PREVIOUS WEEK’S EVENTS (Week 12 – 16 June 2023)

Announcements:

U.S. Economy

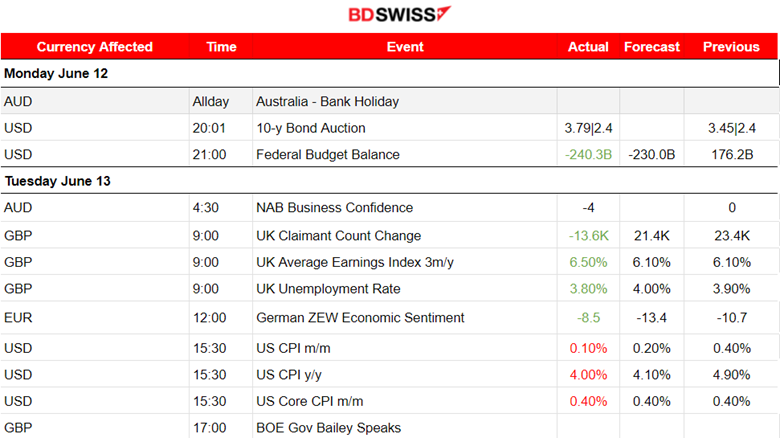

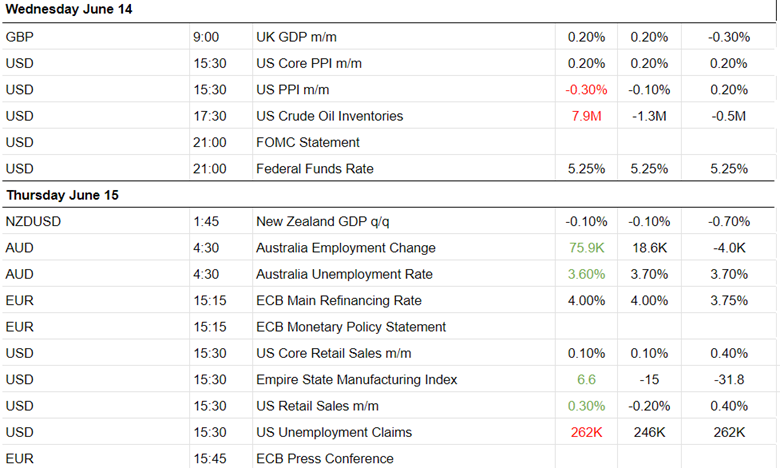

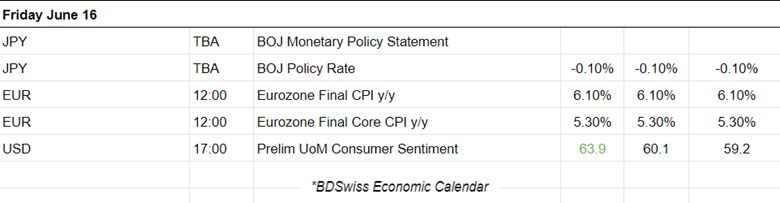

The U.S. federal government’s budget deficit reached at high notable levels, $1.16 trillion for the first eight months of the fiscal year, a 191% yearly increase — a $240 billion for the month of May.

U.S. President Joe Biden signed the legislation that suspends the $31.4 trillion cap on U.S. debt until January 2025 after reaching a deal with congressional Republicans.

The previous week we had the release of the U.S. CPI data that were reported lower than expected. They showed that the inflation rate cooled in May significantly. The consumer price index, which measures changes in a multitude of goods and services, increased just 0.1% for the month versus the previous month’s 0.4% figure. The yearly CPI figure showed a 4% inflation rate, lower than the previous year’s 4.9%. This is the desired result from the Federal Reserve and signals that it is more probable that it would keep interest rates unchanged today.

These lower numbers provide the Fed room to pause rate hikes. Considering all data releases, policymakers were thinking that more assessments needed to take place before increasing rates further. If economic data continues to surprise to the upside and inflation remains, sticky more hikes could take place in July.

The monthly U.S. PPI figure was reported quite low (negative change) yesterday, indicating that prices are indeed dropping. These are inflation-related data. The PPI for final demand declined 0.3% in May, seasonally adjusted. The data support the expectations that prices are actually falling significantly.

