Previous Trading Day’s Events (22 Feb 2024)

Retail sales grew by 0.9% in December from November, more than a forecast for a 0.8% gain, from a flat reading in November, which was upwardly revised from -0.2% previously

“We continue to expect the Canadian economy to slow in the first half of this year as more households feel the impact of higher interest rates,” said Tiago Figueiredo, an economist with Desjardins Group, in a note.

______________________________________________________________________

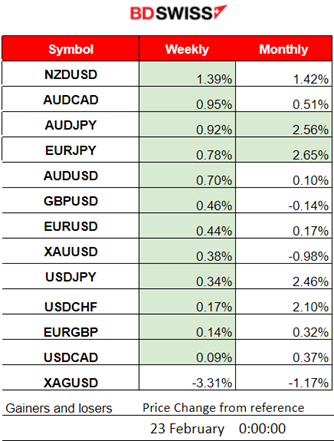

Winners vs Losers

NZDUSD is leading with 1.39% gains for the week so far. The month’s highest gainer is EURJPY followed by AUDJPY with 2.65% and 2.56% gains respectively.

_____________________________________________________________________

_____________________________________________________________________

News Reports Monitor – Previous Trading Day (22 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No significant announcements, no special scheduled releases. The day before, on the 21st Feb, after 22:00 the U.S. indices surged. The S&P 500 registered an all-time closing high on the 22nd Feb due to strong earnings (Check Nvidia case) and a blowout January employment report.

- Morning – Day Session (European and N. American Session)

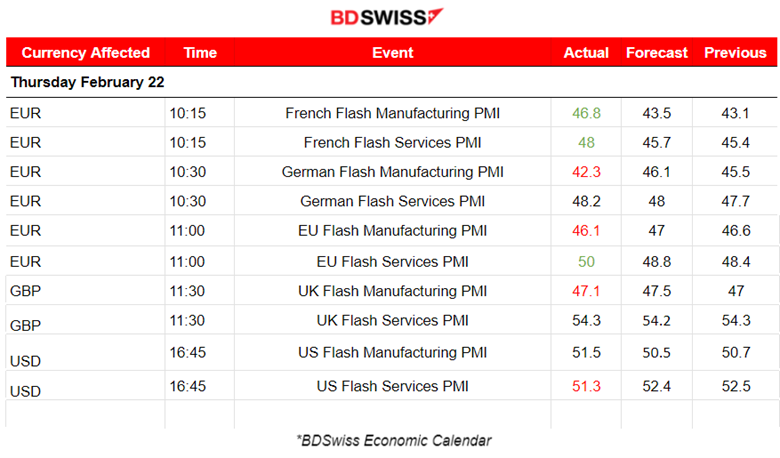

PMI releases:

Eurozone PMIs:

The French economy in contraction with PMis improving. The downturn weakens noticeably. The private sector output levels fell at the weakest pace in the current nine-month period of decline. New orders fell at the softest rate since last May and employment rose for the first time since October 2023. Business confidence strengthened to a seven-month high.

The German economy is worsening. PMIs in contraction with the manufacturing sector suffering the most, a 42.3 points figure. A further drop in business activity across the eurozone’s largest economy, a slightly faster contraction led by a sharp and accelerated reduction in manufacturing output. Demand for goods and services continued to weaken, although employment held broadly steady.

The Eurozone PMIs show that it is the services sector that sees improvement. The reported services PMI figure was exactly 50 points, right on the threshold. The Eurozone downturn eased as output stabilisation in the service sector offset a further steep downturn in manufacturing. Business confidence about the year ahead improved.

United Kingdom PMIs:

In the U.K. the services sector is strong with business expanding at a steady pace as per the PMI figure of 54.3. This solid rate of service sector growth helps to boost U.K. private sector output. A solid improvement in customer demand and a sharp rise in new work.

United States PMIs

The U.S. manufacturing business expands at its fastest pace since 2022 according to the latest reports. It currently experienced stronger orders growth, orders climbed to the highest since May 2022. Factory output expanded the most in 10 months. Both the manufacturing and the services PMIs record figures over 50, showing expansion and leading in overall business performance compared with the other regions.

At 15:30, Canada’s monthly Retail Sales reports showed that the Core figure was lower than expected but still in growth by 0.6%. The non-core Retail Sales figure also recorded growth of 0.9%. There was no major impact on the market at the time of the release.

