PREVIOUS TRADING DAY EVENTS – 04 May 2023

Announcements:

“The services sector is in robust shape across the eurozone… Italy and Spain are currently the main driving forces,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

Although the bloc’s order backlog grew at a weaker pace, across all HCOB PMI indicators, “everything suggests that growth in the eurozone services sector will continue in the months ahead,” he added.

“We are not pausing – that is very clear,” ECB President Christine Lagarde told a press conference. “We know that we have more ground to cover.”

She added that interest rates were not yet “sufficiently restrictive” to get inflation down to the ECB’s 2% target and made reference to future “policy decisions”, suggesting that more than one additional rate rise could be on the cards.

“We continue to expect the ECB to hike rates by 25 bps in June, bringing the deposit rate to a peak of 3.50%, with risks of a final 25 bps hike in July depending on future developments in the U.S. banking system,” Frederik Ducrozet at Pictet Wealth Management said.

“In a nod to the hawks, the ECB hinted at ‘future decisions’ in the plural,” Holger Schmieding at Berenberg said. “This somewhat vague guidance supports the call that the ECB will likely lift rates again by 25 bps on 15 June and on 27 July, to a peak deposit rate of 3.75%.”

______________________________________________________________________

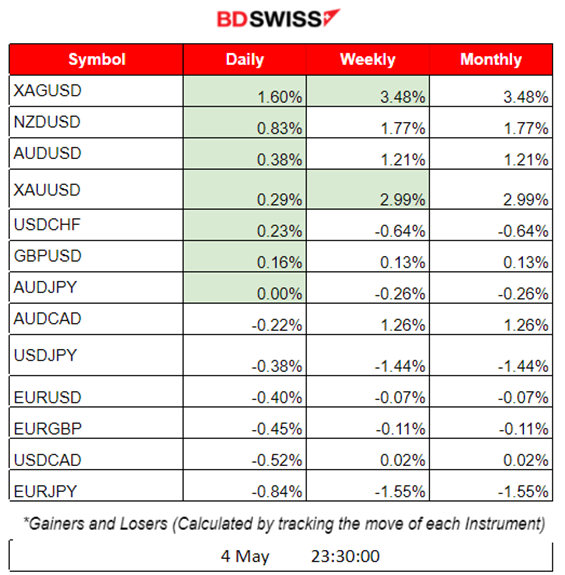

Summary Daily Moves – Winners vs Losers (03 May 2023)

- Metals thrive again. Yesterday Silver was the top winner with 1.60% gain.

- The week finds Silver on top with 3.48% change while Gold is second with 2.99% gain.

______________________________________________________________________

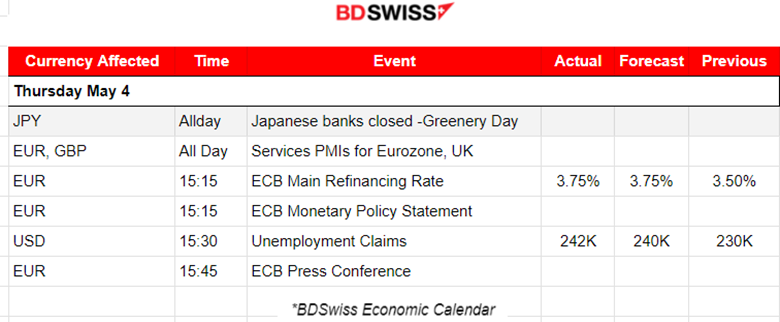

News Reports Monitor – Previous Trading Day (04 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no important scheduled figure releases.

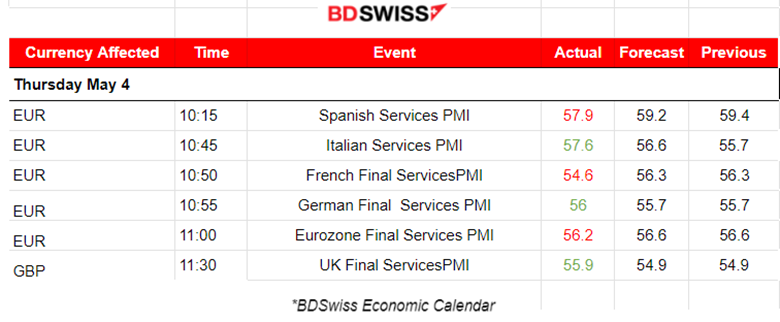

- Morning – Day Session (European)

Eurozone: PMIs for the services sector were released. The figures were as per below. We see that all PIMs show industry expansion since the levels are above 50 with major economies in the Eurozone experiencing an increase in the PMIs figure.

U.K.: PMIs showed that the UK experienced a rapid rise in UK service sector business activity being the fastest for 12 months. The PMI figure was above the previous as well, in expansion territory.

At 15:15, the ECB released its Monetary Policy statement and announced the Main Refinancing Rate figure. The figure was announced to be 3.75% as expected and the EUR depreciated moderately at the time. Lagarde keeps the door open for further rate hikes, however, the ECB stated that it has entered the final stage of the current tightening cycle.

