Visa Inc is a multinational financial services company headquartered in Foster City, California, United States. Founded in 1958, Visa operates a global network that facilitates digital payments in more than 200 countries and territories, serving consumers, merchants, financial institutions, businesses, strategic partners and government entities through innovative technologies. Visa Inc has a capitalization of $497.83B and is expected to report its earnings on Thursday, January 25 after the market closes.

Zacks gives Visa a Rank 3 “Hold” within the Top 35%, #87 of #251 in its Financial Transaction Services industry.

Last quarter (Q3) the company reported EPS of $2.33 and Revenue of $8.61B.

In this earnings release, according to Zacks and Nasdaq, the company is expected to report EPS of $2.33-$2.55 and earnings of $8.5B, which would represent a year-over-year increase of 6.88% and 7.13% respectively compared to the data from $2.18 and $7.94B last year. Regarding the year, an EPS of $9.89 is expected, which would be an increase of 12.77% compared to $8.77 y/y, and earnings of $35.73B, which would be an increase of 9.42% y/y compared to $32.65B. The estimate has 2 downward revisions and 1 upward revision in the last 60 days.

Visa has a P/E ratio of 27.43 and a PEG ratio of 1.83. The company has not reported lower than estimated results since going public in 2008, in the last report on October 24, 2023 there was a surprise EPS of +4.48%.

Recently, Visa acquired Brazilian fintech company Pismo for $1B. Pismo offers integration and connectivity services that allow its clients to operate efficiently within the transaction ecosystem. The acquisition enables Visa to offer core banking functions and processing services to card issuers through cloud-native APIs. This purchase by Visa highlights the potential of the fintech industry in Latin America and the increase in the number of large international companies investing in this technology, representing strong future potential for the company.

The growth in popularity in digital payment methods and the development of Fintech has also been a driving factor for visa development.

Regarding earnings estimates, revenue from services is estimated at $3.88B, which is considered an increase of +10.6% y/y. Data processing revenues at $4,250M, an increase of +11.2% y/y. Revenue from international transactions at $3.05M, a year-on-year change of +9.2%. While other income could reach $677.61M, which would be +15.4% y/y.

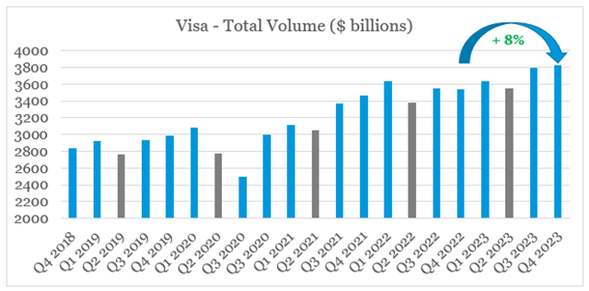

Total transactions are expected to reach 57.518M, an increase of 9.5% from last year’s 52.512M. The total payment volume for the US is estimated at $3,280B, a growth of 8.7% from $3,014B last year. For Europe and LATAM, growth of 15% and 17% respectively is expected. Total volume should reach $3.879B, an increase from the year-ago figure of $3.630B.

Regarding volumes, the payment volume for Europe stands at $624.260B, the company reported $546B.0B the same quarter last year. Europe’s cash volume at $128.04B, while last year it was $120B. Cash volume will reach 592.94B, a good year-on-year difference compared to $616B. CEMEA’s cash volume is expected at $103.92B which contrasts with the year-ago figure of $122B. LAC’s cash volume will reach $128,080B, a reduction from $137B in the same quarter of the previous year.

Rising inflation has also been a factor for Visa’s volume growth.

“Over the course of the quarter, we saw an increase in payment volume from July to September, driven primarily by a sequential improvement in ticket size growth that was primarily led by fuel with higher gasoline prices and comps. “Easier year-over-year growth, as well as a positive impact of the mix” – Visa Q4 Results Transcript

In other matters, it is possible that profits are favored by the continued increase in demand for entertainment and travel.

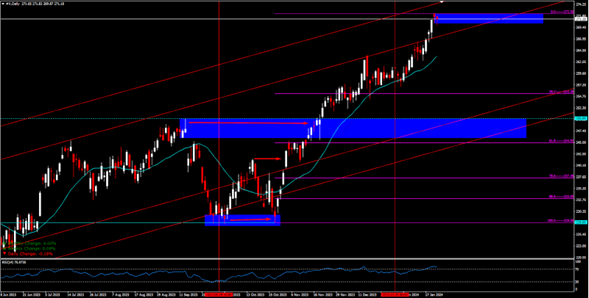

Technical Analysis – Visa Inc – D1

During this quarter to be reported and to date, Visa is in an upward momentum that began on October 27 with a double bottom pattern from the price of $228.00. The price continued to rise and broke the previous all-time highs at $252.60 and the asset is currently at $271.18 after marking new all-time highs at $272.30 very close to the bearish direction of the current channel, closing today with a small hammer candle.

The most likely case is to see a favorable outcome, which could continue to drive the price to new all-time highs. However, due to the area the price is in and the candle it closed with after making all-time highs in support with the RSI, it is possible to see the price take a healthy pullback to some previous level, this could be range which forms the 38.2% Fibo at $255.38, passing through the psychological level of $250 to the 61.8% Fibo at $244.92, which is close to the bullish direction of the channel.

The ADX is at 53.11 with the +DI at 34.17 and the -DI at 8.15, close to fatigue levels and with the +DI falling. The SMA of 20p D1 is at $262.74. RSI overbought with bearish bias at 75.97

Sources:

https://www.zacks.com/stock/quote/V

https://www.nasdaq.com/market-activity/stocks/v/earnings

https://money.cnn.com/quote/news/news.html?symb=V

https://contxto.com/en/brazil/visa-acquires-brazilian-fintech-pismo-in-usd-1000-million-deal/

https://seekingalpha.com/article/4664397-visa-q1-earnings-preview-beginning-of-more-uncertain-2024