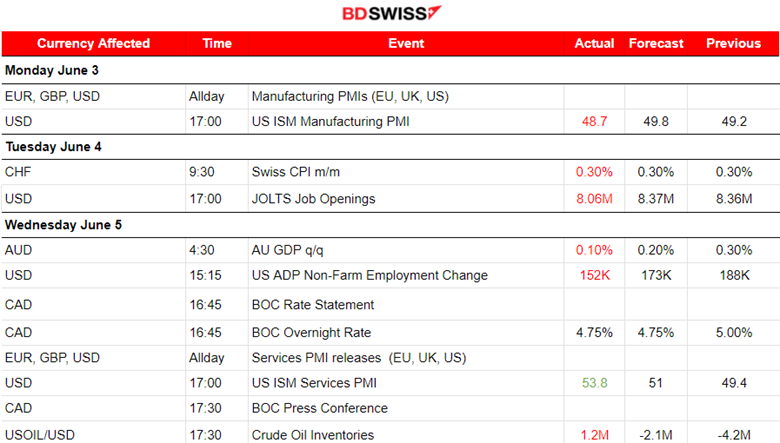

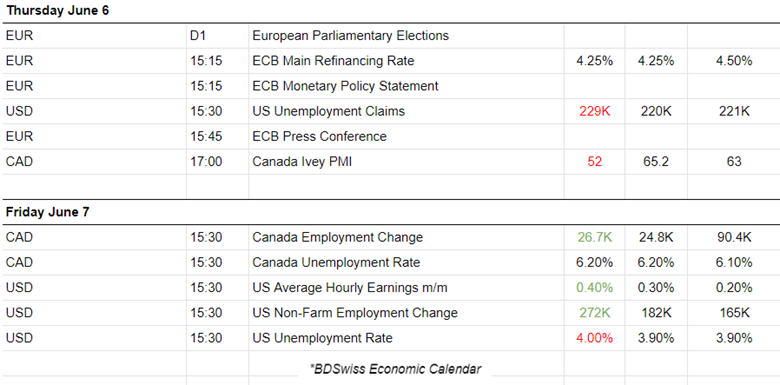

PREVIOUS WEEK’S EVENTS (Week 03- 07.06.2024)

U.S. Economy

U.S. manufacturing activity slowed for a second straight month in May as new goods orders dropped by the most in nearly two years, and spending on construction projects slipped unexpectedly the month before – indications that a gradual slowdown in the economy is taking hold.

The ISM Manufacturing PMI index for May fell to 48.7 from 49.2 in April. It was both the second straight decline and the second month below the 50 level that separates growth from contraction.

U.S. job openings fell more than expected in April. Labour market conditions soften in a manner that could help the Federal Reserve’s fight against inflation. Job openings were down 296K to 8.059 million on the last day of April, the lowest level since February 2021.

The U.S. services sector experienced growth in May, instead, after a short-lived contraction in the prior month, with a measure of business activity improving by the most in three years. These are signs that a tight labour market is easing back into balance but the whole picture is unclear as other data suggest cooling.

The Fed officials this week are expected to leave the policy rate in the same 5.25%-5.50% range where it has been since last July. They have said a rate cut will likely wait until data shows lower inflation towards the target. However, the data on Friday 7th June showed that U.S. job growth accelerated far more than expected in May. The unemployment rate jumped to 4.0% for the first time since January 2022, while nonfarm payrolls increased by 272K jobs last month, way more than the 185K forecast.

The readings in regard to business activity were indeed weak, the unemployment rate rose but the payroll numbers are high. A continued resiliency in the labour market despite the rise in the unemployment rate.

The Fed may delay cutting rates because of a strong labour market that leads to a stronger consumer which in turn leads to inflation.

Canada Economy

Canada’s jobless rate increased as expected while wage growth accelerated as well. The Jobless rate was reported to be 6.2% from 6.1% in April. The average hourly wage growth for permanent employees accelerated to an annual rate of 5.2% from 4.8% in April. That growth rate was the highest since January’s 5.3% rate.

Annual inflation in April stood at 2.7%. Wages have gone up and that’s a problem for the Bank of Canada that already cut rates by 25 basis points. The BoC indicated that further easing would be gradual and dependent on data. The bank will have another month’s job data before its next rate decision announcement on July 24.

______________________________________________________________________

Interest Rates

BOC

The Bank of Canada was the first G7 country to cut interest rates. Governor Tiff Macklem announced that the central bank had reduced rates to 4.75% from 5%, the first cut in four years. Macklem stressed the timing of the next cut would depend on whether inflation continued its downward trajectory.