Unemployment Claims for the U.S. were reported lower than expected. These claims dropped 12K to 201K in February, staying close to the mark of 200K and signalling that the U.S. labour market is still going strong. This contributed to the dollar seeing some more appreciation against other currencies during the N.American session.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (22.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved to the upside during the Asian session following the dollar’s strong depreciation during that period. The dollar had been affected by the FOMC report and the strong earnings reports for Nvidia. Near the start of the European session, the pair reversed to the downside heavily as the USD experienced appreciation, crossing the 30-period MA on its way down and reaching the support near 1.08020. It later retraced to the mean closing the trading day almost flat.

EURGBP (22.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving with low volatility and around the mean until the start of the European session and the PMI releases. At the time of the release of the improving PMI figures the EURGBP experienced moderate shocks bringing the pair more to the downside. At the time of the U.K. PMI figure releases the GBP depreciated heavily causing the pair to reverse and cross the MA on its way up. It reached the resistance 0.85700 before eventually reversing again back to the downside and closing the trading day lower.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 19th Feb, Bitcoin broke the wedge and moved rapidly to the downside, under the 30-period MA, confirming the bearish signals from the RSI (lower highs). On the 20th Feb, Bitcoin experienced a shock during the trading day causing it to jump to the resistance near 53,000 USD, before reversing quickly to the MA crossing it on the way down and finding support near 50,750 USD. It soon retraced to the MA settling close to 51,900 USD. On the 21st Feb, Bitcoin saw a big drop and after testing the support near 50,700 USD multiple times, it reversed to the 30-period MA. Today It seems to continue to test the lows and especially the support near 50,700 USD which signals a strong pressure for going to the downside currently.

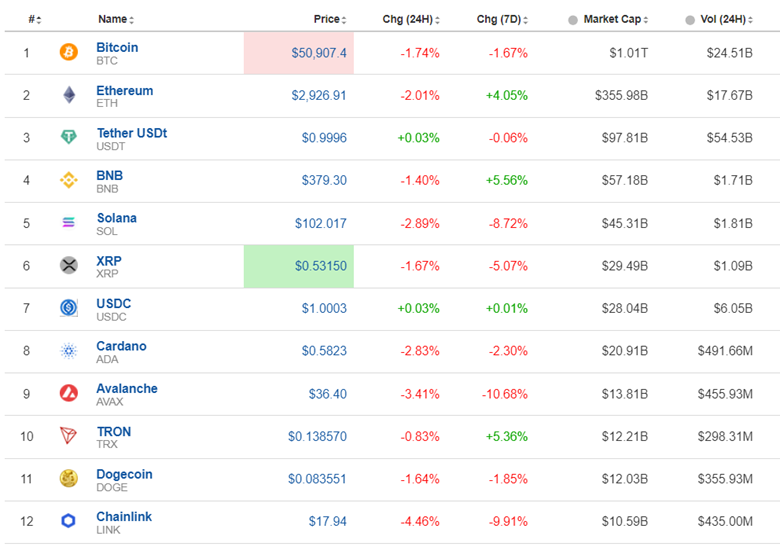

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

A short-term downturn for the Crypto market continues. Crypto performance drops and momentum to the downside is clear. This might change soon though if another fundamental factor jumps in changing the game pushing investors to invest more, especially in ETFs.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

