Here’s How Spread Widening Affects Your Trades

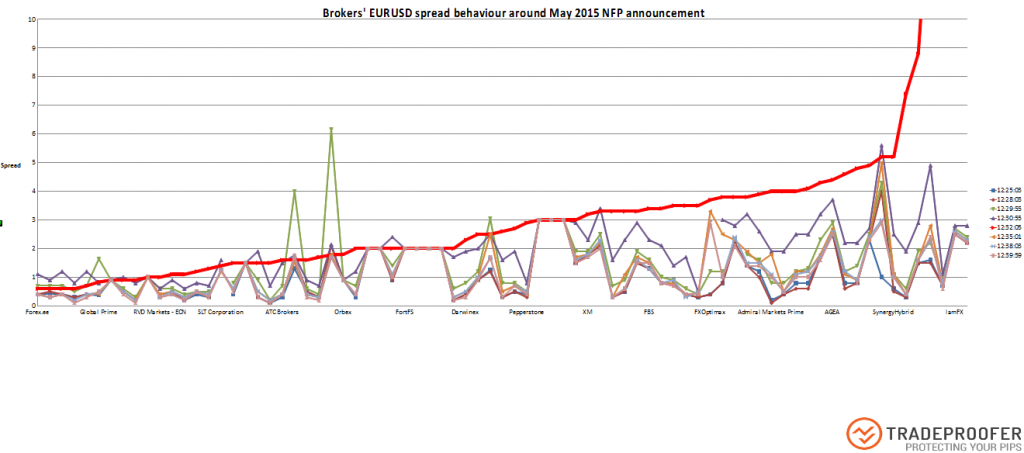

Trading during key market events like the NFP? Spread widening is a key condition to factor in when choosing a broker as it can have a significant impact on your overall profitability and performance.

The Nonfarm Payrolls (NFP) are among the biggest market movers in the Forex markets, which makes the monthly jobs report one of the most closely watched events for forex and CFD traders. The report is used by investors to assess the health of the U.S. economy and can have a massive effect on USD pairs; which is why a great number of traders start preparing for the NFP days in advance, studying all the preliminary figures for clues on how the latest jobs report will fare. If the NFP comes in stronger, this is a good indication that the economy is growing and vice versa.

Why is the NFP so Popular with Forex Traders?

In Forex trading, the level of actual non-farm payroll compared to the estimates is what makes the biggest impact. If the actual NFP data comes in higher than the economists’ forecast, forex traders will usually buy U.S. dollars in anticipation of the currency getting stronger. The opposite is true when the data comes in lower than economists’ expectations. Having a strategy for trading the non-farm payroll report should be in every forex trader’s arsenal, as it is one of the most volatile and potentially lucrative days of the month.

More market movement than usual translates to an opportunity for bigger trades, however, it is important to note that there are a number of parameters that could have a major impact on your profits and losses that go beyond betting on the wrong direction. As BDSwiss’ Leading Analyst and professional trader for more than 15 years, Alexander Douedari notes: “Spread widening during key events and data releases such as the NFP can limit your profits and increase your losses, this is why you need to look carefully into the trading conditions that your broker is offering. Beyond raw spreads, you should look for brokers with less spread widening, faster execution and minimum slippage.”

What is Spread Widening and How Does it Affect Your Profits?

A spread is simply the price difference between where the trader may purchase or sell an underlying CFD asset, this is commonly referred to as the bid and ask price. The difference between the bid and ask is basically what the broker will profit from your trade, regardless of whether your position ends up in profit or loss. You can think of the spread as the trading cost for placing a position, thinner spreads essentially enable you to reduce your trading costs thus making profits larger or losses smaller after you close your positions.

As Alex notes: “During highly volatile events, spreads tend to widen, it becomes, therefore “more expensive” to trade these events, but of course, these events have a higher risk/reward ratio, which is what makes them so popular with forex traders. When spreads widen however, your stop loss can be triggered before prices even begin trending and this can be disastrous for your positions. It is therefore always a good idea to investigate a broker’s spread widening during events of major volatility before attempting to trade with real funds.”

Wider Spreads Equal Larger Costs

A wider spread means larger trading costs, which is why professional traders opt for forex accounts that guarantee fixed or variable raw spreads. Raw spreads usually start from as low as 0 pips and are provided directly from your broker’s liquidity provider. This means that your broker will not be able to manipulate spreads and make them even wider. But even in those scenarios, spreads can differ from broker to broker, depending on their liquidity providers. It is therefore important to choose a broker that offers access to deep liquidity through top tier providers that offer ultra-competitive spreads. This can help reduce your trading costs to a great extent which can translate to bigger profits and fewer losses. Of course, a competitive quote is not the only thing that guarantees lower trading costs, other factors such as latency, execution speed and slippage also play in.

More than Just a Raw Account

Finding the right broker to trade with is key to your success as a trader. “The golden combination in forex trading is thin spreads, minimal slippage, instant execution, no commissions and no markups. Very few brokers in the industry offer such trading conditions, which is what makes BDSwiss one of the most advantageous brokers to trade with,” notes Alex.

With more than 1 million registered clients worldwide, leading forex and CFD financial institution BDSwiss offers its clients ultra-competitive trading conditions including deep institutional liquidity for low spread widening during high volatility, zero markups, zero commissions and a whopping 10 milliseconds execution speed. Specifically, BDSwiss’ revolutionary raw spreads account offers spread trading from 0 pips on all forex and gold pairs for a small monthly subscription fee, enabling all traders no matter their account size to benefit from institutional trading conditions and lower their trading costs. This volume-based account plan starts from just €1 per month and will even upgrade automatically once the trading volume limit is exceeded.

Learn more about BDSwiss’ Trading Account Types here