Rates as of 05:00 GMT

Market Recap

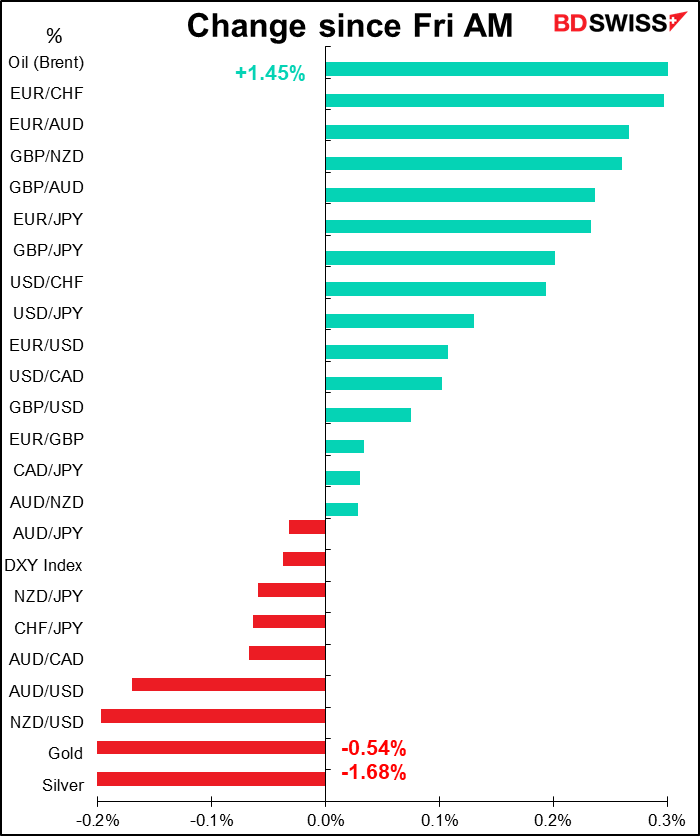

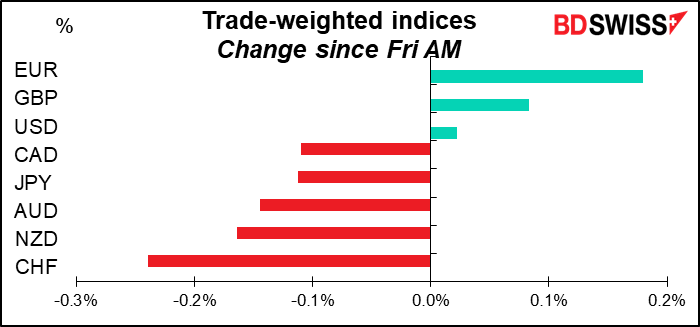

My usual rule is not to bother talking about currencies that move less than ±0.2% because that’s just “Brownian motion” for currencies – the usual ebb-and-flow of demand. However that would leave me with nothing to talk about today and we can’t have that, can we?

