CAD was not significantly affected.

General Verdict:

FOREX MARKETS MONITOR

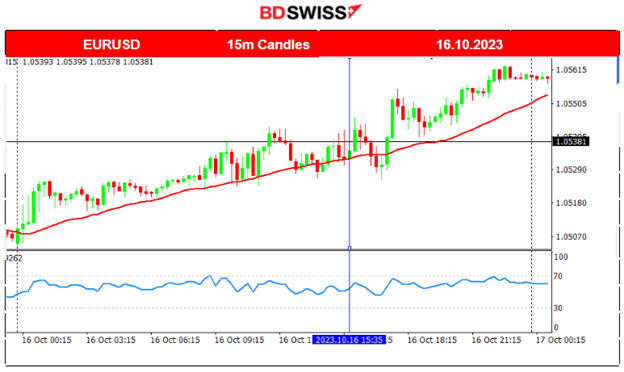

EURUSD (16.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD moved steadily to the upside obviously driven by the USD weakness. It is a clear intraday trend upwards while the price moves while being above the 30-period MA. We already saw that news had no major impact.

___________________________________________________________________

CRYPTO MARKETS MONITOR

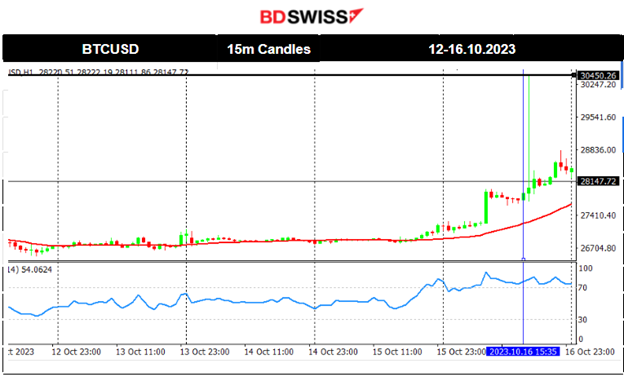

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Surprisingly there was movement on the 15th and yesterday morning with bitcoin jumping and breaking the resistance at 27000 and later at 27300 moving significantly upwards over 700 USD. Retracement back at 27650 eventually happened during the day but later a storm took place. Bitcoin surged over 30K USD as a false report took place of a spot ETF approval that was posted on social app X, formerly Twitter, leading to nearly $100 million in liquidations. The post was deleted soon after it was publicly available but had already sparked enough interactions to have that major impact on prices. Bitcoin has since fallen from 30K USD to 28K USD following scepticism from analysts and reporters.

Source: https://finance.yahoo.com/news/bitcoin-jumps-30k-then-dumps-135714532.html

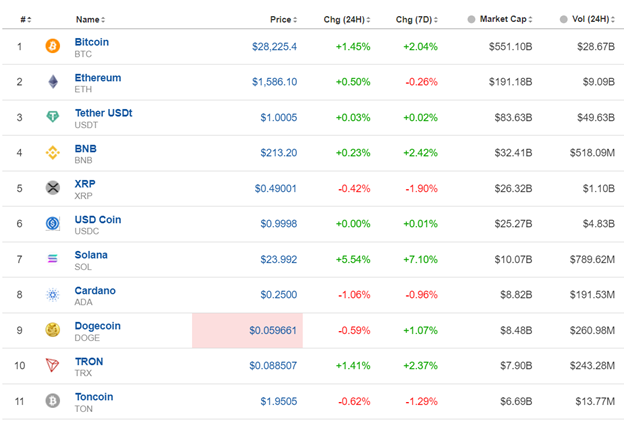

Crypto sorted by Highest Market Cap:

Cryptos show some improvement in the last 24 hours. Bitcoin reports gains of 1.45% during that time while Solana seems to have 5.5% gains, the highest for that period.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

All benchmark indices experienced similar upward paths. The U.S. stock market picked up momentum and caused the indices to move to higher levels. The U.S. CPI news caused a shock in the U.S. stock market. All indices crashed before they retraced again giving the signal that the upward trend is finally over since the price remained under the MA for a long time. The index found support at near 14960 USD and instead of a breakout to the downside, it reversed remarkably to the upside breaking resistance and crossed the 30-period MA on its way up. The important part here is that this movement was high enough causing the index to deviate far from the MA signalling that a downward trend is not at play. There is actually a possible future upward path if we see more resistance levels to break as depicted. The index retraced back to the mean after the rapid movement yesterday to the upside but soon reversed (thus the shadow).

