Announcements:

The Federal Reserve has made several announcements about the recent shock of Silicon Valley Bank failure. On Sunday, the Federal Reserve Board announced it will make additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors and that the Bank Term Funding Program is big enough to cover all US uninsured deposits.

Currency Markets Impact – Past Releases:

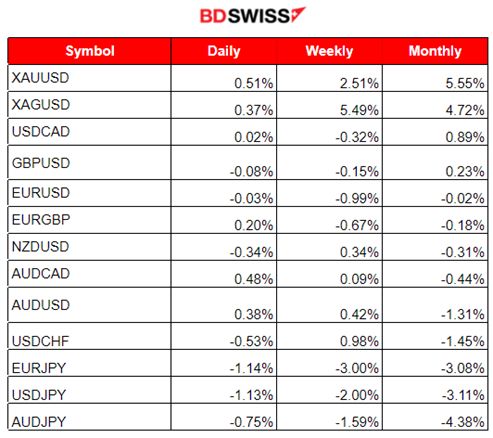

The below figures show that metals gained the most ground this month with Gold experiencing a change of 5.5% of its value.

The dollar has appreciated against a basket of major currencies overall, due to a shock that happened on the 15th, driving the USDCHF to the top of the list of FX Gainers for the week. The Dollar Index has increased during the past week.

*Gainers and Losers (Calculated by tracking the move of each Instrument)

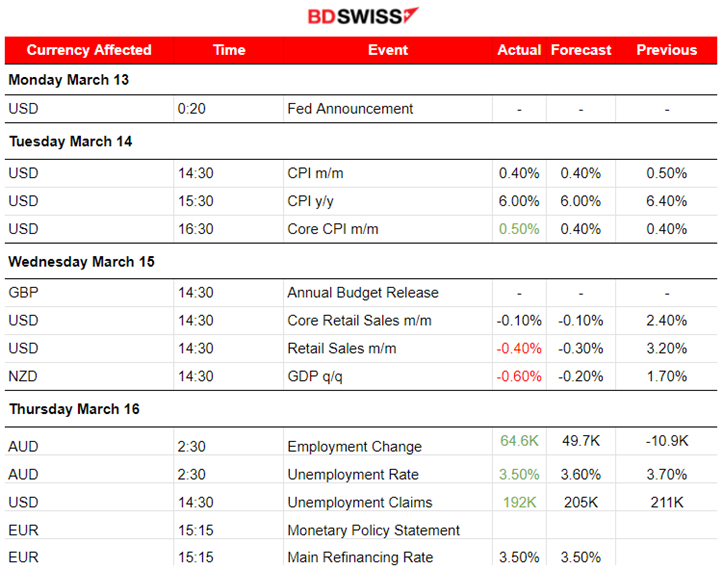

*BDSwiss Economic Calendar

The FX Market has experienced large moves on all major pairs because of these important news announcements and figures that were released. Major pairs concerning traders/investors were EURUSD, GBPUSD, USDJPY and AUDUSD.

The EURUSD pair was following an upward path over the 30 period MA as this week started with the 13th of the month being the most volatile since CPI news usually causes high volatility.

However, on the 15th, after the European Markets opened the EURUSD pair started falling rapidly as the US Dollar rose against a basket of major rivals off four-week lows while participants are expecting the Fed to raise interest rates by 25 basis points next week. In addition, European currencies fell sharply after Credit Suisse’s tumble to a new low, increasing worries about the European banking sector following Silicon Valley Bank (SVB)’s collapse.

The below chart shows the price path of the Dollar Index, the symbol for the US dollar index, which tracks the price of the US dollar against six foreign currencies, aiming to give an indication of the value of USD in global markets. It is clear that there was a shock upwards intra-day.

At the same time though, the fall in EURUSD is also explained by the intentions of the European Central Bank policy makers to lean towards a half-percentage-point rate hike that was going to be announced the next day. This caused the EUR pairs to fall also. Monthly Retail Sales figures showed higher than expected negative change (-0.40%) and near that time the EURUSD pair started to slow down and eventually retrace as shown below:

The US dollar had a similar impact on the GBPUSD pair price while we see the price to drop below the 30 period MA. Chancellor Jeremy Hunt announced on Wednesday the 15th, a promising plan to help the UK economy with important reforms to get more people into work and corporate tax breaks and stated optimistic remarks relevant to growth keeping the pound strong.

