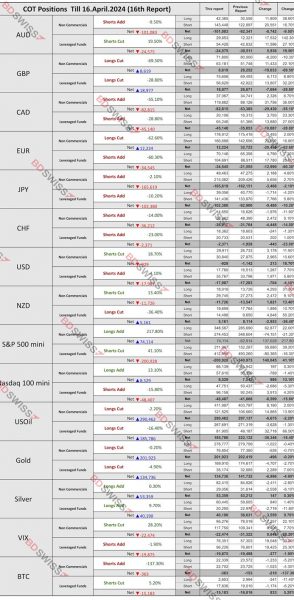

Latest Commitments of Traders (COT) report, April 16, 2024 (16th report of the year) the cut-off date.

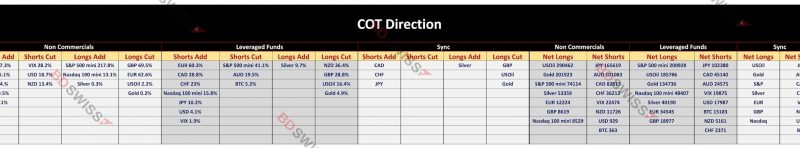

COT direction table (Non Commercials and Leveraged Funds with Sync) The below currencies saw an addition or cut among both (net non-commercials and net leveraged funds).

The below currencies saw an addition or cut among both (net non-commercials and net leveraged funds).

Below is the stacked barchart for the Non Commercials.

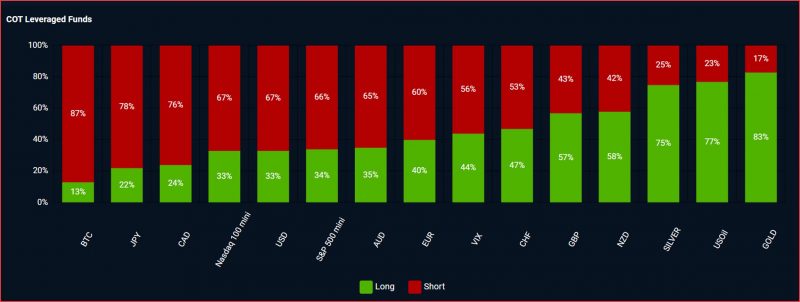

- Commodities have net long positions

- USD, EUR, and GBP are on the mixed side

- Antipodeans and US10Y are leaning towards the shorts side

Below is the stacked barchart for the Leveraged Funds. Source:

Source:

https://www.cftc.gov/MarketReports/CommitmentsofTraders/HistoricalCompressed/index.htm

Forex Source