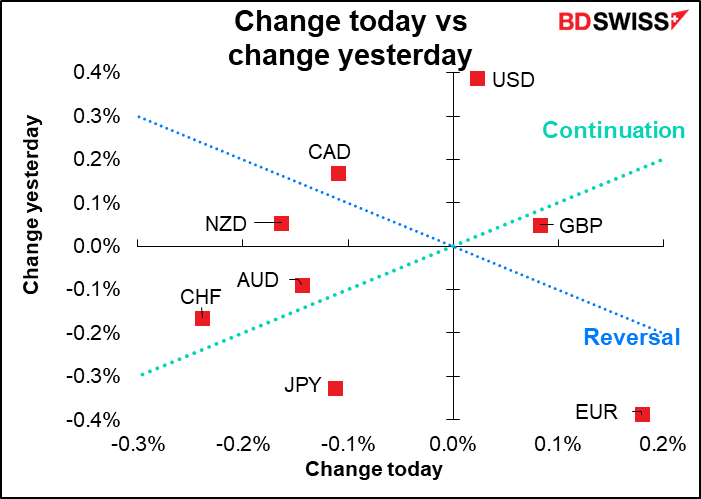

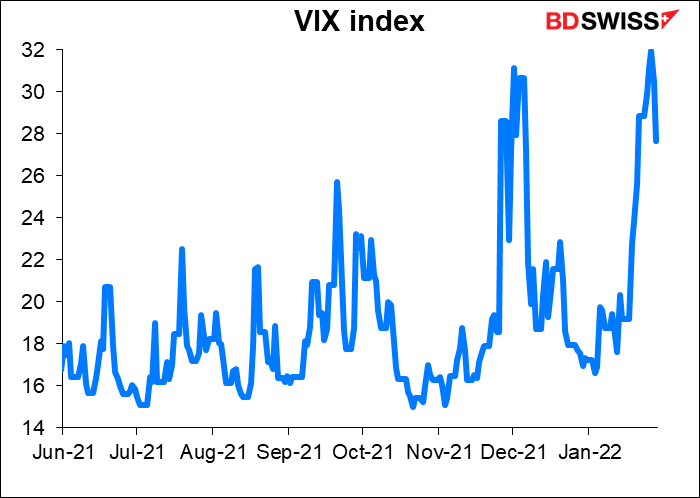

The curious thing today for me is why did the commodity currencies perform so badly when stock markets finally stabilized? There were amazing last-minute rallies on Wall Street Friday, with the S&P 500 and NASDAQ both climbing around 2% in the last 90 minutes of trade to close up 2.4% and 3.1% respectively. After all the Sturm und Drang of last week, when it looked like a market collapse was imminent, at the close Friday the S&P had gained +0.8% on the week and the NASDAQ a tiny +0.01%, while the VIX index, Wall Street’s “fear gauge,” ended the week lower (27.66 vs 28.85 a week earlier).

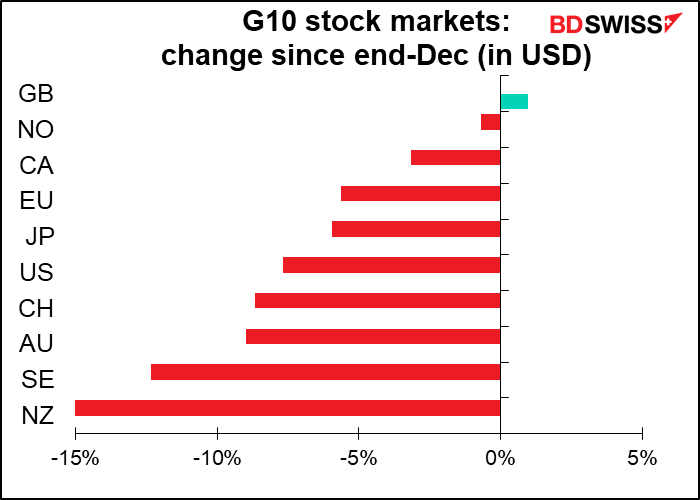

It could be end-month rebalancing, but that doesn’t make much sense either. NZ and Australia were two of the worst-performing stock markets in January. That means investors should be selling other markets (UK, Canada) and buying NZ and AU to rebalance their portfolios.

And it’s not due to the weaker-than-expected Caixin China manufacturing purchasing managers’ index (PMI) out Sunday (49.1 vs 50.0 expected, 50.9 previous), as both currencies have on the contrary been recovering this morning. (The official PMIs were both 0.1 point better than expected, which is hardly significant.)

EUR was the best-performing currency and CHF the worst, although neither move was particularly dramatic. Over the last week EUR/CHF was up about 0.5% last week. Was the Swiss National Bank in supporting the pair? We’ll know more about that later today.

Italian election – a lot of work for nothing

After all I wrote about the Italian election, it turns out that the previous President, Sergio Mattarella, who declined to run again, was somehow re-elected. This leaves PM Draghi as PM still. In other words, no change. Ok well know I know more about how the President of Italy is elected. I hope I remember it in seven year’s time when the subject comes up again.

