PREVIOUS TRADING DAY EVENTS – 23 June 2023

Eurozone business growth fell for the month as a manufacturing recession deepened. Germany, the biggest economy, outperformed on services while France was a big drag with a services PMI of 48. Manufacturing activity has been in decline since July and the downturn deepened.

“This speaks against a recovery of the economy in the coming months, which is expected by many,” Commerzbank economist Christoph Weil said. “We see our assessment confirmed that the euro area economy will contract again in the second half of the year.”

“The so far 400 basis points of ECB rate hikes are increasingly slowing down the economy,” he added.

But economic activity is significantly lower and weak enough for the EU to fall into recession with ECB’s aggressive hikes. The jobless rate is low and nominal wage growth is at its highest in decades. Most policymakers, though, fear inflation more than a recession. The ECB stated that it will hike again in July.

“Another quarter of negative GDP growth is not unimaginable, although the current slump clearly remains mild enough for the European Central Bank not to change course on rate hikes,” ING economist Bert Colijn said.

The S&P Global’s Composite Purchasing Managers’ Index (PMI) preliminary reading showed that in May it was hit by the weakest growth in new orders since January as factories suffered.

The BoE is expected to continue raising the borrowing costs as it tries to tackle inflation which held at 8.7% in May.

“However, such rate hikes will clearly add further to the likelihood of a recession later in the year, which is looking increasingly inevitable as collateral damage in the fight against inflation,” Chris Williamson, chief business economist at S&P Global Market Intelligence said.

Overall, the Federal Reserve’s aggressive interest rate increases over the past year didn’t have such a negative impact on growth as feared. The U.S. economy has continued expanding in the April-through-June period, although it is increasingly reliant on the vast services sector for overall growth in GDP.

“The overall rate of expansion of business activity in the U.S. remained robust in June, consistent with GDP rising at a rate of 1.7% to put second-quarter growth in the region of 2%,” said Chris Williamson.

The Fed projected that rates could rise by perhaps half a percentage point more by year-end from the current policy-rate range of 5.00% to 5.25%. Investors expect the Fed to return to hikes starting from the next meeting.

Sources:

https://www.reuters.com/markets/europe/euro-zone-business-growth-stalls-june-flash-pmi-2023-06-23/

______________________________________________________________________

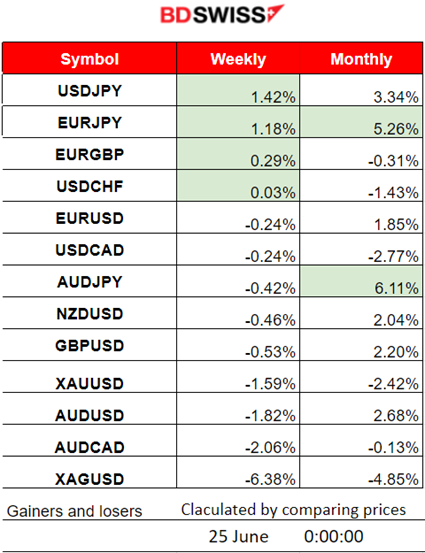

Summary Daily Moves – Winners vs Losers (23 June 2023)

- JPY pairs remained on the top of the winners’ list for last week, with the top gainer USDJPY having a 1.42% price change followed closely by EURJPY with a 1.18% price change.

- So far this month, AUDJPY remains at the top, with 6.11%, followed by EURJPY having a high upward deviation as well, 5.26% so far.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (23 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

U.K. retail sales volumes are estimated to have risen by 0.3% in May 2023. The monthly figure was released at 9:00. Spending and high prices are on. We already know that BOE aggressively hiked.

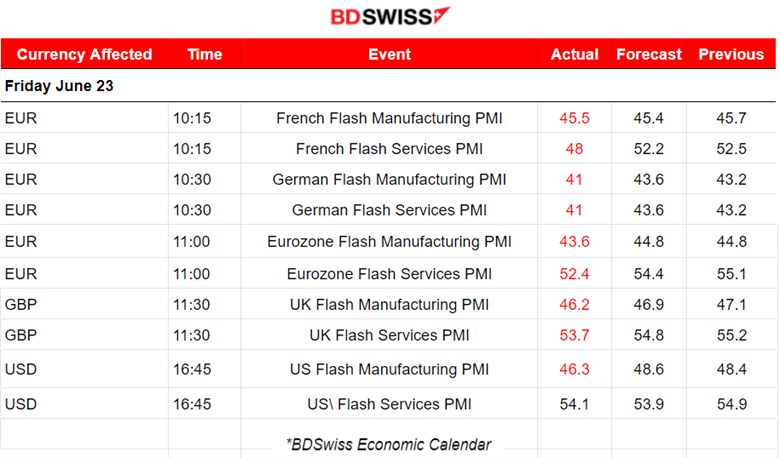

We had the below PMI releases:

EZ: The Flash PMI data for both sectors (Manufacturing and Services) were released showing that Eurozone business growth stalled this month. Manufacturing was below 50 in contraction deepening and the Services index figure was well below the expected, but still above 50.

U.K.: Flash PMI dropped, as the preliminary reading on Friday suggests. The Manufacturing figure worsened while the Services figure slightly improved, being above 50.

U.S.: the survey’s Flash Services sector PMI fell to 54.1 from 54.9 in May. A downfall in business activity as services growth eased for the first time this year and a deepened contraction in the manufacturing sector.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (23.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair moved rapidly downwards with the release of the Flash PMI figures. High deviation from the mean, more than 60 pips drop. It found support at near 1.08440 and eventually retraced back to the mean moving with low volatility sideways during the N. America session.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

This week, the index was following a downward short-term trend since it retraced from the recent long upward movement. The market is just steadily trying to resist any falls, experiencing high volatility. After the reversal on the 22nd of June, which caused the index to move rapidly higher and over the 30-period MA, the index has significantly retraced back to the mean and beyond, testing again the significant support levels near 14805 USD. However, a sideways path is expected, and breaking that support level will signal a volatile downward path again.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude moved significantly lower on the 22nd, deviating highly from the mean and moving downwards. It experienced high volatility but the RSI suggests that the price is slowing down as it shows higher lows while the price shows lower lows. This bullish divergence is signalling a sideways path close to the mean but with the usual high volatility to govern the path.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The Gold price has reversed after moving downwards for several days, breaking important support levels on the way. On Friday, it moved higher crossing the 30-period MA after finding important support near 1910 USD/oz and on the way up it found resistance near 1940 USD/oz before retracing back to the mean. What drove the Gold price upwards on Friday? Possibly the disappointing PMI news for all regions. Business activity was significantly reduced as PMI data suggest and risk-off mood is again leading investment decisions. The Gold price has put a stop to the downward trend for now and will possibly move sideways with high volatility.

______________________________________________________________

News Reports Monitor – Today Trading Day (26 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

Today, we haven’t got a busy schedule. Typical Monday mood.

The German Info Business Climate Survey results are coming out at 11:00. This is a survey of about 9,000 businesses which asks respondents to rate the relative level of current business conditions and expectations for the next 6 months. EUR pairs might be affected showing more volatility than typical. However, we are not expecting shocks.

General Verdict:

______________________________________________________________