PREVIOUS WEEK’S EVENTS (Week 18 – 22 Sep 2023)

Announcements:

PMIs Eurozone, United Kingdom, U.S.

A grim picture again for Eurozone PMIs. The Eurozone will likely contract in the third quarter with no chance for significant growth. The economy would 0.4% contract this quarter. It seems that the manufacturing sector is the main driver.

The U.K.’s PMIs were also showing a devastating picture for business conditions in both sectors. The services sector sank to its lowest since the pandemic lockdown of January 2021. The Economy displayed clear recession signals looking increasingly likely in the U.K. according to economists.

The U.S. PMIs suggest a grim but better picture. The U.S. business activity showed little change in September, with the vast services sector essentially idling at the slowest pace since February, and overall new order activity slipping to the lowest level this year. The relevant PMI shows a reading of 50.1 in September from a final August reading of 50.2. No other PMIs remain slightly over 50 and so in the expansion area.

Demand conditions in the U.S. economy following interest rate hikes and elevated inflation were indeed affected negatively. However, the U.S. Economy in general has avoided a recession that could occur from aggressive interest rate hikes. Job growth and consumer spending have all held up, and the pace of inflation has significantly slowed. Overall employment growth was the strongest in four months, led by the services sector.

_____________________________________________________________________________________________

Inflation

Canada:

In Canada, the Industrial Product Price Index (IPPI) rose 1.3% month over month in August from July on higher prices for energy and petroleum products, as well as chemicals and chemical products. In general, there is currently a stickiness of inflation and a rise in energy prices.

The annual inflation rate for Canada increased to 4.0% from 3.3%. We all experienced a significant rise in the price of oil and gasoline and the increase is mainly attributed to it. The central bank may consider raising interest rates again. The annual rate, the highest since the 4.4% reported in April, is double the Bank of Canada’s 2% target.

The central bank held its key overnight interest rate at 5% on September 6th but said it could raise borrowing costs again should inflationary pressures persist.

United Kingdom:

U.K. Inflation finally seems to get lower significantly. The current annual level of 6.7% is still high and it was quite difficult for them to lower it to that level this year.

Britain’s inflation rate peak was just above 11% last October but even after the latest drop, it remained among the highest in Western Europe, topped only by Austria and Iceland in August. Core inflation fell sharply to 6.2% from 6.9% in July. Service sector inflation slowed to 6.8% from 7.4%. The plan to deal with inflation seems to be working but it is still too high.

_____________________________________________________________________________________________

Interest Rates

FED:

The Federal Reserve kept rates unchanged during the FOMC meeting the previous week, as widely expected. However, it was still seen as a hawkish pause. Fed policymakers still see the bank’s benchmark overnight rate range peaking this year at 5.50% to 5.75%.

SNB:

The Swiss National Bank (SNB) surprised markets by pausing its current cycle of increases. The SNB held its policy interest rate unchanged at 1.75% highlighting the fact that inflation is now lower, currently at 1.6% in August and within its target level. It was described as a “hawkish pause” and marked the first time the central bank has not hiked rates since March 2022.

They stated that they will wait for now and review at the next monetary policy assessment whether the measures we have taken to date are sufficient to keep inflation within the price stability range.

BOE:

The Bank of England (BOE) surprisingly halted its long run of interest rate increases as Britain’s economy slowed and inflation fell. The BoE’s Monetary Policy Committee voted to keep the Bank Rate at 5.25%. However, inflation is still high despite the latest report showing significant cooling. It was the first time since December 2021 that the BOE did not increase borrowing costs.

At 6.7% in August, inflation is falling towards the 5% level the BOE has predicted for the coming months. But it remains more than three times high compared to the central bank’s 2% target.

_____________________________________________________________________________________________

Sources:

https://www.reuters.com/world/uk/uk-recession-risk-deepens-companies-falter-pmi-2023-09-22/

https://www.reuters.com/world/uk/uk-inflation-rate-unexpectedly-falls-67-august-2023-09-20/

_____________________________________________________________________________________________

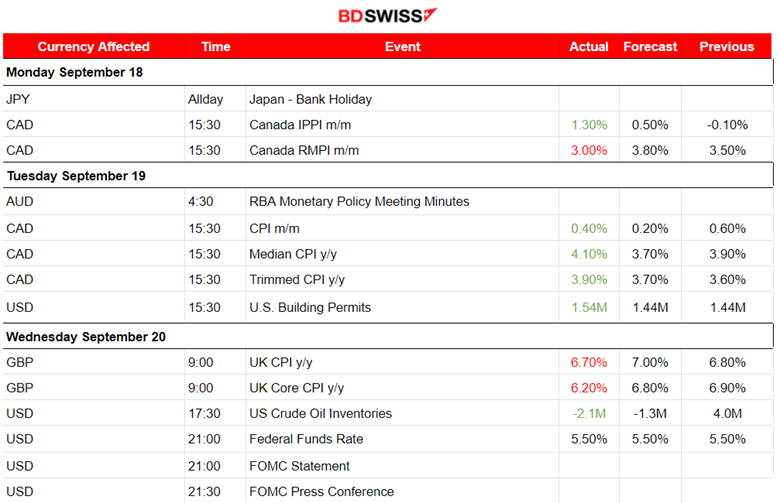

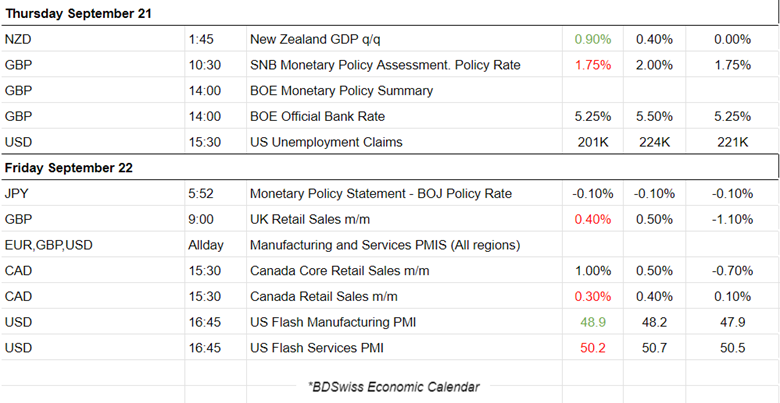

Currency Markets Impact – Past Releases (Week 18 – 22 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