Commitments of Traders Report

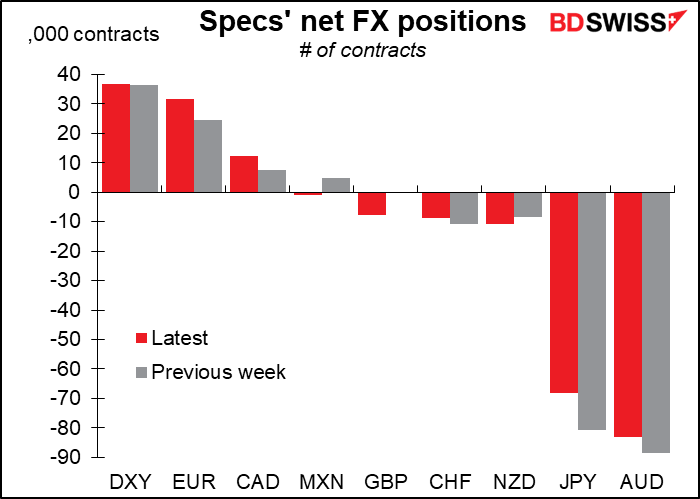

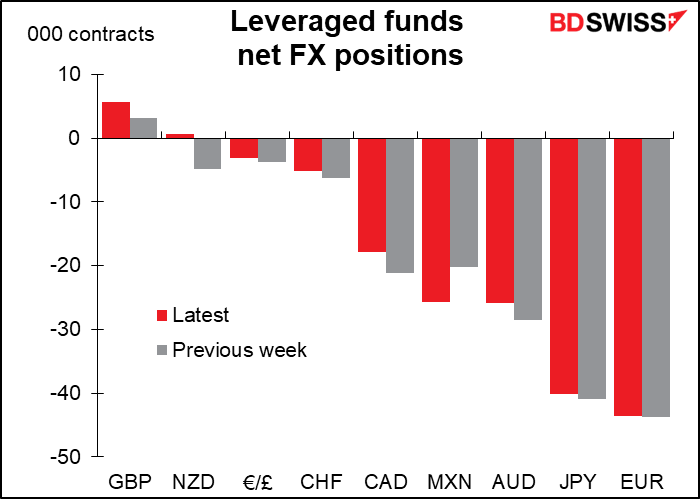

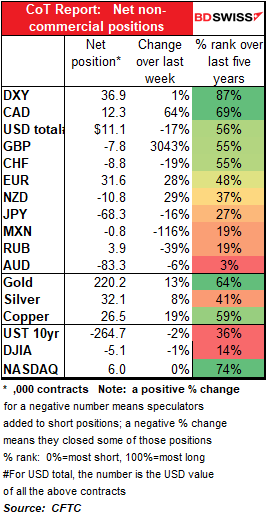

Specs reduced their long USD position last week ahead of the FOMC meeting – big mistake! In USD terms, the biggest change was trimming short JPY positions, then adding to EUR longs. They also trimmed AUD and CHF shorts and added to CAD longs slightly. On the other hand they increased their GBP shorts a bit and flipped to short MXN.

Hedge funds made mostly minor adjustments. They increased their GBP longs and MXN shorts while trimming their CAD and CHF shorts.

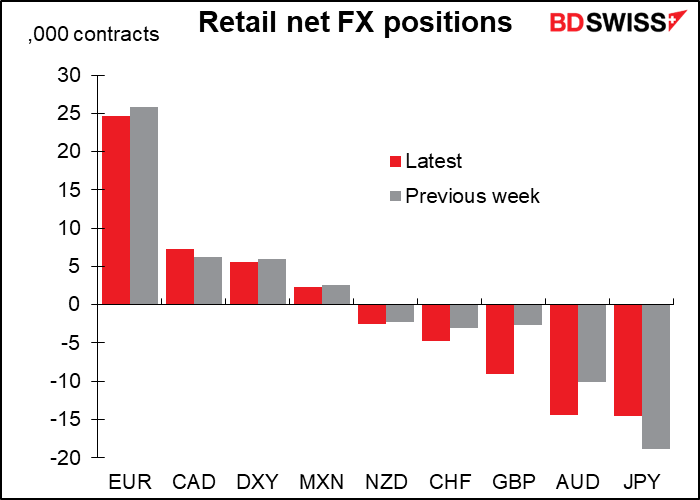

Retail increased their GBP shorts dramatically – have they been reading my comments? They also increased their AUD and CHF shorts. But they trimmed their EUR longs and JPY shorts.