The Federal Reserve (Fed) kept interest rates unchanged for the first time since March 2022 after taking into consideration that inflation is falling significantly. However, the labour market is not cooling enough. No hike, but borrowing costs will likely rise.

With the CPI and PPI data taken into account, economists estimated that the core PCE price index rose 0.3% in May after increasing 0.4% in April. The core PCE price index was forecast to advance 4.6% year-on-year in May after rising 4.7% in April.

The U.S. data related to Retail sales and the U.S. unemployment claims figures were released. Retail sales unexpectedly rose in May, a sign that consumers are still active and contribute significantly to the economy.

Fed Chair Jerome Powell said that inflation pressures continue to run high. The target is 2% and policymakers will have to react with hikes if future releases do not have the desired figures. They have to take June’s employment and inflation reports considerably into consideration.

Unemployment claims were high. The figure showed 262K claims, the same as the previous figure. If this high number is sustained, it will point to a rise in layoffs and a slowing in job growth.

U.K. Economy

The 3-month U.K. Unemployment Rate was reported lower, to 3.8% while the Jobless Claims figure was reported negative, -13.6K. The number of people in employment increased significantly in the latest quarter with increases in both the number of employees and self-employed workers. Wage growth soared.

It is clear that the economy is not cooling. Expectations that the Bank of England would raise interest rates again and perhaps several times to bring inflation down pushed the GBP higher. Wage growth is a problem since it is too high and creates an obstacle to the fight for bringing inflation to the 2% target.

UK recession might be unavoidable as the tight monetary policy will probably continue for longer. A very tight labour market is a big concern. The real Gross Domestic Product (GDP) figure for the U.K. was released also and shows that it is estimated to have grown by 0.2% in April 2023, after a fall of 0.3% in March 2023, despite contractions in manufacturing and construction. The government would stick to its plan to halve inflation this year, which means that hikes will definitely continue.

New Zealand Economy

New Zealand enters a technical recession. According to government data published on Thursday, the Gross domestic product (GDP) fell 0.1% in the first quarter. It experienced two consecutive quarters of contraction.

The reported figure aligned with market expectations and gave traction to the central bank’s position that no further interest rate hikes would be needed. The data suggest, though. New Zealand’s economy is slowing down and further assessment should take place, with more data into consideration, to evaluate if the numbers are enough to achieve low and stable inflation.

Inflation in New Zealand lies at 6.7%, well above the central bank’s target band of 1% to 3%. The cash rate is at 5.5% and the central bank, at its last meeting in May, said the cash rate had peaked.

Australia Economy

Labour market data for Australia were released last week, showing high employment growth with 75.9K change versus the previous -4K figure, while the unemployment rate was reported at 3.6%, down from 3.7%.

This high employment change challenges the central bank, further signalling that more hikes are needed. Policymakers have more work to do even after tightening by 400 basis points to an 11-year high of 4.1%, including a surprise rise earlier this month.

The Reserve Bank of Australia (RBA) Governor Philip Lowe had previously expressed the willingness and determination of the Central Bank to sacrifice jobs to bring inflation back to target by mid-2025.

_____________________________________________________________________________________________

Interest Rates

U.S.

The Fed decided to leave interest rates unchanged but, as signalled in new projections, borrowing costs may still need to rise by as much as half of a percentage point by the end of this year, as the U.S. central bank reacted to a stronger-than-expected economy and a slower decline in inflation.

Fed Chair Jerome Powell highlighted the fact that the job market is still strong and the U.S. economy is resilient despite the aggressive monetary policy tightening of the past year. The pause was out of caution, Powell said. It allows the Fed to gather more information and see the effects of the previous hikes before taking any further decision to raise rates again.

Eurozone

The European Central Bank (ECB) announced its decision to raise rates yesterday. The Main Refinancing Rate (MRR) was raised to 4%, as expected. The ECB closely monitored inflation data and estimated that it would remain too high for too long. They decided to hike in order to ensure that inflation will return to its 2% medium-term target.

Policymakers have already considered a July rate hike since they take other essential data into consideration, such as the tight labour market data.

