PREVIOUS TRADING DAY EVENTS – 15 June 2023

Announcements:

- New Zealand enters a technical recession. New Zealand’s Gross domestic product (GDP) fell 0.1% in the first quarter, according to government data published on Thursday. It experienced two consecutive quarters of contraction.

The reported figure was in line with market expectations and gave traction to the central bank’s position that no further interest rate hikes would be needed. The data suggest though that employment remains strong in New Zealand.

“It’s clear that the New Zealand economy is losing momentum,” Westpac senior economist Michael Gordon said in a note. “What remains to be seen is whether things have slowed enough to put us on a path back to low and stable inflation.”

Inflation in New Zealand lies at 6.7%, well above the central bank’s target band of 1% to 3%. The cash rate is at 5.5% and the central bank at its last meeting in May said the cash rate had peaked.

“As demand-side pressures on inflation continue to abate, the case for rate cuts will become increasingly compelling,” Capital Economics economist Abhijit Surya said in a note.

Source:

- Labor Market data for Australia released by the Australian Bureau of Statistics yesterday show high employment growth with 75.9K change versus the previous -4K figure, while the unemployment rate was reported 3.6%, down from 3.7%.

This is a strong report for Australia’s labour market that challenges the Central Bank further signalling that more hikes are needed until the market cools down. The Reserve Bank of Australia (RBA) has obviously more work to do even after tightening by 400 basis points to an 11-year high of 4.1%, including a surprise rise earlier this month.

Adam Boyton, head of Australian Economics at ANZ: “While the weakness in Q1 GDP suggests the pace of jobs growth should moderate – and by a lot – over coming months, the general robustness of the labour force survey over 2023 to date is undeniable and suggests some ongoing momentum in the economy,” said Boyton.

RBA Governor Philip Lowe had previously expressed the willingness and determination of the Central Bank to sacrifice jobs to bring inflation back to target by mid-2025.

Source:

- The European Central Bank (ECB) announced yesterday its decision to raise the three key ECB interest rates by 25 basis points. The Main Refinancing Rate (MRR) was raised to 4% as expected. The ECB was closely monitoring inflation data and estimated that it would remain too high for too long. They decided to hike in order to ensure that inflation will return to its 2% medium-term target in a timely manner.

Interest rates increased for the eighth successive time, increasing borrowing costs by a combined 4 percentage points in a year. At 6.1%, inflation is already well below double-digit readings from last autumn and a recession, along with sharply lower commodity prices, will cool price growth quickly over the rest of the year.

“The Governing Council’s future decisions will ensure that the key ECB interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target,” the ECB said after lifting the deposit rate by 25 basis points to a 22-year high of 3.5%.

Policymakers have already considered a July rate hike since they take other essential data into consideration such as the tight Labor market data.

“Staff have revised up their projections for inflation excluding energy and food, especially for this year and next year, owing to past upward surprises and the implications of the robust labour market for the speed of disinflation,” the ECB added.

Source:

- The U.S. data related to Retail sales were released yesterday at 15:30 together with the U.S. unemployment claims figures. Retail sales unexpectedly rose in May, a sign that consumers are still active and contribute significantly to the economy. The advance figure for seasonally adjusted initial claims was 262K unchanged from the previous week’s revised level. The USD was steadily depreciating against other currencies yesterday for a long period of time after the ECB rate announcement and the release of these data.

The Fed left its policy rate unchanged. A decision that took place after taking into consideration the data suggesting inflation weakening but at the same time there is data showing strong labour market conditions. If more data show high demand then the Fed could consider raising interest rates next month, though policymakers have to take June’s employment and inflation reports greatly into consideration.

“The U.S. economy is holding up relatively well through the second quarter despite some softness,” said Robert Kavcic, a senior economist at BMO Capital Markets in Toronto.

“Higher interest rates haven’t tamped down consumer demand enough to meaningfully slow price growth, especially on the services side of the economy,” said Ben Ayers, senior economist at Nationwide in Columbus, Ohio. “These hot trends for consumers could lead to another interest rate hike by the Fed in July.”