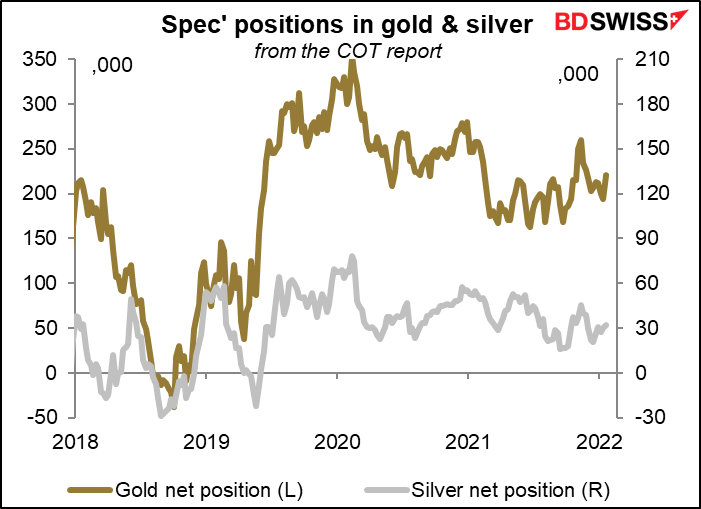

Precious metals: Specs increased both gold and silver longs.

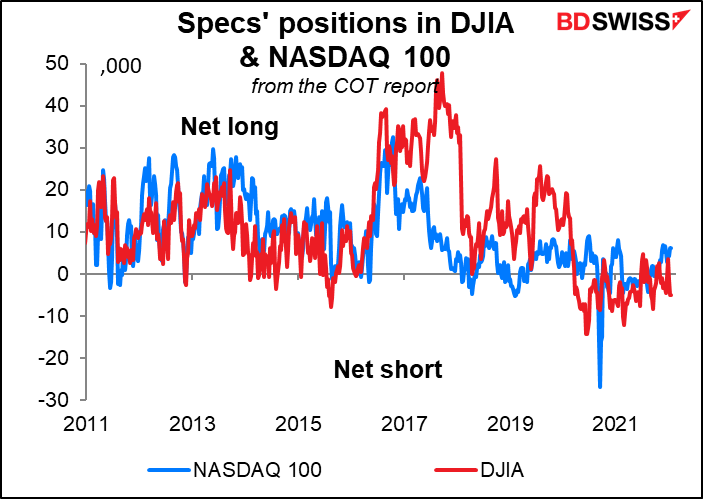

As for stocks, speculators are slightly short the DJIA but slightly long the NASDAQ. Nothing major with either index.