Sources:

https://www.reuters.com/markets/europe/ecb-raises-rates-22-year-high-signals-more-come-2023-06-15/

https://www.reuters.com/world/uk/uk-economy-shows-02-growth-april-ons-2023-06-14/

https://www.reuters.com/markets/us/us-consumer-prices-slow-may-core-inflation-sticky-2023-06-13/

https://www.reuters.com/markets/us/fed-poised-punt-rate-hike-into-summer-wind-2023-06-14/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (12 – 16 June 2023)

_____________________________________________________________________________________________

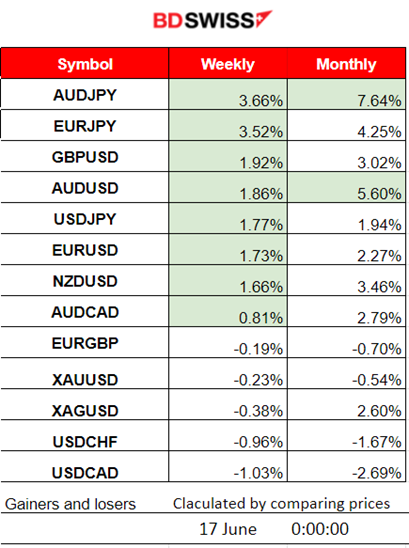

Summary Total Moves – Winners vs Losers (Week 12 – 16 June 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD moved higher overall, driven by the USD. No important announcements conserving the Eurozone took place the previous week and EUR had not been affected much except the ECB rate decision. The EUR appreciated at the time of the release since the ECB decided to hike. The USD depreciated after the release, steadily pushing the EURUSD high.

EURGBP

EURGBP moved sideways and around the 30-period MA with low volatility. The GBP is clearly gaining more ground, though, than the EUR. The BOE is aggressively raising rates since inflation is relatively high. On the 13th of June, we saw a significant drop since GBP appreciated greatly due to the strong labour data release for the U.K. that day. Another significant drop also happened on the 16th of June, but it can be attributed to volatility rather than news releases.

DXY (US Dollar Index)

The dollar has weakened significantly the previous week. We see that the DXY has been moving downwards with a path below the 30 period-MA — a downward trend. The Fed has decided to leave rates unchanged. With no more hikes, depreciation followed. In addition, it experienced a significant fall on the 16th of June. Right after the ECB rate decision and with the release of the Retail Sales data for the U.S., the USD depreciated significantly against other currencies.

_____________________________________________________________________________________________

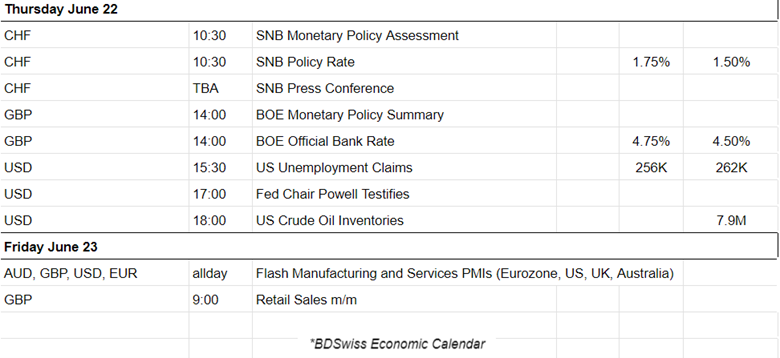

NEXT WEEK’S EVENTS (19 – 23 June 2023)

Rate decisions ahead

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude remained above the 30-period MA. It moves upwards as it climbs the support levels. However, the RSI is still showing signs of bearish divergence. At this point, the potential drop in price may not be so high since the MA is not so low. Considering Crude’s volatility, though, retracements are almost impossible not to happen. Should the price experience a reversal crossing the MA downwards, that would be a great opportunity for long positions after a good support level is found strong enough intraday.

Gold (XAUUSD)

Gold reversed significantly during the week, specifically on the 15th of June. The price moved upwards, crossing the 30-period MA and remained above it. It later moved to higher levels, breaking some resistance levels but retracing back to the mean. Volatility is quite strong, but the price is obviously USD driven. Currently, the USD is losing strength. U.S. Stocks are not climbing as fast and oil also starts to climb. Fed decisions in July will be critical for market movement direction.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The Fed had previously decided that it had done enough with hikes and left the Fed rate unchanged. The data are mixed. A strong labour market while inflation drops. This is puzzling for policymakers since they must decide whether to keep the hike paused. Stocks are still climbing but at a diminishing rate, as it seems. High retracements take place intraday. Still, the index is not reversing significantly to signal a stop for the upward trend. Sideways or even upward continuation is still on, as well as the risk-on mood as it seems.

______________________________________________________________