PREVIOUS TRADING DAY EVENTS – 26 Sep 2023

Australia’s monthly consumer price index (CPI) rose 5.2% in the year to August, up from 4.9% the previous month but the increase was mostly driven by a surge in fuel prices due to global supply factors.

“Inflation’s downtrend stumbled in August… But it’s too early to say inflation is rearing its head again,” said Harry Murphy Cruise, an economist at Moody’s Analytics. “Of course, there are plenty of pain points… Rising services inflation also continues to dampen the ‘good’ news — quickly falling goods inflation. Still, the positives outweigh the negatives.”

Commonwealth Bank of Australia: “We think the RBA will be inclined to see it that way too when it meets next Tuesday for the October rate decision.”

There is also the view from some economists, however, that the bank will hike one more time before the end of the year, likely in November, after the release of the third-quarter inflation report.

Source: https://www.reuters.com/markets/australian-inflation-picks-up-aug-fuel-prices-jump-2023-09-27

“Inflation is slowing, but prices are still higher than they were before the pandemic and this is taking a toll on consumer confidence,” said Christopher Rupkey, chief economist at FWDBONDS in New York.

“Consumers also expressed concerns about the political situation and higher interest rates,” said Dana Peterson, chief economist at The Conference Board in Washington.

The Federal Reserve last week left its benchmark overnight interest rate unchanged at the 5.25%-5.50% range. Though consumers continued to fret over the higher cost of living, their inflation expectations over the next year remained stable. Consumers’ 12-month inflation expectations were unchanged at 5.7% for the third straight month.

Source: https://www.reuters.com/markets/us/us-consumer-confidence-ebbs-september-2023-09-26

______________________________________________________________________

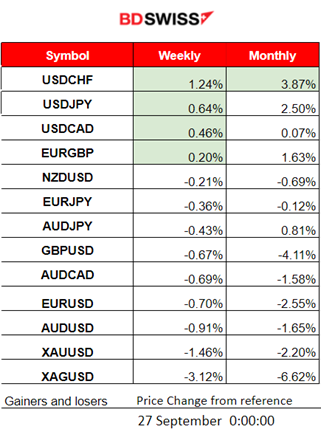

Winners vs Losers

USDCHF still leads this week with 1.27% gains and remains at the top winner’s place this month with 3.87% gains so far. USDJPY follows with 2.50% gains this month.

Weekly we can see that USD pairs with USD as base currency are on the top, giving a hint on how the USD was affected with appreciation against other currencies this week.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (26 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no significant scheduled figure releases.

- Morning–Day Session (European and N. American Session)

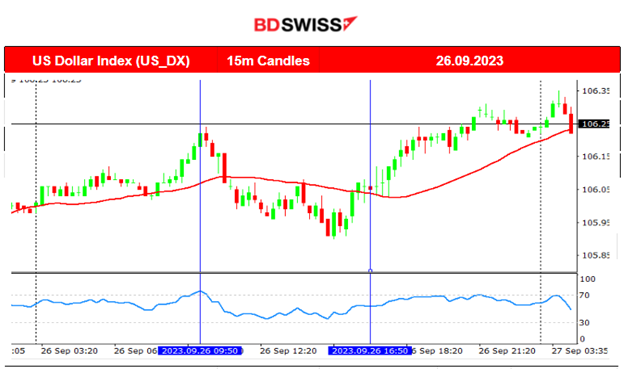

The Change in the selling price of single-family homes in 20 metropolitan areas is measured by the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index. At 16:00 it was reported 1.0% annual change in July, up from a 0% change in the previous month. The 20-City Composite posted a year-over-year increase of 0.1%, improving from a loss of -1.2% in the previous month. The USD was depreciating in general until that time when it finally started to gain strength. The Richmond Manufacturing Index was also reported to be higher than expected adding to that effect.

At 17:00, the CB Consumer Confidence for the U.S., an important indicator of consumer spending, was reported lower again. New Home Sales were also reported lower. The Expectations Index—based on consumers’ short-term outlook for income, business, and labour market conditions—declined to 73.7 (1985=100) in September, after falling to 83.3 in August. The DXY kept its momentum to the upside though after the release.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (26.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced high volatility after the start of the European Session moving to the upside mainly driven by the USD depreciation. It found resistance at 1.06090 and eventually reversed crossing the 30-period MA on its way down. Despite the fact that the figures after 16:00 were actually signalling dollar depreciation the USD appreciated steadily until the end of the trading day. This is probably due to the news announcements released yesterday indicating more expectations for future higher interest rates for the U.S.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