Today’s market

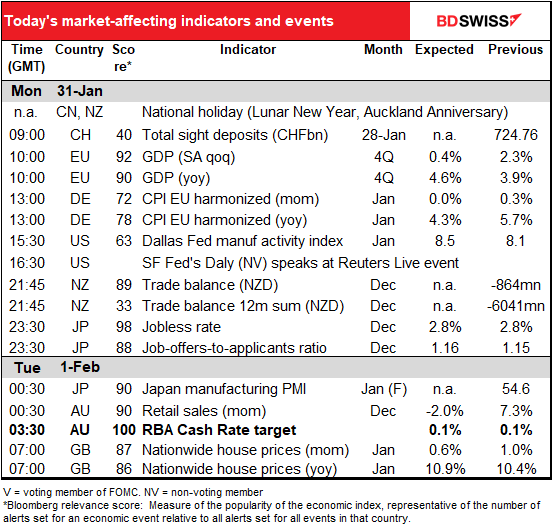

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

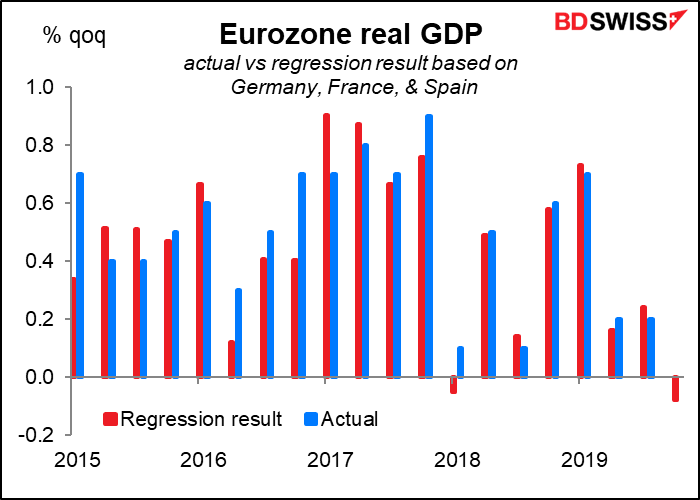

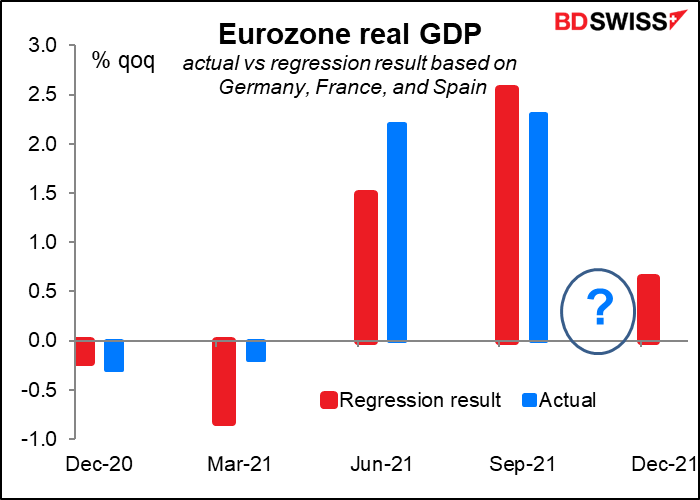

Eurozone GDP is the first item on the schedule for today. But since Germany, France, and Spain were announced on Friday, that gives us a pretty good idea of what the Eurozone-wide figure will be. Using data from 1999 to 2019, those three countries can predict the Eurozone-wide figure with a 96% accuracy. That gives me a forecast of +0.6% qoq for today’s figure, vs the market consensus of +0.4%. Of course my analysis is based on pre-pandemic relationships, which may well have changed for the time being.

In any event the figure probably won’t be that much of a surprise to most dealing desks, because if I can figure this out, the economists working in their offices certainly can, too.

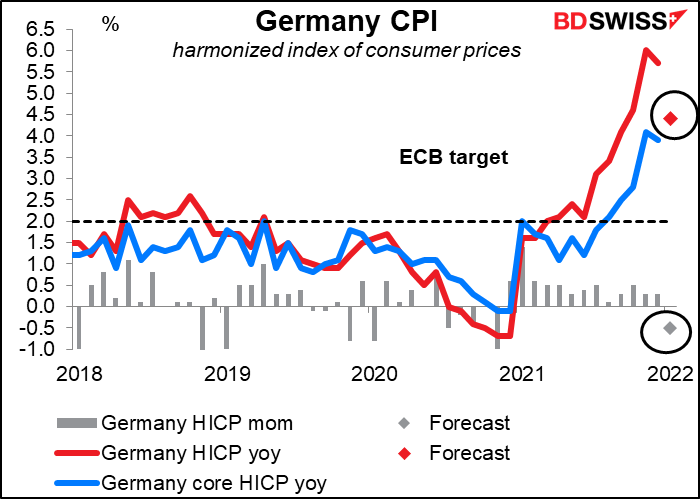

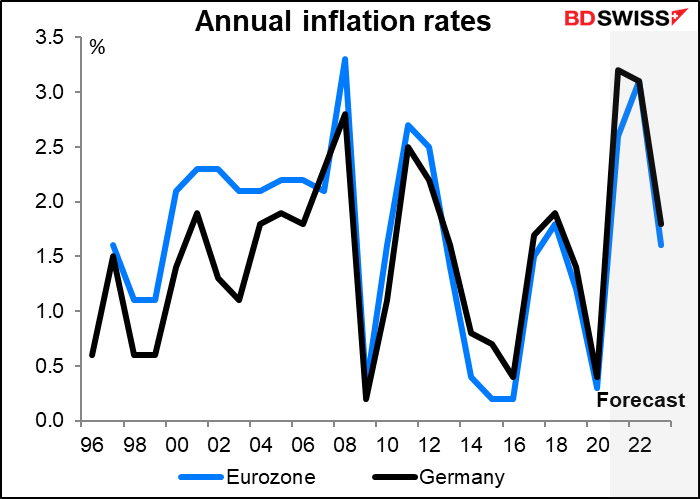

Next up is the German harmonized index of consumer prices (HICP), the EU-wide measure of inflation. (Many countries also have their own domestic versions of the CPI, but they report on a harmonized basis as well.) It’s expected to fall sharply as a result of the impact of the cut – and then reimposition – of VAT now dropping out of the calculation and receeding base effects for energy.

