Previous Trading Day’s Events (07.08.2024)

New forecasts are pointing to lower inflation and growth. ECB policymakers are preparing for a first cut in interest rates, probably in June, provided incoming data, especially on wages, confirms the trend.

“We did not discuss cuts for this meeting, but we are just beginning to discuss the dialling back of our restrictive stance,” ECB President Christine Lagarde told a press conference.

Lagarde hinted strongly that was more likely to happen at the ECB’s June 6 meeting, as wage data for the first quarter will then have been published.

“We will know a little more in April, but we will know a lot more in June,” Lagarde said.

She noted that inflation, including nearly all underlying measures, has been falling towards the ECB’s 2% target and is now expected to come in lower over the next two years.

Inflation has been declining for nearly 18 months, to 2.6% in February.

“We also look very carefully at data concerning underlying inflation and here we are seeing a decline across the board … except domestic inflation,” Lagarde said.

Source: https://www.reuters.com/world/europe/ecb-hold-rates-take-baby-steps-towards-first-cut-2024-03-06/

Powell repeated his testimony of the previous day: that it would likely be appropriate to cut interest rates “at some point this year,” but made clear officials are not ready yet. Policymakers need more evidence that inflation is heading sustainably to the central bank’s 2% goal before acting, he said.

The U.S. dollar has been weakening against a basket of currencies significantly these last couple of days.

______________________________________________________________________

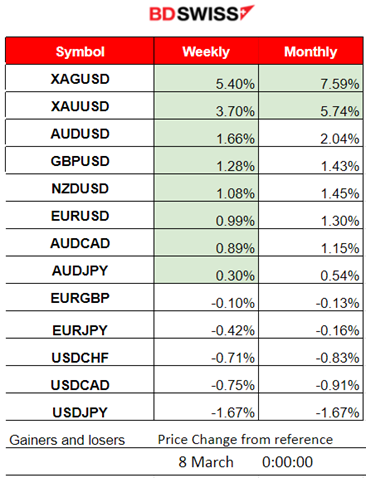

Winners vs Losers

Metals are still at the top of the list. Silver (XAGUSD) is leading for this week and month, 5,4% gains this week and 7.59% gains for the month. Gold (XAUUSD) follows with 5.74% gains so far this month.

______________________________________________________________________

______________________________________________________________________

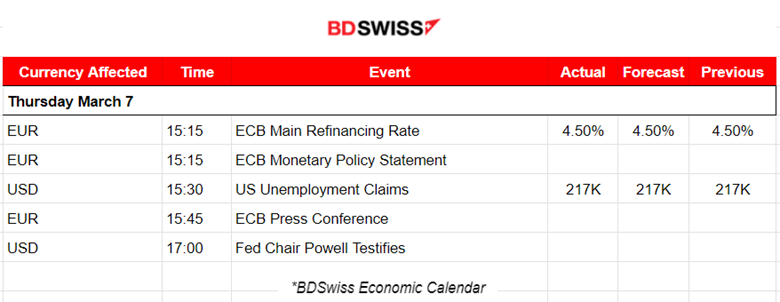

News Reports Monitor – Previous Trading Day (07 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

The ECB decided to keep the three key ECB interest rates unchanged. Since the meeting in January, inflation has declined further. In the latest ECB staff projections, inflation has been revised down, in particular for 2024. The market reacted with moderate EUR depreciation at the time of the news release.

U.S. unemployment claims figures remained stable and as expected.

The Fed Chair Powel testified with comments: “If the economy does as expected we think carefully about removing the restrictive stance of policy. Will begin over the course of this year”. The dollar index started to drop heavily after these comments.