ECB

The European Central Bank (ECB) cut interest rates for the first time in five years but kept its next move in the dark given increasing uncertainty over inflation. The ECB lowered its record-high deposit rate by 25 basis points to 3.75%, joining the central banks of Canada, Sweden and Switzerland. A data-dependent approach will be implemented and a meeting-by-meeting approach to determine the appropriate level and duration of restriction according to the ECB.

Economists see another two rate cuts from the ECB this year, most likely in September and December. ECB however is not pre-committing to a particular rate path.” The Fed has clearly signalled a delay in policy easing and a further delay in U.S. rate cuts is likely to make the ECB more cautious too.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/europe/ecb-cuts-rates-keeps-next-move-under-wraps-2024-06-06/

https://www.reuters.com/markets/rates-bonds/bank-canada-cuts-rates-first-time-four-years-2024-06-05/

https://www.reuters.com/markets/us/us-services-sector-rebounds-may-2024-06-05/

https://www.reuters.com/markets/us/us-job-openings-fall-more-than-expected-april-2024-06-04/

https://www.reuters.com/markets/us/us-factory-activity-slips-second-month-may-ism-says-2024-06-03/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 03- 07.06.2024)

Server Time / Timezone EEST (UTC+02:00)

Currency Markets Impact:

Currency Markets Impact:

Eurozone PMIs

Eurozone PMIs

The month of May signalled the acceleration of Spanish manufacturing sector growth. A rapidly increasing production and new order levels have contributed to having a reported PMI of 54 points, in expansion and improvement from the previous report.

In Italy, the manufacturing sector downturn was sustained in May. A worsening PMI figure was reported, at 45.6 points. Operating conditions deteriorated at a sharper rate. It experienced rapidly reduced order book volumes. Manufacturers lowered their production volumes. Firms cut jobs and reduce input buying.

French manufacturing conditions remain subdued, but business confidence jumped. A sustained weakness in order books. Drop in production volumes. Firms reduced their purchasing activity, as well as both pre- and post-production inventories.

The German manufacturing sector showed further signs of steadying in May. Notable slower declines in both output and new orders. Business confidence towards growth prospects seemed to have increased. Currently, the PMI remains however in the contraction area, quite low at 45.4 points.

In the Eurozone, manufacturing production fell again in May but marginally and to the slowest extent in over a year. Reported PMI remains below 50, in the contraction area, however, this marked the third successive month where the decline in factory output has slowed. Softer contractions in new orders, exports and purchasing activity. Business confidence increased.

U.K. PMI

U.K. manufacturing production growth and new orders hit two-year highs in May. The PMI reading is again reported in the expansion area, at 51.2 points. Output expanded at the quickest pace in over two years. Positive sentiment rose to its highest level since early 2022, with most companies expecting output to expand over the coming year.

U.S. PMI

The U.S. manufacturing sector in May saw order growth and a faster expansion in production midway through the second quarter of the year. May saw an improved 51.3 points PMI figure, in the expansion area. Business confidence picked up and positive expectations regarding the future. The hiring of additional staff took place. Renewed rise in purchasing activity and a build-up of stocks of finished goods.

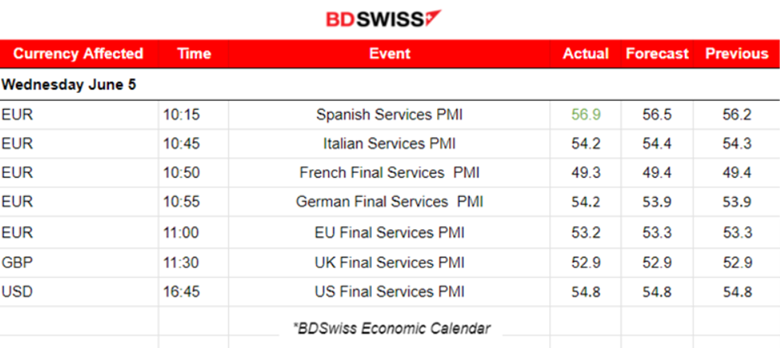

Services PMI releases:

Eurozone PMIs:

Eurozone PMIs:

The Spanish services sector continued to improve during May, with a recorded PMI in expansion, at the remarkable 56.9 points figure. Activity and new business rose, notable job growth, and strengthened future confidence.

A sustained Italian services economy growth was reported yesterday. The PMI stays in expansion, at 54.2 points. New business and activity growth was maintained. It was also reported that there are signs of optimism among service providers. Business expectations grew, beating expectations and job creation gained momentum.

The French service sector stayed in contraction instead in the second quarter. Reported PMI is in contraction, at 49.3 points, but near the 50-level threshold. Activity levels shrank marginally during May. However, it recorded a sustainable pick-up in sales, driven by domestic demand, while employment continued to rise.

The German service sector saw a rise in business activity in May, with stronger underlying demand. Reported PMI was improved, reaching 54.2 points in expansion. Services firms boosted job creation as they reported increased optimism towards future growth. Inflationary pressures in the economy’s largest sector eased midway through the second quarter.