In any case, the inflation rate for the whole year is likely to be 3.2% the highest since 1993 and way above what most economists expected at the beginning of the year. (Eurostat data only goes back to 1996.) Some of the factors pushing up prices were well known and expected ahead of time, such as the VAT issue, base effects with energy prices, and introduction of a new carbon levy for fuels), the pandemic certainly caused unexpected problems of its own. In 2020 we were all concentrated on the deflationary impact of the virus – the collapse in demand. But a global fiscal response that was unprecedented in terms of speed & scale led to an unexpected inflationary impact of the virus: with a lot of consumption shifting from services to goods but goods production constrained by the virus, inflation has skyrocketed everywhere. Not to mention higher commodity prices as well.

Then nothing major on during the US day. Watch for SF Fed President Daly’s comments, the first we’ve heard from any members of the rate-setting Federal Open Market Committee (FOMC) since their meeting last week (besides Chair Powell’s press conference, of course.). (She doesn’t vote at the meetings this year, though.)

Overnight, New Zealand releases its trade data. For some reason I covered this last week too even though it didn’t come out. Of course I never make a mistake so my guess is that it got rescheduled and I didn’t notice. This means I can repeat here what I said before with no problem. (Secretly I’m glad I get to use this twice because I did a lot of work to try to figure out what’s been causing imports to rise and I’m glad I get to use it again.)

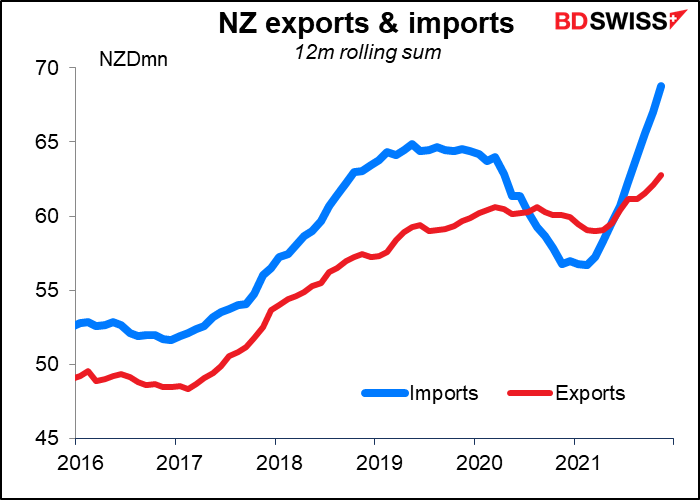

Unfortunately Bloomberg no longer announces a consensus forecast for this, but here’s a graph anyway. The trend is not good.

New Zealand’s exports are increasing, but just not at the same pace as imports. Unfortunately I only have value indices for these two, not volume, so I can’t see whether this is due to the country importing more or to higher prices on what it is importing (as is the case in Japan). Looking at the breakdown of the 21% yoy increase in imports (using a 12m moving sum), vehicles account for 6.5 percentage points (ppt), meaning that NZ too has been caught out by the worldwide increase in auto prices. Mechanical equipment and machinery account for 2.7 ppt, electrical machinery & equipment 1.6 ppt, and iron & steel 1.2 ppt, and pharmaceutical products, 0.7 ppt of the increase. Surprisingly, petroleum products only account for 0.5 ppt and fertilizer 0.4 ppt.

Then we get Japan’s employment data. This has quite a high Bloomberg relevance score even though it only changes at a glacial pace, meaning last month’s figure is as good a guess as any at this month’s. In fact for this month the unemployment rate is expected to be unchanged and the participation rate up 1 tick. This will hardly set the streets of Tokyo on fire.

