On July 23, 2024, Exxon Mobil Corporation (NYSE: XOM) announced its Q2 2024 earnings release will be on August 2, 2024, with results available at 5:30 a.m. CT via Business Wire. The earnings call will occur from 7:30 a.m. to 8:30 a.m. CT, with the presentation and formal remarks posted on their investor website at 5:30 a.m. CDT, and a live webcast for Q&A starting at 7:30 a.m. CDT.

On July 23, 2024, Exxon Mobil Corporation (NYSE: XOM) announced its Q2 2024 earnings release will be on August 2, 2024, with results available at 5:30 a.m. CT via Business Wire. The earnings call will occur from 7:30 a.m. to 8:30 a.m. CT, with the presentation and formal remarks posted on their investor website at 5:30 a.m. CDT, and a live webcast for Q&A starting at 7:30 a.m. CDT.

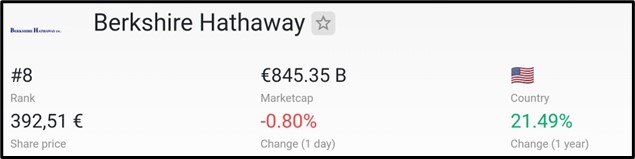

Market Cap

€486.01 billion in market capitalization positions Exxon Mobil as the 17th most valuable entity globally, based on the latest data from companiesmarketcap.com as of August 2024.

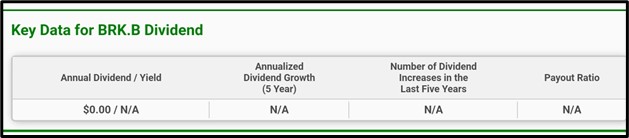

Dividend Information

The stock offers a 3.25% dividend yield, with an annual payout of $3.80, distributed quarterly. With a payout ratio of 46.57%, it boasts 43 years of consistent dividend growth at a rate of 4.16%. The stock’s ex-dividend date was May 14, 2024, and it also provides a buyback yield of 2.53%, leading to a total shareholder yield of 5.73%.

Recent Development At Exxon Mobil

Here are some of the latest updates from ExxonMobil:

ExxonMobil inks a carbon capture contract with CF Industries in Mississippi.

ExxonMobil and EV battery manufacturer SK On draft MOU on U.S.-made Mobil™ Lithium.

ExxonMobil partners with Air Liquide on a global leader low-carbon hydrogen initiative.

Maria Jelescu Dreyfus appointed to ExxonMobil’s Board of Directors.

ExxonMobil finalizes acquisition of Pioneer Natural Resources

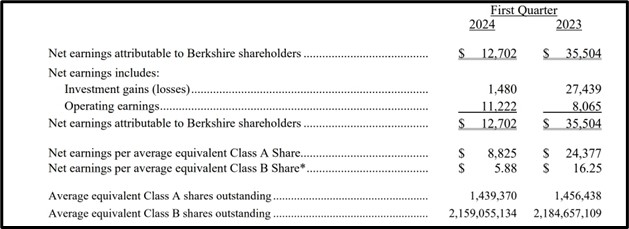

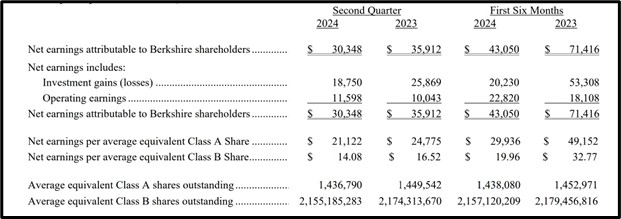

Q1 Earnings Report Recap

Strong Earnings & Cash Flow: Q1 earnings came in at $8.2 billion, down from $11.4 billion YoY, while cash flow from operations surged to $14.7 billion, indicating robust liquidity.

Cost Management & Efficiency: Achieved cumulative structural cost savings of $10.1 billion since 2019, with an additional $0.4 billion in Q1, highlighting effective expense control.

Shareholder Returns: Distributed $6.8 billion to shareholders, including $3.8 billion in dividends and $3.0 billion in share repurchases, with plans to ramp up buybacks to $20 billion annually post-transaction closure.

Capital Structure & Investments: Maintained a conservative debt-to-capital ratio of 16% and a net-debt-to-capital ratio of 3%, while aligning capital expenditures at $5.8 billion with full-year guidance.

“Our strategy and focus on execution excellence is creating significant value for society and our shareholders,” said Darren Woods, chairman and chief executive officer.

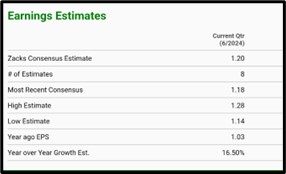

Q2 Earnings Report Analyst Forecast

For the current quarter, sales estimates range from $88.01B to $92.44B, with the Zacks Consensus Estimate at $90.38B, reflecting a projected YoY growth of 9%. Earnings per share (EPS) estimates vary between $1.93 and $2.21, with the consensus at $2.04, suggesting a 5.15% increase from the previous year’s $1.94. The consensus has recently edged down to $2.00, indicating a slight adjustment in expectations.

According to investing.com, Exxon Mobil Corporation (NYSE: XOM) projects an EPS of $2.03 and anticipates revenue of $90.46 billion.

Tradingview.com reports that Exxon Mobil Corporation (NYSE: XOM) is forecasting an EPS of $2.02 and revenue of $90.09 billion.

Tradingview.com reports that Exxon Mobil Corporation (NYSE: XOM) is forecasting an EPS of $2.02 and revenue of $90.09 billion.

Technical Analysis  Downtrend Rejection: Exxon Mobil (NYSE: XOM) shows a downtrendline rejection at $119.31 on the 1-hour chart.

Downtrend Rejection: Exxon Mobil (NYSE: XOM) shows a downtrendline rejection at $119.31 on the 1-hour chart.

Bearish Scenario: If rejection holds, the price may decline to $114.25 and $110.27.

Bullish Scenario: If rejection fails, the price could rise to $125.75 and $133.93.

Apply Risk Management

Conclusion

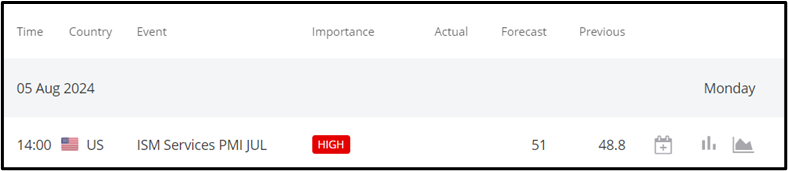

Exxon Mobil Corporation (NYSE: XOM) has demonstrated strong financial performance in Q1 2024, with robust earnings and cash flow despite a decrease from the previous year. The company’s disciplined cost management and substantial shareholder returns underscore its effective strategy. Looking ahead, Q2 forecasts predict a slight increase in EPS and sales, though recent estimates show some downward adjustment. Technical analysis suggests potential price movements depending on trendline rejections. With consistent dividend growth and strategic initiatives, Exxon Mobil is well-positioned for continued performance, but market conditions and technical signals will be key to future direction.

Source

https://investor.exxonmobil.com/news-events/ir-calendar/detail/20240802-2q-2024-earnings-call

https://stockanalysis.com/stocks/xom/dividend/

https://corporate.exxonmobil.com/news/news-releases/2024/0625_exxonmobil-sk-lithium-supply-agreement

https://images.app.goo.gl/5wxkVvwYtSWXfaKe7

https://www.zacks.com/stock/quote/XOM/detailed-earning-estimates

https://www.investing.com/equities/exxon-mobil-earnings