The Eurozone’s economy recorded a third successive month of rising business activity during May with growth accelerating to a one-year high. Stronger demand conditions, output and hiring, improved business confidence. PMI remains in expansion at 53.2 points and points to economic growth in the Eurozone which is at its fastest rate in a year as inflation cools.

U.K. PMI

The UK services economy grew further. PMI remains in expansion at 52.9 points. However, expansion in business activity and new orders eased from their 11-month highs seen in April. Nevertheless, it experienced job growth and a higher level of business confidence.

U.S. PMI

The U.S. services PMI reported 54.8 points indicating a return to growth. New orders spurred U.S. service providers to increase their business activity at a much faster pace midway through the second quarter of 2024.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The dollar was affected heavily several times last week due to the U.S. news regarding the labour market mostly. Despite the low figures regarding JOLTS Job openings and ADP Private employment report the dollar was barely affected with weakening and remained stable. It was affected greatly on the 6th of June with the release of the higher-than-expected unemployment claims that supported the data for cooling. The dollar index however saw a jump upon the NFP report release as the market was surprised by the way higher-than-expected figure. The dollar strengthened due to the fact that expectations for a rate cut in September changed. With such a hot for the labour market figure it would be unlikely that inflation would be reported lower, thus supporting a rate cut from the Fed.

EURUSD

EURUSD

The pair moved sideways since the USD was the main driver. It also experienced moderate volatility in a near 30 pips range while moving sideways before the major news. After the higher-than-expected NFP figure that was reported on the 7th of June, the pair dropped heavily as the USD appreciated dramatically. The dropped marked 150 pips so far and has not experienced a major retracement yet. The RSI shows signs of slowing down but evidence for a retracement is not sufficient yet.

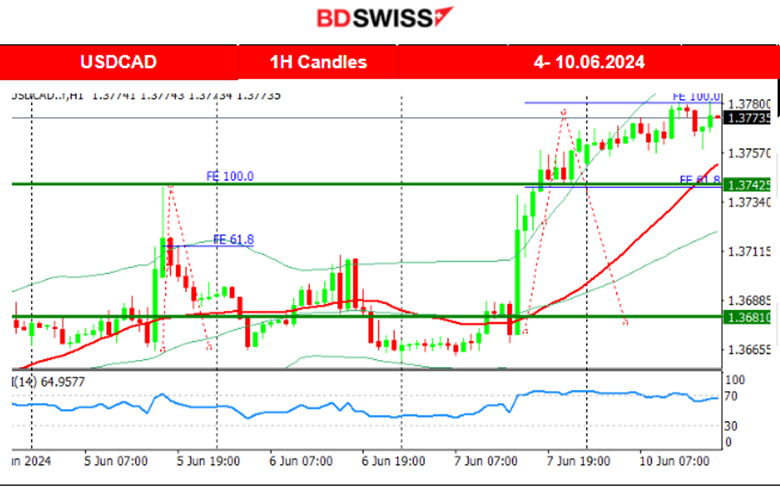

USDCAD

USDCAD

The pair was moving sideways but with high volatility before the NFP and employment data for Canada were released. On the 5th of June, the BOC decided to proceed with a rate cut causing the CAD to depreciate at that time and the USDCAD to jump. A reversal followed and the pair stayed near the 30-period MA while moving sideways. Deviations from the mean were about 20 pips. On the 7th of June that changed with the news release. The CAD got strong but the USD got even stronger with the positive figures for employment, thus the USDCAD jumped and moved even higher than 100 pips. No major retracement has taken place so far.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

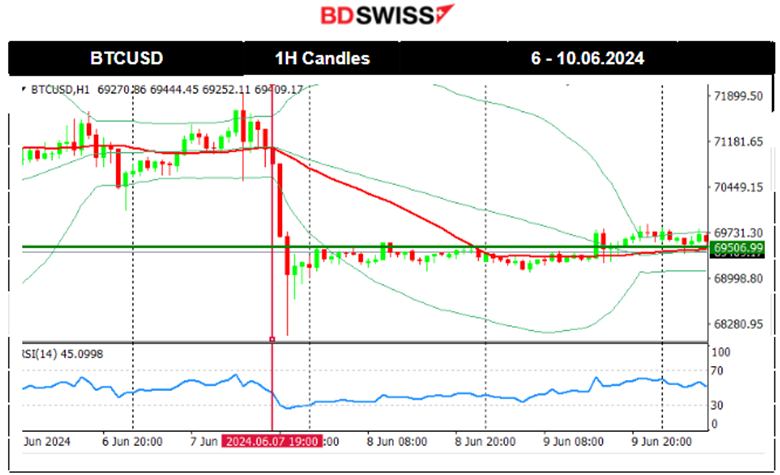

BTCUSD

The price had stalled at the resistance near 69K USD even after the volatile market conditions that took place on the 3rd during the PMI releases. Since the 3rd of June, Bitcoin gained momentum and moved to the upside. It steadily broke resistance levels, 68K, 69K, 70K and lastly 71K. That changed on Friday, 7th of June, with the NFP news release that caused dollar appreciation and bitcoin’s price to crash near 3000 USD. Retracement took place with the price settling at 69.5K USD.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