General Verdict:

__________________________________________________________________

FOREX MARKETS MONITOR

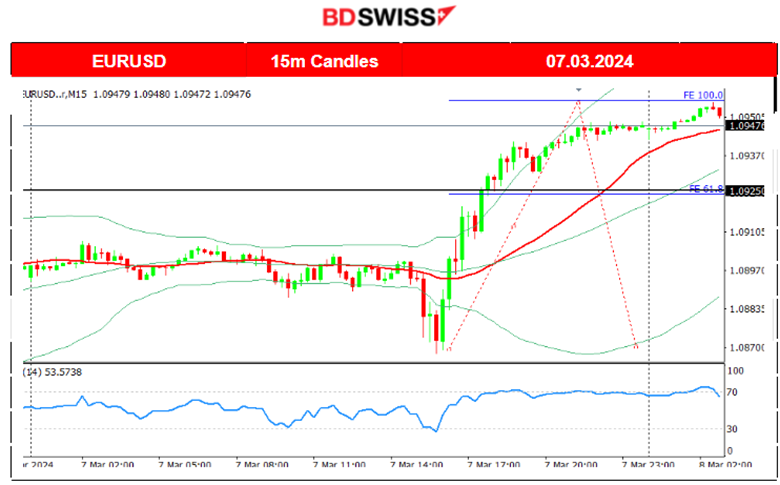

EURUSD (07.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The EURUSD was moving with low volatility and sideways around the mean until 15:15 when the ECB reported its decision to leave rates steady. The market reacted with EUR depreciation as is expecting a cut in June. The impact was not so great, bringing the EURUSD down near 30 pips before eventually reversing to the upside. The dollar lost a lot of strength against the EUR and other currencies causing the pair soon after the announcement to rapidly move to the upside without any retracement taking place the same day. It would be possible to have such retracement back to 1.09250 today, however, the NFP report might distort the analysis if it does not get completed prior.

___________________________________________________________________

___________________________________________________________________

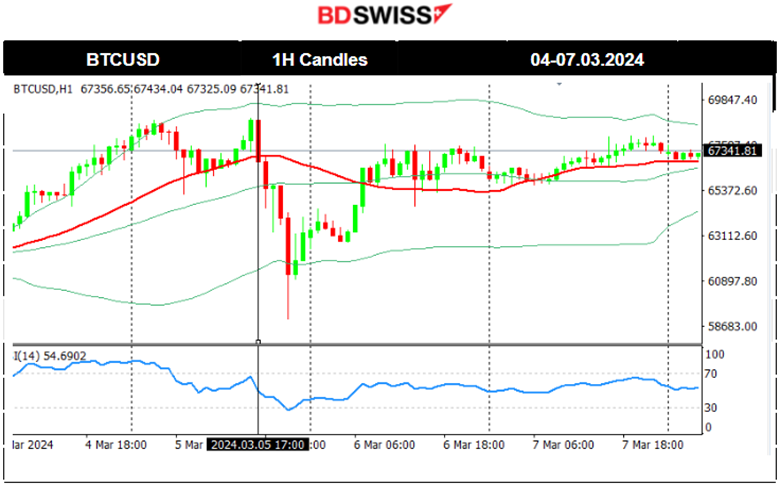

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crazy week for the Crypto market. Bitcoin reached the resistance near 69K USD before reversing aggressively back to the support near 59K. Talking about swings… Reversals of course after rapid drops are common, which is why the asset jumped again high and back to the 30-period MA. It currently settled with lower volatility levels at near 66K-67K USD.