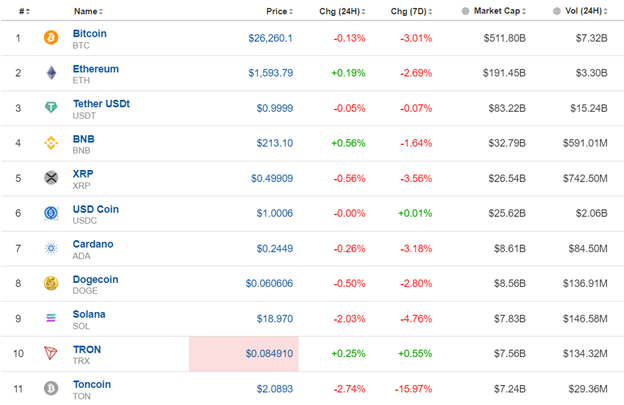

Bitcoin crashed on the 24th Sept and moved relatively rapidly towards the next important support at nearly 26000 amid a generally bearish sentiment among crypto traders. After testing this level several times, it finally retraced back to the 30-period MA where it currently settled until the next big move. It is currently experiencing low volatility moving around the MA and the price forms a pattern that we could say is a triangle formation.

Crypto sorted by Highest Market Cap:

A bearish sentiment recently affected almost all the above crypto assets. Looking at the 7 days column, are all red at the moment; a result from the downward moves starting from the 24-25th Sept.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USD experienced strong appreciation while the U.S. stocks lost significant value in general as per the chart. On the 21st of September, the index moved lower rapidly. This downward movement confirmed the downtrend. The index eventually retraced back to the 61.8 Fibo retracement level after it found strong support at near 14670. Other benchmark indices were following a downtrend as well with a similar price path the previous week. This week, however, a clear consolidation period took place. NAS100 broke that consolidation yesterday when it finally went below the 14640 support level and found another support near 14520 before retracing back to the mean. The view is currently downwards as the 14640 acts now as a resistance.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

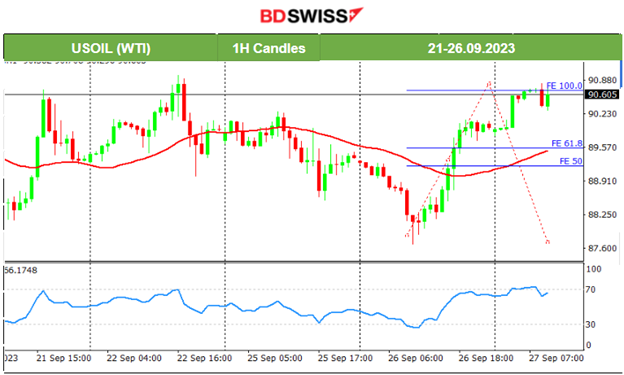

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude’s price has retraced significantly from a long upward movement lately finding strong support at near 88 USD/b on the 26th Sept. It significantly reversed crossing the 30-period MA on its way up and once more going over the 90 USD/b psychological level. This rapid movement upward looks like a short-term shock and the chances for a retracement increase as long as 90.8 USD/b level acts as a strong resistance. The 89.6 level serves as the 61.8 Fibo retracement level.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold has been moving to the downside significantly. This is partly due to the USD strength. The Fed decided to keep interest rates unchanged and the market reacted by keeping the USD strong while Gold is no longer desirable as it seems. Rising expectations about future rate hikes are also playing their part. Currently, gold’s price has been breaking important support levels on its way down and is on a clear downward trend.

______________________________________________________________

News Reports Monitor – Today Trading Day (27 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

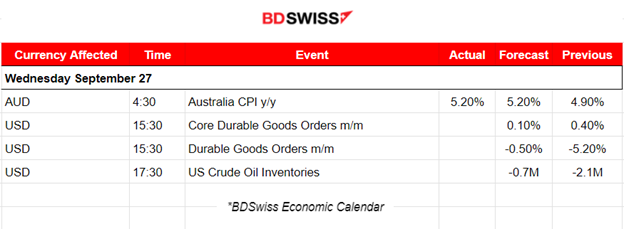

Australia’s monthly CPI indicator rose 5.2% in the twelve months to August, up from a rise of 4.9% in July, as expected. There was no shock and no increased volatility because of this release.

- Morning–Day Session (European and N. American Session)

At 15:30 the durable goods related scheduled figures are about to be released probably causing a moderate shock for the USD pairs. Increased volatility with reversals is common to take place at the time.

Crude oil inventories will be released at 17:30 and changes in inventories are expected to be reported negative again explaining its persistence to remain on high levels. The price of Crude is currently at 90 USD/b.

General Verdict:

______________________________________________________________