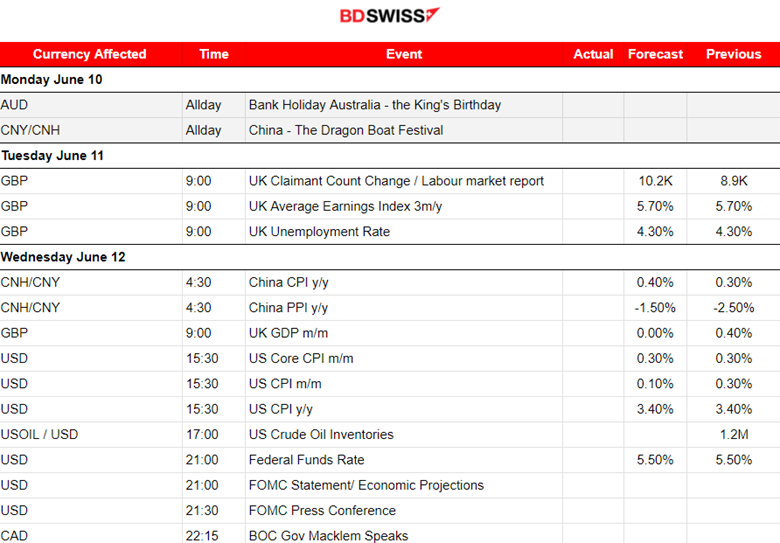

NEXT WEEK’S EVENTS (Week 10- 14.06.2024)

Coming up:

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

The price of crude oil eventually retraced, as mentioned in our previous analysis. It was a long way down until the 4th and the RSI indicated a slowdown and possible bullish divergence increasing the chances for retracement. Retracement reached the 74.5 USD/b level on the 6th of June and moved further to the upside after the release of the higher unemployment claims for the U.S. On the 7th the market experienced some moderate volatility but the price remained stable moving sideways. It currently settled near 75.4 USD/b. The RSI indicates bearish divergence.

Gold (XAUUSD)

Gold (XAUUSD)

On the 5th of June, the price jumped reaching 2,375 USD/oz, before retracement took place. The price continued to move higher on an uptrend and above the 30-period MA. On the 7th of June, Gold saw a sudden drop of 20 dollars passing the first support, indicating an uptrend stop. GOLD dropped ahead of NFP on Friday though. Data showed that China’s central bank didn’t buy any gold last month, ending a massive buying spree that ran for 18 months. Gold’s price had already dropped since 11:00 server time on Friday, near 90 dollars drop for the day. Well, it seems that a retracement could take place. However, it needs more evidence. Not to mention that the USD could appreciate further after the CPI news on the 12th of this week. 2,300 USD/oz is a critical resistance level that, if it is broken, retracement will be more probable to happen with a target level of 2,317 USD/oz.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

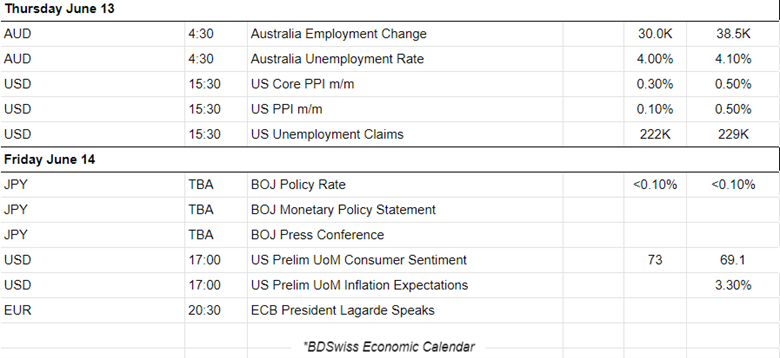

S&P500 (SPX500)

Price Movement

A triangle formation started to form and on the 4th of June, a breakout to the upside took place. The upward movement after the breakout took place and the index reached higher and higher levels. The RSI started to show bearish signals and retracement was possible after this rapid upward movement, as mentioned in our previous analysis. The market was quite volatile upon the release of the employment figures for the U.S. The dollar appreciated while stocks plunged at that time completing the retracement to the 61.8% of the movement. The index soon reversed though back to the 30-period MA and remained stable.

______________________________________________________________