Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

The “risk-on” tone moderated but the EUR continued to climb, breaking through 1.21. The euro gained against most other major currencies, with the exception of CHF and AUD.

Implied volatility for the EUR pairs went shooting up.

This was against the background of waning momentum in global equities as the S&P 500 registered only a modest 0.2% gain and NASDAQ was effectively unchanged – albeit both at or around record levels. Mounting hopes for a fiscal aid package in the US met with continued uncertainty about Brexit, and increasing hopes for a vaccine contrasted with the worsening current situation with the virus, both in the US and Europe. In the US, both hospitalizations and deaths set a new record, while in Europe, Germany announced that it will extend partial lockdown measures for another three weeks and Chancellor Merkel expressed concerns about whether it would be possible to roll out a vaccine completely in Q1 next year.

GBP was the worst-performing currency as the Brexit talks continue to go nowhere while the clock ticks down. EU chief negotiator Barnier reportedly told EU ambassadors that a trade deal is “in the balance.” The problems are the same as always. Bloomberg reported that at the meeting, the French envoy urged Barnier not to make too many concessions simply because time was running out and warned that France could veto the deal if it doesn’t like the terms. Belgium, the Netherlands and Denmark apparently backed France. In other worse, even if Frost and Barnier do reach agreement, there’s no guarantee that the rest of the EU will approve of it. I hope UK PM Johnson decides he needs a smooth transition, otherwise sterling is going to be in serious trouble.

There’s a theory making the rounds that the deadline for negotiations is no deadline at all. The idea is that if the UK crashes out of the EU without an agreement, the economy will suffer so much that the UK side will come back to the negotiating table next year and be willing to accept worse terms than it’s demanding now. I was feeling more confident about the likelihood of an agreement, but if the EU thinks that a “no-deal” Brexit would be in their favor, then that changes the odds.

Oil rose yesterday but is weakening this morning ahead of the resumed OPEC meeting. The cartel meets today with non-OPEC producers in the expanded OPEC+ group. The debate was on whether to increase production as scheduled in January or delay the increase. Now it’s shifted to discussing whether to gradually increase production and if so, at what pace. (Technically they aren’t increasing production, they’re reducing production cuts, so it’s spelled out in terms of tapering off production restraints.) The discussion is whether to start doing so in January or later in the first quarter. This solution is a compromise between those producers who are eager to sell more oil and those who worry about upsetting the fragile supply/demand balance in the market. I think oil could fall further (and CAD weaken) if they do decide to taper down their production cuts instead of extending them, which was the market’s assumption going into the meeting.

Just FYI

I’m told that many Germans are stockpiling cheese and sausages in anticipation of a COVID lockdown — planning, in other words, for a Wurst-Käse scenario.

Today’s market

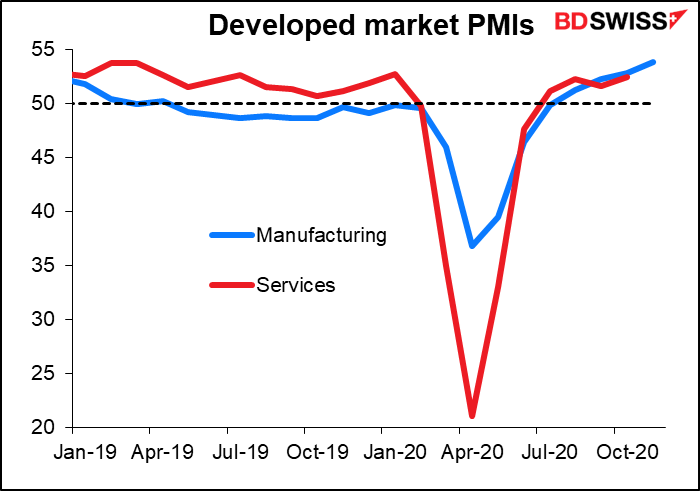

We get the final service-sector purchasing managers’ indices (PMIs) today, plus of course the first-and-only ones from the countries that don’t have preliminary ones, which is the majority. Usually the manufacturing PMIs are the main event and the service-sector ones are just a sideshow, because the manufacturing sector tends to be more cyclical than the service sector – you may wait to buy a new iPad if you’re worried about the future, but you pay for your internet connection before you buy food.