“The rise in unemployment claims in the last two weeks, if sustained, would point to a rise in layoffs and a slowing in job growth but, at this point, fall short of signalling a yellow alert on the expansion of jobs,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York.

Source:

______________________________________________________________________

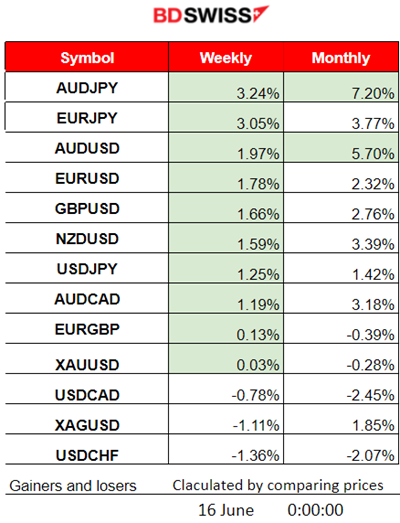

Summary Daily Moves – Winners vs Losers (15 June 2023)

- The AUDJPY is not the top for this week with a 3.24% price change and has also conquered the top of the monthly winners’ list with 7.20% gains so far.

- AUDUSD is following with 5.7% monthly gains.

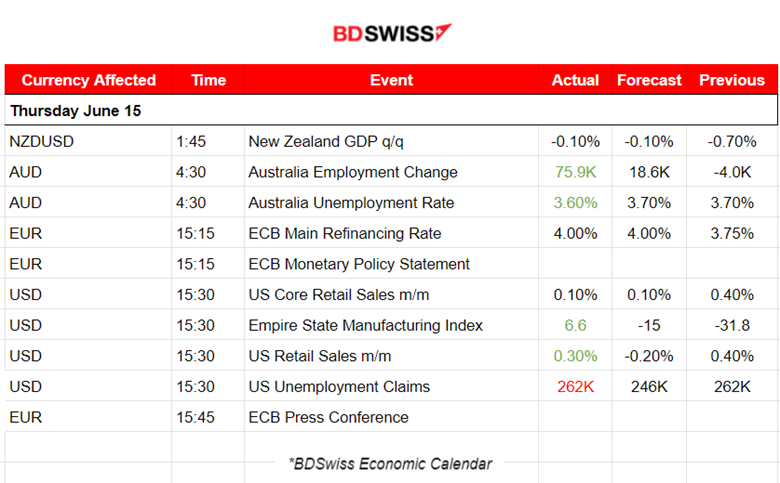

News Reports Monitor – Previous Trading Day (15 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The quarterly figure for New Zealand’s GDP is already out. Less negative change. The report came after the previously revised 0.7% decline in the final quarter of 2022. This shows that NZ experiences a Technical Recession, defined as two consecutive quarters of contraction. The NZD depreciated at the time of the release bringing NZDUSD down more than 20 pips.

Australia’s Labor Market Data was released at 4:30. The Employment change figure was reported high at 75.9K versus the previous -4.0K figure. The unemployment rate was reported lower. The market reacted with AUD appreciation. AUDJPY has moved upwards by more than 100 pips since the release.

- Morning – Day Session (European)

At 15:15 the ECB decided to increase the Main Refinancing Rate to the expected level, of 4%. The EUR appreciated against the dollar. The DXY depreciated heavily against major pairs. A near 125 pips overall upward movement for EURUSD since the figure release.

At 15:30 U.S related figures were released. The Core U.S. Retail Sales figure showed a lower increase, 0.10% against the previous 0.4% while in general, Retail Sales were reported higher than expected. The Unemployment claims were reported at 262K continuing to signal labour market cooling. At that time there was not much of an impact on the USD since the market reacted to the ECB decision 15 minutes earlier. However, the USD continued to weaken steadily until the end of the trading day.

General Verdict:

- High movement during the ECB rate decision at 15:15. USD and EUR were affected greatly.

- EUR appreciation and USD depreciation caused the pair to climb significantly higher.

