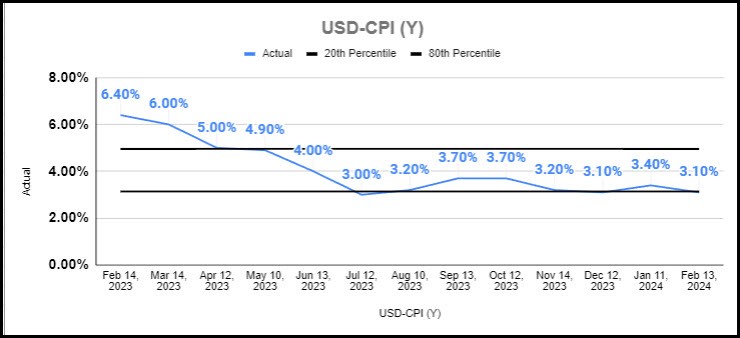

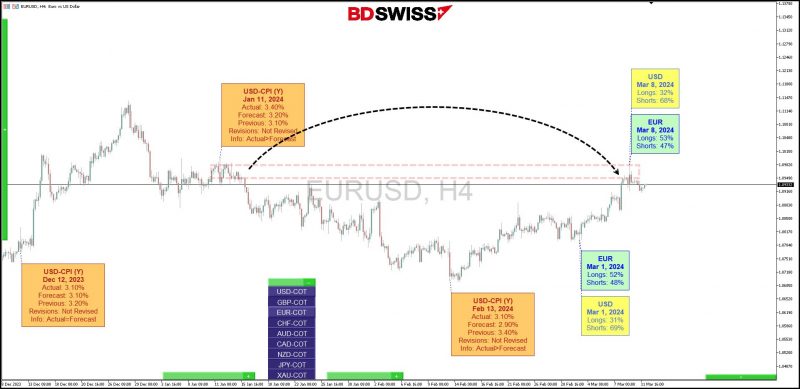

The US CPI for February is set to be announced on Tuesday, March 12, 2024. It is predicted to remain constant at 3.1% yearly, with core inflation (excluding food and energy) at 3.7%. .The recent data and the CPI are significant for the dollar story, as the Feds remain cautious.

Too hot

Too hot

Looking at the numbers, the headline CPI reduction has stalled, with the year-on-year increase rising from 3.0% to 3.1% during the last eight months. However, the Fed is more concerned about the core CPI measurement, which has been trending downward in recent months.

Fed vs inflation

Fed Chair Jerome Powell’s congressional testimony last week left markets with a dovish feeling. He repeated his cautious optimism about the disinflationary path, claiming that the Fed is “not far” from lowering interest rates.

Furthermore, Friday’s US payrolls likely raised more issues about data accuracy than they answered about the current status of the labour market. It displayed an explosive headline print of 275k.

However, there were 167k negative adjustments in the last two months, implying that real job growth was just over 100k. The inconclusiveness highlights the importance of February’s CPI numbers. A month-on-month core reading of 0.3% is inconsistent with the Fed’s inflation goals, indicating that easing is unlikely in April, and we need more conclusive data for June rate cuts.

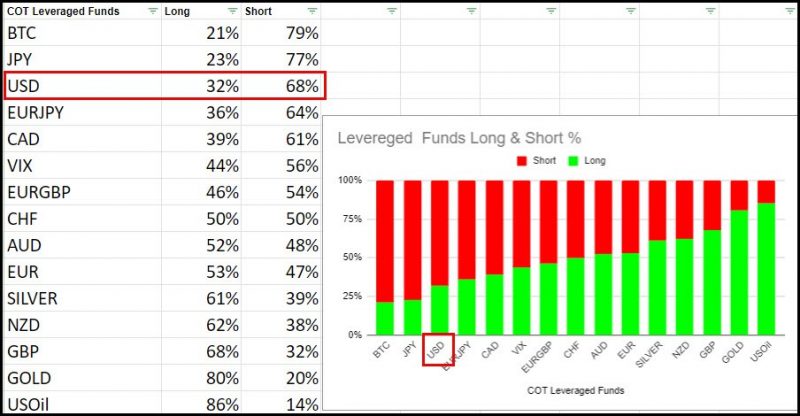

The vulnerability of the USD adds another layer of complexity to the equation. Recent data, including the latest Commodity Futures Trading Commission (CFTC) report, indicates significant short positions on the USD. Powell’s dovish comments have only added fuel to the fire, leading to intensified supply in the greenback. Consequently, any reason for USD strength, such as a higher-than-expected CPI print, could trigger a rapid shift in market sentiment.