Manufacturing wasn’t anywhere near as deeply hit by the pandemic as services were. On the other hand, the bounce-back has been more or less the same for both, up to now.

Ditto for the advanced industrial countries alone.

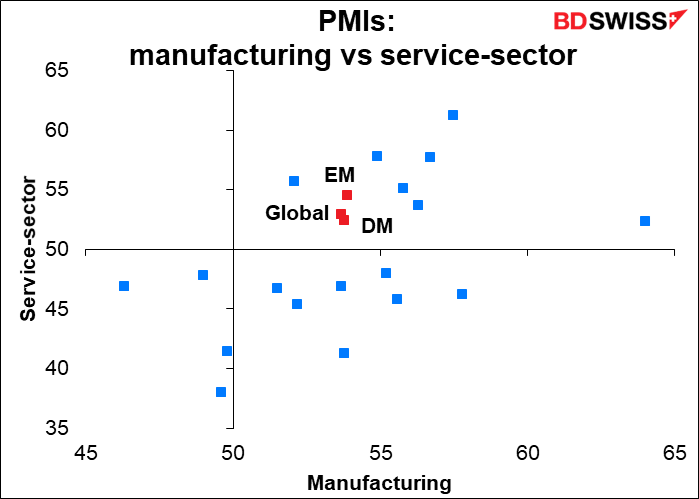

However, that’s probably because the overall index is GDP-weighted. If we just look at the number of countries that are below or above the crucial 50 line, the picture isn’t quite as rosy. Among the major industrial countries, only Switzerland, Australia and the US have service-sector PMIs above 50. The service sectors in major Eurozone countries, Britain and Japan are all still contracting.

Looking at the larger list of countries for which both manufacturing and service-sector PMIs are available, including such major developing nations as China, Brazil, and Russia, there are no countries where the service-sector PMI is above 50 but the manufacturing PMI is not. (This is comparing the November manufacturing PMIs with the October service-sector PMIs for most countries, except those where there is a preliminary service-sector PMI available.)

The early data Wednesday were encouraging. China’s November Caixin services PMI rose to 57.8 from 56.8 (56.4 expected), while Japan’s service-sector PMI was revised up by a surprising 1.1 points to 47.8.

As long as we’re on the subject, let’s skip ahead a bit and talk about the US Institute of Supply Management (ISM) service-sector PMI. It’s expected to fall, as Tuesday’s ISM manufacturing PMI did. But it’s expected to stay far in expansionary territory and not too far off the Markit version of this indicator, so I doubt if it will surprise anyone. Therefore little impact expected.

EU retail sales are not a big market-mover, as you can tell from the modest Bloomberg relevance index. Nonetheless, nowadays people are trying to get a handle on how much people are getting out and about, so I thought I’d include a graph of it today. The small mom rise after a decline in September is not particularly encouraging, but I doubt if it’s enough to derail the trend in the EUR.

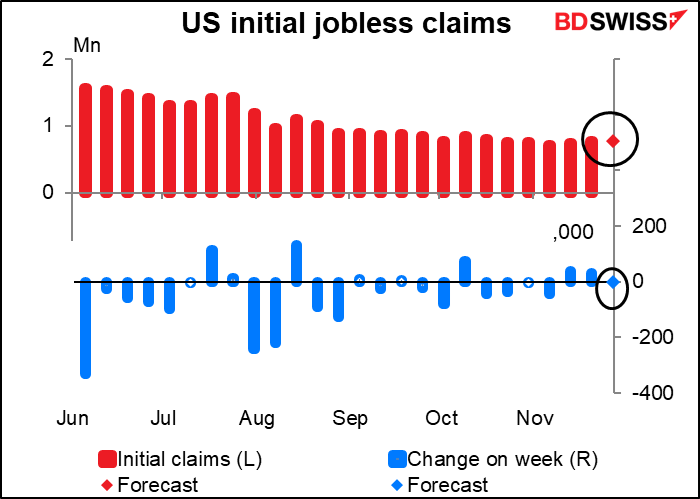

So that brings us to the big indicator of the day: the US jobless claims.