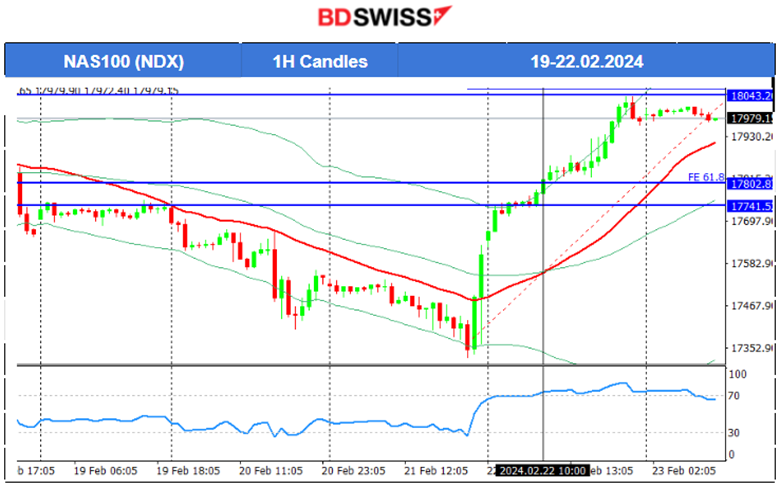

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 19th Feb, the market remained sideways experiencing very low volatility due to the closed stock exchange. However, the next day the market opened with a downward path breaking important support levels. A clear downtrend for now as the index remains below the 30-period MA. Global stocks rallied and after 22:00 yesterday, all U.S. indices are still experiencing a big jump to the upside. The tech-heavy Nasdaq 100 index jumped 1.8% The boss of Nvidia said artificial intelligence (AI) is at a “tipping point” as it announced record sales. It reported that revenues surged by 265% in the three months to 28 January, compared to a year earlier. Eyes are on the U.S. indices. Will volatility be enough today to bring the indices back to the moving average? Short positions before the weekend are quite possible. If this is the end of the upward and rapid movement for NAS100, we use the Fibo retracement levels to find the 61.8% that the market potentially will retrace to, as indicated by the arrow, that level is near 17800 USD. The unlikely scenario is that the surge continues to the upside breaking the resistance at near 18K.

TradingView Analysis:

https://www.tradingview.com/chart/NAS100/CmDSTZHY-NAS100-Shock-Retreat-23-02-2024/

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

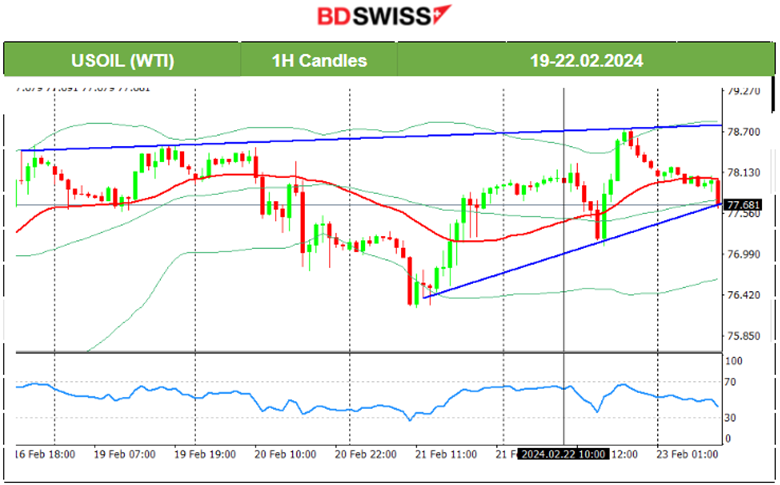

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 16th Feb, the price moved to the upside reaching the resistance at 78.50 USD/b. Crude oil formed a triangle formation and a triangle breakout to the downside took place on the 20th Feb causing a huge drop. On the 21st the price continued with the drop but stopped when it reached the support near the 76.20 USD/b level. It soon reversed to the upside heavily, crossing the 30-period MA on its way up and reaching above 78 USD/b. The 22nd Feb was quite volatile. The price reached the resistance near 78.7 USD/b before reversing fully to the downside.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Since the 15th Feb, Gold’s price is correcting from the drop caused by the recent U.S. inflation report. On the 16th Feb, the price dropped after the PPI news and USD appreciation, reaching support at near 1995 USD/oz before reversing to the upside. The USD currently experiences weakness and is one major factor that pushes Gold’s price more to the upside. The bearish signals (RSI lower highs) in place were indicating a drop. The divergence eventually led to a drop back to 2020 USD/oz on the 21st Feb as stated in our previous analysis. After the drop, Gold reversed to the upside as the dollar depreciated heavily. On the 22nd, Gold experienced a significant drop, finally settling below the MA signalling finally the end of the uptrend.

______________________________________________________________

______________________________________________________________

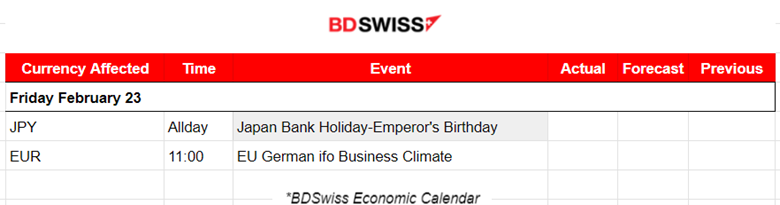

News Reports Monitor – Today Trading Day (23 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

No important announcements, no special scheduled releases.

General Verdict:

______________________________________________________________