While observing this unusual drop, reversing from above the MA to below the MA rapidly, this indicates a short-term intraday shock. Using the Fibonacci Retracement levels is appropriate in order to take advantage of that retracement opportunity.

In the above chart, I am showing how we used the Fibonacci expansion tool to identify the Fibonacci retracement levels after the intraday shock.

Australia’s Employment rate and Unemployment change announcements helped the country’s currency, the Australian Dollar, to keep a steady path. It reversed after the dollar shock, moving above the 30 period MA, thus showing an upward trend. The employment change (64.6K), even though it was more than expected, it is clear that it did not create any significant shock during that time.

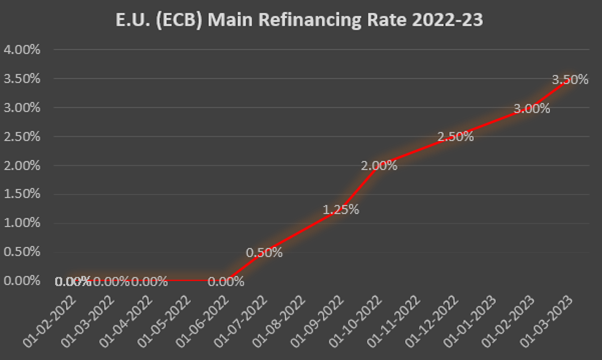

The European Central Bank (ECB) raised its deposit facility rate by another 50 basis points (bps) at the meeting at 15:15 16.03.2023, reaching 3.5% as expected. This caused a minor shock for the EUR downwards, for about 40 pips, which was immediately corrected within 30 minutes.

Source: https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.mp230316~aad5249f30.en.html

NEXT WEEK’S EVENTS

Bank Holidays:

Japanese banks were closed in observance of Vernal Equinox Day on the 21st.

Currency Markets Impact – Scheduled Releases:

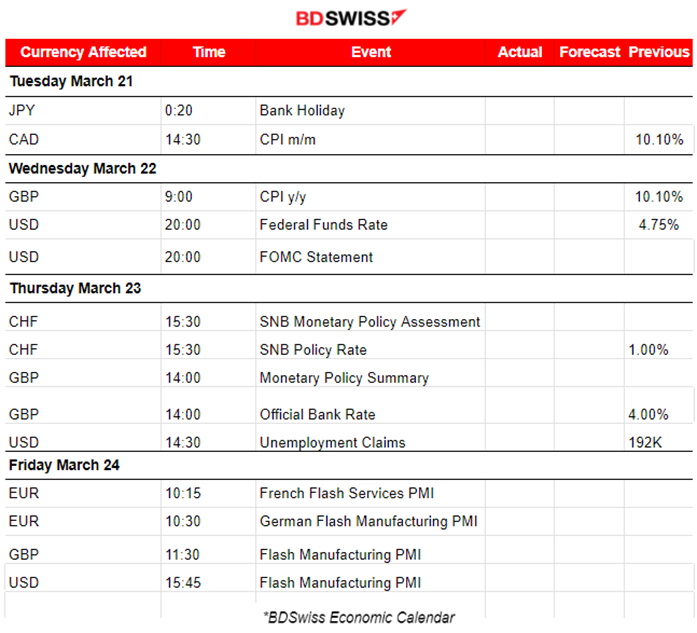

This week we have many important figures that are expected to be released in the next few days including CPI figures/Inflation for Canada and the United Kingdom.

