PREVIOUS TRADING DAY EVENTS – 27 July 2023

The ECB said: “Inflation continues to decline but is still expected to remain too high for too long.

“The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It therefore today decided to raise the three key ECB interest rates by 25 basis points.

“The developments since the last meeting support the expectation that inflation will drop further over the remainder of the year but will stay above target for an extended period. While some measures show signs of easing, underlying inflation remains high overall. The past rate increases continue to be transmitted forcefully: financing conditions have tightened again and are increasingly dampening demand, which is an important factor in bringing inflation back to target.”

However, recent activity surveys suggest the economic slowdown is now affecting both manufacturing and services within the Eurozone.

The Fed had raised its own rates the previous day by 25 basis points as well. While the market expects no more hikes from the Fed and ECB as inflation reaches close to the targets, the Bank of England is still expected to have a few more rate hikes. Inflation in the U.K. remains higher than in the Eurozone or the U.S.

Gross domestic product increased at a 2.4% annualised rate last quarter. The economy grew at a 2.0% pace in the January-March quarter.

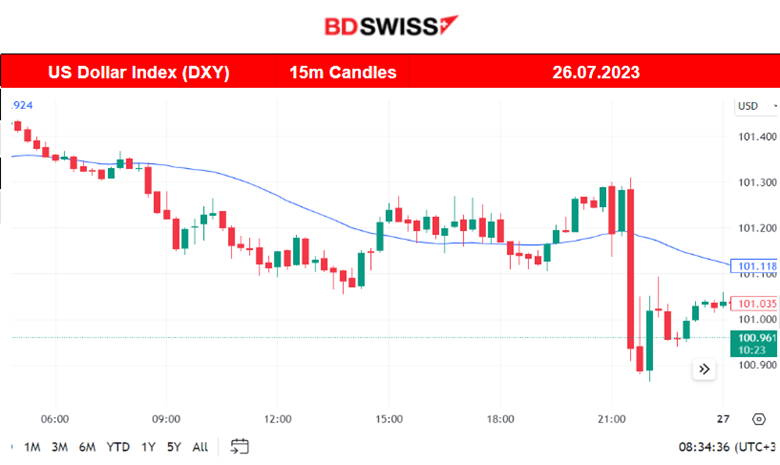

Stocks on Wall Street were trading higher. The dollar rose significantly against a basket of currencies. U.S. Treasury prices fell.

______________________________________________________________________

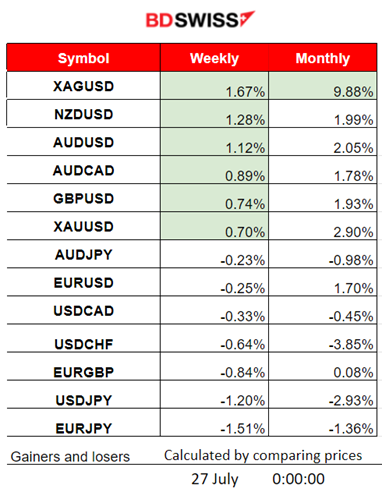

Winners vs Losers

_____________________________________________________________________

News Reports Monitor – Previous Trading Day (27 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements or any special scheduled figure releases.

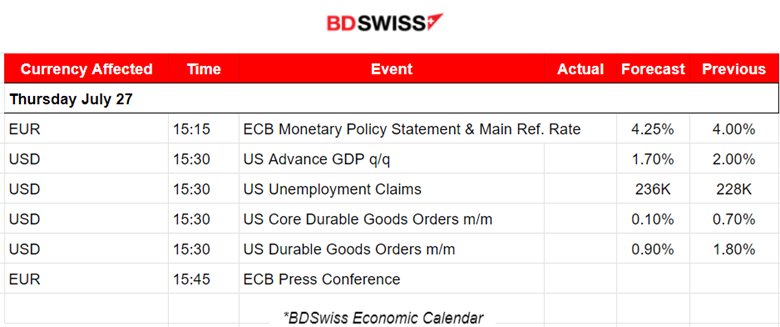

- Morning – Day Session (European & N. American Session)

