PREVIOUS TRADING DAY EVENTS –06 Nov 2023

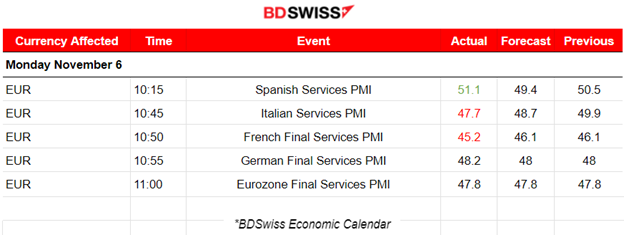

“Final PMIs released today confirmed the preliminary estimates and are consistent with our forecast that euro-zone GDP will contract again in Q4,” said Adrian Prettejohn at Capital Economics. “The outlook also looks very weak, with the new orders PMI falling to its lowest level since September 2012, excluding the early pandemic months, while exports were also particularly weak.”

Services activity in Germany, Europe’s largest economy, slipped back into contraction in October, while in France it shrank again. Italian services activity contracted for a third month running and at its fastest pace in a year.

______________________________________________________________________

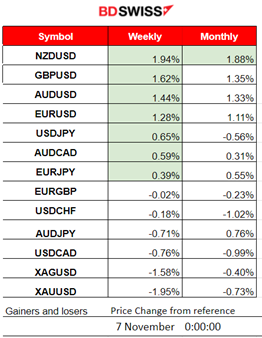

Winners and Losers

News Reports Monitor – Previous Trading Day (06 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

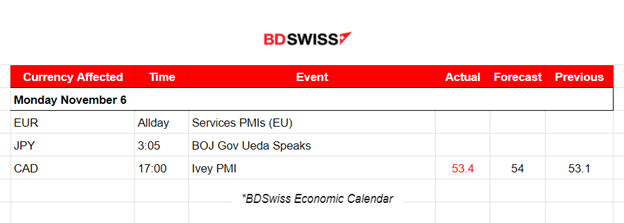

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

PMI releases for the services sector in the Eurozone:

Spain PMI

The services sector is actually doing better in Spain with PMI reported in the expansion area and the figure is higher than the previous. The services economy expanded for a second successive month. Higher activity was attributed due to more hiring, amid some positivity about the future.

Italy PMI

A worse figure for Italy’s services sector in October. The PMI was reported to be 47.7 in contraction and lower than the previous figure. Both activity and new orders fell at their quickest rates in a year. Firms are facing uncertainty due to geopolitical events and faced a marked contraction in sales to non-domestic markets.

France PMI

French business activity across the service sector fell at a strong pace at the start of the fourth quarter. PMI was reported lower at the devastating figure of 45.2 points. A further marked reduction in demand for services from customers both domestically and internationally was a key factor that contributed to this contraction state.

Germany PMI

Germany’s PMI was reported at 48.2 points confirming contraction amid persistent weakness in demand. The labour market is stable with employment decreasing just fractionally. Firms’ expectations towards future activity remained subdued but confidence levels improved.

Eurozone PMI

The eurozone economy continued with contraction extending the current period of decline seen so far in the second half of 2023. In fact, the rate of decrease in business activity accelerated since September. The key factor is the weak level of demand for services. The PMI survey reported the same figure at 47.8.

General Verdict:

____________________________________________________________________

____________________________________________________________________

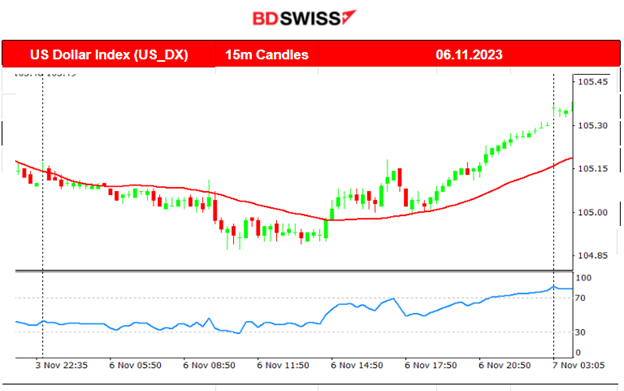

FOREX MARKETS MONITOR

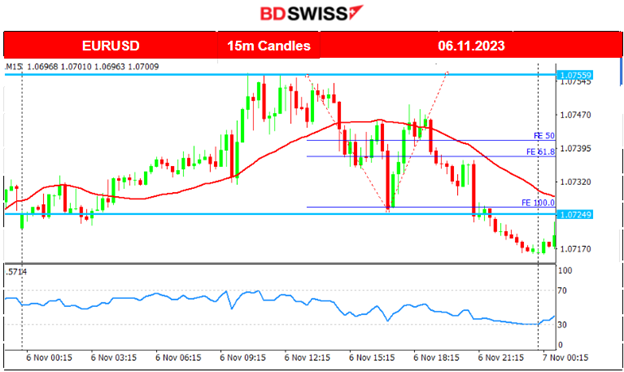

EURUSD (06.11.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced low volatility during the trading day. Monday mood. After the European session started it moved to the upside and then reversed to the downside quickly. The PMI releases have affected the FX market and EUR pairs increasing volatility. However, it is the dollar’s intraday appreciation that eventually caused the pair to close lower for the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

At the beginning of the month, 1st Nov, Bitcoin broke the resistance of 35000 and moved further to the upside while the USD depreciated heavily due to the Fed’s decision to keep rates unchanged. On its way up it found strong resistance again at near 36000 before it retraced back to the 61.8% of the rapid move upwards. It continued with low volatility remaining in the range of 36000 resistance and 34000 support. The employment data releases for the U.S. have not really affected the sideways path of the crypto even though the USD is depreciating heavily against major currencies. The market now tests the near 35400 resistance. If it breaks, it might see the next resistance at 36000 quite suddenly.