______________________________________________________________________

COMMODITIES MARKETS MONITOR

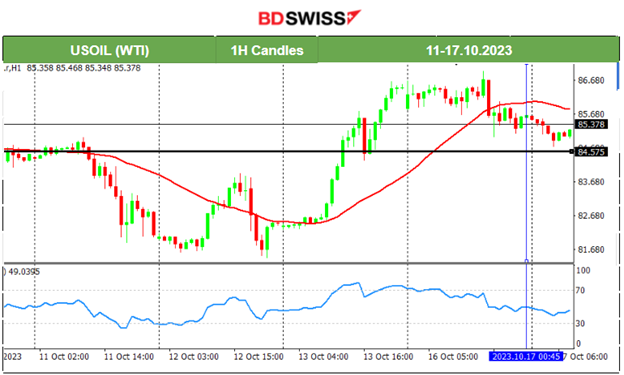

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude continued with high volatility sideways around the MA before eventually deviating significantly to the upside and breaking important resistance levels. This upward movement continued on Friday with the price breaking eventually the resistance at 83.85 USD/b and the 85 USD/b getting higher and higher rapidly until the level of 85.5 USD/b. Yesterday, Crude’s price reached the highest peak for this week at 87 USD/b, significant resistance, before it retarced back to the mean.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was on an uptrend last week but on the 13th it experienced a rapid movement to the upside near 60 USD. The 1885 level was broken and its price was boosted to the upside before retracing. It eventually returned back to the 30-period MA and currently is settled on a sideways path. However, we see today that its price is about to test significant resistance levels and breakouts are probable to take place soon.

______________________________________________________________

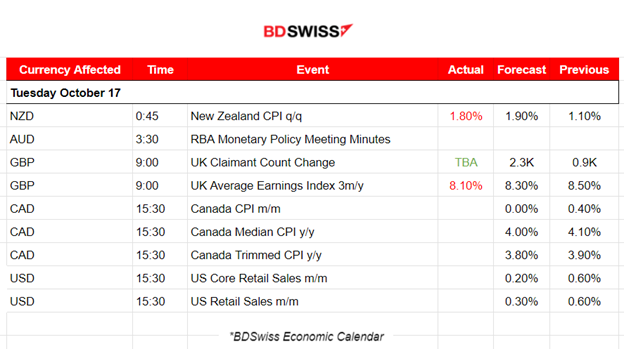

News Reports Monitor – Today Trading Day (17 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

The quarterly CPI change for New Zealand was reported 1.80% slowing more than what economists expected in the third quarter. The annual inflation rate fell to 5.6%, a two-year low, from 6% in the second quarter. NZD depreciated at the time after the shock with NZDUSD dropping near 20 pips before retracing to the mean.

Claimant count in the United Kingdom which measures the change in the number of people claiming unemployment related benefits has not been released yet.

The average weekly earnings figure for the U.K. was reported at 9:00 showing that annual growth in employees’ average total pay (including bonuses) was 8.1% in June to August 2023. Previously reported figure was higher, at 8.5%. The impact on the GBP was minimal, GBP experienced some depreciation that still lasts.

Canada’s CPI data is going to be released at 15:30 and we expect that a shock will take place at the time of the release affecting the CAD pairs. Inflation (yearly figure) is expected to be reported lower.

U.S. Retail sales figures are to be reported as well at that time so USD pairs could see a shock, but rather moderate at that time.

General Verdict:

______________________________________________________________