Most importantly we have:

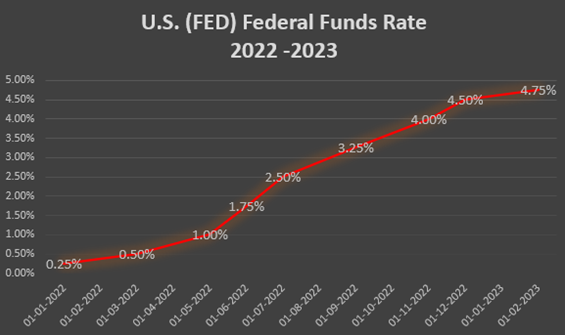

The US has been increasing the FED Fund Rate for some time now. That is the Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Last figure was 4.75% which is very high enough to raise concerns. Most economists expect the Federal Reserve to hike rates next week in a continuing response to high inflation. When the Fed increases interest rates, it encourages people to save more and spend less, reducing inflationary pressures.

The DXY Chart above shows the value of the dollar during the Year 2022. It is clear that as the FED was increasing the FED Fund Rate through the year there was an increase in the value of the US dollar compared against a basket of major currencies.

The Federal Open Market Committee will raise rates by a quarter point at its March 21-22 meeting and at its next two gatherings to a 5.25%-5.5% range, according to economists surveyed by Bloomberg News. (Source: From bnnbloomberg.ca). The actual expected figure is 5%. The actual figure could cause huge volatility, so traders should better trade with caution and ofcourse wait until the actual figures come out.

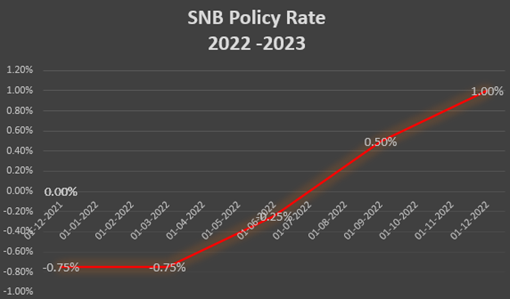

SNB (Swiss National Bank) also has to make hard decisions regarding the SNB rate. It is the SNB’s main operating target. The decision is usually priced into the market. We can see below that they were also increasing the policy rate but not so often as the FED and reached 1%.

From the USDCHF chart we can see how the USD was gaining ground at the start of the year against the CHF with those increases in the FED rate, while SNB kept the rate unchanged during that time.

The SNB expects inflation to remain elevated in Switzerland and further interest rate hikes might be necessary to bring price rises under control. Policy rate is now expected to increase to 1.50%.

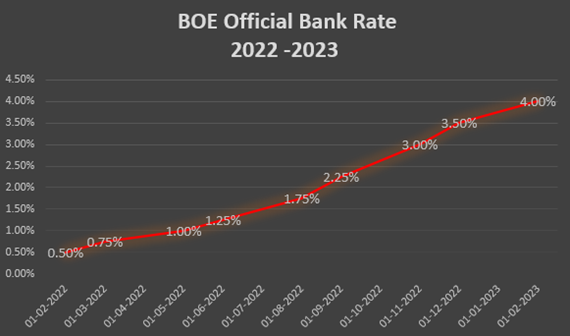

The Bank of England (BOE) has been playing this game with rate-hikes as well, to tight inflation, increasing steadily the rate through the year reaching a rate of 4% as per the chart below.

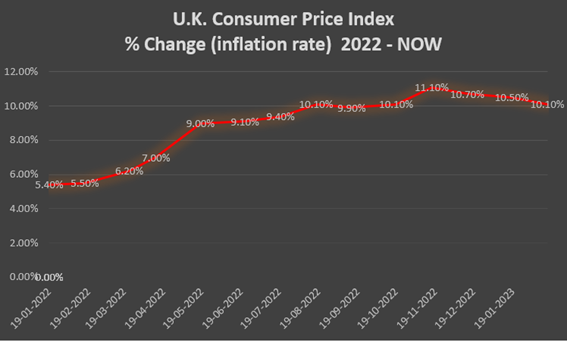

Britain’s poorest households are suffering most from double-digit inflation as the surge in food and energy bills drives a divide with the wealthy.

Consumer prices jumped 12.1% for the poorest tenth of households in the 12 months to December but climbed 9.2% for the richest tenth, according to the Office for National Statistics. Current inflation rate is 10.1%. The target of BOE is 2%.