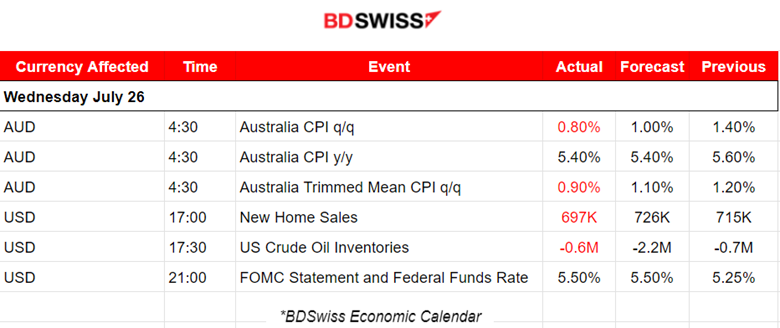

An MRR rate increase of 25 basis points was decided to be applied by the ECB yesterday, as expected. Extreme volatility took place as the EUR and the USD were affected greatly causing the USD to appreciate massively and the EURUSD to drop more than 150 pips.

At 15:30, there are various releases relating to U.S. growth, orders and the labour market, all pointing to USD strengthening. The Advanced Quarterly GDP figure was reported higher. Instead of increasing, the U.S. Unemployment claims were actually reported lower while the durable goods orders were reported higher than expected. One could argue that previous data suggested an economic slowdown in the U.S. high enough for the Fed to consider a pause in this aggressive monetary policy. The data now suggest that inflation could be more sticky than we thought and that the Fed has more work to do. The market reacted with USD appreciation supporting this expectation.

After the start of the ECB press conference at 15:45, the EUR depreciated. The USD continued with strengthening, pushing pairs in one direction and causing high deviations from the intraday means.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

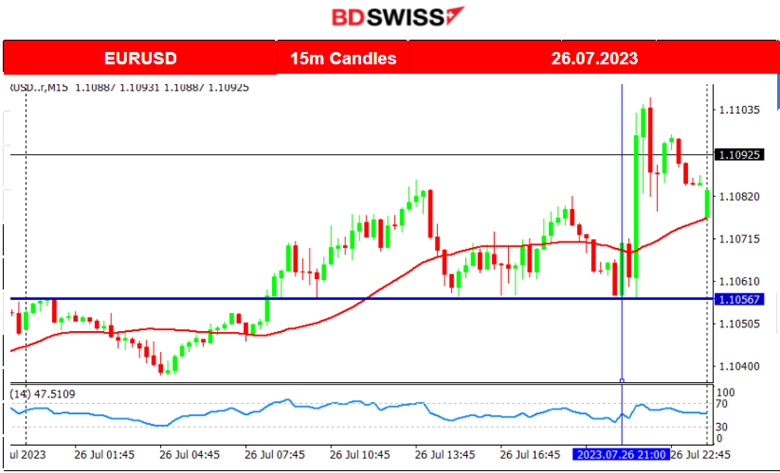

EURUSD (27.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving more to the upside with low volatility until it eventually dropped when the release of the ECB rate decision took place. This massive drop with a large deviation from the intraday mean was caused by dollar appreciation and EUR depreciation. One could expect that after the pair stopped due to a support reach, retracement could follow, but it did not. The Dollar was gaining strength, enough for cancelling any expectation for retracement.

GBPUSD (27.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Due to the ECB’s impact on the EUR, the pair dropped after an early climb, deviating from the 30-period MA. The drop after the ECB’s rate decision release and press conference caused the pair to move moderately to the downside, but eventually experienced a retracement back to the mean after reaching critical support near 0.85440. This path was sideways overall around the mean with high volatility. This is very different from GBPUSD or EURUSD, where no significant retracement took place as the USD was experiencing high lasting appreciation against other major pairs.