DXY (US Dollar Index)

Overall, the Dollar experienced strength last week. It is clear that during the start of the week, the path was volatile but below the 30-period MA. However, on the 20th of September, the Fed’s decision to keep rates unchanged had a significant impact on the USD and caused the DXY to reverse, crossing the MA on its way up and remaining on the upside. The rest of the path was sideways with volatility falling to lower and lower levels moving around the mean until the end of the week. Clearly, there are important support and resistance levels formed since it eventually moved within range.

Support at near 105.35 and Resistance at near 105.80. These levels seem to belong to a triangle formation but it is not clear yet.

EURUSD

It is quite clear that the USD is driving the pair’s path as it is mirroring the DXY chart. The EURUSD started to move to the upside at the beginning of the week and later with the Fed news announced on the 20th of September, it changed direction and reversed to the downside. Volatility lowered as the end of the week was approaching. The Resistance 1.06735 and Support 1.06160 seem to be part of a channel or price range that the pair will probably move in until a shock forces breakouts of those levels to occur.

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin broke the triangle formation that was mentioned in our previous report and moved to the downside rapidly on the 21st Sept. It was breaking important support levels continuously and reached even the support near 26360 before eventually retracing back to 26640. Despite yesterday’s PMI releases and their impact on the USD, BTCUSD did not experience significant volatility and rather remained on the sideways path.

_____________________________________________________________________________________________

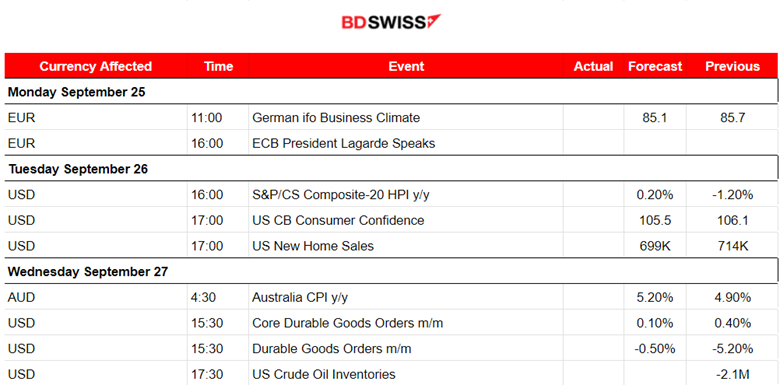

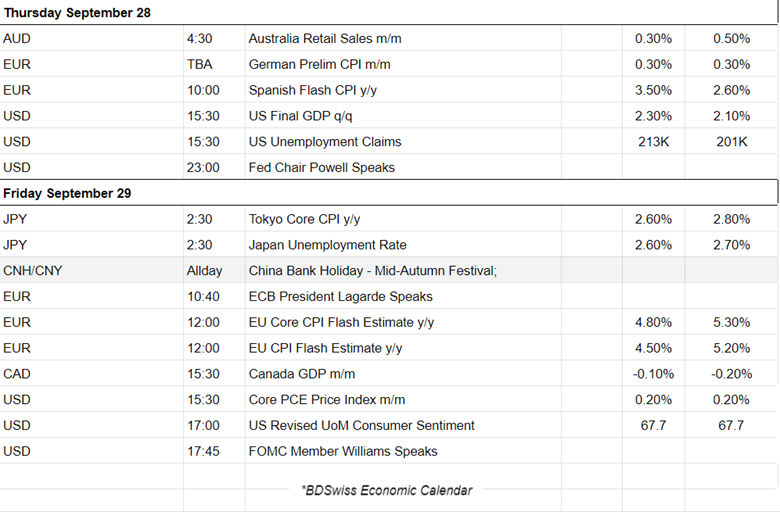

NEXT WEEK’S EVENTS (Week 25 – 29 Sep 2023)

Several CPI figures are going to be announced this week. We have inflation news for the Eurozone, Tokyo and Australia and the Core PCE figure for the U.S.

Other important scheduled figures include the U.S. Durable Goods orders, Canada’s and U.S. GDP.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude price is moving with high volatility sideways. However, it tested the resistance 90.70 twice and eventually broke that level on the 22nd of September, moving higher to the next resistance at 91 USD/oz. Retracement followed back to the mean where it eventually settled near 90 USD/oz.

Gold (XAUUSD)

On the 20th of September, Gold moved to the upside because the market caused USD depreciation before the Fed reports. However, later when the release of the Fed Rate took place, the USD weakened heavily and the Gold price dropped moving downwards towards the support near 1923 USD/oz. Then, it further dropped to the support near 1914 USD/oz and retraced back to the 61.8 Fibo level where it settled. On the 22nd of September, Friday, Gold price moved sideways overall with no significant volatility closing at near 1925 USD/oz.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The USD experienced strong appreciation while the U.S. stocks lost significant value in general as per the chart. On the 21st of September, the index moved lower rapidly. This downward movement confirmed the downtrend. The index eventually retraced back to the 61.8 Fibo retracement level after it found strong support at near 14670. Other benchmark indices are following a downtrend as well with a similar price path.

______________________________________________________________