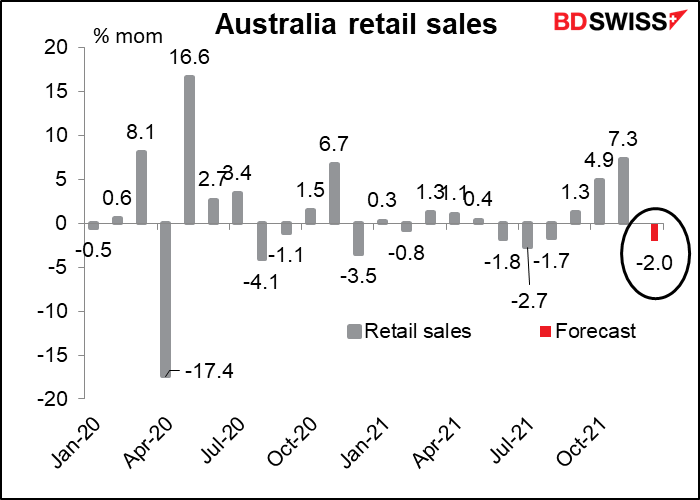

Australian retail sales come out a mere 3 hours before the results of the Reserve Bank of Australia (RBA) meeting are announced. I’m tempted to say that no one will be watching them as a result, but I have seen Australian economic indicators move the market on RBA days. Sales are expected to be down somewhat, but this follows two slam-bang months and so shouldn’t worry anyone. Plus even with this decline they’ll still be some 8.5% above pre-pandemic levels so pretty good. And this is for December, before omicron took over, so not necessarily indicative of what January will be.

That brings us to (trumpet fanfare, please!) the RBA meeting. Of course I discussed this far more than you really are interested in in my Weekly Outlook, so I’ll just repeat the conclusion here and you can click on the link and read the gory details there if you’re interested.

(The basic problem the RBA faces is that inflation is running far above their target. They say they have to wait to see faster growth in wages to make sure that inflation is “sustainably” within their 2%-3% target, but it’s beginning to look like it’s sustainably above their target. So I expect them to give up at this meeting.)

I expect them to announce that they will stop their AUD 4bn-a-week bond purchases, effective mid-February.

I also expect that they will abandon their emphasis on wage growth, which is falling far behind the reality of inflation, and change their forward guidance to allow for the possibility of a rate hike in the not-too-distant future.

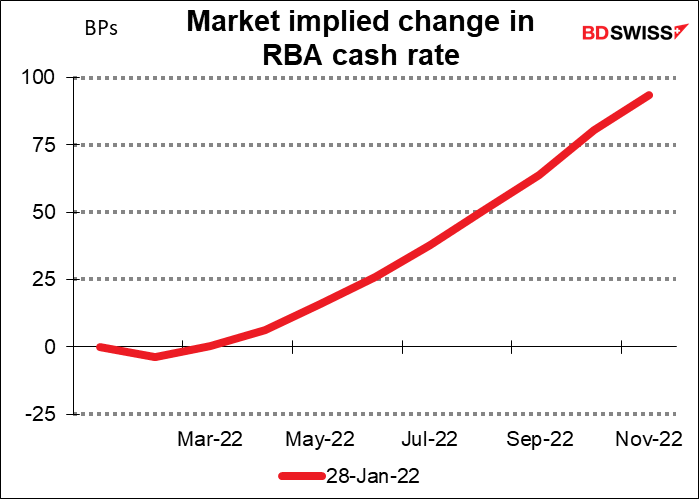

Will that affect AUD? The sad fact is that while the RBA may have no idea when it’s likely to move, the market is already pricing in a rate hike at the June meeting. Australia’s inflation data is only released quarterly – the next one is April 27th, in plenty of time for their May 3rd meeting. It’s conceivable then that they could hike in May — there’s already a 64% chance of a rate hike priced in for that meeting. This week’s meeting could increase that probability, which would probably cause AUD to appreciate.

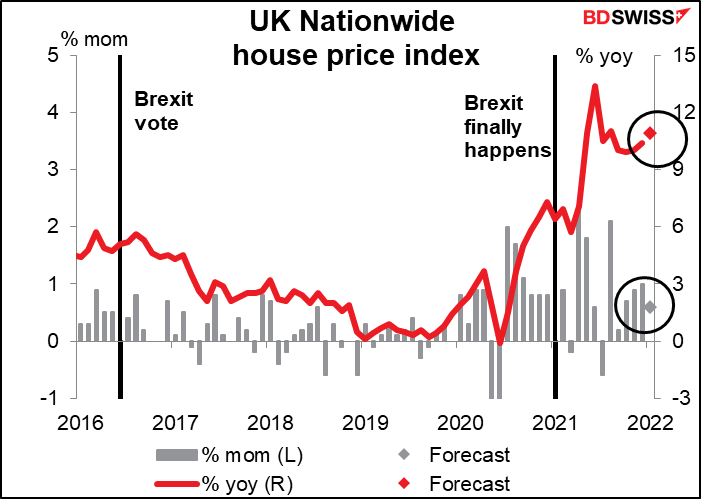

As for the UK Nationwide house price index, it’s expected that house prices in Britain will rise further. If only I had bought the garden flat right below me in Hampstead when I lived there many years ago…