Initial jobless claims are expected to be down a derisory 3k.

Continuing claims are expected to be down 271k, the smallest decline since 11 Sep, when there was no decline at all. It looks like even what meagre improvement in the labor market that we’ve seen is tapering off.

We can expect these figures to turn even worse in the coming weeks. My former colleagues at Deutsche Bank found a fairly robust* correlation between the change in virus cases and the change in initial claims. With several million idiots people traveling home for Thanksgiving, not to mention students returning home as college campuses close for the winter vacation, we can anticipate with dread a pick-up in new cases over the next two or three weeks. That’s worrisome, given the refusal of the Republicans to consider more fiscal support for the economy, including businesses, the unemployed, and indeed even hospitals. The US is headed for disaster.

*in my whole life I’ve only heard the word “robust” used in conversation once, and that was by someone who worked in the financial industry. But we use it all the time.

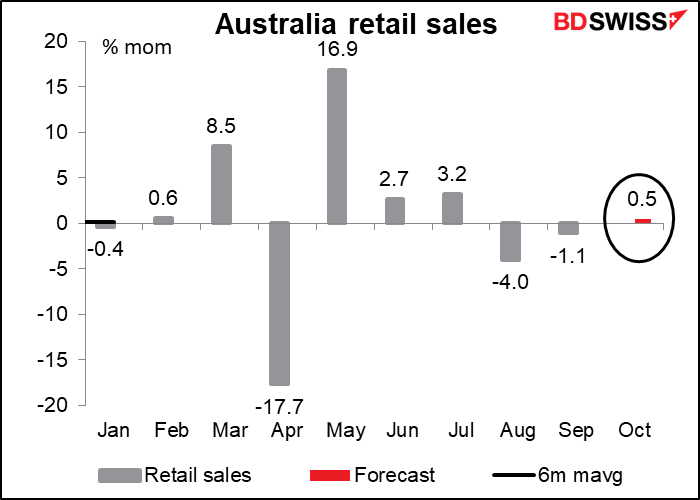

Overnight we get Australian retail sales. Since the Australian Bureau of Statistics (ABS) is releasing a preliminary version of this indicator, I don’t think it’s likely to be very market-moving. The preliminary estimate was for a 1.6% mom rise. That makes me wonder why the consensus market estimate is so far off – I wouldn’t think economists could do any better than the ABS.

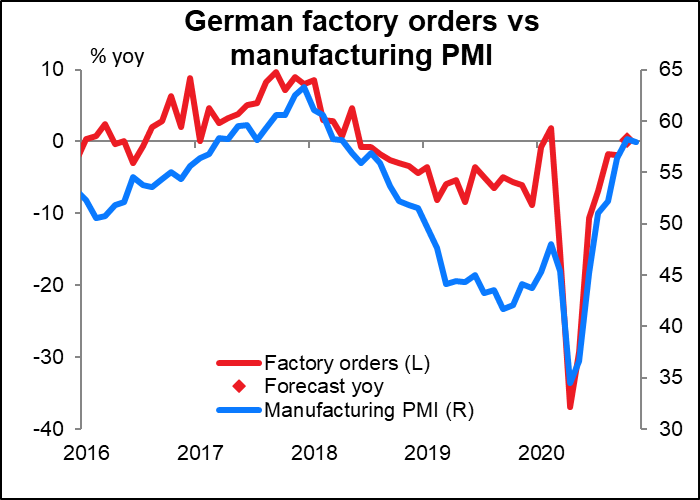

Then Friday morning, while you’re probably debating whether your feet can tolerate the cold floor or should remain within the warm bed, Germany announces its factory orders.

The rise in orders should demonstrate the improving manufacturing cycle as signaled by the manufacturing purchasing managers’ index (PMI) for Germany. Although the index fell slightly in November (to 57.8 from 58.2), it’s still at a relatively high level that indicates continued expansion.