- Metals and U.S. benchmark indices climbed higher.

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (15.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD was moving with low volatility during the Asian session and sideways. At the start of the European session, it experienced more volatility and the market was waiting for the news at 15:15 to react. The ECB decided to increase the Main Refinancing rate to 4% as they previously stated that they will. This caused a shock for the EUR pairs but also for the USD pairs. The EUR gained strength while the USD weakened, thus the EURUSD moved upwards rapidly and for a long period of time deviating from the mean near 125 pips.

EURGBP (15.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURGBP experienced high volatility only after the start of the European session and a shock at the time of the ECB rate release. The pair jumped at that time, at 15:15 and retraced soon after it found a significant resistance near 0.85900. It seems that the EUR has appreciated against other pairs greatly only near the time of the rate release but later lost strength, causing the pairs to retrace back to the mean. Except for the EURUSD of course, which continued the upward movement because of dollar weakening during the rest of the trading day.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

U.S. Stocks have been climbing remarkably for days with some intraday retracements to the mean on the way up. Yesterday, during the ECB Rate decision, all benchmark U.S. indices started to climb higher and higher. The USD was experiencing depreciation against major currencies at that time and it started right after the ECB announced that it decided to increase the Main refinancing Rate to 4%, as expected. The Fed had previously decided that it has done enough with hikes and left the Fed rate unchanged. USD weakening is not a surprise. The risk-on mood is causing stocks to move more to the upside.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude has been on the sideways path but moving with high volatility around the 30-period MA. High deviations are close to 20 USD/b from the mean. In the last few days, the RSI is showing lower highs while the price is higher highs. A bearish divergence is probably in place and crude could move back to the mean.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 15th of June, Gold moved rapidly higher and after finding resistance it remained in a consolidation phase until the 16th of June. Retracement is probable if the price breaks the support near 1958 USD/oz. The Fibonacci retracement tool here fits well and shows that 61.8% of the total upward movement is near 1948.40. The alternative scenario is that the breakout eventually is upwards, breaking the resistance at 1964 USD/oz and the price potentially moves towards the next resistance level at near 1971 USD/oz.

______________________________________________________________

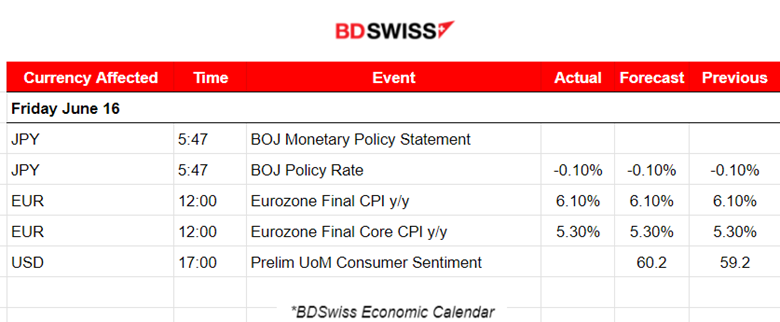

News Reports Monitor – Today Trading Day (16 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The Bank of Japan (BOJ) decided to leave rates unchanged at -0.10%, a decision released at 5:47. At that time the JPY depreciated against other currencies. An intraday shock took place and pairs soon retraced after a near 40-50 pips jump (EURJPY, USDJPY). However,, the JPY pairs reversed again and continued with their upward and steady movement until now.

- Morning – Day Session (European)

Final Eurozone CPI change data were released as expected without having a notable impact on the market.

At 17:00 the Prelim UoM Consumer Sentiment result will be released. The Preliminary release isearlier and thus tends to have the most impact. The USD is expected to experience an intraday shock. Retracement opportunities will probably arise since no other significant movement took place so far.

General Verdict:

- Low volatility for the Day. Friday mood.

- U.S. stocks at market opening might see some retracement from yesterday’s jump. Resistance levels could prevent further movement upward for today at least.

- Gold moves higher with a resistance breakout.

______________________________________________________________