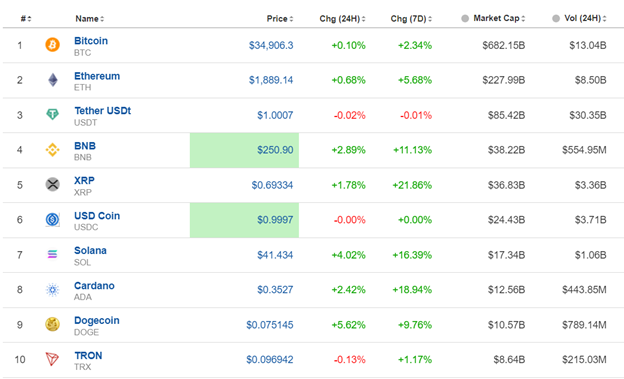

Crypto sorted by Highest Market Cap:

Cryptos are moving steadily to the upside but not significantly. In the last 24 hours, we had no major moves, however, there are some good gains for Dogecoin and Solana with 5.63% and 4% respectively. XRP is the top gainer for the last 7 days with 21.86% gains so far.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

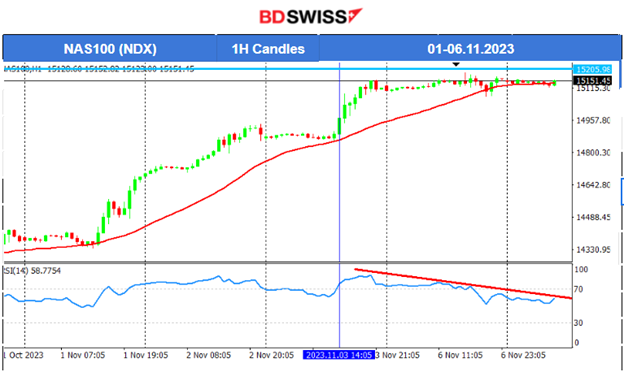

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After the Fed news and the FOMC statement release, the U.S. indices experienced an upward movement. In fact, the Index experienced a strong reversal after a long period of several drops recently. This upward path now, though, is quite unusual, rapid and strong. The weak NFP report and Unemployment rate have pushed the index higher after the news revealed that the labour market cooled significantly and that the effects of elevated interest rates are pretty strong. The chance of further hikes is somehow eliminated, the dollar lost strength significantly and stocks are picked up again as risk-on sentiment looks more positive. Currently, early this week we see some slowdown regarding the upside. The RSI signals bearish divergence and the Fibo tool signals retracement back to the 61.8% level. We have to wait a little bit more for more evidence that indeed the retracement will take place. After some support breaks.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil experienced extreme volatility lately as the fundamentals are causing it to deviate greatly from the mean, sometimes upwards and sometimes downwards. There are forces in place that are offsetting each other, one on the supply side and the other on production. The employment data for the U.S. had an effect on Friday causing the price to drop heavily with Crude testing the 80 USD/b level again. It remained on that level for a while which proved to be strong again and eventually retraced back to the mean soon after. Today there was a break to the downside as the price passed that support and moved lower rapidly. The next support might be at near 78 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold jumped during the NFP report and immediately reversed to the downside with mean reversal. During the jump it reached the resistance at near 2004 UD/oz, however, it reversed lower and remained on the downside. On the 6th Nov, it actually moved steadily further to the downside as the USD started to gain strength again. Today it is currently moving lower after breaking important support near 1970 USD/oz and going towards the 1960 USD/oz support level.

______________________________________________________________

______________________________________________________________

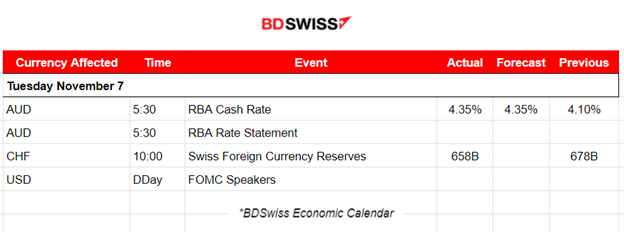

News Reports Monitor – Today Trading Day (07 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Reserve Bank of Australia (RBA) has hiked its cash rate from 4.10% to 4.35%, as expected. Inflation expectations are still running higher than 5%, probably closer to 6%. The new higher 4.35% rate will be at a level that is far lower than most similar central banks have. The market reacted with AUD depreciation causing a near 30 pips drop in AUDUSD at the time of the release with AUD pairs moving lower and lower by the minute soon after.

- Morning–Day Session (European and N. American Session)

No major releases, no major news announcements.

General Verdict:

______________________________________________________________