At 15:30 the Unemployment claims figure was released causing a short USD appreciation. The figure was nearly as expected, just 12K higher than the previous figure.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

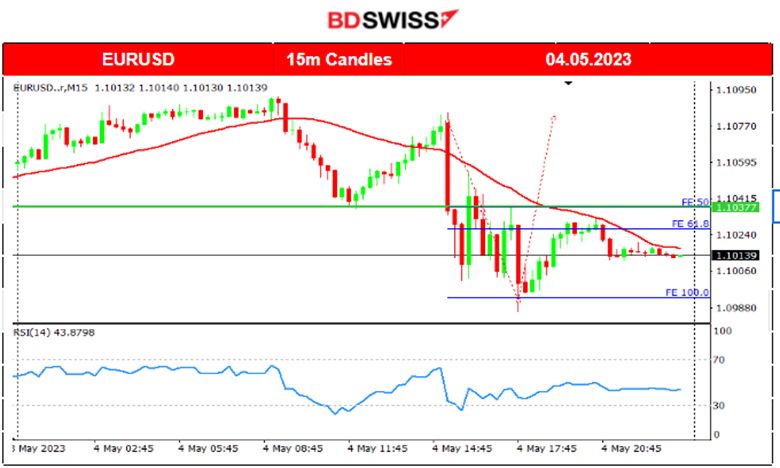

EURUSD (04.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

With the market waiting for the ECB to report on their monetary policy, EUR pairs have been experiencing low volatility before the event that was going to take place at 15:15. Even though the ECB increased the rate the market eventually moved downwards. Since the market was expecting a hike it unsurprisingly reacted in this way. Another thing to consider is that the USD appreciated at the time and that is the reason for the drop as well.

Trading Opportunities

As per our intraday approach, the market experienced 1) a rapid move downwards and 2) support levels suggesting a stop and creating room for a retracement. The Fibonacci Expansion tool is depicted on the chart and shows that the market eventually retraced back to the 61.8 level.

EURGBP (04.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Just like EURUSD, the EURGBP was affected by the ECB’s rate hike. We clearly notice that the pair experienced a drop mainly due to the EUR depreciation at the time of the release. Note that retracement did not take place as expected yesterday. It actually retraced successfully to the 61.8 level this morning (5th May) at 5:00.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. Stocks are suffering from losses this week as labour data and interest rates news affect investors’ decisions. These figure releases took place on the 2nd and 3rd of May where we see that the index experienced a dive during both events. The market has changed dramatically as fear of a U.S. recession grows. The Fed has increased the rate and will probably pause hikes, however, if inflation does not show that it has lowered significantly, we might see more hikes in the future and the risk-off mood will be likely to continue.

The RSI is signalling short-term moves upwards while Price: Lower Lows, RSI: Higher Lows (Bullish Divergence). It would be wise to wait until the NFP release for any important trades to be placed.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

While stocks have been experiencing a fall, Crude Oil was moving downwards as well. It settled near 68.55 USD yesterday. The last report regarding Crude Inventory Data showed a decline of 1.3M barrels reported on the 3rd of May but it was a lower decline than the previous 1.5M. The USD depreciation and the pessimistic expectation of future business activity have affected demand.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The latest figure releases affecting the USD since 2nd May have pushed Gold higher and higher causing the price to form an upward trend. This happens because the USD depreciates, however, demand for less risky investments also takes place. As we have seen recently, stocks are moving lower and metals are moving higher during the current market situation with fears of a U.S. recession.

______________________________________________________________

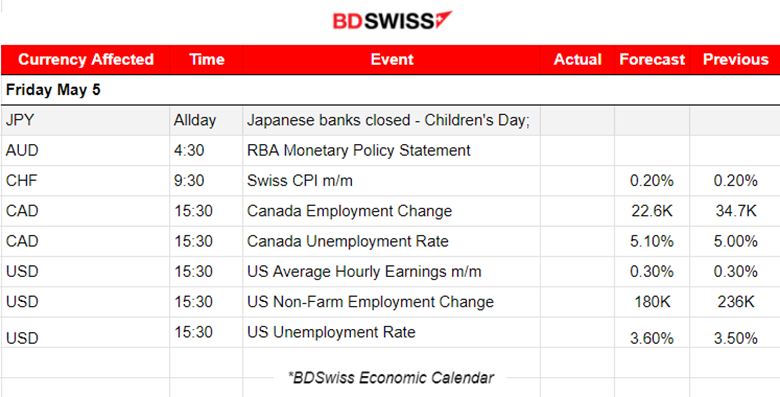

News Reports Monitor – Today Trading Day (05 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The RBA (Reserve Bank of Australia) released its monetary policy statement. The market has already reacted heavily last time with the rate figure release. No major impact this time.

- Morning – Day Session (European)

CHF pairs experienced a shock during the release of the CPI figure at 9:30. CHF depreciated.

The most important news of the month is the NFP, today at 15:30. We have the labour data for the U.S. and also for Canada at the same time. Hence, we expect high volatility and related pairs to move in one direction after breaking important levels. Depending on the effect, the USDCAD might experience high deviation.

The consensus shows lower estimated figures for U.S. employment change suggesting that labour market cooling is expected to continue. Especially now after the rate hike, fears for a recession will likely grow stronger.

General Verdict:

______________________________________________________________