___________________________________________________________________

EQUITY MARKETS MONITOR

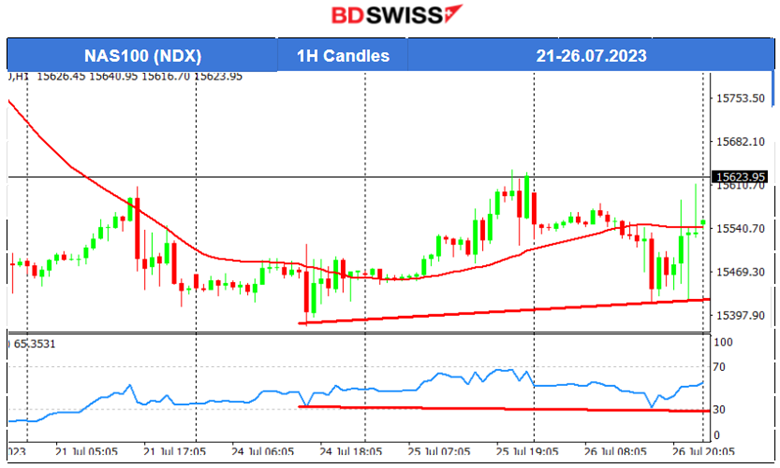

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The long and recent upward movement of the NAS100 index was interrupted. In the last couple of days, the index moved sideways with high volatility around the mean. It showed actual signs of recovering from the previous downward movement as it was moving steadily to the upside breaking resistances. Yesterday, during the ECB press conference, the Dollar was gaining remarkable strength but the U.S. benchmark indices kept moving to the upside steadily. Only after the NYSE opening, the U.S. Stock market suffered an intraday crash, reversing heavily from the upside, crossing the MA and staying below the mean. The biggest drop was observed after 20:00. The NAS100 index retraced back to the mean after finding support near 15420 USD.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

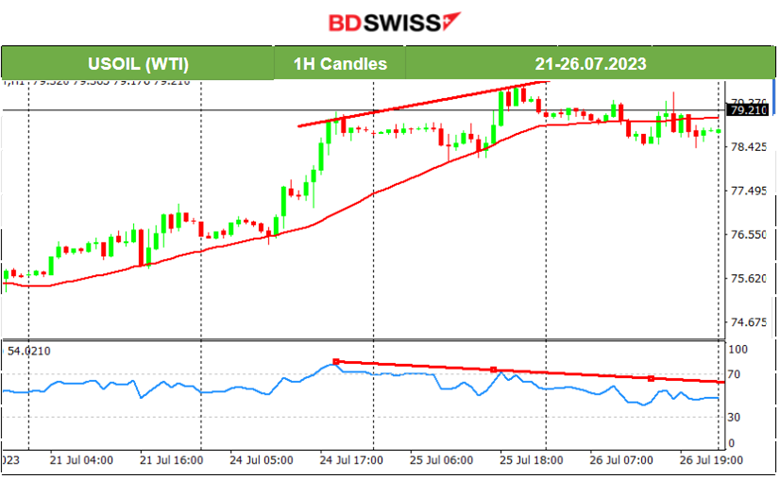

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude is moving steadily with moderate volatility within an upward channel as it seems. The Dollar strengthening yesterday, after the ECB rate decision, did not have a surprising impact on the price. It remains on the trend and moves while being above the 30-period MA.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The Gold price crossed the 30-period MA, on its way up and remained on the upside. It seemed to be in an upward channel with low volatility. The RSI indicated that there is a bearish divergence that would cause the end of this upward path. Apparently, it has. However, the drop that happened on the 27th is attributed to the USD strengthening that took place after the ECB rate decision, causing the Gold price to drop since it is denominated in USD. Retracement followed after the price found strong support near 1942 USD/oz.

______________________________________________________________

News Reports Monitor – Today Trading Day (28 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No change in the BOJ rate; it remains still at -10%. The Bank of Japan (BoJ) published its quarterly outlook report, following its July policy meeting where it highlighted that risk to inflation skewed to the upside for fiscal year 2023-2024. Japan’s economy is moderately recovering and inflation expectations are showing signs of heightening again. JPY appreciation was observed at the time of the release, causing the JPY pairs to experience a high shock. USDJPY fell more than 140 pips but soon retraced back to the mean.

- Morning – Day Session (European)

At 15:30, we have the release of important scheduled figures for Canada and the U.S. Canada’s monthly GDP change is expected higher while the U.S. Core PCE Price index figure is expected to be lower. The PCE price index should coincide with the latest low inflation data. The U.S. annual inflation figure was reported at 3%. The Employment Cost Index figure is expected to be reported lower. These figures will probably cause an intraday shock for the USD pairs at the time of the release.

The Revised UoM Consumer Sentiment report released at 17:00 could have the same but moderate impact on the USD.

General Verdict:

______________________________________________________________