BOE will make its final increase next Thursday 23.03.2023, lifting the Bank Rate 25 basis points to 4.25%, the figure now currently expected to be announced. If the actual figure announced is the same as the one expected then markets should not experience any big moves, other than small intraday-shocks.

Commodities Markets:

Crude Oil has been experiencing volatility the past few days. As per the chart below we can see that its price has overall fallen below 70 USD /barrel. The price was already following a downward trend, moving below the MA and on the 15th an intraday shock caused the price of its CFD to reach 65.8 USD.

International Energy Agency (IEA) Report Shows Russia Production Remains Strong. With Russia causing oversupply and the fact that no one was planning for a banking crisis, this is driving US OIL prices down.

From a Technicians point of view the 66.80 USD is a good support level to be taken into consideration. The price could reach the next major support of 60 USD if we see no important changes or events happening affecting the price to the upside or sideways.

Exchanges:

As far as the US indices are concerned, the US30 Dow Jones has been moving sideways for the last week. NAS100 has been experiencing an upward trend.

The index is moving above the 50 period MA since the 14th. After every New York Stock Exchange market opening we see that it keeps rising, breaking resistances as investors bet on technology and other growth oriented stocks. The S&P 500 is showing a similar chart with more volatile moves going above and below the MA.

Investors have been closely watching bank stocks after the closures of Silicon Valley Bank and Signature Bank. Stocks fall while there are worries about banks and possible recession signs.

PMIs:

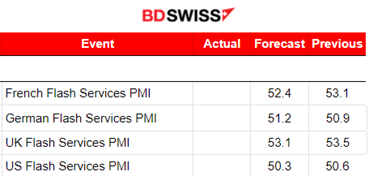

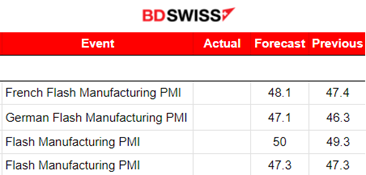

This week there are the purchasing managers’ indices (PMIs) from several of the major industrial economies, releases taking place on the 24th March.

Manufacturing PMIs are near and/or exactly 50 levels of this index, in contractionary territory. In general the Eurozone, UK and US PMIs started declining in mid 2022 and after that began to climb again towards 50. All region figures now show manufacturing PMIs are close to 50 deviating by 2-3 points. Forecasts are showing higher estimates but not significant.

The service-sector PMIs are near all above 50 with mixed forecasts as to where they are expected to go. In general, there is no clear indication that there will be a significant change in these indices and the impact currently on the FX pairs will be most likely related to volatility rather than forming specific trends.

(PMIs: Survey of about 800 purchasing managers which asks respondents to rate the relative level of business conditions. They serve as leading indicators of economic health – businesses react quickly to market conditions. Purchasing managers probably hold the most current and relevant insight into the company’s view of the economy.)

______________________________________________________________

The information and opinions in this report were prepared by Marios C. Kyriakou. Though the information herein is believed to be reliable and has been obtained to be reliable, the author makes no representation as to its accuracy or completeness. This report is provided for informational purposes only and does not take into account the particular investment objectives, financial situations, or needs of individual traders. It is not an offer, or a solicitation of an offer, to buy or sell any financial instruments or to participate in any particular trading strategy.

The author is not acting as a financial adviser, consultant or fiduciary to you or any of your agents (Collectively “You” or “Your”) with respect to any information provided in this report. Information contained herein is being provided solely on the basis that the recipient will make an independent assessment of the merits of any investment decision and it does not constitute a recommendation of, or express an opinion on, any product or service or any trading strategy. The information presented is general in nature and it is not directed to retirement accounts or any specific person or account type and is therefore provided to You on the express basis that it is not advice, and You may not rely upon it in making Your decision.

The author may hold positions in any of the currencies that he is writing about. He may also be holding debt or equity securities in any of the markets or issuers he writes on.

Hyperlinks to third-party websites in this report are provided for reader convenience only. The author neither endorses the content nor is responsible for the accuracy or security controls of those websites.