Scenarios

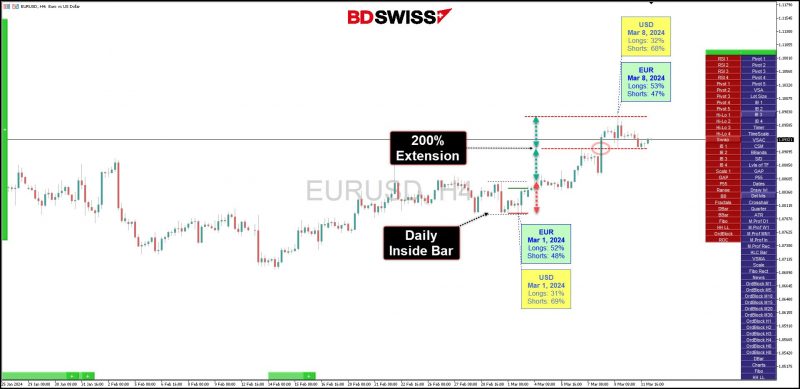

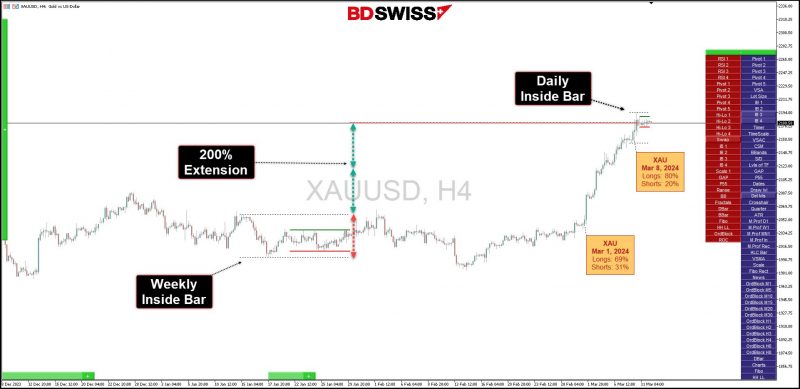

The scenario is poised to unfold in two possible directions, each contingent upon the CPI print meeting, exceeding, or falling short of expectations. Should the CPI figures come in higher than anticipated, particularly in core inflation measures, it could trigger a surge in demand for the US dollar (USD). This, in turn, would likely prompt a reversal of recent strength in the EURUSD pair, while also exerting downward pressure on gold prices.

Conversely, a miss in the CPI print could provide temporary relief to markets, instilling confidence that the battle against inflation is progressing. In such a scenario, we could see further gains in the EURUSD pair, accompanied by renewed interest in gold as a safe-haven asset.

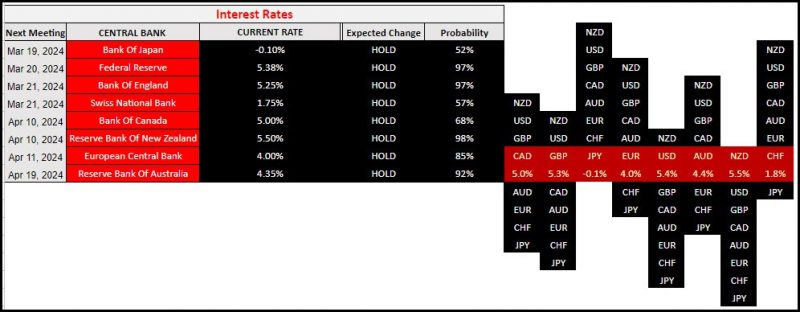

As usual, the Consumer Price Index (CPI) will play a crucial role in interest rate expectations, not only in the US but also in other central banks. The European Central Bank (ECB) predictions were influenced the last time data was released, with money markets in February adjusting their projections from “120 basis points (BPS) to 110 BPS for ECB rate cuts in 2024.”

Source:

https://www.fxstreet.com/analysis/three-fundamentals-for-the-week-us-inflation-and-related-figures-dominate-trading-202403110720