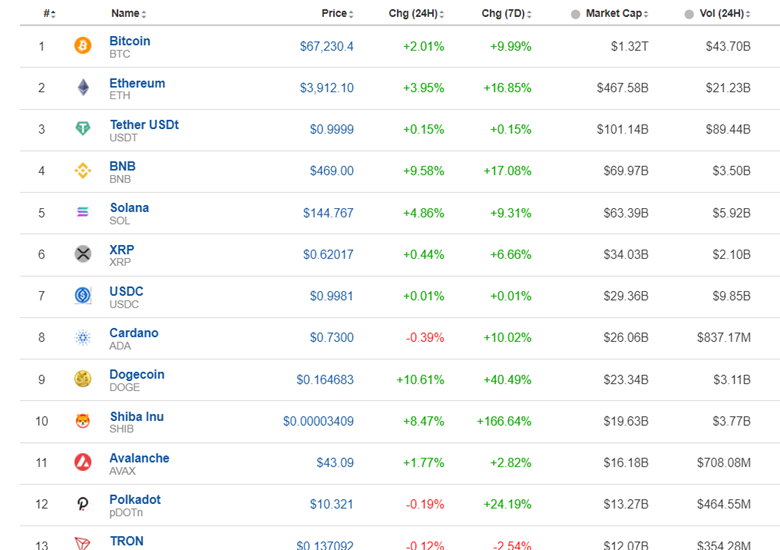

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market saw a surprising uptrend as institutional investors stepped in the markets aggressively. The markets reversed to the highs again gaining back some losses during the last couple of days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 4th March, the index retraced to the 30-period MA. Soon after it crossed it on the way down showing signals that the uptrend ended. Before any intraday notable retracement occurred yesterday, 5th March, stocks dropped upon exchange opening. All three U.S. indices retreated more than 1%, with weakness in mega-cap growth companies such as Apple Inc and the chip sector. Retracement to the 18,000 USD level and beyond eventually took place as the market moved to the upside on the 6th March correcting from the rapid drop. On the 7th March, the market moved to the upside as future borrowing costs could lower significantly and as Powell reassures that cuts will take place as long as the economy continues to show resilience and progress in regards to inflation. The dollar weakened significantly while stocks gained. The index jumped out of the triangle formation reaching the resistance near 18,350 USD before retracing to the 61.8 Fibo. We could see some more upside movement before the NFP as the effect from yesterday seems to continue further.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 1st of March, the price jumped high reaching the resistance at 80.3 USD/b before retracing back to 79.3 USD/b. On the 4th of March, it eventually reversed fully back to the support at near 77.9 USD/b. Crude oil price fell further on the 5th March reaching the next important support at 77.5 USD/b as OPEC+ extends output cuts. More supply in place puts pressure on prices to drop further. On the 6th March, a surprise increase of the price took place causing a breakout of the depicted channel with the price reaching the resistance at near 80 USD/b before retracing and back to the 30-period MA. The 7th of March found the price on a quite volatile path but closing the trading day higher. A short-term uptrend could lead the price to reach 80 USD/b again however, extra care should be taken at 15:30 when the NFP report and Canada’s employment data will be released, affecting Crude oil in unpredictable ways.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The surge continued breaking significant resistance and jumping more than 20 USD upwards as expected. Gold reached remarkably the level of 2,140 USD/oz. Will this time Gold experience a significant retracement? It is on an uptrend with the RSI showing a bearish divergence as highs get lower and lower while the price has higher highs. However, the price is still above the 30-period MA. On the 6th March, support remained strong and the dollar depreciation pushed Gold to higher and higher levels reaching over 2,150 USD/oz. On the 7th March, the RSI continued with lower highs but the USD weakening kept Gold stable and leaning more to the upside instead.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (08 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

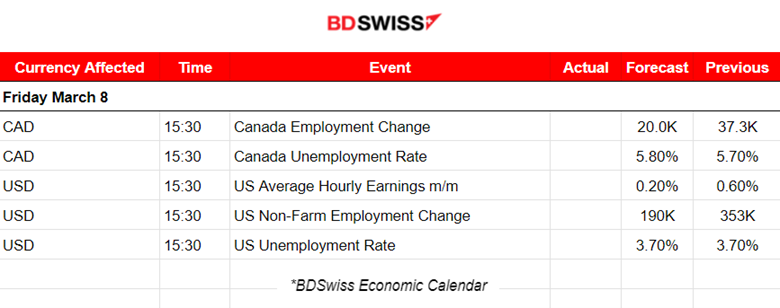

At 15:30 we have the most important scheduled figure releases of the month. Canada’s labour market data releases along with the U.S. releases. Canada is expecting a slower increase in employment but a higher unemployment rate. The CAD pairs will probably be affected greatly by an intraday shock as the releases usually come out with surprises.

The NFP report is expected to show a lower figure and a steady unemployment rate suggesting that longer than expected unchanged interest rate policy, no cuts yet, and high inflation, cause cooling. Yet the numbers are high enough and the PMIs are strong for the U.S. to sustain elevated interest rates for longer. The impact on the USD pairs will be great in any case since market participants are expected to respond to the figures with high activity and volume. These figures will play a huge role in determining the future interest rate policy. Indications of strong cooling of the labour market could push the Fed to proceed with cuts sooner than expected.

General Verdict:

______________________________________________________________